Nyheter

Valour Monthly Update – June ’23

Publicerad

2 år sedanden

Welcome to our monthly newsletter Valour Monthly Update – June ’23 where we share insights and developments from across Valour and the wider crypto space.

To stay up to date on our latest activity and engage with our community, join us across our social channels:

State of the Market:

June can be predominantly characterised by the increasingly apparent shift in institutional interest towards crypto assets. Following investment titan BlackRock’s spot Bitcoin ETF application, prices increased some 17% (1W), closing at a net gain of 10% (30D). Spurring a tide of similar applications and refilings by the likes of WisdomTree, VanEck, Invesco and Fidelity, the price effect has been profound, solidifying Bitcoin’s 85% YTD (H1) increase, pushing the wider crypto market up 5% (30D), back beyond the $1.2tn mark.

Indeed, the month’s unfoldings have seen Bitcoin level out in the $30k range. With the outcome of the Fed’s June FOMC meeting signalling several further anticipated rate hikes, Bitcoin’s narrative as an inflation hedge has been reawakened – with an observable rise in open futures contracts. Seemingly, following the decision to maintain the federal funds rate between 5.00 – 5.25%, BTC’s correlation with the S&P 500 has fallen back below 0, whilst its correlation with gold and inverse relationship with the DXY continues to strengthen.

Whilst many displayed concern at the SEC’s rapid dismissal of ETF filings as ‘inadequate’ requesting further ‘descriptive detail’ to be able to make a judgement, the fact that the governmental agency has engaged in a form of discourse is not to be overlooked. With the wave of June’s institutional adoption expanding to Deutsche Bank’s digital asset custody application, the launch of Citadel and Charles Schwab-backed EDX Markets, as well as the listing of the first leveraged Bitcoin futures ETF on the CBOE exchange, crypto’s paradigm shift is becoming evidently more clear. Whereas the passage of time has both presented and challenged several of the sector’s previous narratives, the latest developments seem to indicate that narratives are gradually converging, a feat which will be cemented with further regulatory clarity and participation anticipated throughout the rest of 2023 and 2024.

In the News:

Policy

• Standard Chartered and PwC China have joined forces in producing a whitepaper on the application of CBDCs in the Guangdong Province, following the region’s $535bn cross-border trade in 2021.

• Circle Internet Singapore, the stablecoin issuer’s Singapore affiliate received a Major Payment Institution (MPI) licence from the Monetary Authority of Singapore (MAS), enabling the company to offer token services and cross-border transactions in the region.

• The Bank of Thailand has initiated a pilot program for a retail CBDC, collaborating with two further banks and Singaporean payment provider 2C2P, exploring the benefits of CBDCs in retail transactions.

• Hong Kong’s Monetary Authority has completed its public consultation on stablecoin regulations, aiming to introduce its full guidelines by 2024.

• Ripple has partnered with Colombia’s Banco de la República to pilot blockchain technology on the XRP ledger. Running through to 2023, the pilot will be overseen by the country’s Ministry of Information and Communications Technologies (MinTIC).

• The UK government has moved forward with its proposed Financial Services and Markets Bill aimed at strengthening the country’s financial services sector and adoption of crypto services.

• Swiss National Bank (SNB) has unveiled plans for a wholesale CBDC pilot, listing the wCBDC on the SIX digital exchange.

• The EU has outlined plans to leverage blockchain technology for verifying educational and professional credentials, with the EBSI Vector project improving the efficiency and security of cross-border credentials.

• The Tel Aviv Stock Exchange has completed the minting of its first test digital government bond ERC-1155 security token as part of the experimental blockchain project between the Ministry of Finance and the stock exchange.

Business

• German telecoms giant Deutsche Telekom announced that it is using its infrastructure to become one of the 100 validators providing staking and validation services on the Polygon network.

• Nike announced that its .swoosh NFT platform will be integrated with EA Sports games, unlocking a host of features and enhancing the personalised experience of virtual sports.

• Fashion giant Louis Vuitton has ramped up its Web3 efforts, launching the VIA Treasure Trunk, providing an immutable and transparent representation of the label’s iconic rectangular travel trunk.

• Ankr has widened its partnership with Microsoft with the introduction of AppChains, a blockchain creator tool that enhances accessibility and usability for developers launching dedicated blockchain solutions.

• Venture capital giant Andreessen Horowitz (a16z) has expanded its international presence with the opening of a London office, citing the jurisdiction’s embrace of blockchain technology and commitment towards favourable regulation for crypto and Web3.

Markets

• U.S-based multi-asset investment giant BlackRock has filed an application for a spot Bitcoin ETF with both the U.S Securities and Exchange Commission (SEC) and Nasdaq exchange.

• Following BlackRock’s spot ETF application, several other investment firms have followed suit, with the likes of Valkyrie, WisdomTree, Invesco and Fidelity amongst the new and refiled applicant holders.

• U.S-based options exchange Cboe Digital received approval by the United States Commodity Futures Trading Commission (CFTC) for margined BTC and ETH based futures contracts.

• The CME group has announced its planned introduction of ETH to BTC ratio futures, realising a new means for the relative trading opportunities between the two largest digital assets.

• MicroStrategy has purchased another $347m of Bitcoin bringing its total holdings to 152,333 ($4.5bn) at an average cost of $29,668.

• German Deutsche Bank has reportedly applied to the country’s financial authority (BaFin for a digital asset custody licence, signalling interest in widening its digital assets service offering, first announced in 2020. The Crypto.com exchange has been granted a Major Payment Institution (MPI) licence by Singapore’s Monetary Authority (MAS), covering Digital Payment Token (DPT) services.

• Banco Santander’s asset servicing arm, CACEIS Bank, has obtained a crypto custody licence from the French regulator. With more than $5tn in AUC, CACEIS will broaden its custody solution to digital assets in the French market.

• JPMorgan has expanded its blockchain based JPM Coin, introducing Euro-denominated for corporate payments, with German-based giant Siemens amongst the first to process a payment.

• Melanion Capital has listed a Bitcoin equities ETF on Amsterdam’s stock exchange, tracking the firm’s Bitcoin Exposure Index.

• Hong Kong-based First Digital Group has successfully launched its First Digital USD (FUSD) stablecoin on the BNB Smart Chain, backed 1:1 with USD reserves or highly liquid assets held by regulated Asian financial institutions.

• JPMorgan has continued exploring blockchain-based solutions, partnering with leading Indian banks (HDFC, ICIC, Axis, Yes, and IndusInd) for interbank settlement of US denominated transactions.

• Stablecoin issuer Tether has announced a partnership with Bitcoin-centric El Salvador, investing $1bn in the country’s renewable energy Bitcoin mining initiative, Volcano Energy.

Tech

• NFT platform Enjin has launched a new mainnet by forking the Polkadot parachain Efinity, thereby expanding the Web3 platform’s capabilities in the blockchain space.

• Polygon has unveiled a series of upgrades dubbed Polygon 2.0, aiming to become the value layer of the internet, enhancing capabilities to enable users to create, exchange and program value.

• USDC stablecoin issuer Circle is set to launch a native version of USDC on Ethereum-based Layer-2 scaling solution Arbitrum, speeding up transactions via the use of cross-chain transfer protocols (CCTPs).

• Total Ethereum staked on the Beacon chain has surpassed 23m, amounting to more than $43bn in value. With an APR of 4.5%, staking activation queues currently stand at 45 days.

• Layer-2 scaling solution ZkSync has outlined a new Hyperchains network testnet aiming to improve overall scalability and efficiency via a modular framework of ZK-powered Hyperchains.

Valour’s Monthly Overview:

June saw several material developments on the corporate front. Announcing the appointment of Sue Ennis to its board of directors, the company also provided highlights into AUM, net sales and the outcome of its 2023 Annual General and Special Meeting. On the product side, Valour’s launch of its first physically backed Bitcoin Carbon Neutral product on the Xetra exchange reflects the Company’s dedication towards providing trusted investor access to decentralised finance (DeFi) and the future of the digital economy, whilst maximising value for its shareholders.

June 22: Valour Inc. Appoints Sue Ennis to Board of Directors

Valour Inc. is pleased to announce the appointment of Sue Ennis to its board of directors. As an acclaimed leader in emerging technology and innovation, Sue has over 15 years of experience, raising more than $1bn for Canadian structured product and small cap companies. Currently VP of Corporate Development at Hut8, Canada’s leading data infrastructure operators and Bitcoin miner, Sue continues to have a significant impact on the trajectory of technology and innovation in Canada. With previous leadership roles at Shyft Network, Coinsquare, Voyager and Invesco, Sue’s dynamic career and dedication to the financial sector will benefit the Company’s path forward, reinforcing its mission to pioneer the integration of traditional capital markets and decentralised finance.

This news follows the appointment on June 20 of two other new Directors, Mikael Tandetnik and Stefan Hascoet.

June 21: Valour Inc. Provides Corporate Updates on AUM, Net Sales, and Other Corporate News

Valour Inc. announced several corporate updates for the month ending May 2023. At month close, Valour’s AUM stood at C$178.9m, with net sales increasing to C$475.2m. Meanwhile, Valour’s investment in partially owned SEBA Bank AG stood at C$37m. Recognising the substantial rise in AUM, CEO Olivier Roussey Newton highlighted that equity valuation underperformance followed the clean out of approximately 13m shares following an aggressive sell order. However, with the Company’s continued monthly growth and pipeline of new products, Valour will continue to increase its assets over the balance of the year. The Company also announced that Mr. Stan Bharti and Forbes & Manhattan, Inc. have divested their shareholdings in the company and no longer have any interest in it. In addition, the Company revealed that it has entered into shares for debt settlement agreements with various officers and consultants of the Company to settle an aggregate balance of $674,837.78 of accrued fees, issuing common shares of the Company at a price of C$0.085 per ‘Debt’ share. Subject to acceptance of Cboe Canada, the settlement agreements will help the Company strengthen its balance sheet by reducing its liabilities and further aligning the interests of officers and consultants with shareholders of the Company.

June 20: Valour Inc. Announces 2023 AGM Voting Results

Valour Inc. announced the voting results from its Annual General and Special Meeting of shareholders held on June 20, 2023. With 14.60% of all issued and outstanding shares of the Company represented at the meeting, shareholders approved the election as directors of, Olivier Roussy Newton (99.07%), Krisztian Toth (94.09%), William Steers (85.23%), Mikael Tandetnik (99.10%), and Stefan Hascoet (99.19%). Additionally, shareholders voted overwhelmingly in favour of the ratification and approval of the appointment of BF Borgers CPA PC, the Company’s auditors, with 98.8% in favour and 1.12% withholding their vote. Further to this, shareholders voted 98.26% in favour of the Company’s name change to ”DeFi Technologies Inc.,” with 1.74% withholding their vote on the Name Change. The board of directors expresses gratitude to shareholders for their continued participation and support.

June 15: Valour Announces the Launch of its First Physically Backed Bitcoin Carbon Neutral Product (ETP) on Frankfurter Wertpapierboerse XETRA

Valour announced the launch of its physically backed Bitcoin Carbon Neutral Product (ETP) on the Börse Frankfurt (Xetra) exchange. The 1Valour Bitcoin Physical Carbon Neutral ETP (ISIN:GB00BQ991Q22) offers investors exposure to Bitcoin and presents a trusted investment method that benefits the environment and aligns with ESG goals through the funding of certified carbon removal and offset initiatives.

Valour has partnered with leading climate action infrastructure provider Patch in the structuring of the ETP, ensuring all carbon emissions linked to the investment will be targeted to achieve a carbon neutral output. As the 13th ETP offered by Valour and the first product on its physically backed platform, Valour anticipates the launch of further innovative products, offering investors trusted access to decentralised finance and Web3.

Venture Spotlight:

Our portfolio companies continue to build their products and develop new partnerships. Here are some of their highlights for the month of June.

Boba Network announced that it had surpassed the 10m txn mark on BobaBNB. Having processed a record 3m transactions throughout the month of May, BobaBNB has seen significant month-on-month growth, up from 2.8m transactions in April, 500k in March, and 99k in February. In addition to several new partnerships and integrations, Boba increased its wallet count by 80,000, with approximately 200k daily transactions.

CLV announced the integration of its CLV Wallet with GateKeeper for PolygonID Verifiable Credential Management. The new partnership will enable users to issue, claim and store verifiable credentials powered by PolygonID. Meanwhile, CLV announced a further integration with the first crypto-biometric network Humanode chain, enabling the utilisation of HMND through the multichain wallet.

Skolem expanded its support for a number of Layer-2 blockchains as well as adding a new execution feature to enable swaps between wrapped and unwrapped native currencies (wETH, ETH, wMATIC, MATIC, wAVAX and AVAX). On the platform front, the team announced that it has started building dashboards for blue chip DeFi protocols directly on its front-end, providing users with simple access to money market data, starting with AAVE v2.

Sovryn announced several general updates including a system upgrade that enables support to WalletConnect v2.0. In addition to work on a non-custodial bridge between Stacks and Rootstock to bring Sovryn’s 100% Bitcoin-backed $DLLR stablecoin to Bitflow liquidity pools, crypto wallet provider Exodus announced that it has added the Sovryn Dollar to its corporate treasury and user wallets.

Volmex launched the public testnet of its perpetual futures exchange protocol. Based on a decentralised matching engine and order book that is underpinned by off-chain relayers, the perpetual futures contracts enable users to hedge, diversify, and speculate with crypto volatility products. Volmex will expand the testnet to additional ETH-based L2s in the coming weeks, enabling support for additional stablecoin collaterals.

Wilder World published their first dev log providing updates on the metaverse’s latest version (v.0.1.15). Focussing on updates to Wheels, Wiami, and zSpace, the log provides users with an in-depth overview of the latest developments across the Wilder World ecosystem.

Valour ETPs

For the month ending June, Valour reported an increase in total assets under management to $140.6m, as aggregated net sales continued to steadily increase. Notwithstanding the recent increase in price levels across the crypto space, Valour’s pipeline of products across both its certificates and physically backed issuance programs will undoubtedly contribute towards further growth, suitably positioning the company ahead of further market developments.

Valour offers fully hedged digital asset ETPs with low to zero management fees, with product listings across European exchanges, banks and brokers. Valour’s current product suites includes 12 unique ETPs including, Cardano (ADA), Polkadot (DOT), Solana (SOL), Uniswap (UNI), Avalanche (AVAX), Cosmos (ATOM), Enjin (ENJ), Binance (BNB), Bitcoin Carbon Neutral, and Valour Digital Basket 10 (VDAB10). Valour’s flagship Bitcoin Zero (BTC) and Ethereum Zero (ETH) products are the first fully hedged, passive investment products with 0% management fees.

For more information on products and offerings, visit: https://valour.com/.

Du kanske gillar

-

Valour utökar utbudet av digitala tillgångar med lanseringen på Börse Frankfurt

-

Investerarnas intresse kraftigt förändrat under februari 2025

-

BNB’s 2025 Roadmap: Why This Sleeper Crypto is Surging

-

Avalanche9000 Explained: Scaling, Speed, and What’s Next

-

Valour tillkännager megalanseringen av 20 nya ETPer för digitala tillgångar på Spotlight Stock Market

-

Rekordlansering av ETPer på Spotlight Stock Market– Valour noterar 20 nya instrument

Nyheter

SPFT ETF är en global satsning på teknikföretag

Publicerad

17 timmar sedanden

18 april, 2025

SPDR MSCI World Technology UCITS ETF (SPFT ETF) med ISIN IE00BYTRRD19, strävar efter att spåra MSCI World Information Technology-index. MSCI World Information Technology-index spårar informationsteknologisektorn på de utvecklade marknaderna över hela världen (GICS-sektorklassificering).

ETFENs TER (total cost ratio) uppgår till 0,30 % p.a. SPDR MSCI World Technology UCITS ETF är den billigaste ETF som följer MSCI World Information Technology index. ETF:n replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFEn ackumuleras och återinvesteras i ETFEn.

SPDR MSCI World Technology UCITS ETF är en stor ETF med tillgångar på 709 miljoner euro under förvaltning. Denna ETF lanserades den 29 april 2016 och har sin hemvist i Irland.

Fondens mål

Fondens investeringsmål är att följa resultatet för företag inom tekniksektorn, över utvecklade marknader globalt.

Indexbeskrivning

MSCI World Information Technology 35/20 Capped Index mäter utvecklingen för globala aktier som klassificeras som fallande inom tekniksektorn, enligt Global Industry Classification Standard (GICS).

Handla SPFT ETF

SPDR MSCI World Technology UCITS ETF (SPFT ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| gettex | EUR | SS47 |

| Bolsa Mexicana de Valores | MXN | WTECN |

| Borsa Italiana | EUR | WTEC |

| Euronext Amsterdam | EUR | WTCH |

| London Stock Exchange | USD | WTEC |

| London Stock Exchange | GBP | TECW |

| SIX Swiss Exchange | USD | WTEC |

| XETRA | EUR | SPFT |

Största innehav

| Värdepapper | Vikt % |

| Apple Inc. | 18,34% |

| Microsoft Corporation | 18,34% |

| NVIDIA Corporation | 18,09% |

| Broadcom Inc. | 4,29% |

| ASML Holding NV | 2,39% |

| Advanced Micro Devices Inc. | 1,50% |

| Adobe Inc. | 1,44% |

| Salesforce Inc. | 1,44% |

| Oracle Corporation | 1,33% |

| QUALCOMM Incorporated | 1,28% |

Innehav kan komma att förändras

Nyheter

Dogecoin in a portfolio: A small 1% allocation has a loud bark!

Publicerad

18 timmar sedanden

18 april, 2025

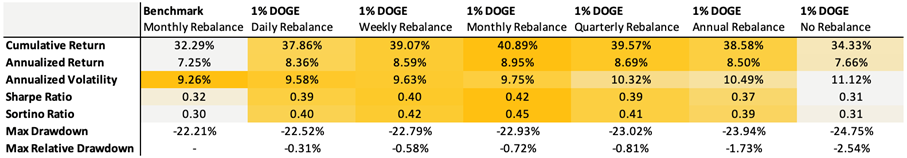

Dogecoin has outperformed other major cryptoassets over the past decade, while also exhibiting a low correlation to crypto and traditional assets. This creates a compelling argument for a portfolio allocation. We tested a Bitcoin-enhanced growth portfolio, which is a traditional 60/40 infused with 3% Bitcoin, and we introduced a modest 1% DOGE allocation. Since most prospective investors likely already hold Bitcoin, this offers a lens into how the two assets can complement each other.

Despite the small portfolio allocation, every approach delivered stronger returns. The benchmark returned 7.25% annually, while DOGE-enhanced portfolios reached as high as 8.95%. Sharpe ratios improved in almost all tests, indicating better risk-adjusted returns. Volatility did slightly tick up, but drawdowns remained largely contained. Even with no rebalancing, the max drawdown only deepened by a few percentage points, underscoring that even a 1% DOGE allocation adds meaningful punch without destabilizing the broader portfolio.

Rebalancing remains essential to capturing upside effectively. Without it, returns can plateau while risk quietly compounds. Monthly or weekly rebalancing offered the best balance, maximizing returns while keeping volatility and drawdowns in check, especially during periods of broader market stress, as we’ve recently seen. Given Dogecoin’s momentum-driven nature, a more strategic approach linked to broader crypto market cycles may offer even greater optimization beyond routine rebalancing.

With the right structure, a 1% allocation to Dogecoin isn’t reckless—it’s rewarding.

Bear Case

Despite strong fundamentals and a rich cultural legacy, Dogecoin’s recent rally, fueled by post-election memecoin mania, may have front-run its true cycle potential. As attention shifts to newer narratives, DOGE risks being seen as ’yesterday’s play,’ potentially underperforming even in a rising market. Still, that wouldn’t signal a flaw in its model, just a pause in a fast-rotating cycle.

Assuming a continued 10% compounded annual growth rate (CAGR) from its 2021 peak of $0.73, DOGE would be projected to land around $0.38 by 2025—still more than 2x from today’s levels but modest relative to past cycles. More notably, this would mark the first time Dogecoin fails to reach a new all-time high in a full market cycle.

Neutral Case

Dogecoin may not dominate headlines like it did at its peak, but it still holds cultural relevance and widespread recognition. In a scenario where the total crypto market cap peaks at $5 trillion this cycle and DOGE maintains a solid, albeit slightly reduced, market share of 3% instead of its previous 4%, this would result in a market capitalization of approximately $150 billion for DOGE.

At that valuation, DOGE would trade near $1 per coin, a ~5.5x gain from current levels around $0.185. This neutral case assumes Dogecoin retains its stature as the leading memecoin, despite increased competition, with stable adoption and renewed retail interest, but without the same euphoria of the last cycle.

Bull Case

If we take DOGE’s bottom price of $0.007 just before the last bull run began and fast-forward two years to the bottom of the current cycle at $0.0585, that move reflects a CAGR of 189%. If DOGE were to mirror this explosive growth, DOGE would reach approximately $1.42.

In this scenario, Dogecoin benefits from renewed memecoin mania, increasing real-world adoption, and stronger interest fueled by regulatory clarity and potential integration with major platforms like Elon Musk’s X. A full return of retail enthusiasm and broad cultural momentum could reestablish DOGE as the breakout asset of the cycle, potentially even doubling its all-time high.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

VBTC ETN spårar priset på kryptovalutan Bitcoin

Publicerad

19 timmar sedanden

18 april, 2025

VanEck Bitcoin ETN (VBTC ETN) med ISIN DE000A28M8D0, spårar värdet på kryptovalutan Bitcoin. Den börshandlade produktens TER (total cost ratio) uppgår till 1,00 % p.a. Denna ETN replikerar resultatet av det underliggande indexet med en skuldförbindelse med säkerheter som backas upp av fysiska innehav av kryptovalutan.

VanEck Bitcoin ETN är en stor ETN med 568 miljoner euro tillgångar under förvaltning. Denna ETN lanserades den 19 november 2020 och har sin hemvist i Liechtenstein.

Produktbeskrivning

Kombinera spänningen med bitcoin med enkelheten och säkerheten hos traditionell finans. Bitcoin är den äldsta kryptovalutan, med det största börsvärdet. Det ses ofta som digitalt guld, ett digitalt värdelager i en tid av osäkerhet. VanEck Bitcoin ETN är en fullständigt säkerställd börshandlad sedel som investerar i bitcoin.

- 100 % uppbackad av bitcoin (BTC)

- Förvaras hos en reglerad kryptodepå, med kryptoförsäkring (upp till ett begränsat belopp)

- Kan handlas som en ETF på reglerade börser (om än inom ett annat segment)

Huvudriskfaktorer

Volatilitetsrisk: Handelspriserna för många digitala tillgångar har upplevt extrem volatilitet under de senaste perioderna och kan mycket väl fortsätta att göra det. Digitala tillgångar har bara introducerats under det senaste decenniet och klarhet i regelverket är fortfarande svårfångad i många jurisdiktioner.

Valutarisk, teknikrisk, juridiska och regulatoriska risker. Du kan förlora pengar genom att investera i fonderna. Värdet på investeringarna kan gå upp eller ner och investeraren kanske inte får tillbaka det investerade beloppet.

Underliggande index

MarketVector Bitcoin VWAP Close Index (MVBTCV Index).

Handla VBTC ETN

VanEck Bitcoin ETN (VBTC ETN) är en europeisk börshandlad kryptovaluta. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Euronext Amsterdam.

Det betyder att det går att handla andelar i denna ETP genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Euronext Amsterdam | USD | VBTC |

| Euronext Paris | EUR | VBTC |

| XETRA | EUR | VBTC |

| gettex | EUR | VBTC |

| SIX Swiss Exchange | CHF | VBTC |

SPFT ETF är en global satsning på teknikföretag

Dogecoin in a portfolio: A small 1% allocation has a loud bark!

VBTC ETN spårar priset på kryptovalutan Bitcoin

iShares och Franklin Templeton listar nya ETFer på Xetra

BE28 ETF företagsobligationer med förfall 2028 och inget annat

Fonder som ger exponering mot försvarsindustrin

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Warren Buffetts råd om vad man ska göra när börsen kraschar

Svenskarna har en ny favorit-ETF

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFonder som ger exponering mot försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFastställd utdelning i MONTDIV mars 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSju börshandlade fonder som investerar i försvarssektorn