Nyheter

Tax Reform Adds Fuel to Gold’s Engine

Publicerad

7 år sedanden

Tax Reform Adds Fuel to Gold’s Engine a Gold Commentary July by Joe Foster, Portfolio Manager/Strategist

Gold’s Yearend Pattern Repeated: Oversold Ahead of Rate Increase Then Rebound

The Federal Reserve (the ”Fed”) raised rates for the third time in 2017 following the Federal Open Market Committee (FOMC) meeting on December 12. Since 2015, gold has established a yearend pattern where it becomes oversold ahead of the December Fed rate decision. This pattern repeated again this year as the gold price trended to a five-month low of $1,236 per ounce on the day of the Fed meeting and then promptly rebounded from the Fed-induced low to end December with a $28.11 gain (2.2%) at $1,303.05 per ounce. Commodity price strength also aided gold as copper and crude oil both made multi-year highs in the last week of the year.

Gold stocks also tested their second half lows on December 12 and, like gold bullion, staged a comeback to end December with the NYSE Arca Gold Miners Index 1 (GDMNTR) rising 4.6% and the MVIS Global Junior Gold Miners Index2 (MVGDXJTR) gaining 8.1% for the month.

Strong 2017 Performance on Geopolitical Risk, U.S. Dollar Weakness, and Commodities Strength

Gold and gold stocks performed well in 2017. The gold price advanced $150.78 per ounce (13.1%), the GDMNTR was up 12.2%, and the MVGDXJTR gained 6.2%. These gains were impressive for a market in which investors generally showed little interest in gold while being preoccupied with new records in the stock market, bitcoin, and ancient art. Gold also did not receive much help from the physical markets, as Indian demand remained near the lows of 2016 and China’s central bank refrained from purchasing gold. The resilience in the price of gold came from a global sense of geopolitical risk and uncertainty, overall strength in commodities, and unexpected weakness in the U.S. dollar. Gold stocks typically outperform gold bullion in a positive gold market. However, this year was one of mean reversion after a strong 2016 (GDMNTR up 55%), along with a lack of sizzle that investors are seeing elsewhere. Healthy earnings and increased guidance among gold companies were not enough to capture much investor interest in 2017.

Tax Reform Adds to Deficit, Increases Systemic Risk

Anyone hoping that Washington D.C. would become fiscally responsible under Republican Party rule has seen their hopes go up in flames, as new tax rules appear likely to drive the U.S. deeper into debt. Some say economic growth created by tax cuts will likely generate more government revenue. In a recent Wall Street Journal article, ex-Congressional Budget Office (CBO) director Douglas Holtz-Eakin stated that he believes tax policy can partially offset costs if it is well designed. We believe the new tax code is not well designed, as it is nearly as complicated as the old one, widely unpopular, and contains many provisions set to expire in 2025. The tax windfall corporations will receive comes at a time when profits are high and cheap credit is plentiful. If companies were inclined to spend more on capital expansions, they would have done so already, but instead many companies have used cash to buy back stock and pay dividends. We believe it is too late in the cycle for tax stimulus to have a lasting effect. In addition, fiscal stimulus has limited effects when debt levels are high, as they are today. None of the federal income tax cuts since 1980 have succeeded in shrinking the deficit through growth. The Reagan tax cuts of 1981 could not forestall a recession that started in July of that year, caused by tighter Fed policy. Similarly, any growth resulting from Trump’s tax cuts could give the Fed more latitude to raise rates.

Tax reform will add an estimated $1.5 trillion to the deficit over ten years, according to the Joint Committee on Taxation (JCT). In October, the U.S. Treasury Department reported the budget shortfall increased 14% in 2017 to $666 billion, which is equal to 3.3% of GDP. At $16 trillion, public federal debt is 85% of GDP and Harvard University economist Jason Furman estimates debt escalating to 98% of GDP by 2028. The CBO figures interest charges will consume 15% of federal revenues in 2027, up from 8% currently. The annual report from the trustees of the nation’s largest entitlement programs show the trust funds running out for Medicare in 2029 and for Social Security in 2034. The new tax law only piles more onto this growing mountain of debt.

Total non-financial debt in the U.S. stands at $47 trillion, equal to 250% of GDP and $14 trillion more than at the peak of the last credit bubble when debt/GDP stood at 225%. Thanks to below market rates engineered by central banks, debt service has not yet become a problem. Low rates have forced investors to take on more risk in order to generate acceptable returns. Another side effect is the proliferation of European ”zombie companies”, meaning their interest cost exceeds earnings and kept on life support by banks fearful of losses if the companies declare bankruptcy. The Bank for International Settlements (BIS) estimates that 10% of publicly traded companies in six major European countries are zombies. As central banks embark on tighter policies, at some point higher rates could create debt service problems. Gluskin Sheff3 reckons every percentage point rise in the level of rates will ultimately drain 2.5% out of nominal GDP growth.

Looming Economic Downturn, Decline in Markets Supports Gold Allocation

It appears the only way to stop sovereign debt from growing is through tax increases or spending cuts. By now it should be clear that these options are politically impossible, which suggests that deficits will continue to grow until they cause a crisis severe enough to motivate change. ”Crypto-mania” and a stock market that goes nowhere but up indicates that a crisis is the last thing on investors’ minds. However, in our opinion, we are at a stage in the cycle when concerns should be high. The expansion is heading into its ninth year. The economy is at full employment and the personal savings rate has declined from 6% in 2015 to 2.9% in November. By now many have bought their first home, a new car, remodeled the kitchen, taken that overseas vacation, or bought a second home. Some are in a position to speculate on their favorite ETF, cryptocurrency, or FAANG stock (Facebook, Apple, Amazon, Netflix, and Google). There comes a point when investors are all-in and something happens that triggers a selloff – a geopolitical event, an economic downturn, or a black swan 4 emerges. Markets decline, but there are few investors with the capacity or desire to buy more, so markets decline more. Momentum kicks in and there’s more selling until sentiment turns for the worse. The selloff becomes a contagion that spreads uncontrollably. It has happened to tech stocks and it’s happened to instruments linked to mortgage securities. It is likely to happen again.

Based on the gold price strength following December rate increases in 2015 and 2016, we expect to see firmness in the gold price in the first quarter. However, headwinds may come for gold if economic growth enables the Fed to tighten more than expected. Also, the U.S. dollar might strengthen if the new tax code causes corporations to repatriate profits stockpiled overseas. We believe any weakness in gold during the first half of 2018 could be transitory. Moving through 2018 and into 2019, we believe the chance of an economic downturn increases, along with the probability of a significant decline in the markets. High levels of debt could cause a downturn to turn into a financial crisis. We now know that quantitative easing5 and below-market rates have failed to generate needed growth or inflation. In the next crisis, look for central banks to resort to even more radical policies, such as directly funding treasuries. It is conceivable that there could be global currency debasement on a scale never seen before. In such a scenario, hard assets, especially gold and gold stocks, could significantly outperform most, if not all, other asset classes in our opinion. There comes a time in every economic cycle when investors should seek portfolio insurance. We believe the time is now.

by Joe Foster, Portfolio Manager and Strategist

With more than 30 years of gold industry experience, Foster began his gold career as a boots on the ground geologist, evaluating mining exploration and development projects. Foster is Portfolio Manager and Strategist for the Gold and Precious Metals strategy.

Please note that the information herein represents the opinion of the author and these opinions may change at any time and from time to time.

IMPORTANT DISCLOSURE

1 NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold.

2 MVIS Global Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver.

3 Gluskin Sheff + Associates Inc., a Canadian independent wealth management firm, manages investment portfolios for high net worth investors, including entrepreneurs, professionals, family trusts, private charitable foundations, and estates.

4 A black swan is an event or occurrence that deviates beyond what is normally expected of a situation and is extremely difficult to predict; these events are typically random and are unexpected.

5 Quantitative Easing by a central bank increases the money supply engaging in open market operations in an effort to promote increased lending and liquidity.

Important Disclosures

This commentary originates from VanEck Investments Limited (“VanEck”) and does not constitute an offer to sell or solicitation to buy any security.

VanEck’s opinions stated in this commentary may deviate from opinions presented by other VanEck departments or companies. Information and opinions in this commentary are based on VanEck’s analysis. Any forecasts and projections contained in the commentary appear from the named sources. All opinions in this commentary are, regardless of source, given in good faith, and may only be valid as of the stated date of this commentary and are subject to change without notice in subsequent versions of the commentary. Any projections, market outlooks or estimates in this material are forward-looking statements and are based upon certain assumptions that are solely the opinion of VanEck. Any projections, outlooks or assumptions should not be construed to be indicative of the actual events which will occur.

Du kanske gillar

-

Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

-

Q2 2025 Outlook: In the Middle of the 3% Reckoning

-

Deep Dive into Pyth Network

-

Deep Dive into Pyth Network

-

The Layer-1 Challengers: Why These Layer-1 Might Be the Real Ethereum Killers

-

ETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

Nyheter

iShares noterar fond för flyg- och försvarssektorn på Xetra

Publicerad

43 minuter sedanden

26 april, 2025

iShares Global Aerospace & Defence UCITS ETF investerar i aktier i företag från utvecklade marknader som tillhör flyg- och försvarssektorn. Åtagandet inkluderar tillverkare av civil eller militär flyg- och försvarsutrustning, relaterade reservdelar eller produkter, försvarselektronik och rymdutrustning.

Sedan tidigare är denna börshandlade fond noterad på Euronext Amsterdam.

| Namn | ISIN Ticker | Avgift | Utdelnings- policy |

| iShares Global Aerospace & Defence UCITS ETF USD (Acc) | IE000U9ODG19 5J50 (EUR) | 0,35% | Ackumulerande |

Produktutbudet inom Deutsche Börses ETF- och ETP-segment omfattar för närvarande totalt 2 408 ETFer, 199 ETCer och 256 ETNer. Med detta urval och en genomsnittlig månatlig handelsvolym på cirka 23 miljarder euro är Xetra den ledande handelsplatsen för ETFer och ETPer i Europa.

Nyheter

8RMY ETF köper bara aktier i europeiska försvarsföretag

Publicerad

2 timmar sedanden

26 april, 2025

HANetf Future of European Defence UCITS ETF Accumulating (8RMY ETF) med ISIN IE000I7E6HL0 försöker att följa VettaFi Future of Defence Ex US-indexet. VettaFi Future of Defence Ex US-indexet följer resultatet för företag som är verksamma inom militär- eller försvarsindustrin. Amerikanska företag är exkluderade. Vikten av europeiska företag i indexet är minst 90 procent.

De börshandlade fondens TER (total expense ratio) uppgår till 0,39 % per år. HANetf Future of European Defence UCITS ETF Accumulating är den enda ETFen som följer VettaFi Future of Defence Ex US-indexet. ETFen replikerar resultatet för det underliggande indexet genom fullständig replikering (genom att köpa alla indexkomponenter). Utdelningarna i ETFen ackumuleras och återinvesteras.

Denna ETF lanserades den 7 april 2025 och har sitt säte i Irland.

Future of European Defence UCITS ETF

En europeisk försvars-ETF, från ett europeiskt företag, utan exponering mot USA.

Europa åtar sig att göra stora försvarsinvesteringar: Efter årtionden av underutnyttjande återupprustar Europa äntligen. EU har lagt fram en försvarsplan på 800 miljarder euro, medan enskilda europeiska NATO-medlemmar snabbt ökar sina egna militära budgetar.

Strategisk autonomi innebär att köpa europeiskt: Europas upprustning handlar inte bara om att spendera mer – det handlar om att bygga försvarsoberoende. För att minska beroendet av amerikansk utrustning prioriterar EU europeiskt tillverkade vapen, fordon och system, vilket ger den europeiska försvarssektorn en stark medvind.

Europeisk försvars-ETF från ett europeiskt företag

Detta är den första europeiska försvars-ETF som lanserats av ett europeiskt företag – och stöds av teamet bakom den snabbt växande NATO-ETFen.

Europeisk försvars-ETFens mål

Future for European Defence UCITS ETF (8RMY) syftar till att ge exponering mot NATO och NATO+-allierades försvars- och cyberförsvarsutgifter, exklusive USA.

Med ökande hot och amerikanskt stöd som inte längre garanteras, ser europeiska NATO-medlemmar över sina försvarsstrategier och ökar kraftigt militära utgifter. Efter ett decennium av att inte ha uppnått 2 % av BNP-målet har Europa tillsammans underutnyttjat med uppskattningsvis 850 miljarder euro. För att återuppbygga och modernisera sina väpnade styrkor riktar regeringarna nu denna förnyade investering mot europeiska försvarsföretag – vilket stärker kontinentens strategiska självförsörjning.

European Defence ETF följer VettaFi Future of Defence Ex US Index, som är utformat för att fånga upp europeiska företag vars majoritet av sina intäkter kommer från militära utgifter.

Handla 8RMY ETF

HANetf Future of European Defence UCITS ETF Accumulating (8RMY ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Euronext Paris | EUR | ARMY |

| gettex | EUR | 8RMY |

| Borsa Italiana | EUR | ARMI |

| London Stock Exchange | GBX | NAVY |

| London Stock Exchange | USD | ARMY |

| XETRA | EUR | 8RMY |

Största innehav

| Namn | Vikt % |

| RHEINMETALL AG COMMON | 14,81% |

| THALES SA COMMON STOCK | 12,49% |

| LEONARDO SPA COMMON STOCK | 10,13% |

| BAE SYSTEMS PLC | 9,86% |

| SAAB AB COMMON STOCK SEK | 7,78% |

| SAFRAN SA COMMON STOCK | 7,06% |

| KONGSBERG GRUPPEN ASA | 6,27% |

| ROLLS-ROYCE HOLDINGS PLC | 4,37% |

| AIRBUS SE COMMON STOCK | 3,27% |

| DASSAULT AVIATION SA | 2,86% |

Innehav kan komma att förändras

Nyheter

Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

Publicerad

3 timmar sedanden

26 april, 2025

The investment environment in 2025 has been marked by increased uncertainty, including evolving trade dynamics involving the U.S. and rising geopolitical risks, which have weighed on overall market sentiment. Notably, though, gold has shone, surging past the symbolic $3,100 per ounce mark for the first time in history.

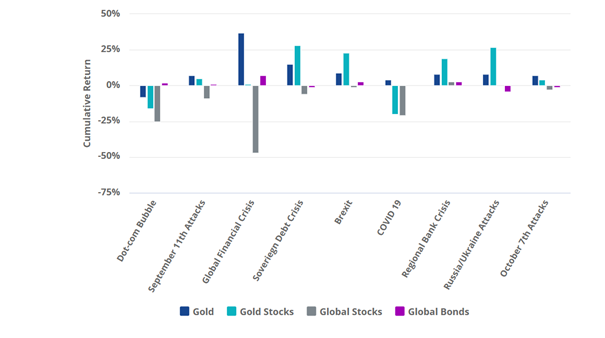

Gold has recently gained attention as investors seek potential hedges against rising inflation, currency fluctuations, and broader market volatility. Historical data suggests that both gold and gold mining equities have sometimes outperformed during periods of market stress, though such outcomes are not guaranteed and may vary depending on broader macroeconomic dynamics. The chart below displays historical episodes where gold and gold mining equities experienced relative strength during market corrections. However, such past performance should not be interpreted as a reliable indicator of future results.

Source: VanEck, World Gold Council.

The early months of 2025 have seen a resurgence in gold mining stock interest, with the VanEck Gold Miners ETF (GDX) receiving significant capital inflows. These flows reflect changing investor sentiment but should not be viewed as a guarantee of future returns.

Improved management

While gold mining stocks are a play on the gold price, they are much more than that. In the past, gold mining companies indulged in wanton value destruction. During gold’s last bull market that ended in 2011, mining companies borrowed heavily to fund new developments and extract gold from low quality mines. After the gold price dropped, they were forced to announce write-downs.

But since then, they have learned to keep costs under control. Indeed, for more than 10 years gold mining companies’ costs have grown by far less than a gold price that’s at least doubled. Despite the sharp rise in gold prices, especially in post 2020, miners have lagged significantly, likely reflecting ongoing capital and operating challenges noted between 2011 and 2015. This divergence may suggest a potential value opportunity if mining equities eventually re-rate closer to gold’s performance. Nevertheless, this is an assumption and may not turn out to be true, as structural issues or market dynamics could continue to weigh on miners’ valuations.

Gold Miner Premium/Discount to Gold

Source: Scotiabank. Data as February 2025.

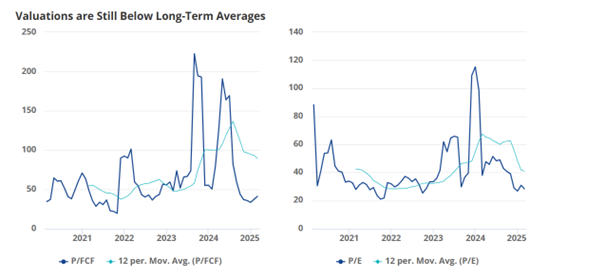

Gold miners are expanding their profit margins, generating cash and embarking on share buy backs. What’s more, many have strong balance sheets. Yet still they trade at valuations below historical averages. Valuation metrics such as price-to-free cash flow (P/FCF) and price-to-earnings (P/E) ratios remain below the 12-month moving average.

Valuations are Still Below Long-Term Averages

Source: Morningstar data.

Gold miners differentiate from gold because they are operating businesses influenced by company-specific factors such as management decisions, production efficiency, regulatory environments, and geopolitical risks. While gold is a passive asset driven by macroeconomic trends, miners add an additional layer of exposure to operational performance and cost structures.

A supportive macro backdrop

The performance of gold mining stocks is naturally influenced by the trajectory of gold prices. From a macroeconomic standpoint, factors such as inflation concerns and central bank policies continue to shape a cautiously optimistic outlook for gold, although the asset remains subject to volatility. Central banks continue to be net buyers, with 2023 marking a record year in terms of official sector demand. This trend has extended into 2024 and early 2025, underscoring institutional confidence in gold as a long-term store of value.

At the same time, the unfolding trade war is contributing to a more volatile global environment. These developments could support the case for gold and, by extension, gold mining equities. Moreover, recent efforts to improve transparency around global gold reserves, including audits of holdings in Fort Knox and London, have added credibility to the market, potentially reducing the perceived risk premium for miners.

Valuable portfolio diversification

From an investor’s perspective, gold mining stocks can be a useful diversifier in a broader equity portfolio, especially at a time of uncertainty for equity markets. Historically, gold mining stocks have exhibited a high sensitivity to changes in the price of gold, sometimes outperforming the metal itself during prolonged bull markets. However, they also tend to underperform during downturns, reflecting their leveraged exposure to gold price movements. Past performance is not indicative of future results. The table below shows the low correlation of the two VanEck gold miners UCITS ETFs with the MSCI World Index of global stock prices. This low correlation suggests that gold mining ETFs may perform differently than global equities, potentially helping to reduce overall portfolio volatility during periods of market stress. That said, they also carry equity-like risks, and investors should assess their portfolio objectives and risk tolerance accordingly.

Low Price Correlations with Stocks

| Investment | MSCI World | Gold Price | VanEck Junior Gold Miners ETF | VanEck Gold Miners ETF |

| MSCI World | 1.00 | |||

| Gold Price | 0.10 | 1.00 | ||

| VanEck Junior Gold Miners ETF | 0.38 | 0.76 | 1.00 | |

| VanEck Gold Miners ETF | 0.31 | 0.81 | 0.96 | 1.00 |

Source: Morningstar data.

A better way to play the rally?

When the VanEck Gold Miners UCITS ETF was introduced in 2015, it aimed to provide investors with a way to gain diversified exposure to gold mining equities. Early performance was tempered by concerns related to past capital discipline within the sector. Recent inflows into ETF may reflect renewed investor interest, although sentiment toward mining equities can remain sensitive to market and operational developments.

As gold glitters at a time of market volatility, there are good reasons to think gold miners may be a better way to play the rally. It should however be noted that while gold prices and mining companies are closely linked, investing in miners introduces additional layers of risk and complexity and investors should consider all the risk factors before investing.

IMPORTANT INFORMATION

This is marketing communication. Please refer to the prospectus of the UCITS and to the KID/KIID before making any final investment decisions. These documents are available in English and the KIDs/KIIDs in local languages and can be obtained free of charge at www.vaneck.com, from VanEck Asset Management B.V. (the “Management Company”) or, where applicable, from the relevant appointed facility agent for your country.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neudtadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under MiFID under the Markets in Financial Instruments Directive (“MiFiD). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the Management Company. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

”The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk for any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”), expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, noninfringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. It is not possible to invest directly in an index.”

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

VanEck Gold Miners UCITS ETF (the ”ETF”) is a sub-fund of VanEck UCITS ETFs plc, an open-ended variable capital umbrella investment company with limited liability between sub-funds. The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

VanEck Junior Gold Miners UCITS ETF (the ”ETF”) is a sub-fund of VanEck UCITS ETFs plc, an open-ended variable capital umbrella investment company with limited liability between sub-funds. The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investing is subject to risk, including the possible loss of principal. Investors must buy and sell units of the UCITS on the secondary market via a an intermediary (e.g. a broker) and cannot usually be sold directly back to the UCITS. Brokerage fees may incur. The buying price may exceed, or the selling price may be lower than the current net asset value. The indicative net asset value (iNAV) of the UCITS is available on Bloomberg. The Management Company may terminate the marketing of the UCITS in one or more jurisdictions. The summary of the investor rights is available in English at: complaints-procedure.pdf (vaneck.com). For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

iShares noterar fond för flyg- och försvarssektorn på Xetra

8RMY ETF köper bara aktier i europeiska försvarsföretag

Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

Fem spanska fonder som har ökat med +12% under 2025

ASRP ETF ett spel på medtech företag världen över

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa