Nyheter

Fundamental Improvements in the Aftermath, What’s Next?

Publicerad

2 år sedanden

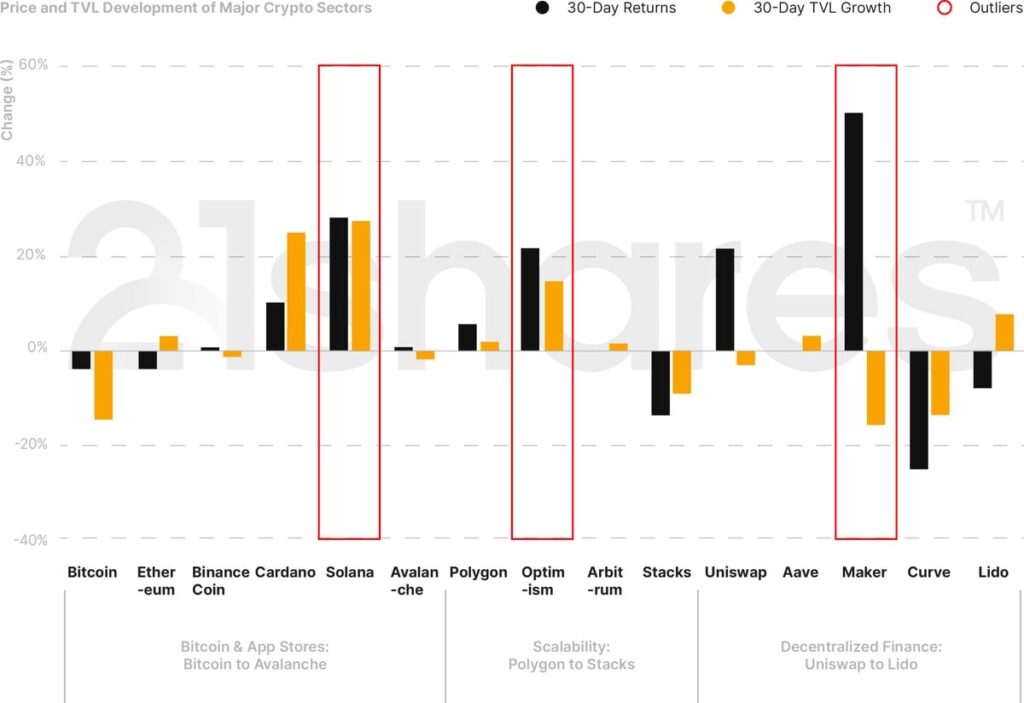

Markets reacted in opposite directions this month, as regulating the cryptoasset industry is still in talks in the U.S. New developments in the Ripple case spurred some optimism, with the hope that the long tail of cryptoassets may not be considered crypto-securities. Bitcoin and Ethereum fell by almost 4% each over the past month. However, the market cap of the decentralized finance (DeFi) industry alone has increased by 8%. As shown below, the biggest winners of July were Maker, which increased by 50% in returns, Solana (+28%) came in second, and thirdly Optimism (+ 21.8%). These jumps in price movements can be attributed to fundamental improvements and developments in both the application and infrastructure layers, which we will elaborate on later in this monthly review.

Figure 1: Price and TVL Development of Major Crypto Sectors

Source: 21shares, CoinGecko, DeFi Llama. Data as of July 30 close.

5 Trends to Remember from July

• XRP by itself may not be a security, according to a U.S. court decision.

On July 13, U.S. District Court Judge Analisa Torres issued a summary judgment order that was partly in favor of the Securities and Exchange Commission (SEC) and partly in favor of Ripple. Specifically, Judge Torres distinguished between the target of an investment contract (e.g., XRP as a token) versus the sale and marketing of that asset (e.g., the investment contract around the sale or offer of XRP). The former was not held to be a security, but the latter was in certain circumstances. Judge Torres’ decision also held that there were disputes of material fact that were not appropriate to resolve on summary judgment, so there could be a trial relating to a few additional issues (including whether Ripple’s founders aided and abetted Ripple’s securities law violations). Although not conclusive, the court’s decision spurred short-lived optimism across the cryptoassets market. On July 13, Bitcoin reached $31.45K, the highest since May 2022. Ethereum, on the other hand, surpassed the $2K, a level last seen in April following the Shanghai upgrade. As for the industry’s long tail of tokens, especially those labeled in previous SEC lawsuits (against Coinbase and Binance) as securities, Solana, Polygon, and Cardano all enjoyed roughly 30% increase in returns for the two days following the verdict.

Hoping it would mean the same for the collapsed Terra Luna, Terraform Labs filed a motion to dismiss their case based on Judge Torres’ “programmatic sales” argument. On July 21, the lawyers for the SEC filed a response against Terraform’s motion, vaguely suggesting that they’re considering an appeal against the Ripple court decision. Judge Jed Rakoff rejected Terraform’s motion at the end of the month, saying that the court rejected the approach adopted by Judge Torres in the Ripple case. While this may not change XRP’s ruling, it may affect the market sentiment of the token, which has persevered as of writing this report, still enjoying the 40% increase over the past month.

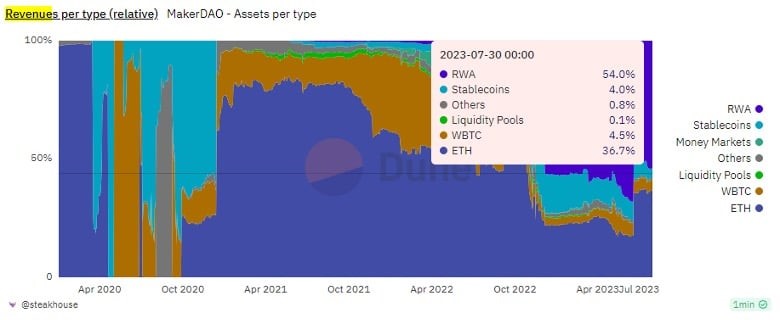

• MakerDAO: A Return to Fundamentals

Maker also implemented the enhanced DAI savings rate (eDSR), first increasing the yield to 3.49% in June, while a subsequently approved proposal in late July switched the interest rate into a dynamic model that could potentially see the yield reach 8%. Thus, eDSR could catalyze the adoption of DAI as the deposit rewards could surpass the risk-free benchmark of traditional finance, represented by the US treasury at 4%, and help to establish an attractive savings rate that could improve the liquidity of DeFi. This isn’t to argue that Maker’s deposit rewards would be considered a safe investment compared to the risk-free rate of the US Treasury, as the US government is the sole lender of last resort, but it does show the measures DeFi protocols are adopting in order to compete and build a sustainable treasury leveraging the current macro environment. Although temporary, elevated interest rates present a valuable window for projects to capitalize on, fostering lasting treasury growth. Finally, Maker’s shift towards real-world assets (RWA) is proving fruitful, generating around $90M in annual revenue, with more than 50% exposure.

Figure 2: Revenues per Type

Source: Steakhouse on Dune

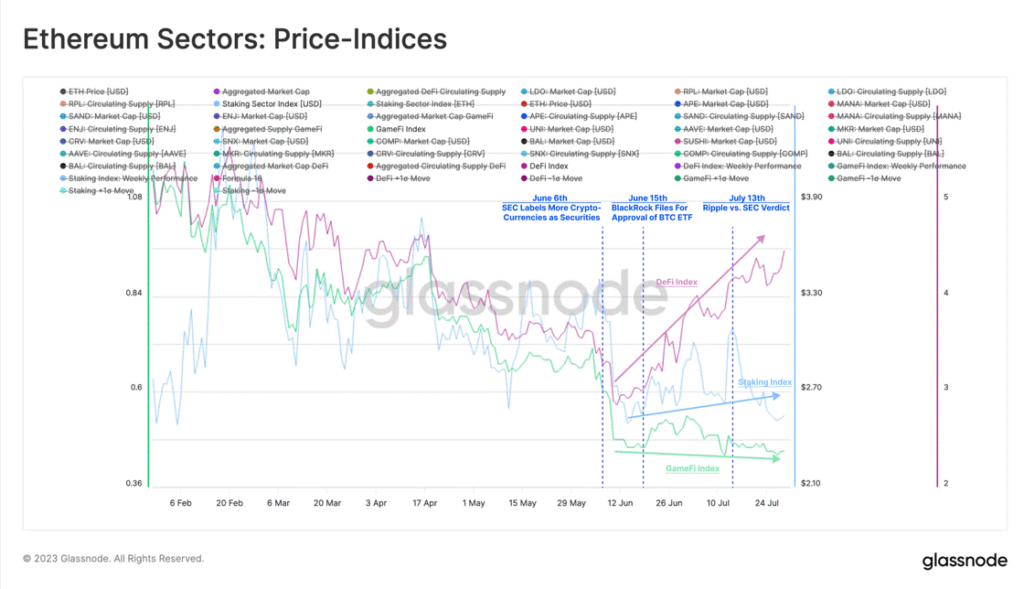

This growth is significant as it provides a practical revenue generation approach without relying solely on token emissions. It also showcases the benefits of bridging with the TradFi, encouraging other protocols to build sustainable treasuries for runway protection during times of volatility. Furthermore, the increase in DAI’s savings rate elevates DeFi’s stablecoin yield benchmark, incentivizing protocols to become more competitive and driving further user adoption. It is worth noting that DeFi tokens outperformed the market in July, potentially forming a bottom for the first time in almost two years. So, we’ll be closely observing Maker’s impact on the broader sector and how it could influence their decision to further integrate with TradFi.

Figure 3: Price Indices Performance of the Different Ethereum Industries

Source: Glassnode

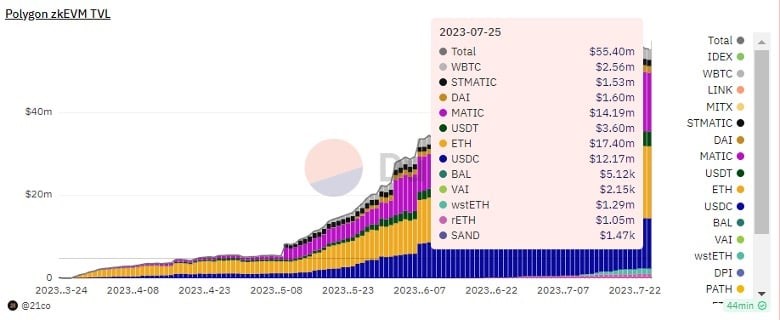

• The Evolution of Polygon 2.0 as an Infrastructure Power House

The Polygon Foundation has revealed plans for the infrastructure of Polygon 2.0. This new network aims to unify various scaling services under a Layer 2 framework that uses Zero Knowledge technology for interoperability. The architecture has four main categories: Staking, Interoperability, Execution, and Proving, with emphasis on the first two. The staking layer will offer shared security like Polkadot and Cosmos, while interoperability focuses on native asset transfers across networks. Polygon will also upgrade its POS chain to a zkEVM network, using existing validators for submitting routing data to Ethereum.

Further, The MATIC token will transition to POL at a 1:1 ratio with uncapped supply and 2% yearly emissions to support staking and the ecosystem’s growth. Finally, Governance will be categorized into three branches to establish clear responsibilities for the stakeholders and form a treasury to help drive the growth of Polygon. The announcement, culminating Polygon’s 6-week program to unveil its new network design, saw a steady growth in total number of users and an increase of close to 100% in AuM on the new scaling solution, climbing from ~$23M to ~$55M, as shown below.

Figure 4: Polygon zkEVM scaling solution AuM

Source: 21shares on Dune

• A Rise in Institutional Adoption

With Europe’s first comprehensive legislation regulating cryptoassets (Markets in Crypto Assets) going into effect in 2024, the following instances speak volumes of the dire need for legal clarity to streamline the adoption of this asset class along with its underlying technology, especially for institutions.

• Societe Generale became the first company to receive a digital asset service provider (DASP) license in France. The license allows Forge, the bank’s cryptoasset division, to operate digital asset custody, sell and purchase digital assets for legal tender, and trade digital assets. In April, Forge launched CoinVertible (EURCV), an institutional-grade, euro-pegged stablecoin so far only built on the Ethereum blockchain, with plans to become blockchain-agnostic.

• Bank of Italy partnered with Polygon for a limited environment for trading securities on DeFi, tailored especially for institutions. Milano Hub, the bank’s innovation center, selected the “Institutional DeFi for Security Token Ecosystem Project”, an ecosystem project promoted by Cetif Advisory to research opportunities offered by DeFi and experiment with security tokens. This project is anticipated to act as a catalyst to onboard Italian banks, asset management companies, and other financial institutions into a DeFi platform that is fully compliant with regulatory requirements, which is the main obstacle to institutional adoption.

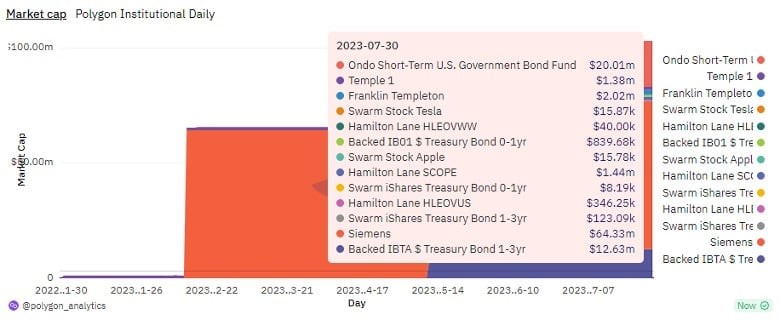

Figure 5: Breakdown of the RWA-backed assets issued by Institutions on the Polygon network

Source: Polygon Analytics on Dune

• Ethereum’s Scaling Solutions are Transitioning Towards Customizable Scalability

Allowing projects to deploy tailored applications as standalone networks enables customization of fee payments, permissions, and application development using various programming languages. Initiating this trend in early 2023, Arbitrum and Optimism introduced Orbit and OpStack, respectively, to bootstrap the creation of custom networks. OpStack emerged as the preferred solution, as it was adopted by major players like Coinbase, Binance, WorldCoin, and Zora, leveraging Optimism’s law of chains to promote seamless interoperability among OP-stack-based chains and addressing a crucial gap in crypto’s infrastructure. For context, Coinbase’s base network launched on July 13, securing close to $85M in total deposits in less than two weeks. Although the hype around meme coins drove the activity, the trend still demonstrates users’ excitement for Ethereum’s scaling future.

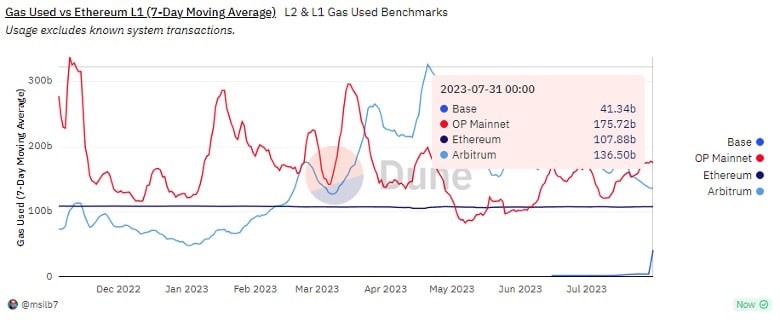

Figure 6: Gas Used by Scaling Solutions to Settle Transactions on Ethereum

Source: @msiib7 on Dune

That said, ZkSync and Starkware entered the competition with ZKStack and Stark Net Stacks in July, offering customizable frameworks for embryonic networks to address their unique business needs. This development brings exciting prospects for programmable scalability and resolves privacy issues that are not easily achievable on Ethereum or its scaling solutions alone. Finally, the trend of embracing the Ethereum ecosystem was evident with Celo’s announced intent to pivot from an Ethereum competitor into an L2 anchored to Ethereum’s security. A decision that is driven by the need to benefit from the deep liquidity and vibrant developer ecosystem

What to Expect

• A Breakthrough in Resolving Cryptocurrency Infrastructure Challenges

Chainlink’s highly anticipated interoperability product finally launched on Mainnet. CCIP is an inter-blockchain communication standard that enables data and value transfer across four incompatible networks at the start. The solution incorporates four features to improve bridging: Active Risk Management (ARM) Network to detect and pause the malicious activity, programmatic transfers to automatically execute predefined instructions, rate limits for preventing unauthorized token transfers beyond a certain threshold, and smart execution to enable seamless cross-chain activities without extra payments using a pre-funded account. Check out our State of Crypto Issue 8 for a deeper dive into the technology.

CCIP is crucial in addressing weak security in cross-chain bridges, which have been exploited for nearly $2.5B in value over time. Thus, it’s a pivotal milestone to have an internet of contracts, similar to how the TCP/IP unified the global internet, facilitating liquidity to be globally accessible and the value of applications to flow across networks to be established on a battle-tested infrastructure that has enabled more than $8T in transactional value.

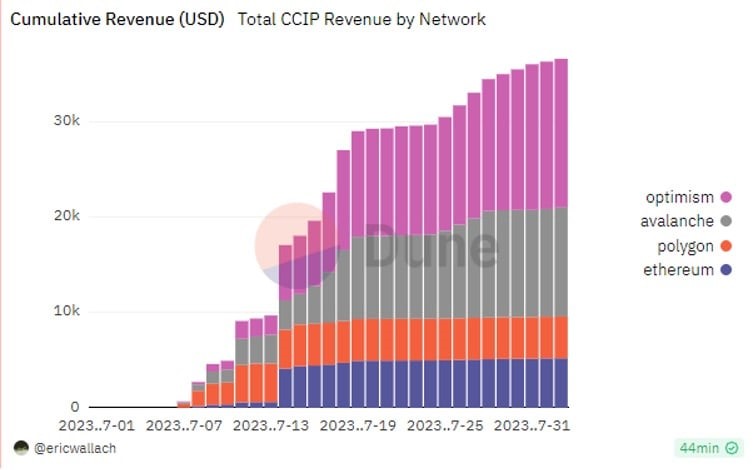

Further, CCIP may become Chainlink’s most significant product due to the wide need for interoperability. For context, applications using Chainlink’s CCIP can pay in LINK or ERC20 tokens, with a 10% premium on ERC20 to encourage LINK usage. This makes LINK a universal gas currency across chains, removing the need for token sales by node operators and phasing out the foundation’s subsidies. Finally, with a fee-based model in place, CCIP can generate sustainable earnings for DONs, the backbone of Chainlink’s security. That said, despite initial modest earnings of $35K over the past months, partnerships with Synthetic and Aave using CCIP for token transfers and cross-chain governance suggest significant growth potential. Integration with SWIFT also solidifies CCIP’s position as a cross-chain solution for both crypto and traditional finance.

Figure 7: Total Revenue Accrued by CCIP

Source: @Ericwallach on Dune

• Solana Attempting to Claw Back

Although Solana faced a challenging start to the year due to FTX’s collapse, then the SEC’s legal actions against Coinbase and Binance, recent developments have hinted at a potential recovery. First, Solana Labs introduced Solang, enabling Ethereum developers to use Solidity (Ethereum’s programming language) on Solana, and GameShift, a web3 game development API streamlining the game development process. Then, Neon EVM went live, offering Ethereum-compatible smart contracts on Solana without significant code modifications.

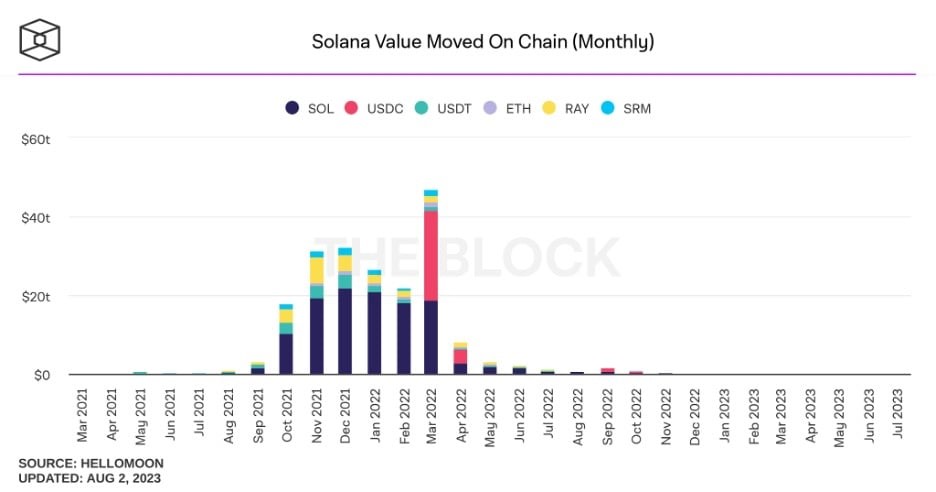

Overall, Solana’s activity is showing signs of hopeful recovery, with active addresses rising 25% in the past seven weeks and total AuM hitting a year-high. Catalysts like Jump Crypto’s Firedancer, diversifying node software and combating outages, and demanding apps like Hiver and Teleport could drive excitement. Further, Saga, Solana’s phone device, might boost adoption as it abstracts the complexity of web3. Nonetheless, there’s still a lot of work to do to encourage users to move their capital back to Solana, especially as the total value transferred on the network remains at relatively muted levels.

Figure 8: Monthly Value moved on Solana

Source: TheBlock

• Ramifications of the Ripple Case

Although the court decision is inconclusive, we may see foundations and developers rethinking their strategies when bootstrapping their services and products to accommodate regulatory expectations, primarily concerning how their protocols achieve decentralization. It took Uniswap two years to launch its token after it had dedicated this time to focus on the fundamentals of the decentralized app, which is a tactic that has proved to pay off, building Uniswap to become the world’s largest decentralized exchange with more than $3B in assets under management and a market cap of almost $5B. More projects at the application layer could postpone token launches until they establish alignment between their product’s core services and market demand. Established projects may overhaul their entire business models to enhance token value capture. As discussed earlier in this report, we are already witnessing this shift with Polygon’s new tokenomics. Following Uniswap’s steps, entrepreneurs will focus their efforts on scoring investments from traditional players in venture capital and private equity instead of launching their tokens from the very start to raise funds.

Bookmarks

- Research Analyst Tom Wan’s insights were featured on Forkast News.

- Digging Into Ethereum Withdrawals and Future Improvements.

- Want to learn more about Ripple? Read our investment thesis.

- Celsius has been selling its assets as part of its bankruptcy proceedings.

- Learn more about Ethereum’s Liquid Staking Derivatives, which now constitute the largest DeFi sector by AUM and are expected to continue proliferating as the ETH staking ratio grows.

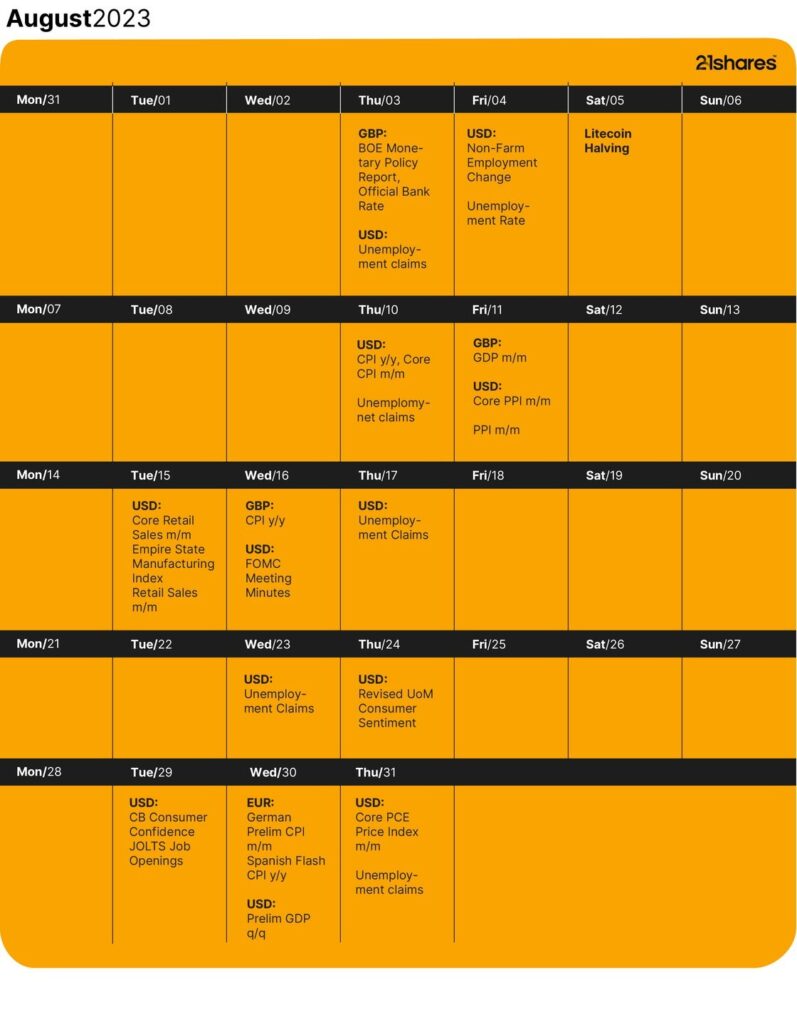

Next Month’s Calendar

These are the top events we’re closely monitoring in August.

• August 10: CPI data in the U.S.

• August 16: FOMC Meeting Minutes

Source: 21shares, Forex Factory, CoinMarketCap

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

Nyheter

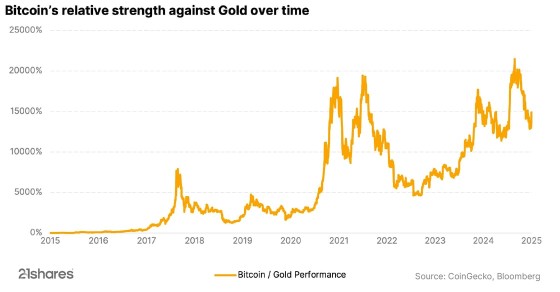

From digital asset to safe haven: Why is Bitcoin acting like gold?

Publicerad

15 timmar sedanden

28 april, 2025

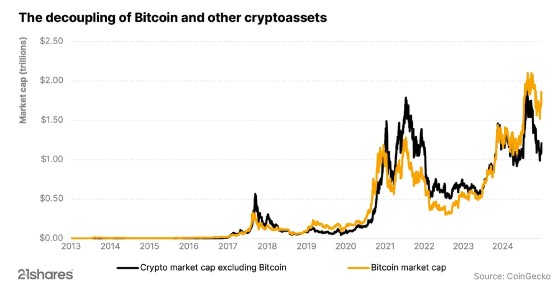

Bitcoin’s price has taken a different path from U.S. stocks over the past weeks. While major indexes such as the S&P 500 and Nasdaq have experienced declines, Bitcoin has risen to its highest levels in recent months, positioning itself as a safe haven, similar to gold. Understand how Bitcoin and gold have been synced for some time and what the correlation might look like in the future.

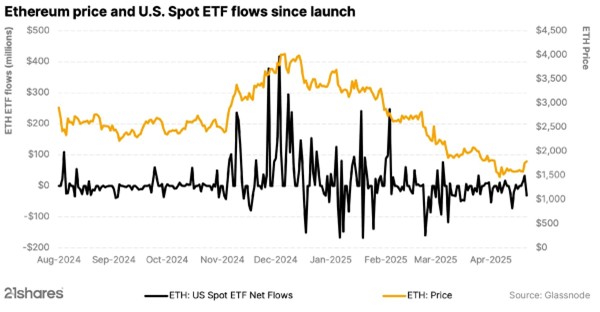

Ethereum’s big reboot: Why investors should be excited

Ethereum is making headlines due to a potential change in its core software, the Ethereum Virtual Machine (EVM), that operates across thousands of computers, enabling Ethereum to execute smart contracts and securely track transactions. However, Ethereum’s co-founder, Vitalik Buterin, has suggested replacing the EVM with a new system called RISC-V. Discover why the change is necessary and its potential impact on investors.

Thousands of altcoins, but no altcoin season: What comes next?

Over the past year, the crypto market has entered a new era. Bitcoin hit new all-time highs, outperforming other cryptocurrencies and decoupling from the stock market. Unlike previous cycles, the expected “altcoin season” did not occur, with Bitcoin remaining strong and money not flowing into other cryptocurrencies or altcoins. So, the big question is: Has altcoin season run its course?

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

WELC ETF ger exponering mot företag inom sällanköpsvaror

Publicerad

16 timmar sedanden

28 april, 2025

Amundi S&P Global Consumer Discretionary ESG UCITS ETF DR EUR (D) (WELC ETF) med ISIN IE00061J0RC6, strävar efter att spåra S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Consumer Discretionary index. Det S&P-utvecklade ex-Korea LargeMidCap Sustainability Enhanced Consumer Discretionary-indexet spårar stora och medelstora företag från den diskretionära konsumentsektorn. ESG-kriterier (miljö, social och bolagsstyrning) beaktas vid valet av värdepapper.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,18% p.a.. Amundi S&P Global Consumer Discretionary ESG UCITS ETF DR EUR (D) är den billigaste ETF som följer S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Consumer Discretionary index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen delas ut till investerarna (Årligen).

Amundi S&P Global Consumer Discretionary ESG UCITS ETF DR EUR (D) är en mycket liten ETF med 5 miljoner euro förvaltade tillgångar. Denna ETF lanserades den 20 september 2022 och har sin hemvist i Irland.

Investeringsmål

AMUNDI S&P GLOBAL CONSUMER DISCRETIONARY ESG UCITS ETF DR – EUR (D) försöker replikera, så nära som möjligt, resultatet för S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Consumer Discretionary Index (Netto Total Return Index). Denna ETF har exponering mot stora och medelstora företag i utvecklade länder. Den innehåller uteslutningskriterier för tobak, kontroversiella vapen, civila och militära handeldvapen, termiskt kol, olja och gas (inkl. Arctic Oil & Gas), oljesand, skiffergas. Den är också utformad för att välja ut och omvikta företag för att tillsammans förbättra hållbarhet och ESG-profiler, uppfylla miljömål och minska koldioxidavtrycket.

Handla WELC ETF

Amundi S&P Global Consumer Discretionary ESG UCITS ETF DR EUR (D) (WELC ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

Största innehav

Denna fond använder fysisk replikering för att spåra indexets prestanda.

| Namn | Valuta | Vikt % | Sektor |

| AMAZON.COM INC | USD | 18.89 % | Sällanköpsvaror |

| TESLA INC | USD | 13.29 % | Sällanköpsvaror |

| HOME DEPOT INC | USD | 5.75 % | Sällanköpsvaror |

| LVMH MOET HENNESSY LOUIS VUI | EUR | 5.44 % | Sällanköpsvaror |

| TOYOTA MOTOR CORP | JPY | 4.58 % | Sällanköpsvaror |

| MCDONALD S CORP COM NPV | USD | 2.63 % | Sällanköpsvaror |

| LOWE S COS INC COM US 0.50 | USD | 2.38 % | Sällanköpsvaror |

| SONY GROUP CORP (JT) | JPY | 2.25 % | Sällanköpsvaror |

| BOOKING HOLDINGS INC | USD | 2.02 % | Sällanköpsvaror |

| TJX COMPANIES INC | USD | 1.89 % | Sällanköpsvaror |

Innehav kan komma att förändras

To understand Celestia’s value and its role in the ecosystem, it’s helpful to first understand how traditional blockchain systems are structured.

Most blockchains, like Ethereum or Bitcoin, are monolithic which means they perform all major functions (consensus, data availability, and execution) on a single layer. This design ensures security but according to new modular networks, limits scalability and flexibility.

The modular blockchain thesis, which Celestia is leading, proposes separation of layers and respective responsibilities in the network. Instead of having one network and its validators perform all of its functions, it may be better to have specialized layers:

• Consensus Layer: Ensures that all nodes agree on the order of transactions.

• Data Availability Layer: Ensures transaction data is accessible to all participants.

• Execution Layer: Processes the actual logic and computation of smart contracts.

By unbundling these components, developers can build more efficient, flexible systems that scale far beyond what monolithic blockchains can support. Not all applications need similar levels of security and not all applications need to scale up to millions of transactions. Additionally, one application might be scaling beyond the capabilities of its host network, severely effecting the available data throughput of other applications. This limits developers to the monolithic technology stack provided by a virtual machine such as Ethereum’ EVM.

The Issue of Data Availability

One of the most misunderstood yet crucial components of any blockchain is data availability. In simple terms, it ensures that the data behind each block is fully accessible and verifiable by all participants in the network. Another way to describe it is as the confidence a user can have that the data required to verify a block is really available to all network participants. Data availability is therefore important to all stakeholders of the blockchain ecosystem.

If a block producer withholds data, then nodes cannot verify the block, which leads to potential censorship or fraud.

Traditionally, a blockchain network can offer data availability with the following mechanisms:

• Full Replication: Every node stores the entire blockchain and verifies all data. Secure but not quite scalable.

• Sharding: Breaks the blockchain into smaller pieces (shards), spreading data across nodes. Scalable but highly complex to implement.

• Committee-Based Models: Small groups of nodes are trusted to verify data availability. Efficient, but less decentralized.

Celestia takes a completely different approach using a novel method called Data Availability Sampling (DAS). Instead of requiring every node to download all data, DAS allows lightweight nodes to randomly sample small chunks of a block. If enough pieces are retrievable, the node can confidently assume the full block is available. This slashes resource requirements while maintaining security and decentralization.

Why Data Availability Matters

Data availability might sound like a nerdy technical term, but it’s one of the most important yet one of less invisible parts of how blockchains work.

Let’s say you’re using a crypto app to trade tokens, store art, or move money. Every time you do something, that action (also referred to as a transaction) needs to be recorded and shared with the rest of the network so everyone agrees it happened. If that data disappears or can’t be verified, the whole system becomes untrustworthy. You might think your tokens moved but if no one else can see that record or a different version of that record, it’s as if it never happened.

Here’s a real-life parallel: imagine a public scoreboard at a sports game. If the scorekeeper shows the score to only a few people and then hides the board, how can the rest of the crowd trust the result? Everyone needs to see the score to believe it’s fair. In crypto, data availability is what makes sure the scoreboard is always visible to all participants at any time.

How DAS Changes the Game

Traditionally, ensuring data availability meant every node had to download and verify the entire block of data for any purpose related to particular data inside the block, like reading a whole newspaper just to check one article. Ethereum and most competing monolithic layer-1’s operate this way. It works, but it’s expensive, slow, and becomes less practical as blockchains scale in terms of data throughput required by its Dapps therefore limiting the types of applications that developers can build.

Celestia’s Data Availability Sampling (DAS) is a breakthrough that lets even simple devices (like smartphones) verify that a block’s data is available—by checking just a few random pieces. If enough pieces are found and correct, the network can be confident the full block is truly there and correct.

This innovation means:

• Light clients can safely participate in the network without downloading everything.

• Rollups and app-chains can post their data to Celestia with minimal overhead.

• Scalability skyrockets without sacrificing decentralization.

Celestia’s Role in Scaling Applications

Celestia is the first blockchain designed specifically to be a modular data availability layer. That means it doesn’t execute smart contracts or handle transactions directly, instead, it provides a foundation for others to build new networks, also referred to as rollups.

Developers can launch rollups or full execution environments, and use Celestia to handle the consensus and data availability side. This unlocks several key benefits:

• Massive scalability: Apps can scale independently from each other.

• Customization: Developers choose their own virtual machines, consensus mechanism and execution logic.

• Decentralization: Thanks to DAS, even small devices can validate the system.

This approach flips the script on how we think about launching and scaling blockchains. Instead of competing for space on a monolithic chain, apps get their own chains, backed by Celestia’s secure and scalable data availability layer while giving developers full stack control over their applications.

Celestia Enables Scalability and Offers Full-Stack Control

Using the restaurant example from Sui vs Aptos. Imagine a big, busy restaurant where the chefs, waiters, and cashiers all work in the same small kitchen. It gets crowded, orders take forever, and sometimes things go wrong while the backlog of orders keeps growing. That’s how traditional blockchains work, doing everything in one place.

Now imagine if the restaurant separated the jobs: the chefs cook in a big kitchen, waiters serve from a clean dining area, and the cashiers handle payments at the front desk. Everything runs smoother, faster, and the restaurant can grow in a environment that is less prone to congestion. That is what Celestia is doing for blockchains. Let’s say a small specialty restaurant opens up next door, leveraging Celestia’s register and order management system. That new restaurant can fully focus on delivering the best food and experience to customers, knowing that Celestia’s technology won’t be the limiting factor when scaling up their kitchen. The modularity that Celestia’s restaurant offers is allowing a lot of small scale restaurants to exist without the overhead of individual administrative work. It goes even a step further, Celestia allows you to just use it register while letting smaller restaurants pick their own kitchen (execution environment) and order management system (consensus layer).

In conclusion, Celestia is challenging the believe that blockchains should always be monolithic and blockchains need to offer the same technology stack to all developers on its chain. It is a significant leap forward in the crypto ecosystem and opens possibilities that were previously not feasible.

Diversify Crypto Exposure to Modular Blockchain Technology with the VanEck Celestia ETN

Key features of the VanEck Celestia ETN

• Celestia enables secure scaling of blockchain applications with modular technology.

• Fully-collateralized by TIA in cold-storage.

• Total return of TIA: Tracks the MarketVector™ Celestia VWAP Close Index (MVTIAV).

Why VanEck Crypto ETNs? Here’s why:

• With nearly 70 years in asset management and a strong track record in crypto, we bring deep industry knowledge and proven reliability.

• We combine traditional financial strengths with cutting-edge crypto innovation, backed by a CEO who truly believes in crypto’s future.

• We ensure clarity in our product structures and avoid high-risk or opaque practices, with assets fully backed by cryptocurrency in secure cold storage.

• Our assets are secured by a licensed European bank in Liechtenstein, providing top-tier compliance and security.

• We use the safest institutional custody setup available, prioritizing your security over cost savings.

Crypto is an asset class with high potential returns but investing in digital assets comes with great risk, why choose products that potentially introduce even more risks? Choose VanEck for a secure, transparent, and expertly managed crypto investment experience.

Main Risk Factors:

Investors should note that there is no direct ownership for the crypto assets, but a claim against Issuer to receive such assets.

• Complexity risk: The complexity of the project and its technological concepts make it challenging to assess its viability and valuation.

• Adoption risk: Celestia introduces additional adoption risk as it is uncertain if the concept of modular blockchains will succeed.

• Technology risk: Celestia introduces additional technology risk due to the technology being less mature and therefore could be more prone to bugs and exploits.

• Regulatory Risk: market disruptions and governmental interventions may make digital assets illegal.

• Risk of Losses and Volatility: The trading prices of many digital assets have experienced extreme volatility in recent periods and may continue to do so. There is a risk of total loss as no guarantee can be made regarding custody due to hacking risk, counterparty risk and market risk.

• Other risks specific to this ETN’s Digital Assets can also be found on the VanEck Crypto Academy.

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

IMPORTANT INFORMATION

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Strasse 30, 60486 Frankfurt am Main, Deutschland and VanEck Switzerland AG, Genferstrasse 21, 8002 Zurich, Switzerland.

It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

The underlying Index is the exclusive property of MarketVector GmbH, which has contracted with CC Data Limited to maintain and calculate the Index. CC Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MarketVector GmbH, CC Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. ’1st year’ shows the most recent of these 12-month periods and ’2nd year’ shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH / © VanEck Switzerland AG

From digital asset to safe haven: Why is Bitcoin acting like gold?

WELC ETF ger exponering mot företag inom sällanköpsvaror

Introduction to Celestia

YYYY ETF använder optioner för att ge månadsvis utdelning

Virtune lanserar Virtune Stellar ETP på Nasdaq Stockholm

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa