Nyheter

Polygon (MATIC) Research Primer

Publicerad

1 år sedanden

Polygon is an Ethereum scaling solution as well as a platform to connect Ethereum-compatible blockchains. The key features that Polygon provides include modular security through validators, sovereignty with a customizable tech stack, economical transaction cost and instant transaction finality on the main chain. The network is also designed for high customizability, extensibility and upgradability with short time-to-market community collaboration.

The Polygon foundation, started in 2017, is based in Bangalore, India and the British Virgin islands. It was founded by Jaynti Kanani, Sandeep Nailwal, Anurag Arjun and Mihailo Bjelic. Originally known as Matic, the entity went through a rebranding to Polygon in February 2021 and released its flagship product a year before in June 2020.

In this report, we will offer an exhaustive overview of the Polygon network, Matic as a cryptoasset, and discuss the various investment risks associated with Matic — in addition to how an investor can think about the future value of its underlying cryptoasset. This report offers an exhaustive coverage of Polygon PoS and Matic available on the market.

How Polygon PoS Works

The value proposition of Polygon PoS is to create a network of different blockchains and smart contracts that will be connected to the Ethereum blockchain with the objective to augment the efficiency, in other words, the transaction capacity and speed of the Ethereum blockchain. Polygon’s PoS tech stack is as such removing computation and transactions’ storage from the Ethereum blockchain to these different blockchains, also dubbed sidechains.

What helps distinguish Polygon amongst the other promising scaling solutions is that the network extends beyond a singular provision of its flagship product, the Polygon commit chain. The platform brings in connectivity amongst other scalability applications including individual chains also called plasma chains and other L2 applications such as Optimistic and Zero-Knowledge (ZK) rollups. Additionally, Polygon provides a development framework designed to launch native applications and sovereign blockchain compatible with Ethereum. First, are stand alone chains – independent networks that rely on their own security and personalized consensus mechanism, which make them fitting for prevalent projects as it’s easier to integrate their strong communities into serving as validators and securing the network. Second, are secured chains – networks anchored to Ethereum which utilize security-as-a-service for directly leveraging the reliability of ETH through validity and fraud proofs, or by a set committee of Polygon validators where their underlying smart contract logic resides on the Ethereum main chain, resembling a correspondent model to Polkadot’s shared-security archetype.

As seen, Polygon seeks to cater to crypto’s wider expansive ecosystem by serving as an AWS-like open-source aggregator of scaling solutions for developers. This is manifested with their offering of Polygon SDK, Polygon Avail (data availability layer for independent blockchains), Polygon’s Hermez and Miden (ZK-rollup-based ETH scaling solutions), interoperability protocol for data interchange along with 2-way-pegged bridges for cross-chain asset exchangeability. And finally, Polygon’s commit-chain, where most of the activity currently exists.

On this note, it’s important to realize how Polygon’s main chain stacks differently from other side-chains, and how its security is improved upon by virtue of making it more reliant on Ethereum’s base layer security. Understanding the POS architecture will delineate the relationship between the 2 chains – particularly when viewing the staking and checkpointing logic.

Polygon uses the Proof-of-Stake consensus mechanism and a unique crypto-based architecture to run its most widely used commit-chain, consisting of three layers:

- The Ethereum layer: a set of contracts on the Ethereum network.

- The Heimdall layer: a set of proof-of-stake Heimdall nodes (ie, downloaded softwares in computers) running in parallel to Ethereum and monitoring the set of contracts on the Ethereum network.

- The Bor layer: a set of block-producing Bor nodes shuffled by Heimdall nodes.

Polygon validators intermittently perform periodic proofs of blocks produced by block producers in a Block Producer Layer (Bor layer) against the Ethereum blockchain. These checks settle any transaction disagreements that happen on the Polygon sidechain through a cryptographic proof for the Proof-of-Stake model. Staking is done on a set of smart contracts on the Ethereum network. Heimdall nodes monitor the set of smart contracts for the staked tokens on the Ethereum network and select Bor nodes to produce blocks on the Polygon PoS network. Bor nodes produce blocks in rounds, called spans, based on the selection by Heimdall nodes, which in turn is done based on the staked token amounts on the Ethereum network.

The process of transaction verification by network participants is done as follows: MATIC token holders (delegators) choose validators and then delegate staked tokens to them in exchange for a portion of the validators’ revenue. The Heimdall architecture chooses random block producers (miners) from a random pool of PoS validators in the MATIC network to verify transactions. Every validator set change will be relayed by the validator node on Heimdall which is embedded onto the validator node. This allows Heimdall to remain in sync with the Polygon PoS contract state on the Ethereum mainchain at all times. The Polygon PoS Chain contract deployed on the mainchain is considered to be the ultimate source of truth, and therefore all validation is done via querying the contract of the Ethereum blockchain. This practically translates to leveraging Ethereum-based finality, as well as providing a safe mechanism to restore the Polygon chain state in the event of a catastrophe through the aforementioned checkpoints.

Both delegators and validators share the risk and reward of the validation process. Validators stake their MATIC tokens on the Ethereum blockchain. If a validator acts maliciously by double-signing or has significant downtime, their stake may be slashed.

The Polygon community has been committed to building a strong staking ecosystem as they eventually move to be completely decentralized. Validators are rewarded in proportion to their Matic staked. As of writing, a total of $2.39 billion worth of MATIC has been staked, which accounts for 27.79% of all available Matic.

The MATIC Token

Polygon’s native coin MATIC is an Ethereum-based ERC-20 token that powers the Polygon network. Users can place their Ether in a Polygon smart contract, converting any value denominated in Ether (ETH) into MATIC at a 1:1 peg. Users can also withdraw back into the Ethereum blockchain in ETH.

Similar to Ether for Ethereum network, MATIC plays an important role in securing the network.It has a maximum supply of 10 billion tokens, with a current circulating supply of 6.6 billion. On a high level, the currency is used as a utility token to pay for fees, powering transactions, when issuing transfers or interacting with smart contracts. Matic can also be used in staking to secure the Proof Of Stake network as validators in return for staking rewards.

Token Distribution

The initial distribution of the matic token consisted of :

• Private Sale tokens comprise 3.80% of the total supply of 10 billion:

→ Seed Round: Sale conducted at a rate of 1 MATIC = 0.00079 USD and raised a total of USD 165,000, selling 2.09% of total token supply.

→ Early Supporters: sale conducted at a rate of 1 MATIC = 0.00263 USD and raised a total of USD 450,000, selling 1.71% of the total token supply.

• Launchpad sale tokens comprise 19% of total supply. It was conducted in April 2019 for a total raise of ~$5,000,000 USD worth of BNB at ~$0.00263 per token for 19% of the total token supply. The BNB to MATIC rate will be determined on the day of the sale.

• Team tokens comprise 16% of the total supply.

• Advisors tokens comprise 4% of the total supply.

• Network Operations tokens comprise 12% of the total supply.

• Foundation tokens comprise 21.86% of the total supply.

• Ecosystem tokens comprise 23.33% of the total supply

The token release schedule is set to be completed by October 2022.

The State Of Polygon

The Polygon ecosystem experienced exponential growth in Q2 of 2021 with Total Locked Value (TVL) at $115 million at the end of March to a peak of $10.5 billion in June 2021. It is worthy to note that despite the market crash on May 19th 2021, the network was able to sustain a rise in TVL and growth, peaking in June. This was also instigated by $40 million worth of incentives launched in partnership with Aave to lenders and borrowers on Aave’s Polygon market. This distribution accounted for 1% of the total Matic supply. The incentive program was a part of a wider plan to make DeFi on Ethereum more scalable and inclusive as an alternative to traditional finance with the drastic reduction of fees on Polygon when compared to Ethereum.

As one of the easiest to use and integrate commit chains, the Polygon ecosystem currently has 500+ dapps spanning DeFi, gaming, NFTs, exchanges and cross-blockchain solutions. The rise of Polygon dapps is widely attributed to the EVM compatibility of the Layer 2 scaling solution and ease for Ethereum projects to launch on Polygon. Aside from the liquidity mining incentives that drew users to the network, yield farming opportunities with drastically reduced fees were also attributed to the sudden rise in TVL. As of September 2021, Quickswap is the leading decentralized exchange (DEX) on Polygon PoS with daily trading volume in excess of $100 million and 15.4K users . DEX daily and total revenues from various chains are depicted as a comparison below. PancakeSwap is the primary DEX for Binance Smart Chain and Pangolin is the primary DEX for Avalanche.

Polygon is often depicted as a Layer 2 solution for Ethereum scalability. However, by definition, for a network to be considered a Layer 2, it must derive its security from a Layer 1 like Ethereum. This would mean that users would not have to rely on the validators for the security of their funds. The current architecture of Polygon as a PoS sidechain with its own validators is therefore defined and considered by many as a Layer 1. The adaptability of Polygon’s architecture may see the network evolving to integrate ZKrollups, Optimistic rollups and standalone side chains in the future, with Layer 2 like characteristics.

The current network utilization rate can be represented by several key metrics. Polygon has recorded 836.74M transactions since its launch, with over 74M unique addresses on chain of which over 200,000 are active on the network. Reviewing the performance of Matic in the last year the YTD growth is 6,768%, current validator staking APR is at ~11%, with the network supported by 100 distributed validators and 15 RPC nodes (September, 2021). In October 2021, the active Polygon PoS chain addresses overtook Ethereum to a record high of 566,516 unique daily addresses. This accounts for a 168% growth in 30 days compared to Ethereum’s 0.6%.

The Future of Polygon

The arrival of Ethereum 2.0 , often referred to as ‘the Merge’ will enable better security, faster and more economical transactions on the Ethereum network, bringing the question to many: Will Polygon be able to maintain its relevance?

The recent rise of competing Layer 2s to meet the scaling problem of Ethereum such as Optimism, Arbitrum, Starkware, Loopring and many others has diverted much of Polygon’s initial TVL to other chains. As of September, not including Polygon, Arbitrum is the leading Layer 2 with 59% of the remaining market share equalling to $1.45B, the current TVL of Polygon is approximately $4.5B, down from its $10.5B peak.

Optimistic rollups use fraud proofs, the resolution of theses on the Layer-1 base chain involves a challenge of state changes. The way in which these rollups are validated makes moving tokens from a rollup to its Layer-1 base chain extremely time consuming. Typical exit times between rollups and Layer-1 base chains vary between a day and a week. In comparison to Optimistic rollups, the withdrawal of assets from the Polygon network usually takes 45 minutes, with the exception of Matic withdrawal, which takes seven days.

The time delay in the asset withdrawals from Layer 2 solutions can play an important role in the decision making process in the cross-chain distribution of assets. Particularly, in a time of market volatility, quick access to liquidity and the ease of asset movement are crucial for DeFi users. There are multiple projects working on possible solutions to mitigate this risk, manage challenge-period inefficiencies and minimize opportunity costs associated with this period. Not only will these solutions provide cost savings but it may also enable cross-rollup composability of applications in the future. To remain competitive, Polygon has an ambitious roadmap to implement optimistic rollups, ZK-rollups and Validium chains. Most notable in their recent progress was a $250 million deal made with Hermez, open-source ZK rollup scaling project, in August 2021.

The future of Polygon will likely see a greater number of dapps verticals taking advantage of the network’s ultra low cost transaction fees.The drastic reduction in transaction fees compared to any other chain, can lower the barrier for entry and use for new DeFi users. One prime example is the number of users on Aave on Polygon vs Aave on Ethereum. Despite the TVL on Ethereum being over $12.B and only $1.9B on Polygon, there are 26,000 Users on Polygon vs 10,000 on Ethereum.

At the end of July, Binance also announced that users could withdraw Matic directly from and onto the protocol’s mainnet. This integration granted a direct, low cost, seamless route for onboarding into Polygon PoS without having to bridge through Ethereum. These established avenues of capital flow that Polygon provides for new DeFi users will without a doubt serve Polygon well in the future. As we see a greater flow of capital from centralized exchanges into DeFi, the ease of this onboarding process will play a critical part on which scaling solution will come out on top.

Notable partnerships include DraftKing’s announcement to use Polygon to support custom NFT drops and secondary-market transactions. Ernst & Young also recently selected Polygon to deploy EY blockchain solutions, demonstrating the trend of professional services to onboard blockchain solutions for transaction verification that prioritise privacy technologies whilst supporting regulatory compliance.

Aside from the advantage of Polygon PoS’s EVM compatibility reducing the friction for developers building on Polygon, the network’s ability to aggregate scaling solutions is a definitive competing edge. Rather than focusing on one scaling solution like Optimism, Arbitrum or Starkware, it is designed to be adaptable and to accommodate multiple Layer 2 solutions. Polygon envisions and provides the base infrastructure for the future of cross chain interoperability, similar to Polkadot.

Valuing Polygon

There are two ways we can think of the potential value of Polygon’s native asset, Matic. The first is carrying out a market sizing exercise to compare its value to that of its main competitors as its target market. Secondly, we can compare Polygon’s current adoption — through the proxy of fees paid on the network — to that of Ethereum in order to understand if the current value of Polygon can be justified whether there’s product-market fit.

Market Sizing:

The chart below shows the current market capitalization of Solana, Polygon, Ethereum, and Binance Smart Chain. Ethereum represents what the market has judged, as the current best use-case of blockchain technology while the smart contracts use case can be argued to be just as valuable in the long term. Binance Smart Chain and Solana are networks that similarly experienced substantial growth in the first half of 2021 and serve as comparison for ecosystem development.

Total Value Locked

This section compares the current TVL of Polygon relative to other major networks such as Ethereum, Binance, Terra, Solana and Bitcoin. TVL can be a useful tool to compare network utilization and a method to measure the flow of capital within DeFi.

Fees

Revenue generation is often a key metric when assessing network value. By assessing the total number of transactions and the average cost per transaction we are able to estimate the total revenue generated. Fees are a good signal for the overall demand for a given smart contract platform and arguably the strongest barometer of fundamental growth. Polygon’s 881.46M transactions give an estimated annualized revenue of $14.1 million. Ethereum’s annualized revenue stands at $13.32 billion.

Price-to Sales (P/S) Ratio compares a protocol’s market cap to its revenues. Unlike the Price to Earnings ratio, where inflated token prices can be inaccurately depicted, P/S ratio derives the network’s value from tangible revenues. This metric is particularly useful for early-stage protocols where income is often reinvested into growth. A relatively low ratio like Polygon compared to other competitors like Solana and Avalanche, could imply that the protocol is undervalued and vice versa (Token Terminal, 2020). An evaluation of historic P/S ratio against its market cap can also demonstrate the consistency of fees and revenue. This chart indicates the P/S ratio for other Layer 1s in comparison to Polygon PoS.

Risks

Unlike Proof of Work (PoW) networks that require miners to contribute computing power to secure the network, PoS crypto networks require users to stake a share or all of their holdings in the network’s token to secure the network and keep it running.

Liquidity risk: Illiquidity of staking returns to be converted into bitcoin or stablecoins may be difficult if there is little to no volume of the staked asset. Polygon PoS has a lock up period of 8-10 days.

Rewards duration: Like lockup periods, some staking assets may not pay out staking rewards daily and make re-investments delayed. Polygon PoS pays out every 8-10 days.

Validator risk: Running a validator node may run the risk for incurring penalties if a disruption or double-signing occurs (slashing). Slashing is designed to incentivize node security, availability, and network participation.

Slashing: If a validator misses a certain number of validations or engages in certain manipulative acts on the network, staked assets may be slashed (ie. claimed by the network as a fine). This risk is minimal under normal operating conditions.

Technological risks: A double spending bug in Polygon’s Plasm bridge was identified in October 2021, the code relates to a contract that locks up to 1 billion USD worth of funds on Layer 1 and is utilized when users move funds to and from the Polygon network. Fortunately, the existence of Polygon’s bug bounty program on ImmuneFi helped identify and rectify the vulnerability before it could be exploited23. Gerhard Wagner discovered the vulnerability which could have led to a string of attacks totalling approximately $850 million, it took 30 minutes for Polygon to begin fixing the issue and Wagner was subsequently awarded with $2 million from the bug bounty program.

Disclaimer

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable. However, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential to not grow as expected.

There is currently relatively little use of crypto assets in the retail and commercial marketplace compared to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment. Nothing in this report does or should be considered as an offer by 21Shares AG and/or its affiliates to sell or Maticicitation by 21Shares AG or its parent of any offer to buy bitcoin or other crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or Maticicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or Maticicit an offer to invest in any jurisdiction.

Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties.Actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax, or other advice and users are cautioned against basing investment decisions or other decisions Maticely on the content hereof.

Du kanske gillar

-

Stablecoins: The real powerhouse of crypto

-

Dogecoin in a portfolio: A small 1% allocation has a loud bark!

-

Trump’s trade war puts Bitcoin in the spotlight

-

Bitcoin supply on crypto exchanges hits 5-year low and that’s a good sign

-

Markets Swing Wildly After Tariff Shock – Bitcoin Rebounds Strongly

-

21Shares Dogecoin ETP: Drivs av community, omdefinierar kryptolandskapet

Stablecoins are digital currencies tied to assets like the U.S. dollar, offering the price stability needed for payments. They maintain their peg by being backed 1:1 by their underlying fiat currency, with issuers holding equivalent amounts in cash and cash equivalents, making stablecoins a digital representation of those reserves. Their market has doubled to over $235 billion, with daily usage nearly doubling in two years.

Why are stablecoins making headlines now?

Due to their clear product-market fit and growing mainstream adoption, stablecoins have become a top priority for regulation, with both industry leaders and policymakers calling for swift action.

On April 4, the Securities and Exchange Commission’s Division of Corporation Finance finally clarified that stablecoins are not securities if backed one-for-one by USD or similar assets and used for payments or value storage. These “Covered Stablecoins” are not marketed as investments, lack profit incentives, and include protections like reserves, making securities law registration unnecessary for issuance or redemption.

The GENIUS Act, introduced in February and advanced by the U.S. Senate Banking Committee in March, marks a major step toward creating a clear legal framework for stablecoin issuance and oversight. This clarity is driving momentum as Fidelity is set to launch its own stablecoin, and Bank of America is preparing to follow it once legislation is finalized.

Globally, the European Union’s Markets in Crypto Assets (MiCA) framework has already come into effect, reinforcing a broader shift toward formal integration of stablecoins into traditional finance. These developments reflect a growing consensus that stablecoins are emerging as essential infrastructure for global payments, treasury management, and digital asset adoption.

What are the benefits of stablecoins?

Stablecoins are digital currencies designed for fast, low-cost, and stable transactions. Since their launch in 2014, they’ve become a go-to tool for online payments, especially cross-border transfers. As they’re pegged to stable assets like the U.S. dollar or euro, they avoid the wild price swings seen in other cryptocurrencies.

They’re accessible to anyone with internet, making them especially valuable in regions with high inflation or limited banking access, like Argentina or Turkey.

With some built on public blockchains, stablecoins offer transparency, letting users track transfers and supply in real time. For institutions, they also simplify treasury management by acting as efficient digital cash that can be deployed instantly.

Who are the major players in the stablecoin race?

Tether (USDT) and Circle (USDC), the two largest stablecoin issuers, collectively hold over $204 billion in U.S. Treasuries, making them the 14th largest holders globally. Their combined treasury holdings surpass those of entire nations, including Norway and Brazil.

USDT leads with $144 billion in circulation; USDC, backed by Coinbase and known for compliance, has become a trusted digital dollar across global finance.

Why stablecoins matter: A revenue engine for blockchains

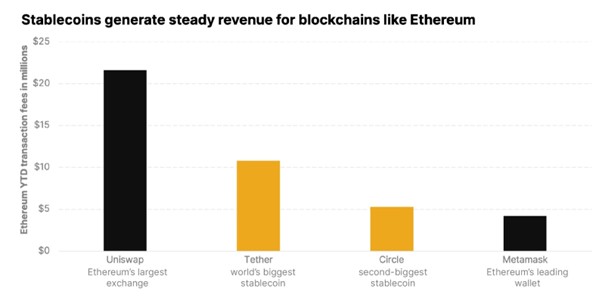

Stablecoins generate steady revenue for blockchains like Ethereum and Solana by driving transaction fees with each transfer. With trillions in annual volume, they help sustain network activity beyond speculation.

On Ethereum, for example, USDT and USDC transactions are major contributors to daily gas fees. Year to date, Tether ranks #3 and USDC ranks #5 in terms of total gas consumed. Tether and Circle also dominate daily transaction activity on Ethereum, averaging approximately 12 million and 6 million transactions per day, respectively, making them the top two entities on the network by daily transaction count.

Meanwhile, on Solana, stablecoin activity has surged, helping sustain validator rewards and strengthen protocol economics. In addition to the mainstream utility, stablecoins represent reliable, protocol-level cash flow, making them crypto’s killer use case.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

BE29 ETF är en portfölj företagsobligationer med förfall 2029

Publicerad

19 timmar sedanden

19 april, 2025

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis (BE29 ETF) med ISIN IE000ZC4C5Q1, försöker följa Bloomberg 2029 Maturity EUR Corporate Bond Screened-index. Bloomberg 2029 Maturity EUR Corporate Bond Screened Index spårar företagsobligationer denominerade i EUR. Indexet speglar inte ett konstant löptidsintervall (som är fallet med de flesta andra obligationsindex). Istället ingår endast obligationer som förfaller under det angivna året (här: 2029) i indexet. Indexet består av ESG (environmental, social and governance) screenade företagsobligationer. Betyg: Investment Grade. Löptid: december 2029 (Denna ETF kommer att stängas efteråt).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,10 % p.a. Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis är den billigaste ETF som följer Bloomberg 2029 Maturity EUR Corporate Bond Screened index. ETFen replikerar resultatet för det underliggande indexet genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Ränteintäkterna (kuponger) i ETFen delas ut till investerarna (kvartalsvis).

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis är en mycket liten ETF med 1 miljon euro tillgångar under förvaltning. Denna ETF lanserades den 18 juni 2024 och har sin hemvist i Irland.

Produktbeskrivning

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF Dist syftar till att tillhandahålla den totala avkastningen för Bloomberg 2029 Maturity EUR Corporate Bond Screened Index (”Referensindexet”), minus avgifternas inverkan. Fonden har en fast löptid och kommer att upphöra på Förfallodagen. Fonden delar ut intäkter på kvartalsbasis.

Referensindexet är utformat för att återspegla resultatet för EUR-denominerade, investeringsklassade, fast ränta, skattepliktiga skuldebrev emitterade av företagsemittenter. För att vara kvalificerade för inkludering måste företagsvärdepapper ha minst 300 miljoner euro i nominellt utestående belopp och en effektiv löptid på eller mellan 1 januari 2029 och 31 december 2029.

Värdepapper är uteslutna om emittenter: 1) är inblandade i kontroversiella vapen, handeldvapen, militära kontrakt, oljesand, termiskt kol eller tobak; 2) inte har en kontroversnivå enligt definitionen av Sustainalytics eller har en Sustainalytics-kontroversnivå högre än 4; 3) anses inte följa principerna i FN:s Global Compact; eller 4) kommer från tillväxtmarknader.

Portföljförvaltarna strävar efter att uppnå fondens mål genom att tillämpa en urvalsstrategi, som inkluderar användning av kvantitativ analys, för att välja en andel av värdepapperen från referensindexet som representerar hela indexets egenskaper, med hjälp av faktorer som index- vägd genomsnittlig varaktighet, industrisektorer, landvikter och kreditkvalitet. När en företagsobligation som innehas av fonden når förfallodag kommer kontanterna som fonden tar emot att användas för att investera i kortfristiga EUR-denominerade skulder.

ETFen förvaltas passivt.

En investering i denna fond är ett förvärv av andelar i en passivt förvaltad indexföljande fond snarare än i de underliggande tillgångarna som ägs av fonden.

”Förfallodag”: den andra onsdagen i december 2029 eller annat datum som bestäms av styrelseledamöterna och meddelas aktieägarna.

Handla BE29 ETF

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis (BE29 ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Borsa Italiana.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Borsa Italiana | EUR | BE29 |

| XETRA | EUR | BE29 |

Största innehav

| Namn | CUSIP | ISIN | Kupongränta % | Vikt |

| AT&T Inc 2.35% 05/09/29 | 00206RHH8 | XS1907120791 | 2.350 | 2.22% |

| Holcim Finance Luxembourg SA 1.75% 29/08/29 | L4806FAH4 | XS1672151492 | 1.750 | 2.14% |

| Unibail-Rodamco-Westfield SE 1.5% 29/05/29 | F95094ST0 | XS1619568303 | 1.500 | 2.08% |

| Baxter International Inc 1.3% 15/05/29 | — | XS1998215559 | 1.300 | 2.08% |

| Euronext NV 1.125% 12/06/29 | N3113KAT5 | XS2009943379 | 1.125 | 2.06% |

| Blackstone Property Partners Europ 1.75% 12/03/29 | L1051PAD9 | XS2051670300 | 1.750 | 2.04% |

| Walmart Inc 4.875% 21/09/29 | U9311FAG3 | XS0453133950 | 4.875 | 1.72% |

| Banco Bilbao Vizcaya Argentaria SA 4.375% 14/10/29 | E118054J9 | XS2545206166 | 4.375 | 1.65% |

| Toyota Motor Credit Corp 4.05% 13/09/29 | U89233WV5 | XS2597093009 | 4.050 | 1.63% |

| Nykredit Realkredit AS 4.625% 19/01/29 | K74493TG0 | DK0030512421 | 4.625 | 1.62% |

Innehav kan komma att förändras

Nyheter

Guld-ETFer slår Bitcoin-ETFer kraftigt under första kvartalet 2025

Publicerad

20 timmar sedanden

19 april, 2025

Under hypervolatila marknader omvärderar investerare vanligtvis vad de äger. De ser också över vilka investeringar som är bäst lämpade för att navigera i svåra tider. Guld är alltid ett självklart val, och under den nuvarande turbulensen har det inte gjort dem besvikna. Faktum är att gammaldags guld-ETF, börshandlade fonder som investerar i guld slår till och med bitcoinfonder med en enorm marginal.

Marknadsreferenser som SPDR S&P 500 ETF såg stora dippar från 1 januari till 15 april 2025 SPDR-fonden föll med 7,99 procent under den tiden medan iShares Bitcoin Trust ETF sjönk med 10 procent. Samtidigt steg SPDR Gold Shares-fonden, världens största ETF med fysiskt guld som backas upp, med nästan 23 procent. Fonden har tillgångar på över 98 miljarder dollar.

Medan S&P 500 belönade investerare rikligt under 2023 och 2024, ”sedan befrielsedagen, den 2 april i år, har spelplanerna för 2025 ändrats lite”, säger John Kinnane, chef för nyckelkunder på Sprott Asset Management.

Mitt i de krympande marknaderna har det skett en översvämning av ETFer som fysiskt stöds av guld och silver. I april ökade ETFer för ädelmetaller med 6,6 miljarder dollar i nya tillgångar och vann de största nettoinflödena för månaden i råvarukategorin.

Även ETFer för gruvaktier har klarat sig bra. VanEck Gold Miners ETF, till exempel, avkastade över 49 procent för året fram till den 15 april.

Det finns också specialiserade strategier. USCF Gold Strategy Plus Income Fund erbjuder en unik inkomsttwist på guld genom att sälja täckta köpoptioner för att generera intäkter. Den har en 30-dagars SEC-avkastning på 3,36 procent och har hittills i år ökat med 20,72 procent.

”En av guldets bestående egenskaper är att det faktiskt är en okorrelerad tillgång. Investerare av alla slag letar efter låg korrelation så att de i tider av volatilitet – som vi befinner oss i just nu – får en jämnare avkastning för sin totala portfölj”, säger Kinnane.

I februari lanserade Sprott Sprott Active Gold & Silver Miners ETF. Den inkluderar aktier i guld- och silvergruvor i en ETF-ticker med en aktivt förvaltad strategi.

Medan guldlänkade fonder har blomstrat har varken bitcoin eller resten av kryptovalutamarknaden gett investerarna något särskilt skydd.

Bitwise 10 Crypto Index Fund, ett mått på 10 olika kryptovalutor, inklusive bitcoin, sjönk med 21,28 procent från 1 januari till 15 april. Mindre kryptovalutor, särskilt meme-mynt och tokens, har presterat usla.

Guldets överprestationer har hjälpts av den kraftigt ökande efterfrågan från investerare, men också av köp från centralbanker. 2024 var tredje året i rad som de lade till mer än 1 005 ton till sina globala guldreserver.

”Respondenterna var tydliga med att centralbanksgemenskapen skulle fortsätta att öka sina allokeringar till guld inom kort”, stod det i en rapport om reserver från World Gold Council från 2024.

Stablecoins: The real powerhouse of crypto

BE29 ETF är en portfölj företagsobligationer med förfall 2029

Guld-ETFer slår Bitcoin-ETFer kraftigt under första kvartalet 2025

INGH ETF är en satsning på global infrastruktur

SPFT ETF är en global satsning på teknikföretag

Fonder som ger exponering mot försvarsindustrin

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Warren Buffetts råd om vad man ska göra när börsen kraschar

Svenskarna har en ny favorit-ETF

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFonder som ger exponering mot försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFastställd utdelning i MONTDIV mars 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSju börshandlade fonder som investerar i försvarssektorn