Nyheter

ETFmarknaden i Europa firar sitt 24-årsjubileum med tillgångar på två biljoner USD

Publicerad

1 år sedanden

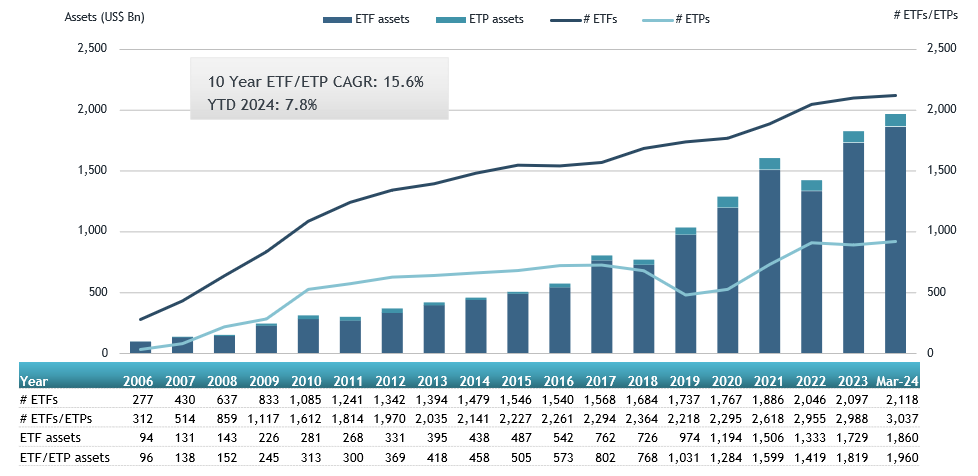

ETFGI, ett ledande oberoende forsknings- och konsultföretag som täcker trender i det globala ETF-ekosystemet, rapporterar att ETFmarknaden i Europa firar sitt 24-årsjubileum med rekordtillgångar på nästan 2 biljoner US-dollar. De första europanoterade ETF:erna gjorde sin debut den 11 april 2000. Dessa två ETFer var baserade på Euro Stoxx 50– och Stoxx Europe 50-indexen, och de var noterade på Deutsche Boerse i Tyskland.

Tillgångar som investerats i ETF-branschen i Europa nådde rekordhöga 1,96 biljoner USD i slutet av mars. Under mars samlade ETF-branschen i Europa nettoinflöden på 11,02 miljarder USD, vilket ger årets nettoinflöden till 49,52 miljarder USD, enligt ETFGIs mars 2024 europeiska ETFer och ETPers industrilandskapsrapport, den månatliga rapporten som är en del av en årlig betald forskningsprenumerationstjänst. (Alla dollarvärden i USD om inget annat anges.)

Höjdpunkter

- Tillgångar som investerats på ETFmarknaden i Europa nådde ett rekord på 1,96 Tn i slutet av mars och slog det tidigare rekordet på 1,90 Tn i slutet av februari 2024.

- Tillgångarna ökade med 7,8 % YTD 2024, från 1,82 Tn USD i slutet av 2023 till 1,96 Tn USD.

- Nettoinflöden på 11,02 miljarder USD i mars 2024.

- YTD nettoinflöden på 49,52 miljarder USD är tredje högsta någonsin efter YTD nettoinflöden på 59,30 miljarder USD 2021 och YTD nettoinflöden på 49,73 miljarder USD 2022.

- Artonde månaden med på varandra följande nettoinflöden.

”S&P 500-indexet ökade med 3,22 % i mars och är upp 10,56 % YTD 2024. De utvecklade marknaderna exklusive det amerikanska indexet ökade med 3,62 % i mars och steg 5,26 % YTD 2024. Spanien (upp 10,72 %) och Italien (upp 6,34 %) såg de största ökningarna bland de utvecklade marknaderna i mars. Emerging markets-indexet ökade med 1,50 % under mars och steg 2,08 % YTD 2024. Peru (upp 10,27 %) och Columbia (upp 8,19 %) såg de största ökningarna bland tillväxtmarknaderna i mars”, enligt Deborah Fuhr, managing partner, grundare och ägare av ETFGI.

Tillgångstillväxt i ETF-branschen i slutet av mars

Källa: ETFGI

I slutet av mars hade ETFmarknaden i Europa 3 037 produkter, med 12 209 noteringar, tillgångar på $1,96 Tn, från 99 leverantörer listade på 29 börser i 24 länder.

Under mars samlade ETFer nettoinflöden till 11,02 miljarder USD. Aktie-ETFer samlade nettoinflöden på 9,81 miljarder USD under mars, vilket förde YTD nettoinflöden till 39,30 miljarder USD, högre än 19,38 miljarder USD i nettoinflöden av eget kapital YTD 2023. Ränte-ETFer rapporterade nettoinflöden på 719,00 USD YTD under 1 mars, vilket gav 25 USD nettoinflöden. miljarder, lägre än 15,49 miljarder USD i nettoinflöden YTD år 2023. Råvaru-ETFer rapporterade nettoutflöden på 75,35 miljoner USD under mars, vilket förde YTD nettoutflöden till 2,32 miljarder USD, lägre än 1,67 miljarder USD i nettoinflöden YTD 2023. på 670,27 miljoner USD under månaden, vilket samlade ett nettoinflöde för året i Europa på 2,33 miljarder USD, högre än 2,17 miljarder USD i nettoinflöden YTD 2023.

Betydande inflöden kan tillskrivas de 20 bästa ETFerna av nya nettotillgångar, som samlat in 9,63 miljarder USD under mars. iShares Core S&P 500 UCITS ETF – Acc (CSSPX SW) samlade in 918,91 miljoner USD, det största enskilda nettoinflödet.

Topp 20 ETFer efter nettoinflöden i mars 2024: Europa

| Namn | Kortnamn | Assets ($ Mn) Mar-24 | NNA ($ Mn) YTD-24 | NNA ($ Mn) Mar-24 |

| iShares Core S&P 500 UCITS ETF – Acc | CSSPX SW | 84,308.60 | 4,744.81 | 918.91 |

| UBS ETF (LU) MSCI United Kingdom UCITS ETF (GBP) A-acc – Acc | UC64 | 2,485.72 | 653.33 | 753.94 |

| Invesco MSCI USA ESG Universal Screened UCITS ETF – Acc | ESGU | 2,188.25 | 792.66 | 741.48 |

| Xtrackers II EUR Overnight Rate Swap UCITS ETF – 1C – Acc | DBXT | 7,281.96 | 2,089.43 | 596.35 |

| HSBC S&P 500 UCITS ETF | H4ZF | 6,756.08 | 661.46 | 562.23 |

| iShares MSCI EM ESG Enhanced UCITS ETF | EEDM | 5,000.88 | 886.95 | 556.22 |

| Vanguard FTSE All-World UCITS ETF | VGWL | 24,771.34 | 1,410.78 | 545.51 |

| Invesco S&P 500 UCITS ETF – Acc | P500 | 25,176.99 | 939.08 | 497.72 |

| iShares MSCI ACWI UCITS ETF – Acc | IUSQ | 12,806.01 | 1,453.06 | 469.35 |

| iShares USD Treasury Bond 0-1yr UCITS ETF | IBCC | 14,990.95 | 1,433.49 | 431.07 |

| iShares € High Yield Corp Bond UCITS ETF | EUNW | 7,694.75 | 1,427.77 | 413.53 |

| SPDR S&P 500 UCITS ETF | SPY5 | 12,491.17 | 3,418.58 | 388.74 |

| iShares Core MSCI World UCITS ETF – Acc | EUNL | 75,051.88 | 3,236.70 | 382.75 |

| Amundi Bloomberg Equal-weight Commodity ex-Agriculture UCITS ETF – Acc | LYTR | 1,668.95 | 367.30 | 378.26 |

| iShares STOXX Europe Small 200 UCITS ETF (DE) | SCXPEX | 916.86 | 401.43 | 357.42 |

| Amundi MSCI Japan UCITS ETF – Acc | LCUJ | 4,400.85 | 158.96 | 343.86 |

| UBS ETF (CH) – MSCI Switzerland (CHF) A-dis – Acc | SWICHA | 1,126.17 | 354.69 | 335.87 |

| SPDR MSCI World UCITS ETF – Acc | SPPW | 5,653.51 | 715.38 | 324.95 |

| Amundi S&P 500 Climate Net Zero Ambition PAB UCITS ETF | ZPA5 | 3,965.66 | 925.46 | 320.42 |

| JPMorgan US Research Enhanced Index Equity ESG UCITS ETF – Acc | JREU | 7,047.30 | 1,230.55 | 315.09 |

Källa ETFGI

De 10 bästa ETPerna av nya nettotillgångar samlade ihop 1,69 miljarder USD under mars. WisdomTree Physical Silver – Acc (PHAG LN) samlade in 832,90 miljoner USD, det största enskilda nettoinflödet.

Topp 10 ETPer efter nettoinflöden i mars 2024: Europa

| Namn | Kortnamn | Assets ($ Mn) Mar-24 | NNA ($ Mn) YTD-24 | NNA ($ Mn) Mar-24 |

| WisdomTree Physical Silver – Acc | VZLC | 2,057.21 | 793.35 | 832.90 |

| iShares Physical Silver ETC – Acc | SSLN | 785.65 | 254.30 | 245.97 |

| Xtrackers IE Physical Gold ETC Securities – Acc | XGDU | 3,640.08 | 231.87 | 167.72 |

| AMUNDI PHYSICAL GOLD ETC (C) – Acc | GOLD | 4,575.61 | 307.29 | 127.12 |

| Xtrackers Physical Gold ETC (EUR) – Acc | XAD5 | 2,202.38 | 92.10 | 80.28 |

| WisdomTree Copper – Acc | OD7C | 1,667.78 | 337.85 | 68.51 |

| Xtrackers Physical Gold Euro Hedged ETC – Acc | XAD1 | 1,335.65 | 5.06 | 50.49 |

| SG ETC FTSE MIB -3x Daily Short Collateralized – Acc | MIB3S | 33.07 | 88.10 | 40.49 |

| 21Shares Toncoin Staking ETP | TONN | 40.81 | 39.94 | 39.94 |

| Invesco Physical Gold ETC – EUR Hdg Acc | 8PSE | 564.18 | 59.65 | 33.11 |

Källa: ETFGI

Investerare har tenderat att investera i Equity ETFs under mars.

Du kanske gillar

Nyheter

WELC ETF ger exponering mot företag inom sällanköpsvaror

Publicerad

19 minuter sedanden

28 april, 2025

Amundi S&P Global Consumer Discretionary ESG UCITS ETF DR EUR (D) (WELC ETF) med ISIN IE00061J0RC6, strävar efter att spåra S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Consumer Discretionary index. Det S&P-utvecklade ex-Korea LargeMidCap Sustainability Enhanced Consumer Discretionary-indexet spårar stora och medelstora företag från den diskretionära konsumentsektorn. ESG-kriterier (miljö, social och bolagsstyrning) beaktas vid valet av värdepapper.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,18% p.a.. Amundi S&P Global Consumer Discretionary ESG UCITS ETF DR EUR (D) är den billigaste ETF som följer S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Consumer Discretionary index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen delas ut till investerarna (Årligen).

Amundi S&P Global Consumer Discretionary ESG UCITS ETF DR EUR (D) är en mycket liten ETF med 5 miljoner euro förvaltade tillgångar. Denna ETF lanserades den 20 september 2022 och har sin hemvist i Irland.

Investeringsmål

AMUNDI S&P GLOBAL CONSUMER DISCRETIONARY ESG UCITS ETF DR – EUR (D) försöker replikera, så nära som möjligt, resultatet för S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Consumer Discretionary Index (Netto Total Return Index). Denna ETF har exponering mot stora och medelstora företag i utvecklade länder. Den innehåller uteslutningskriterier för tobak, kontroversiella vapen, civila och militära handeldvapen, termiskt kol, olja och gas (inkl. Arctic Oil & Gas), oljesand, skiffergas. Den är också utformad för att välja ut och omvikta företag för att tillsammans förbättra hållbarhet och ESG-profiler, uppfylla miljömål och minska koldioxidavtrycket.

Handla WELC ETF

Amundi S&P Global Consumer Discretionary ESG UCITS ETF DR EUR (D) (WELC ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

Största innehav

Denna fond använder fysisk replikering för att spåra indexets prestanda.

| Namn | Valuta | Vikt % | Sektor |

| AMAZON.COM INC | USD | 18.89 % | Sällanköpsvaror |

| TESLA INC | USD | 13.29 % | Sällanköpsvaror |

| HOME DEPOT INC | USD | 5.75 % | Sällanköpsvaror |

| LVMH MOET HENNESSY LOUIS VUI | EUR | 5.44 % | Sällanköpsvaror |

| TOYOTA MOTOR CORP | JPY | 4.58 % | Sällanköpsvaror |

| MCDONALD S CORP COM NPV | USD | 2.63 % | Sällanköpsvaror |

| LOWE S COS INC COM US 0.50 | USD | 2.38 % | Sällanköpsvaror |

| SONY GROUP CORP (JT) | JPY | 2.25 % | Sällanköpsvaror |

| BOOKING HOLDINGS INC | USD | 2.02 % | Sällanköpsvaror |

| TJX COMPANIES INC | USD | 1.89 % | Sällanköpsvaror |

Innehav kan komma att förändras

To understand Celestia’s value and its role in the ecosystem, it’s helpful to first understand how traditional blockchain systems are structured.

Most blockchains, like Ethereum or Bitcoin, are monolithic which means they perform all major functions (consensus, data availability, and execution) on a single layer. This design ensures security but according to new modular networks, limits scalability and flexibility.

The modular blockchain thesis, which Celestia is leading, proposes separation of layers and respective responsibilities in the network. Instead of having one network and its validators perform all of its functions, it may be better to have specialized layers:

• Consensus Layer: Ensures that all nodes agree on the order of transactions.

• Data Availability Layer: Ensures transaction data is accessible to all participants.

• Execution Layer: Processes the actual logic and computation of smart contracts.

By unbundling these components, developers can build more efficient, flexible systems that scale far beyond what monolithic blockchains can support. Not all applications need similar levels of security and not all applications need to scale up to millions of transactions. Additionally, one application might be scaling beyond the capabilities of its host network, severely effecting the available data throughput of other applications. This limits developers to the monolithic technology stack provided by a virtual machine such as Ethereum’ EVM.

The Issue of Data Availability

One of the most misunderstood yet crucial components of any blockchain is data availability. In simple terms, it ensures that the data behind each block is fully accessible and verifiable by all participants in the network. Another way to describe it is as the confidence a user can have that the data required to verify a block is really available to all network participants. Data availability is therefore important to all stakeholders of the blockchain ecosystem.

If a block producer withholds data, then nodes cannot verify the block, which leads to potential censorship or fraud.

Traditionally, a blockchain network can offer data availability with the following mechanisms:

• Full Replication: Every node stores the entire blockchain and verifies all data. Secure but not quite scalable.

• Sharding: Breaks the blockchain into smaller pieces (shards), spreading data across nodes. Scalable but highly complex to implement.

• Committee-Based Models: Small groups of nodes are trusted to verify data availability. Efficient, but less decentralized.

Celestia takes a completely different approach using a novel method called Data Availability Sampling (DAS). Instead of requiring every node to download all data, DAS allows lightweight nodes to randomly sample small chunks of a block. If enough pieces are retrievable, the node can confidently assume the full block is available. This slashes resource requirements while maintaining security and decentralization.

Why Data Availability Matters

Data availability might sound like a nerdy technical term, but it’s one of the most important yet one of less invisible parts of how blockchains work.

Let’s say you’re using a crypto app to trade tokens, store art, or move money. Every time you do something, that action (also referred to as a transaction) needs to be recorded and shared with the rest of the network so everyone agrees it happened. If that data disappears or can’t be verified, the whole system becomes untrustworthy. You might think your tokens moved but if no one else can see that record or a different version of that record, it’s as if it never happened.

Here’s a real-life parallel: imagine a public scoreboard at a sports game. If the scorekeeper shows the score to only a few people and then hides the board, how can the rest of the crowd trust the result? Everyone needs to see the score to believe it’s fair. In crypto, data availability is what makes sure the scoreboard is always visible to all participants at any time.

How DAS Changes the Game

Traditionally, ensuring data availability meant every node had to download and verify the entire block of data for any purpose related to particular data inside the block, like reading a whole newspaper just to check one article. Ethereum and most competing monolithic layer-1’s operate this way. It works, but it’s expensive, slow, and becomes less practical as blockchains scale in terms of data throughput required by its Dapps therefore limiting the types of applications that developers can build.

Celestia’s Data Availability Sampling (DAS) is a breakthrough that lets even simple devices (like smartphones) verify that a block’s data is available—by checking just a few random pieces. If enough pieces are found and correct, the network can be confident the full block is truly there and correct.

This innovation means:

• Light clients can safely participate in the network without downloading everything.

• Rollups and app-chains can post their data to Celestia with minimal overhead.

• Scalability skyrockets without sacrificing decentralization.

Celestia’s Role in Scaling Applications

Celestia is the first blockchain designed specifically to be a modular data availability layer. That means it doesn’t execute smart contracts or handle transactions directly, instead, it provides a foundation for others to build new networks, also referred to as rollups.

Developers can launch rollups or full execution environments, and use Celestia to handle the consensus and data availability side. This unlocks several key benefits:

• Massive scalability: Apps can scale independently from each other.

• Customization: Developers choose their own virtual machines, consensus mechanism and execution logic.

• Decentralization: Thanks to DAS, even small devices can validate the system.

This approach flips the script on how we think about launching and scaling blockchains. Instead of competing for space on a monolithic chain, apps get their own chains, backed by Celestia’s secure and scalable data availability layer while giving developers full stack control over their applications.

Celestia Enables Scalability and Offers Full-Stack Control

Using the restaurant example from Sui vs Aptos. Imagine a big, busy restaurant where the chefs, waiters, and cashiers all work in the same small kitchen. It gets crowded, orders take forever, and sometimes things go wrong while the backlog of orders keeps growing. That’s how traditional blockchains work, doing everything in one place.

Now imagine if the restaurant separated the jobs: the chefs cook in a big kitchen, waiters serve from a clean dining area, and the cashiers handle payments at the front desk. Everything runs smoother, faster, and the restaurant can grow in a environment that is less prone to congestion. That is what Celestia is doing for blockchains. Let’s say a small specialty restaurant opens up next door, leveraging Celestia’s register and order management system. That new restaurant can fully focus on delivering the best food and experience to customers, knowing that Celestia’s technology won’t be the limiting factor when scaling up their kitchen. The modularity that Celestia’s restaurant offers is allowing a lot of small scale restaurants to exist without the overhead of individual administrative work. It goes even a step further, Celestia allows you to just use it register while letting smaller restaurants pick their own kitchen (execution environment) and order management system (consensus layer).

In conclusion, Celestia is challenging the believe that blockchains should always be monolithic and blockchains need to offer the same technology stack to all developers on its chain. It is a significant leap forward in the crypto ecosystem and opens possibilities that were previously not feasible.

Diversify Crypto Exposure to Modular Blockchain Technology with the VanEck Celestia ETN

Key features of the VanEck Celestia ETN

• Celestia enables secure scaling of blockchain applications with modular technology.

• Fully-collateralized by TIA in cold-storage.

• Total return of TIA: Tracks the MarketVector™ Celestia VWAP Close Index (MVTIAV).

Why VanEck Crypto ETNs? Here’s why:

• With nearly 70 years in asset management and a strong track record in crypto, we bring deep industry knowledge and proven reliability.

• We combine traditional financial strengths with cutting-edge crypto innovation, backed by a CEO who truly believes in crypto’s future.

• We ensure clarity in our product structures and avoid high-risk or opaque practices, with assets fully backed by cryptocurrency in secure cold storage.

• Our assets are secured by a licensed European bank in Liechtenstein, providing top-tier compliance and security.

• We use the safest institutional custody setup available, prioritizing your security over cost savings.

Crypto is an asset class with high potential returns but investing in digital assets comes with great risk, why choose products that potentially introduce even more risks? Choose VanEck for a secure, transparent, and expertly managed crypto investment experience.

Main Risk Factors:

Investors should note that there is no direct ownership for the crypto assets, but a claim against Issuer to receive such assets.

• Complexity risk: The complexity of the project and its technological concepts make it challenging to assess its viability and valuation.

• Adoption risk: Celestia introduces additional adoption risk as it is uncertain if the concept of modular blockchains will succeed.

• Technology risk: Celestia introduces additional technology risk due to the technology being less mature and therefore could be more prone to bugs and exploits.

• Regulatory Risk: market disruptions and governmental interventions may make digital assets illegal.

• Risk of Losses and Volatility: The trading prices of many digital assets have experienced extreme volatility in recent periods and may continue to do so. There is a risk of total loss as no guarantee can be made regarding custody due to hacking risk, counterparty risk and market risk.

• Other risks specific to this ETN’s Digital Assets can also be found on the VanEck Crypto Academy.

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

IMPORTANT INFORMATION

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Strasse 30, 60486 Frankfurt am Main, Deutschland and VanEck Switzerland AG, Genferstrasse 21, 8002 Zurich, Switzerland.

It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

The underlying Index is the exclusive property of MarketVector GmbH, which has contracted with CC Data Limited to maintain and calculate the Index. CC Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector GmbH, CC Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. ’1st year’ shows the most recent of these 12-month periods and ’2nd year’ shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / © VanEck Switzerland AG

Nyheter

YYYY ETF använder optioner för att ge månadsvis utdelning

Publicerad

2 timmar sedanden

28 april, 2025

YieldMax Big Tech Option Income UCITS ETF Distributing (YYYY ETF) med ISIN IE000MMRLY96, är en aktivt förvaltad börshandlad fond.

ETFen ger tillgång till en covered call-strategi på teknikaktier. En covered call-strategi kombinerar en lång position i en tillgång med försäljning av köpoptioner på denna tillgång.

Den börshandlade fondens TER (total expense ratio) uppgår till 0,99 % per år. Utdelningen i ETFen delas ut till investerarna (månadsvis).

ETFen lanserades den 25 mars 2025 och har sitt säte i Irland.

Fondens mål

YieldMax™ Big Tech Option Income UCITS ETF (YYYY) är en aktivt förvaltad ETF som söker löpande intäkter och kapitaltillväxt via direktinvesteringar i en utvald portfölj av teknik- och teknikrelaterade företag. YYYY ETF strävar efter att dela ut sådan intäkt varje månad.

Investeringsstrategi

YieldMax™ UCITS ETFer förvaltas aktivt där varje fond strävar efter att generera månatlig intäkt från en diversifierad portfölj av covered call-strategier. Strategin med covered call-optioner är en allmänt använd inkomststrategi som bygger på försäljning av optioner för att skörda intäkter från en akties volatilitet, inklusive de som erbjuder små eller inga egna utdelningar.

YieldMax™ UCITS ETFer syftar till att generera månatliga intäkter från försäljning av amerikansknoterade köpoptioner på amerikansknoterade aktier. Fonderna strävar också efter att fånga kapitaltillväxt genom exponering mot aktiekursavkastningen för samma aktier.

Handla YYYY ETF

YieldMax Big Tech Option Income UCITS ETF Distributing (YYYY ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| gettex | EUR | YYYY |

| Borsa Italiana | EUR | YMAG |

| London Stock Exchange | GBX | YMAP |

| London Stock Exchange | USD | YMAG |

| XETRA | EUR | YYYY |

Största innehav

| Namn | Vikt % |

| MICROSOFT CORP | 4.31% |

| NETFLIX INC | 4.23% |

| INTUIT INC | 4.20% |

| CISCO SYSTEMS INC | 4.15% |

| SERVICENOW INC | 4.12% |

| INTL BUSINESS MACHINES CORP | 4.11% |

| PALANTIR TECHNOLOGIES INC-A | 4.09% |

| ALPHABET INC-CL A | 4.07% |

| TESLA INC | 4.04% |

| BROADCOM INC | 4.03% |

Innehav kan komma att förändras

WELC ETF ger exponering mot företag inom sällanköpsvaror

Introduction to Celestia

YYYY ETF använder optioner för att ge månadsvis utdelning

Virtune lanserar Virtune Stellar ETP på Nasdaq Stockholm

Börshandlade fonder för den som vill investera i skogen

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa