Nyheter

Pro-Crypto Presidency, New All-Time Highs, What’s Next?

Publicerad

6 månader sedanden

• The crypto market jumped 17% following the presidential election, sparking renewed momentum.

• Bitcoin and Ethereum typically rally before Inauguration Day, with gains in 2020 exceeding 150% and 250%, respectively.

• Bitcoin crossed $82K, Sui surpassed $3, and Solana nears new highs driven by its DeFi-ecosystem, boosting market optimism.

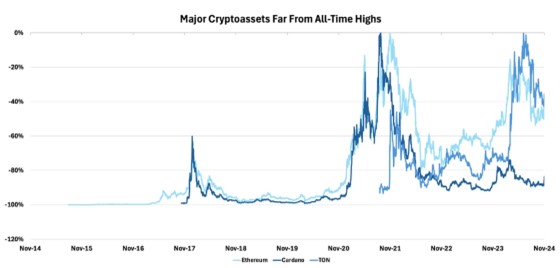

• Ethereum, Cardano, and Toncoin are rallying but remain well below their all-time highs, hinting at significant upside potential. Cardano, in particular, surged nearly 100% following rumors that founder Charles Hoskinson may collaborate with U.S. regulators on crypto policy.

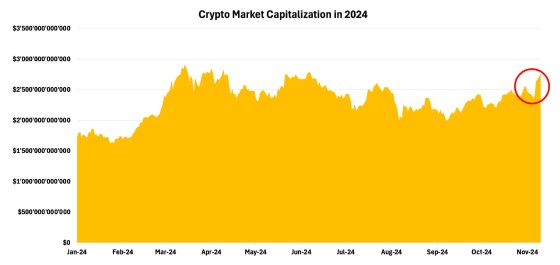

In just a week, the U.S. presidential election has sparked a crypto market rally, pushing total market capitalization up by 17% to $2.7T —a $400B surge. Leading the charge, Bitcoin rocketed almost 20% to an all-time high of more than $82K, while Ethereum broke out of its months-long slump, jumping by over 30%. Market optimism is running high as investors anticipate a smooth transition between the Biden and Trump administrations, with upcoming monetary policy shifts and a mounting geopolitical landscape adding to the momentum.

Figure 1 – Crypto Market Capitalization in 2024

Source: Coingecko, 21Shares

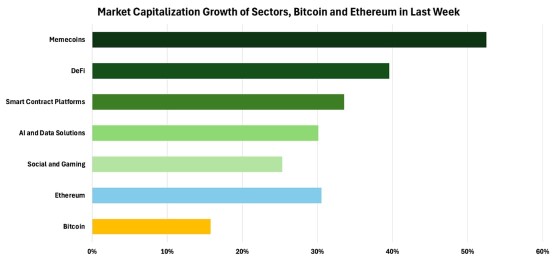

Before diving into the factors shaping this market cycle, let’s take a closer look at how each crypto sector has performed in this historic week. Leading the charge are memecoins, growing by more than 50%, and capturing significant attention, driven largely by Solana’s high speeds. Decentralized Finance (DeFi) has also rallied on speculation around favorable regulatory changes, which we broke down in our last newsletter in more detail.

Figure 2 – Market Capitalization Growth Across Sectors, Bitcoin and Ethereum

Source: Artemis, 21Shares

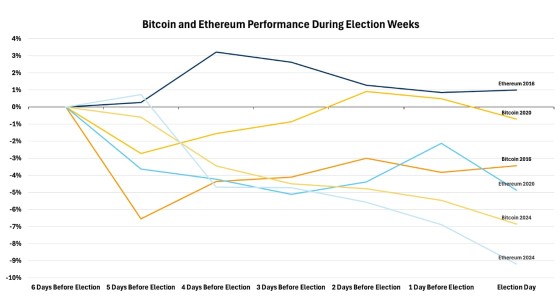

How Does The Market React Around Elections?

The pre-election period has historically put pressure on crypto markets, with Bitcoin and Ethereum often facing declines as uncertainty peaks, as shown in Figure 3. This year saw an even sharper downturn, with Bitcoin dropping nearly 7% in the days leading up to the election. This steeper decline likely reflects the unprecedented attention on the crypto industry, prompting many market participants to de-risk ahead of the event.

Figure 3 – Bitcoin and Ethereum Performance Leading up to Elections

Source: Coingecko, 21Shares

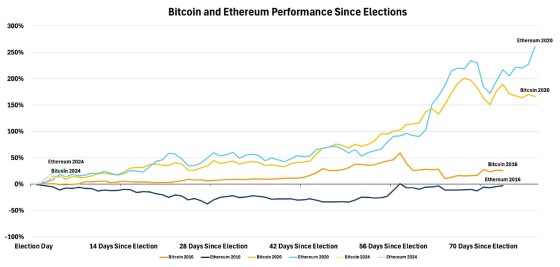

However, as shown in Figure 4, cryptoassets tend to rally in the months following an election—regardless of the political outcome. With a pro-crypto president-elect and a Congress now dominated by crypto-friendly representatives, market sentiment seems primed for a potential rebound. Historically, Bitcoin has averaged a November return of 44%, with particularly strong performance in years that coincide with both a U.S. election and a Bitcoin halving.

Figure 4 – Bitcoin and Ethereum Performance Since Elections

Source: Coingecko, 21Shares

Bitcoin and Ethereum have historically seen significant gains leading to Inauguration Day on January 20. For instance, in 2020, Ethereum surged by over 250%, and Bitcoin rose by more than 150% during this period. January following an election is often particularly favorable for Ethereum, likely as capital shifts from Bitcoin to other assets down the tail.

Figure 5 – Bitcoin and Ethereum Performance in January Post-Elections

Source: Coinglass, 21Shares

Let’s examine how the market is shaping up this time and explore what to expect in the months ahead.

Market Dynamics Post U.S. Election: Current Leaders

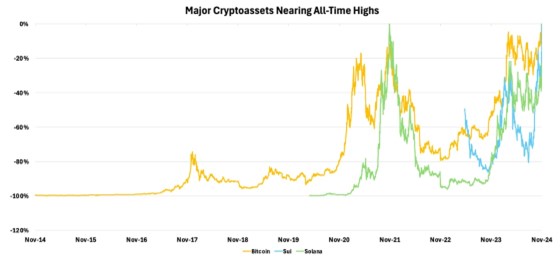

Following the election, several key cryptoassets are nearing or setting new all-time highs, as illustrated in Figure 6. Bitcoin reached a fresh all-time high (ATH) of approximately $74K on election night, then surged past the $80K mark over the weekend, maintaining its upward momentum. Solana, while not yet at a new high, is only 20% away after rallying 34% post-election. Sui also hit a new ATH, rising 66% since Election Day when it traded nearly $2B. As Sui continues to capture market share, particularly by appealing to a new wave of users with consumer-facing applications, it warrants close monitoring as a potential satellite investment alongside Solana.

Figure 6 – Major Cryptoassets Nearing All-Time Highs

Source: Coingecko, 21Shares

Despite several assets already nearing or surpassing ATHs, key indicators suggest there’s still room for growth in this cycle, as post-election rallies often build momentum in the following months.

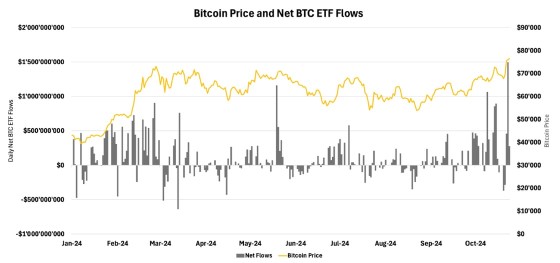

Institutional demand for Bitcoin surged post-election, driven by a pro-crypto administration’s victory. In the three days leading up to the election, net outflows totaled $755M as markets were risk-averse. However, once results were announced, inflows rebounded sharply, with nearly $1.5B in net flows on Thursday alone—the highest single-day inflow of the year and roughly equivalent to all miner rewards issued since the beginning of Q3!

Figure 7 – Bitcoin Price and Net BTC ETF Flows

Source: Glassnode, 21Shares

That said, institutional adoption is still in its early stages, with broader interest on the horizon. The introduction of BTC ETF options enables hedge funds to deploy more sophisticated strategies, boosting market liquidity and accelerating the growth of Bitcoin’s derivatives market—currently only 5% of Bitcoin’s market cap, compared to 10-15x in traditional assets. Additionally, as wirehouses and RIAs complete their one-year due diligence early next year and begin actively allocating client portfolios, Bitcoin could follow a post-election trajectory similar to 2020, as shown in Figure 4.

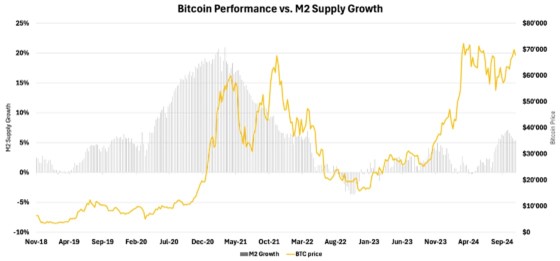

We may see further capital flowing into Bitcoin because of the easing monetary conditions emerging worldwide. Last Thursday, the Fed cut rates by 25bps, following similar moves from the Bank of England, with the ECB likely to follow suit. This rate-cutting trend is driving an indirect expansion in M2 money supply globally, increasing liquidity in the financial system.

Figure 8 – Bitcoin Performance vs. M2 Supply Growth

Source: BGeoMetrics, 21Shares

Bitcoin acts as a ”liquidity sponge,” attracting capital during periods of monetary expansion, as shown in Figure 8. When central banks increase M2 through rate cuts or quantitative easing, Bitcoin initially sees speculative inflows as a high-growth asset. As inflation concerns build, its role as an inflation hedge gains traction, creating a dual response to rising liquidity. With looser monetary conditions emerging, such as in 2020, Bitcoin could be primed to push past the six-figure mark.

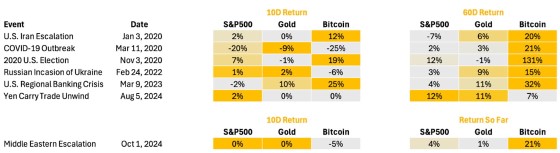

Bitcoin has also shown a solid tendency to rebound in response to market uncertainties, as illustrated in Figure 9 below. While President Trump has demanded a de-escalation of the conflict in the Middle East by January 20, negotiations have stalled, with Qatar suspending its mediation role.

Figure 9 – Bitcoin Price Performance in Face of Macroeconomic Uncertainty

Source: Yahoo Finance, 21Shares

This resilience highlights Bitcoin’s appeal as a sovereign, censorship-resistant asset in times of crisis. With Donald Trump pledging to establish a strategic Bitcoin reserve and support U.S.-based mining, Bitcoin’s fundamentals appear well-positioned to sustain upward momentum in this post-election cycle despite ongoing tensions in the Middle East.

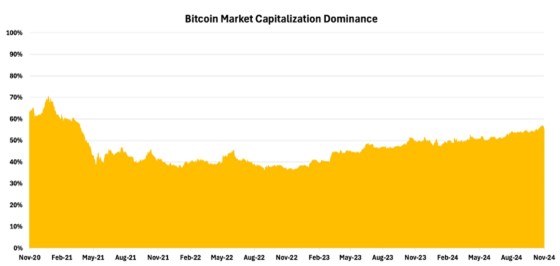

As a result of this year’s events, Bitcoin’s market dominance has surged to around 57%, as shown in Figure 10, its highest level since March 2021. However, a recent 3% dip over the weekend hints that other assets are beginning to lead the charge, signaling a shift toward broader market diversification as investors start allocating capital across the wider crypto landscape.

Figure 10 – Bitcoin Market Capitalization Dominance

Source: Coingecko, 21Shares

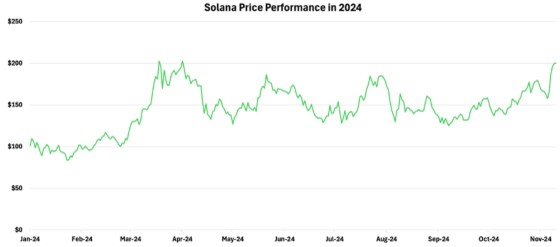

As shown in Figure 11, Solana has been performing exceptionally well this year, with momentum expected to carry through the current cycle. It recently surpassed the $217 mark, setting a new year-to-date high. This surge has been driven by strong retail engagement and a vibrant DeFi sector, which initially catalyzed Solana’s growth earlier in the year. Now, with a resurgence in SPL-based tokens, Solana’s ecosystem appears poised to continue attracting capital and retail interest, supporting its upward trajectory.

Figure 11 – Solana Performance

Source: Coingecko, 21Shares

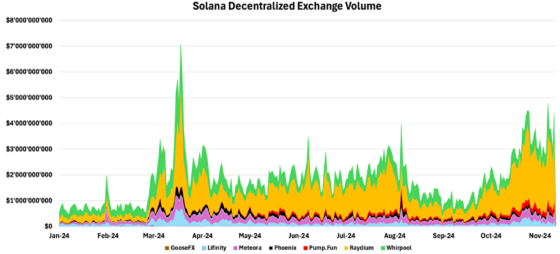

Memecoins have proven to be an effective gateway for onboarding retail investors, with much of this activity centered on the Solana blockchain. Their recent surge has pushed Solana’s DeFi sector to new heights, as many of these tokens are actively traded on decentralized exchanges (DEX) like Raydium. In November, Solana’s DEXs collectively surpassed $34B in trading volume—nearly double Ethereum’s. Raydium alone has outperformed Uniswap in both transaction volume and fee generation, underscoring Solana’s growing dominance in DeFi and the strong appeal for SPL-based tokens among retail traders

Figure 12 – Solana Decentralized Exchange Volume

Source: Dune, 21Shares

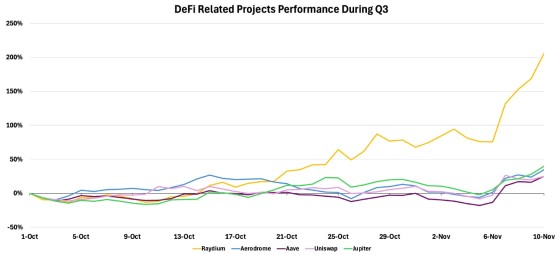

The elections sparked a significant rally across DeFi tokens, particularly for Raydium, as shown in Figure 13 below. This momentum reflects the anticipation of more straightforward, favorable regulatory conditions. According to data from StandWithCrypto:

• In the House of Representatives, 268 pro-crypto candidates vs. 122 anti-crypto candidates

• In the Senate, 19 pro-crypto candidates vs. 12 anti-crypto candidates.

This shift toward a pro-crypto legislative body is expected to be a tailwind for DeFi, alleviating past regulatory pressures faced by projects like Uniswap, which had previously been targeted by the SEC. Additionally, President-elect Trump’s DeFi initiative, World Liberty Financial, built on Aave, signals potential political support that could reduce legal risks, creating a more supportive regulatory environment for innovation across the sector.

Figure 13 – DeFi Related Projects Performance During Q3

Source: Coingecko, 21Shares

Benefitting from more favorable conditions, several DeFi projects are on the verge of transformative changes. For example, Uniswap’s upcoming launch of its DeFi-focused chain, Unichain, is expected to strengthen UNI’s investment case by allowing token holders to capture revenue that has historically gone to Ethereum—totaling over $3.5B since inception.

While some key assets are soaring to new highs, others remain well below their peaks, presenting intriguing opportunities as capital rotates. We’ll examine these recently underperforming crypto assets and explore the factors that may drive their recovery in the months ahead.

Market Dynamics Post U.S. Election: Current Laggers

Several cryptoassets remain well below their all-time highs, with Ethereum, Cardano, and Toncoin down approximately 35%, 84%, and 36%, respectively, as shown in Figure 14. Yet, these assets have rallied impressively since the election—in fact, no major cryptoasset has declined since Election Day. Ethereum crossed the $3K mark for the first time since February, Cardano nearly doubled with a 100% surge, and Toncoin rebounded with a 22% gain. Recent market activity suggests that these market laggers—especially Ethereum and Cardano—have faced challenges this year.

While The Open Network (TON) is gaining, it is still recovering from Telegram founder Pavel Durov’s August arrest—and may gain stronger traction later in the cycle, as the market currently favors chains with established DeFi ecosystems. With its Web2 integration and user-friendly access via Telegram, TON is well-positioned to attract crypto entrants—an advantage that could become more valuable as retail interest reignites in the latter stages of the cycle.

Figure 14 – Major Cryptoassets Far Away From All-Time Highs

Source: Coingecko, 21Shares

Ethereum has struggled to keep pace with Bitcoin this year, particularly as Bitcoin has crossed the $70K mark five times, with Ethereum lagging each time. This underperformance reflects Ethereum’s challenging transition as it adapts to a new business model where much of its activity is offloaded to Layer 2 (L2) networks. These networks rely on Ethereum for security but handle transactions off-chain, reducing fees and congestion on Ethereum’s mainnet. However, this efficiency comes at a cost: L2s pay minimal fees to Ethereum, raising concerns about the mainnet’s long-term economic sustainability.

Nevertheless, Ethereum’s recent rally to $3.2K suggests it may have found new tailwinds. Following the election, the BTC-to-ETH ratio hit a new high for the year, indicating that Bitcoin had significantly outpaced Ethereum. As shown in Figure 15, this ratio has started to decline, signaling a potential shift in capital from Bitcoin toward Ethereum and other alternatives.

Figure 15 – Bitcoin to Ethereum Ratio

Source: Coingecko, 21Shares

We expect Ethereum’s growth to continue its momentum through next year despite recent challenges. Ethereum may implement revenue-sharing agreements with L2s, establishing minimum fees that L2s pay back to the mainnet—thereby strengthening the contributions to Ethereum’s core ecosystem. Additionally, more Layer 1s, like Celo, are shifting to operate as Ethereum L2s, which will increase demand for Ethereum’s block space.

Meanwhile, traditional financial and crypto-native firms are accelerating their L2 adoption, bringing new users and capital onto Ethereum. Coinbase’s L2, Base, has been highly successful, amassing nearly $3B in TVL and over 1M users, with Kraken recently following suit. Rumors of Sony launching its L2 are also circulating. These initiatives unlock consumer-facing applications, help address Ethereum’s disjointed ecosystem, and spark renewed interest from both crypto and traditional players.

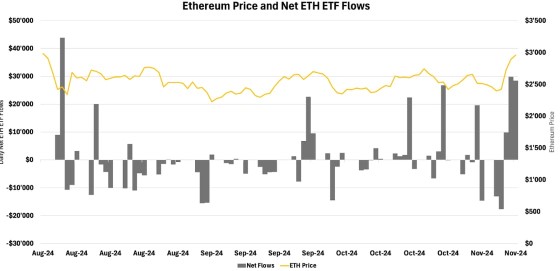

Despite the recent launch of Ethereum ETFs, institutional inflows have significantly trailed behind Bitcoin’s. Net flows into Ethereum ETFs total just $137M, a stark contrast to Bitcoin’s $24B. This discrepancy is partly due to Ethereum’s more complex value proposition as a platform for decentralized applications, which may take longer for investors to embrace fully. Additionally, these ETFs have not activated staking, limiting their appeal to investors interested in yield-generating assets.

However, recent signs indicate growing institutional interest in Ethereum. Since Election Day, Ethereum has seen net inflows of $196M, bringing its cumulative ETF flows into positive territory since launch, as shown in Figure 16. With anticipated regulatory clarity, TradFi integrations on the horizon, and potential improvements to Ethereum’s mainnet revenue model, Ethereum could be poised for a revival.

Figure 16 – Ethereum ETF Net Flows

Source: Glassnode, 21Shares

Moving from Ethereum to another lagging asset, Cardano has seen renewed interest as it enters its Voltaire era, following the Chang Hard Fork (covered here). Announced in late October, Cardano is pivoting to become a Bitcoin L2, and this shift aims to leverage Cardano’s smart contract capabilities to enhance Bitcoin’s functionality. Under this setup, Cardano maintains its Layer 1 independence but works alongside Bitcoin, enabling both networks to capitalize on their convergence.

Additionally, Cardano has recently rallied on news that founder Charles Hoskinson plans to assist the new administration in developing crypto-friendly policies in the U.S. With Input Output, Cardano’s development company, setting up a policy office in Washington, Cardano’s position in U.S. regulatory discussions is set to strengthen. At 80% below its ATH, Cardano presents a strategic entry opportunity for investors.

Post-election, several leading cryptoassets are approaching new all-time highs, while others remain far from their peaks, presenting intriguing opportunities. Bitcoin reached over $80K over the weekend, while Solana and Sui surged significantly. However, Ethereum, Cardano, and Toncoin—still well below their all-time highs—have shown impressive rallies, signaling potential growth.

What’s happening this week?

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

Nyheter

Europafokuserade ETPer ser större andel av flödena under första kvartalet

Publicerad

46 minuter sedanden

25 april, 2025

HANetf har släppt sin rapport om börshandlade europeiska ETPer för första kvartalet 2025, som avslöjar banbrytande insikter i den snabba utvecklingen av den europeiska ETF-marknaden.

Tillgångar i europeiska ETPer nådde 2,4 biljoner dollar under första kvartalet, varav ETFer stod för 2,28 biljoner dollar. Kärnaktions-ETFer ledde flödena (45,70 miljarder dollar) medan räntebärande ETFer ökade med 15,19 miljarder dollar.

Viktiga data

- Europeiska ETPer överstiger 2,4 biljoner dollar i förvaltat kapital under första kvartalet 2025

- Flöden omdirigerades till Europafokuserade ETPer jämfört med USA-fokuserade mitt i tullkrisen

- Kärnaktions-ETFer överstiger milstolpen på 1 biljon dollar i förvaltat kapital med 45,70 miljarder dollar i nettoflöden under första kvartalet

- Aktiva ETFer i förvaltat kapital ökade med 11,65 % under första kvartalet och optionsbaserade ETFer i förvaltat kapital med 54,55 %.

- Antalet europeiska ETP-varumärken fortsätter att öka och uppgår nu till totalt 131.

- Europa godkänner semitransparenta ETFer, vilket potentiellt uppmuntrar fler aktiva förvaltare i USA att gå in på den europeiska ETF-marknaden.

- Försvars-ETFer såg flöden på 4,16 miljarder dollar under första kvartalet, vilket motsvarar 4,5 % av de totala ETF-flödena i Europa och en 5-faldig ökning jämfört med föregående kvartal.

Läs hela rapporten för att upptäcka kvartalsdata, ETF-marknadens utveckling, tillväxten inom nya områden som optionsbaserade ETFer och mer.

Nyheter

JAAA ETF an aktiv satsning på säkerställda obligationer

Publicerad

2 timmar sedanden

25 april, 2025

Janus Henderson Tabula USD AAA CLO UCITS ETF USD Acc (JAAA ETF) med ISIN LU2994520851 är en aktivt förvaltad börshandlad fond. Denna ETF ger tillgång till USD CLO:er (collateralised loan obligations) med AAA-rating.

Den börshandlade fondens TER (total expense ratio) uppgår till 0,35 % per år. Ränteintäkterna (kupongerna) i ETFen ackumuleras och återinvesteras.

Den börshandlade fonden lanserades den 26 mars 2025 och har sitt säte i Luxemburg.

En högkvalitativ aktiv USD CLO ETF

En börshandlad fond med collateralised loan obligations som erbjuder ett övertygande alternativ till företag med investment grade-betyg. AAA CLOer syftar till att erbjuda högre avkastning och större kreditspread* för en tillgång av bättre kvalitet med liten känslighet för räntevolatilitet.

*Skillnaden i avkastning mellan värdepapper med liknande löptid men olika kreditkvalitet, ofta använd för att beskriva skillnaden i avkastning mellan företagsobligationer och statsobligationer. Vidgade spreadar indikerar generellt en försämrad kreditvärdighet hos företagslåntagare, medan en minskning indikerar en förbättring.

Investeringsprocess

Fonden kommer att investera minst 80 % av sitt substansvärde i godtagbara CLO:er (Contract Loans) med valfri löptid som har kreditbetyget AAA (eller motsvarande av ett nationellt erkänt kreditvärderingsinstitut) vid köptillfället, med fokus på USD CLO:er. Om värdepapper i portföljen nedgraderas till under ett kreditbetyg på AAA (eller motsvarande), kommer investeringsförvaltaren att sträva efter att sälja de relevanta värdepapperen så snart som rimligen är möjligt, förutsatt att förvaltaren bedömer att det är i investerarnas bästa intresse.

Portföljförvaltningsstrategier och synpunkter utvecklas med input från diskussioner inom Janus Hendersons CLO-portföljförvaltningsteam och den bredare räntebärande gruppen. Analytiker tilldelas att undersöka specifika möjligheter (inträde, utträde eller annat) och fokusera på de vägledande principerna för att bygga en djup förståelse för säkerheter (typ, jurisdiktion, historisk utveckling), motparter (förvaltare, serviceföretag, hedgeleverantörer), kontroll (juridisk, innehavarens rättigheter, kontroll i fallissemang), kassaflöde (förväntat, stressat, allokering). Som en del av denna process beaktas specifikt EU:s värdepapperiseringsregler. Denna interna forskning kompletteras med data från kreditvärderingsinstitut, investeringsbanker, oberoende analys- och värdepapperiseringsdataleverantörer. Alla rekommendationer är föremål för en minsta granskning med fyra ögon innan de verkställs.

Investeringsmål

Fonden strävar efter att ge avkastning från en kombination av inkomst och kapitaltillväxt på lång sikt genom att investera i en aktivt förvaltad portfölj av AAA-rankade collateralised loan obligations (CLOs). Fonden förvaltas aktivt med hänvisning till J.P. Morgan Collateralized Loan Obligation Index AAA (CLOIE AAA). Delfondens portfölj kan avvika avsevärt från jämförelseindexet.

Handla JAAA ETF

Janus Henderson Tabula USD AAA CLO UCITS ETF USD Acc (JAAA ETF) är en europeisk börshandlad kryptovaluta som handlas på London Stock Exchange.

London Stock Exchange är en marknads som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| London Stock Exchange | USD | JAAA |

Nyheter

Can crypto outperform amidst the current market turmoil?

Publicerad

3 timmar sedanden

25 april, 2025

Financial markets have been roiled by President Trump’s tariff policies, leading to sharp volatility across asset classes. US equities have taken the brunt of it, with the S&P 500 down as much as 20% from its January highs. Bond markets are also unstable, reflecting shifting expectations around 2025 interest rates.

This wave of macroeconomic uncertainty has made it harder to detect underlying investment trends—especially in crypto. Despite its independence from direct government influence, digital assets haven’t been immune to the turbulence. But while volatility has hit traditional markets hard, crypto has once again shown resilience, underpinned by improving fundamentals and a strengthening regulatory backdrop.

What we’ve learned since November

In the wake of President Trump’s election in November, digital assets were hitting all-time highs. But instead of urging investors to chase returns, we warned against getting swept away by the “FOMO” mindset that often happens with investors in this asset class. Our message was simple: stick to your target allocation and avoid overexposure after sharp price increases. This approach is designed to help investors benefit from crypto’s long-term asymmetric potential without succumbing to emotional swings.

Even before the election the Nasdaq Crypto Index™ (NCI™) had already risen nearly 50% for the year (as of October 31, 2024). Trump’s win added fuel to the fire, boosting optimism that US crypto regulation could finally turn a corner. By year-end, the NCI™ had more than doubled, closing with a 105% gain.

That bullish momentum continued into early 2025, driven by post-halving optimism, improving adoption metrics, and the tailwinds of Trump’s return. However, the tariff shock has since erased much of crypto’s post-election gains, reigniting questions about the asset class’s staying power in a chaotic macro environment. While further corrections are possible, we believe this phase represents another one of those important long-term entry points—just as we’ve seen before.

Why fundamentals still matter

It’s important to keep in mind that crypto’s value and price trajectory isn’t driven solely by macro noise. Several key forces are still working in its favor:

• Bitcoin’s 2024 halving has constrained supply, historically a key catalyst for price appreciation.

• Easing US monetary policy has provided a tailwind to risk assets across the board.

• Institutional adoption continues to grow, with more asset managers, banks, and platforms embracing digital assets in portfolios.

But perhaps the most underappreciated catalyst right now is regulatory clarity in the US. The stance toward the industry has shifted significantly. After years of mixed messages and an enforcement-first approach to regulation, US policymakers are now working toward a more coherent and constructive framework for digital assets. For example:

• There’s real momentum in Congress to pass bipartisan legislation around custody, stablecoins, and crypto exchange-traded products (ETPs)—all of which could serve as gateways for broader institutional participation.

• Regulators are seeking input from the industry, recognizing the need for practical and innovation-friendly rules.

• This policy shift isn’t just eliminating noise—it’s a structural tailwind that could accelerate adoption, investment flows, and long-term utility for digital assets.

Even amid the recent pullback, the NCI™ remains up 7.0% since Trump’s election—outperforming most risk assets and second only to gold, which is up 8.7%. In contrast, the broader “Trump rally” has fizzled in traditional markets: the S&P 500 and Nasdaq-100 are both down more than 10% over the same period, weighed down by tariff fears and growth uncertainty.

That divergence highlights a key point: while crypto remains exposed to global macro risks, its relative strength continues to stand out. And as the regulatory and adoption picture improves, the case for long-term crypto allocations is only growing stronger.

Looking ahead: stay disciplined, think long term

With tariffs reshaping global trade and pushing the world toward a more fragmented economic order, crypto’s borderless, decentralized, and politically neutral nature becomes increasingly relevant. It offers a hedge not only against inflation and currency debasement but also against geopolitical dislocation and systemic risk.

The excitement of late 2024 wasn’t a one-off, and neither is the current wave of fear. Crypto’s long-term role in portfolios remains intact. The temptation to react emotionally—whether by chasing peaks or fleeing during corrections—is strong. But discipline, not emotion, is what wins over time.

With regulatory clarity gaining ground and adoption continuing to advance, we believe digital assets are on solid footing—ready not only to weather the current volatility but to emerge stronger as new regulatory clarity, institutional adoption, and use cases unfold in 2025.

This material expresses Hashdex AG and its subsidiaries and affiliates (“Hashdex”)’s opinion for informational purposes only and does not consider the investment objectives, financial situation or individual needs of one or a particular group of investors. We recommend consulting specialized professionals for investment decisions. Investors are advised to carefully read the prospectus or regulations before investing their funds. The information and conclusions contained in this material may be changed at any time, without prior notice. Nothing contained herein constitutes an offer, solicitation or recommendation regarding any investment management product or service. This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability or use would be contrary to applicable law or regulation or which would subject Hashdex to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied or duplicated in any form by any means or (ii) redistributed without the prior written consent of Hashdex. By receiving or reviewing this material, you agree that this material is confidential intellectual property of Hashdex and that you will not directly or indirectly copy, modify, recast, publish or redistribute this material and the information therein, in whole or in part, or otherwise make any commercial use of this material without Hashdex’s prior written consent.

Investment in any investment vehicle and cryptoassets is highly speculative and is not intended as a complete investment program. It is designed only for sophisticated persons who can bear the economic risk of the loss of their entire investment and who have limited need for liquidity in their investment. There can be no assurance that the investment vehicles will achieve its investment objective or return any capital. No guarantee or representation is made that Hashdex’s investment strategy, including, without limitation, its business and investment objectives, diversification strategies or risk monitoring goals, will be successful, and investment results may vary substantially over time. Nothing herein is intended to imply that the Hashdex s investment methodology or that investing any of the protocols or tokens listed in the Information may be considered “conservative,” “safe,” “risk free,” or “risk averse.”

Certain information contained herein (including financial information) has been obtained from published and non-published sources. Such information has not been independently verified by Hashdex, and Hashdex does not assume responsibility for the accuracy of such information. Hashdex does not provide tax, accounting or legal advice. Certain information contained herein constitutes forward-looking statements, which can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “anticipate,” “project,” “estimate,” “intend,” “continue” “believe” (or the negatives thereof) or other variations thereof. Due to various risks and uncertainties, including those discussed above, actual events or results, the ultimate business or activities of Hashdex and its investment vehicles or the actual performance of Hashdex, its investment vehicles, or digital tokens may differ materially from those reflected or contemplated in such forward-looking statements. As a result, investors should not rely on such forward- looking statements in making their investment decisions. None of the information contained herein has been filed with the U.S. Securities and Exchange Commission or any other governmental or self-regulatory authority. No governmental authority has opined on the merits of Hashdex’s investment vehicles or the adequacy of the information contained herein.

This document qualifies as advertisement within the meaning of article 68 of the Swiss Financial Services Act and/or article 95 of the Swiss Financial Services Ordinance and is not a prospectus, basic information sheet (BIB) or a key information document (KID). Any prospectus (in connection with an offer to the public or admission to trading) and/or any BIB or KID (for a product which was meant to be offered to retail clients), in each case if applicable and/or available, of financial instruments described in herein, from the date of its publication (which may be before, on or after the date of this document) and subject to applicable securities laws, is available from Hashdex AG.

Nasdaq®, Nasdaq Crypto Index™, NCI™, Nasdaq Crypto Index Europe™ and NCIE™ are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Hashdex Asset Management Ltd. The Hashdex Nasdaq Crypto Index ETF and Hashdex Nasdaq Crypto Index Europe ETP (the “Products”) have not been passed on by the Corporations as to their legality or suitability. The Products are not issued, endorsed, sold, or promoted by the Corporations.THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE PRODUCTS.<

Europafokuserade ETPer ser större andel av flödena under första kvartalet

JAAA ETF an aktiv satsning på säkerställda obligationer

Can crypto outperform amidst the current market turmoil?

Fastställd utdelning i MONTDIV april 2025

WELG ETF en satsning på healthcareföretag världen över

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa