Nyheter

Why Are DEXs the Undisputed Game-Changer of Modern Digital Finance?

Publicerad

2 månader sedanden

The decentralized finance (DeFi) sector is poised for explosive growth, with estimates projecting at least an $80B valuation by the end of 2025. This remarkable trajectory is fueled by a confluence of factors, including favorable regulatory shifts and the pivotal role of decentralized exchanges (DEXs) in driving market trends. At the heart of the DeFi landscape are four key exchanges that exemplify the sector’s dynamism and potential:

- Uniswap: The industry titan with multi-chain dominance

- Aerodrome: Base network’s powerhouse

- Raydium: Solana’s DeFi cornerstone

- Jupiter: The innovative aggregator reshaping Solana’s ecosystem

Why focus on these exchanges now? The DeFi sector is at a critical juncture:

• Imminent protocol upgrades promise to reshape market dynamics.

• Institutional participation is surging, driven by regulatory clarity.

• The Total Value Locked (TVL) in DeFi is expected to surpass $250B by year-end.

• DEXs are playing a crucial role in emerging trends, including the rise of memecoins, AI agents and tokenized real-world assets.

As we delve into these four pivotal exchanges, we’ll uncover the technological advancements, market strategies, and regulatory adaptations that are set to define DeFi’s trajectory in 2025 and beyond.

For starters, what are Decentralized Exchanges (DEXs)?

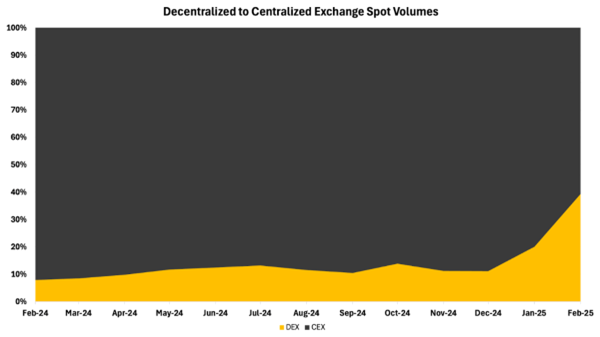

DEXs are non-custodial exchanges empowering users to trade assets directly via self-executing smart contracts, bypassing traditional intermediaries. By linking non-custodial wallets like MetaMask and Phantom, traders retain full control of their funds while swapping tokens across different blockchains. Instead of centralized order books, DEXs leverage automated market makers (AMMs)—algorithmic liquidity pools that set prices and enable anyone to contribute capital, democratizing market access for both users and liquidity providers. As seen below, the ratio of volume between decentralized vs. centralized venues has reached its highest level to date.

Figure 1: Decentralized to Centralized Exchange Spot Volumes

Source: 21Shares, TheBlock

Why are DEXs important?

DEXs dismantle financial gatekeepers, democratizing access through unstoppable, open-source protocols that fuel permissionless innovation. Unlike centralized giants like Mt. Gox or Bitfinex—whose catastrophic hacks exposed systemic fragility—DEXs are immune to single-point failures due to the decentralized nature of their underlying networks. Their censorship-resistant design ensures no entity can freeze assets or halt transactions. For example, the SEC sent a Wells notice to Uniswap Labs alleging they’re facilitating the trading of unregistered securities. While the foundation removed the tokens from its front end, the underlying smart contracts remained accessible on Ethereum. This meant that users could still interact with these tokens through alternative front-ends or by directly engaging with underlying smart contracts. This reinforces that while regulators target surface-level interfaces, the core infrastructure remains immutable—a testament to DeFi’s immutable foundational promise.

Having said that, aggregators also play an important role. Just as brokerage platforms consolidate fragmented liquidity across centralized exchanges, DEX aggregators in crypto fulfill a similar role. These tools optimize trade execution by intelligently routing orders, reducing slippage and costs by 2-5%. Working symbiotically with DEXs like Uniswap, aggregators drive 20-35% of DEX volume, creating a win-win ecosystem: DEXs gain increased activity, while aggregators thrive on consolidated liquidity. This collaboration transforms isolated pools into a cohesive financial network.

Why are we talking about them now?

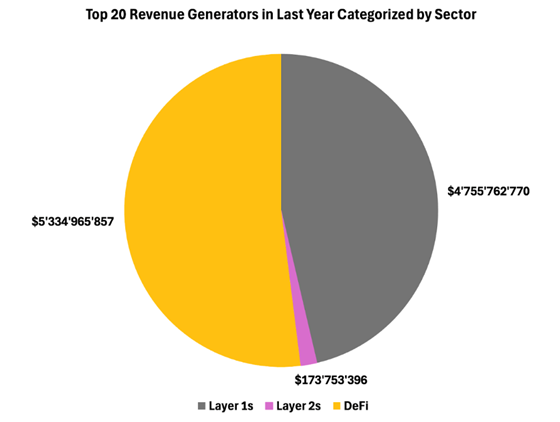

For one, DeFi ranks among the highest revenue-generating sectors in the crypto ecosystem, as seen in Figure 2. This stems from DeFi’s early maturity and its strong Product-Market Fit due to its vital role in enabling access to emerging sectors.

Figure 2: Breakdown of the top 20 revenue-generating protocols, categorized by sectors, over the last year.

Source: 21Shares, TokenTerminal

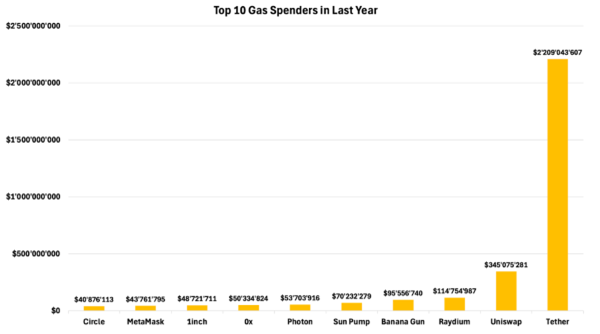

Specifically, DEXs dominate blockchain activity as the primary gas consumers, with platforms like Uniswap and Raydium consistently ranking as top spenders across the landscape, as seen in Figure 3. Furthermore, exchanges have a symbiotic relationship with stablecoins: over half of Tether’s on-chain transactions originate from trading, creating a self-reinforcing cycle where Tether liquidity fuels DEX volume. At the same time, DEX demand solidifies Tether’s dominance. By driving 60-75% of on-chain activity through token swaps, stablecoin demand, and dApp liquidity provision, exchanges act as a foundational access point for the crypto ecosystem.

Figure 3: Top 10 Gas Spenders in Last Year

Source: 21Shares, TokenTerminal

In a sense, DEXs not only drive their own ecosystem but also generate a significant portion of the demand for the underlying blockchains they operate on. However, they can capture even more value and strengthen the investment case for their native tokens by positioning them as the gas token for their dApp. Given the self-reinforcing ecosystem and user loop they create, it becomes increasingly logical for DEXs to evolve into their own app-chains—allowing them to fully internalize transaction fees, optimize performance, and enhance user experience while maintaining sovereignty over their liquidity and trading infrastructure.

We are seeing this starting to materialize, both with Uniswap’s Unichain, which we wrote an entire previous newsletter on, and Jupiter’s Jupnet. The latter is a new omnichain network aiming to unify liquidity across multiple blockchains into one platform, creating a decentralized ledger that enhances usability for both users and developers. Jupnet envisions a future where a single account can seamlessly access all chains, currencies, and commodities—referred to as the ”1A3C” vision. This approach is designed to simplify blockchain interactions while empowering new innovations in cross-chain liquidity and usability.

The evolution of Uniswap and Jupiter into application-specific chains represents a strategic shift in the DeFi landscape driven by similar motivations. Both protocols aim to optimize their ecosystems by vertically integrating their operations. Uniswap’s upcoming Unichain and Jupiter’s cross-chain network are designed to significantly reduce fees, enhance trading speeds, and consolidate fragmented liquidity across multiple chains. In addition, it also creates new revenue streams by capturing MEV —estimated at over $400M annually—that previously leaked to third parties. By internalizing these value streams, both protocols transform from mere liquidity providers into self-sustaining trading ecosystems while building defensible moats against competitors

Beyond this strategic shift, Uniswap is also setting itself up for success with the release of v4, which was just deployed this week. The latest upgrade enhances v3’s efficiency with optimizable adapters that enable custom logic during swaps, liquidity actions, or fee collection. This modular design supports advanced features like limit orders, dynamic fees, and automated liquidity management without core protocol changes. Traders and liquidity providers benefit from reduced costs and flexible fee structures that optimize value distribution.

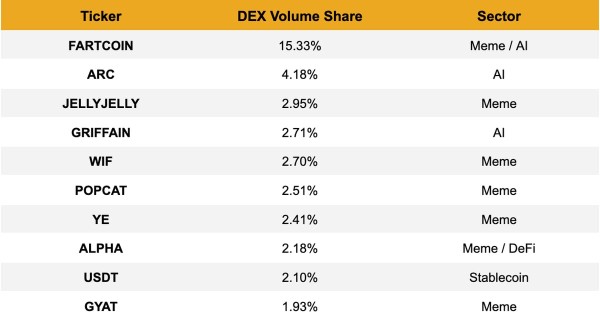

DEX Memecoin Frenzy

The surge in non-custodial infrastructure adoption has been significantly propelled by memecoins, offering an accessible gateway for newcomers to the crypto ecosystem, especially as these tokens are often unavailable on centralized exchanges during their initial launch. This trend has been a major catalyst for DEX growth over the past year, peaking with Trump’s memecoin launch. A prime example is Raydium, Solana’s largest DEX, where memecoin trading dominates activity. In the last 24 hours, memecoins represented 7 of the top 10 most traded tokens on the platform, accounting for over 30% of its total volume. Expanding this view, 41 of the top 50 traded tokens were memecoins, contributing to more than 50% of Raydium’s daily trading volume. These statistics underscore the pivotal role of memecoin speculation in driving DEX activity and liquidity in decentralized markets.

Figure 4: Raydium 24-Hour Spot Trading Volume

Source: 21Shares, Coingecko

$TRUMP, World Liberty Financial (WLFI) Convergence, What’s Next?

The Trump ecosystem appears poised to expand its crypto footprint. Following their DeFi lending platform (WLF), a Trump-branded DEX could emerge as the logical next step—transforming TRUMP from a memecoin into the cornerstone of a self-sustaining DeFi network. Despite ranking 40th in market cap, TRUMP already claims a top-10 trading volume spot, signaling robust demand. A dedicated DEX would amplify this activity while unlocking fee-based revenue, solidifying Trump’s crypto influence through an integrated swap-lend-earn ecosystem.

Looking ahead, a Trump Layer 2 or appchain could elevate this vision. By designating TRUMP as the network’s native gas token, the ecosystem could internalize transaction fees, enhance scalability, and deepen token utility. Such a move would transcend memecoin status, potentially reshaping how public figures monetize digital influence and the overall perception of these tokens.

Having established the critical role of DEXs, let’s now explore the key factors that set them apart and their key value propositions:

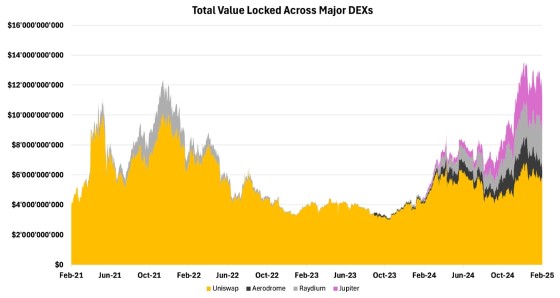

Total Value Locked serves as DeFi’s primary metric for measuring capital deployed across protocols. Initially, Uniswap dominated this space by capitalizing on Ethereum’s first-mover advantage and network effects, reaching a peak TVL of $10B. Despite severe market fluctuations during recent crypto winters, DEX TVL remained stable – demonstrating DeFi’s market maturity and sustainable product-market fit.

Figure 5: Total Value Locked Across Major DEXs

Source: 21Shares, DeFiLlama

The competitive landscape has shifted significantly with new entrants challenging Ethereum’s dominance. Aerodrome leveraged Coinbase’s Base network integration to streamline user onboarding, while Solana’s low-cost infrastructure fueled growth of protocols like Raydium and Jupiter, which now collectively hold over $5B in TVL. These developments reduced Uniswap’s market share from near-total dominance to roughly 50% of the combined TVL held by these three emerging rivals. This redistribution highlights DeFi’s evolution into a multi-chain ecosystem where scalability and user experience increasingly dictate platforms’ success.

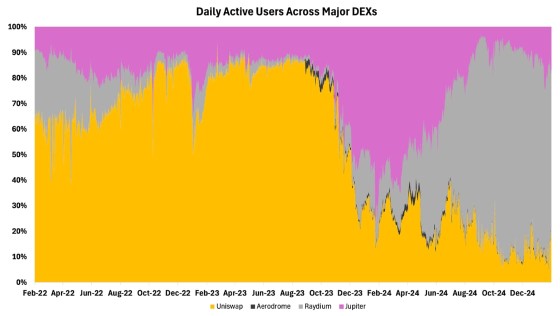

Daily active users follow a similar trend. Uniswap, benefiting from Ethereum’s ecosystem, once dominated but Solana-based apps, especially Raydium, surged. By late last year, Raydium captured over 80% of daily active users, driven by memecoin trading’s retail appeal.

Figure 6: Daily Active Users Across Major DEXs

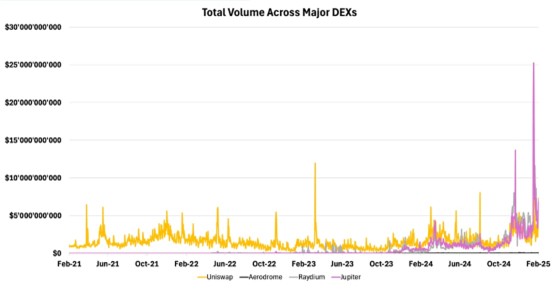

Figure 7: Total Volume Across Major DEXs

Source: 21Shares, TokenTerminal, Artemis

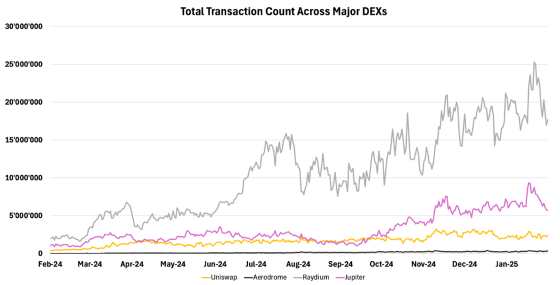

Transaction counts also highlight the rapid growth of Solana-based platforms, particularly Raydium, driven by speculative trading and low costs. As shown in Figure 8, Raydium reached a peak of over 25M transactions in a single day, more than double its other competitors, showcasing its dominance in the current DEX landscape.

Figure 8: Total Transaction Count Across Major DEXs

Source: 21Shares, Token Terminal, Dune

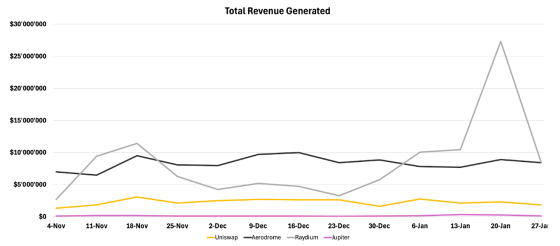

Figure 9 highlights that Raydium’s significant activity translates into equally notable revenue generation, making nearly $30M in revenue the weekend ahead of the inauguration. Meanwhile, Aerodrome generates substantial revenue due to the vote-escrow mechanism which is explored in a later section.

Figure 9: Total Revenue Generated

Source: 21Shares, TokenTerminal, Dune

For the technically curious, the following section delves deep into the intricacies that distinguish these DEXs.

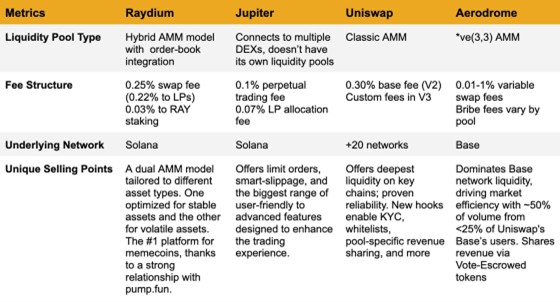

Figure 10: Comparing the Different DEX Platforms

Source: 21Shares

The main differentiating feature amongst DEXs is how they operate their liquidity models. For example, Raydium’s Hybrid AMM model combines Concentrated Liquidity Market Maker (CLMM) with Central Limit Order Book (CLOB), offering both customizable liquidity ranges and traditional order matching. This model provides flexibility for traders and liquidity providers. Alternatively, Uniswap’s Classic AMM, maintains liquidity across all price points, ensuring continuous liquidity. However, this model may be less capital efficient and more rigid.

Finally, Aerodrome’s *ve(3,3) AMM, inspired by Curve Finance, introduces vote-escrowed tokens and bribes to incentivize liquidity provision. This model allows token holders to lock their tokens for voting rights and elevated rewards, potentially creating a more engaged and stickier liquidity base. As such, each model offers a unique balance between simplicity, capital efficiency, and user incentives.

To summarize, these are the key distinctions between all 4 models:

• Raydium offers customizable liquidity ranges and traditional order matching.

• Jupiter is an aggregator that lacks its own liquidity engine. However, it offers centralized exchange-level features like limit orders and dynamic slippage calculator,upgrading the typical DEX user-experience.

• Uniswap V3 pioneered concentrated liquidity, enabling roughly 4000x capital efficiency vs V2 in stablecoin pairs.

• Aerodrome uses Curve-style vote-escrow tokens (veAERO) with bribes directing 73% of revenue.

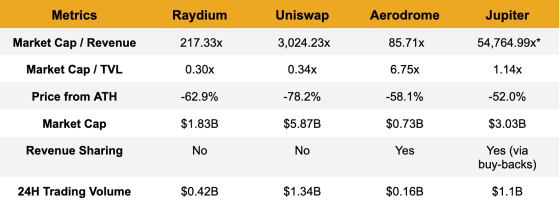

Having identified the differences between the platforms’ technologies, let’s compare the valuation of their respective tokens:

Figure 11: DEXs’ Tokens Valuation Metrics

Source: 21Shares, TokenTerminal

*Jupiter’s revenue here only accounts for its spot market activity, although the bulk of its activity actually comes from its derivatives platform, that’s why it has such a seemingly unfavorable market cap / revenue ratio.

As seen, Aerodrome stands out as a remarkably undervalued token compared to its peers, driven by its impressive revenue generation and dominance on the Base network. Despite operating on a single chain and capturing less than 25% of Uniswap’s user base, Aerodrome’s performance underscores the power of strong product-market fit. Its success, particularly when compared to multi-chain platforms like Uniswap, highlights the potential for focused, chain-specific exchanges. In terms of Market Cap to TVL, Uniswap and Raydium’s low ratio suggest undervaluation, reflecting high capital efficiency and stronger usage. However, relative valuation is just one factor to consider, as these protocols are at varying stages of maturity. The evolving DeFi landscape suggests a future where multiple specialized exchanges can thrive simultaneously, each carving out its niche in the broader ecosystem.

All in all, DeFi emerges as a 2025 standout sector, fueled by regulatory tailwinds and accelerating institutional adoption of on-chain infrastructure. At its core, DEXs like Uniswap and Jupiter are evolving into critical infrastructure, leveraging innovations such as Unichain and Jupnet to achieve institutional-grade scalability while pioneering app-chain architectures. As the DEX/CEX volume ratio reaches record highs just shy of 40%, these platforms are uniquely positioned to capitalize on the migration to decentralized markets. Their growing emphasis on user-aligned tokenomics—where revenue-sharing mechanisms transform governance tokens into yield-generating assets—creates a compelling value proposition for investors navigating this new era of value accrual in DeFi.

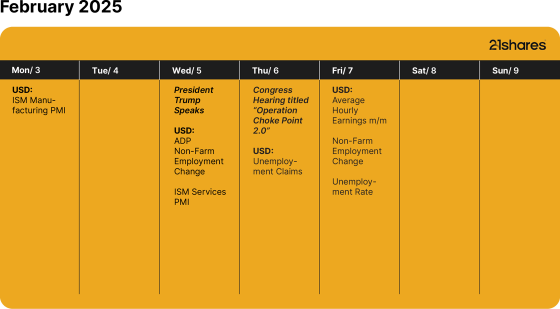

What’s happening this week?

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Stablecoins: The real powerhouse of crypto

-

Dogecoin in a portfolio: A small 1% allocation has a loud bark!

-

Trump’s trade war puts Bitcoin in the spotlight

-

Bitcoin supply on crypto exchanges hits 5-year low and that’s a good sign

-

Markets Swing Wildly After Tariff Shock – Bitcoin Rebounds Strongly

-

21Shares Dogecoin ETP: Drivs av community, omdefinierar kryptolandskapet

Stablecoins are digital currencies tied to assets like the U.S. dollar, offering the price stability needed for payments. They maintain their peg by being backed 1:1 by their underlying fiat currency, with issuers holding equivalent amounts in cash and cash equivalents, making stablecoins a digital representation of those reserves. Their market has doubled to over $235 billion, with daily usage nearly doubling in two years.

Why are stablecoins making headlines now?

Due to their clear product-market fit and growing mainstream adoption, stablecoins have become a top priority for regulation, with both industry leaders and policymakers calling for swift action.

On April 4, the Securities and Exchange Commission’s Division of Corporation Finance finally clarified that stablecoins are not securities if backed one-for-one by USD or similar assets and used for payments or value storage. These “Covered Stablecoins” are not marketed as investments, lack profit incentives, and include protections like reserves, making securities law registration unnecessary for issuance or redemption.

The GENIUS Act, introduced in February and advanced by the U.S. Senate Banking Committee in March, marks a major step toward creating a clear legal framework for stablecoin issuance and oversight. This clarity is driving momentum as Fidelity is set to launch its own stablecoin, and Bank of America is preparing to follow it once legislation is finalized.

Globally, the European Union’s Markets in Crypto Assets (MiCA) framework has already come into effect, reinforcing a broader shift toward formal integration of stablecoins into traditional finance. These developments reflect a growing consensus that stablecoins are emerging as essential infrastructure for global payments, treasury management, and digital asset adoption.

What are the benefits of stablecoins?

Stablecoins are digital currencies designed for fast, low-cost, and stable transactions. Since their launch in 2014, they’ve become a go-to tool for online payments, especially cross-border transfers. As they’re pegged to stable assets like the U.S. dollar or euro, they avoid the wild price swings seen in other cryptocurrencies.

They’re accessible to anyone with internet, making them especially valuable in regions with high inflation or limited banking access, like Argentina or Turkey.

With some built on public blockchains, stablecoins offer transparency, letting users track transfers and supply in real time. For institutions, they also simplify treasury management by acting as efficient digital cash that can be deployed instantly.

Who are the major players in the stablecoin race?

Tether (USDT) and Circle (USDC), the two largest stablecoin issuers, collectively hold over $204 billion in U.S. Treasuries, making them the 14th largest holders globally. Their combined treasury holdings surpass those of entire nations, including Norway and Brazil.

USDT leads with $144 billion in circulation; USDC, backed by Coinbase and known for compliance, has become a trusted digital dollar across global finance.

Why stablecoins matter: A revenue engine for blockchains

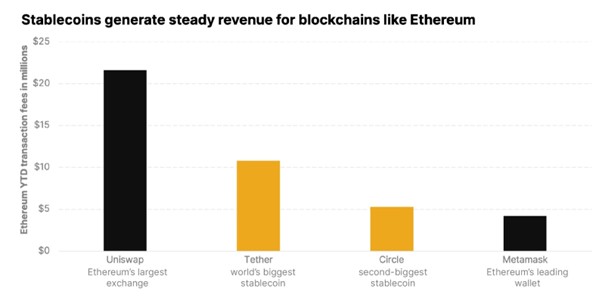

Stablecoins generate steady revenue for blockchains like Ethereum and Solana by driving transaction fees with each transfer. With trillions in annual volume, they help sustain network activity beyond speculation.

On Ethereum, for example, USDT and USDC transactions are major contributors to daily gas fees. Year to date, Tether ranks #3 and USDC ranks #5 in terms of total gas consumed. Tether and Circle also dominate daily transaction activity on Ethereum, averaging approximately 12 million and 6 million transactions per day, respectively, making them the top two entities on the network by daily transaction count.

Meanwhile, on Solana, stablecoin activity has surged, helping sustain validator rewards and strengthen protocol economics. In addition to the mainstream utility, stablecoins represent reliable, protocol-level cash flow, making them crypto’s killer use case.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

BE29 ETF är en portfölj företagsobligationer med förfall 2029

Publicerad

7 timmar sedanden

19 april, 2025

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis (BE29 ETF) med ISIN IE000ZC4C5Q1, försöker följa Bloomberg 2029 Maturity EUR Corporate Bond Screened-index. Bloomberg 2029 Maturity EUR Corporate Bond Screened Index spårar företagsobligationer denominerade i EUR. Indexet speglar inte ett konstant löptidsintervall (som är fallet med de flesta andra obligationsindex). Istället ingår endast obligationer som förfaller under det angivna året (här: 2029) i indexet. Indexet består av ESG (environmental, social and governance) screenade företagsobligationer. Betyg: Investment Grade. Löptid: december 2029 (Denna ETF kommer att stängas efteråt).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,10 % p.a. Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis är den billigaste ETF som följer Bloomberg 2029 Maturity EUR Corporate Bond Screened index. ETFen replikerar resultatet för det underliggande indexet genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Ränteintäkterna (kuponger) i ETFen delas ut till investerarna (kvartalsvis).

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis är en mycket liten ETF med 1 miljon euro tillgångar under förvaltning. Denna ETF lanserades den 18 juni 2024 och har sin hemvist i Irland.

Produktbeskrivning

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF Dist syftar till att tillhandahålla den totala avkastningen för Bloomberg 2029 Maturity EUR Corporate Bond Screened Index (”Referensindexet”), minus avgifternas inverkan. Fonden har en fast löptid och kommer att upphöra på Förfallodagen. Fonden delar ut intäkter på kvartalsbasis.

Referensindexet är utformat för att återspegla resultatet för EUR-denominerade, investeringsklassade, fast ränta, skattepliktiga skuldebrev emitterade av företagsemittenter. För att vara kvalificerade för inkludering måste företagsvärdepapper ha minst 300 miljoner euro i nominellt utestående belopp och en effektiv löptid på eller mellan 1 januari 2029 och 31 december 2029.

Värdepapper är uteslutna om emittenter: 1) är inblandade i kontroversiella vapen, handeldvapen, militära kontrakt, oljesand, termiskt kol eller tobak; 2) inte har en kontroversnivå enligt definitionen av Sustainalytics eller har en Sustainalytics-kontroversnivå högre än 4; 3) anses inte följa principerna i FN:s Global Compact; eller 4) kommer från tillväxtmarknader.

Portföljförvaltarna strävar efter att uppnå fondens mål genom att tillämpa en urvalsstrategi, som inkluderar användning av kvantitativ analys, för att välja en andel av värdepapperen från referensindexet som representerar hela indexets egenskaper, med hjälp av faktorer som index- vägd genomsnittlig varaktighet, industrisektorer, landvikter och kreditkvalitet. När en företagsobligation som innehas av fonden når förfallodag kommer kontanterna som fonden tar emot att användas för att investera i kortfristiga EUR-denominerade skulder.

ETFen förvaltas passivt.

En investering i denna fond är ett förvärv av andelar i en passivt förvaltad indexföljande fond snarare än i de underliggande tillgångarna som ägs av fonden.

”Förfallodag”: den andra onsdagen i december 2029 eller annat datum som bestäms av styrelseledamöterna och meddelas aktieägarna.

Handla BE29 ETF

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis (BE29 ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Borsa Italiana.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Borsa Italiana | EUR | BE29 |

| XETRA | EUR | BE29 |

Största innehav

| Namn | CUSIP | ISIN | Kupongränta % | Vikt |

| AT&T Inc 2.35% 05/09/29 | 00206RHH8 | XS1907120791 | 2.350 | 2.22% |

| Holcim Finance Luxembourg SA 1.75% 29/08/29 | L4806FAH4 | XS1672151492 | 1.750 | 2.14% |

| Unibail-Rodamco-Westfield SE 1.5% 29/05/29 | F95094ST0 | XS1619568303 | 1.500 | 2.08% |

| Baxter International Inc 1.3% 15/05/29 | — | XS1998215559 | 1.300 | 2.08% |

| Euronext NV 1.125% 12/06/29 | N3113KAT5 | XS2009943379 | 1.125 | 2.06% |

| Blackstone Property Partners Europ 1.75% 12/03/29 | L1051PAD9 | XS2051670300 | 1.750 | 2.04% |

| Walmart Inc 4.875% 21/09/29 | U9311FAG3 | XS0453133950 | 4.875 | 1.72% |

| Banco Bilbao Vizcaya Argentaria SA 4.375% 14/10/29 | E118054J9 | XS2545206166 | 4.375 | 1.65% |

| Toyota Motor Credit Corp 4.05% 13/09/29 | U89233WV5 | XS2597093009 | 4.050 | 1.63% |

| Nykredit Realkredit AS 4.625% 19/01/29 | K74493TG0 | DK0030512421 | 4.625 | 1.62% |

Innehav kan komma att förändras

Nyheter

Guld-ETFer slår Bitcoin-ETFer kraftigt under första kvartalet 2025

Publicerad

8 timmar sedanden

19 april, 2025

Under hypervolatila marknader omvärderar investerare vanligtvis vad de äger. De ser också över vilka investeringar som är bäst lämpade för att navigera i svåra tider. Guld är alltid ett självklart val, och under den nuvarande turbulensen har det inte gjort dem besvikna. Faktum är att gammaldags guld-ETF, börshandlade fonder som investerar i guld slår till och med bitcoinfonder med en enorm marginal.

Marknadsreferenser som SPDR S&P 500 ETF såg stora dippar från 1 januari till 15 april 2025 SPDR-fonden föll med 7,99 procent under den tiden medan iShares Bitcoin Trust ETF sjönk med 10 procent. Samtidigt steg SPDR Gold Shares-fonden, världens största ETF med fysiskt guld som backas upp, med nästan 23 procent. Fonden har tillgångar på över 98 miljarder dollar.

Medan S&P 500 belönade investerare rikligt under 2023 och 2024, ”sedan befrielsedagen, den 2 april i år, har spelplanerna för 2025 ändrats lite”, säger John Kinnane, chef för nyckelkunder på Sprott Asset Management.

Mitt i de krympande marknaderna har det skett en översvämning av ETFer som fysiskt stöds av guld och silver. I april ökade ETFer för ädelmetaller med 6,6 miljarder dollar i nya tillgångar och vann de största nettoinflödena för månaden i råvarukategorin.

Även ETFer för gruvaktier har klarat sig bra. VanEck Gold Miners ETF, till exempel, avkastade över 49 procent för året fram till den 15 april.

Det finns också specialiserade strategier. USCF Gold Strategy Plus Income Fund erbjuder en unik inkomsttwist på guld genom att sälja täckta köpoptioner för att generera intäkter. Den har en 30-dagars SEC-avkastning på 3,36 procent och har hittills i år ökat med 20,72 procent.

”En av guldets bestående egenskaper är att det faktiskt är en okorrelerad tillgång. Investerare av alla slag letar efter låg korrelation så att de i tider av volatilitet – som vi befinner oss i just nu – får en jämnare avkastning för sin totala portfölj”, säger Kinnane.

I februari lanserade Sprott Sprott Active Gold & Silver Miners ETF. Den inkluderar aktier i guld- och silvergruvor i en ETF-ticker med en aktivt förvaltad strategi.

Medan guldlänkade fonder har blomstrat har varken bitcoin eller resten av kryptovalutamarknaden gett investerarna något särskilt skydd.

Bitwise 10 Crypto Index Fund, ett mått på 10 olika kryptovalutor, inklusive bitcoin, sjönk med 21,28 procent från 1 januari till 15 april. Mindre kryptovalutor, särskilt meme-mynt och tokens, har presterat usla.

Guldets överprestationer har hjälpts av den kraftigt ökande efterfrågan från investerare, men också av köp från centralbanker. 2024 var tredje året i rad som de lade till mer än 1 005 ton till sina globala guldreserver.

”Respondenterna var tydliga med att centralbanksgemenskapen skulle fortsätta att öka sina allokeringar till guld inom kort”, stod det i en rapport om reserver från World Gold Council från 2024.

Stablecoins: The real powerhouse of crypto

BE29 ETF är en portfölj företagsobligationer med förfall 2029

Guld-ETFer slår Bitcoin-ETFer kraftigt under första kvartalet 2025

INGH ETF är en satsning på global infrastruktur

SPFT ETF är en global satsning på teknikföretag

Fonder som ger exponering mot försvarsindustrin

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Warren Buffetts råd om vad man ska göra när börsen kraschar

Svenskarna har en ny favorit-ETF

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFonder som ger exponering mot försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFastställd utdelning i MONTDIV mars 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSju börshandlade fonder som investerar i försvarssektorn