Nyheter

Cryptoassets Included in A Diversified Portfolio

Publicerad

1 år sedanden

When one considers investing in a given asset class and subsequently a specific asset – two primary questions should be asked:

- What is the investment thesis for this asset class?

- What proportion of a portfolio should be allocated to this asset class given current financial goals and constraints?

This primer will provide the answer to the second question (2). At its core, the question is optimal portfolio construction and the risk management of said portfolio for a given set of constituents. For brevity, we will assume the reader understands basic Modern Portfolio Theory but perhaps is less familiar with cryptoasset terminology and will define and expand on concepts where deemed necessary. Our report’s key argument is that adding cryptoasset exposure will lead to superior risk-adjusted investment outcomes precisely due to their unique property of having largely unrelated risk premiums compared to all other asset classes.

Coverage

- Correlation of Returns Across Asset Classes

- Correlation of Returns During Distressed Times

- Portfolio with Different Rebalancing Frequencies

- Dynamic Allocation with Blockchain Indicators

- Conclusion

- Disclaimer

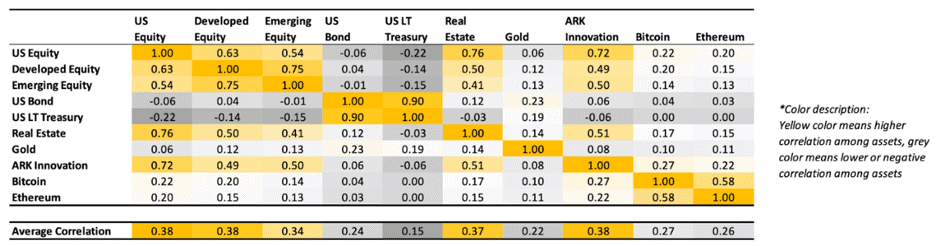

Correlation of Returns Across Asset Classes

In Figure 1, we compare the correlation of returns for several major asset classes, represented by popular exchange-traded funds (ETFs), as well as Bitcoin (BTC) and Ether (ETH). The ETFs chosen represent a variety of asset classes and risk profiles and are as follows:

• US Equity, represented by SPY – The SPDR S&P 500 ETF

• Developed Equity, represented by EFA – The iShares MSCI EAFE ETF

• Emerging Equity, represented by EEM – The iShares MSCI Emerging Markets ETF

• US Bond, represented by AGG – The iShares Core U.S. Aggregate Bond ETF

• US Long Term Treasury, represented by TLT – The iShares 20+ Year Treasury Bond ETF

• Real Estate, VNQ – The Vanguard Real Estate ETF

• Gold, GLD – The SPDR Gold Shares ETF

• ARK Innovation, represented by ARKK

Bitcoin’s correlation with major asset classes ranges from 0.00 to 0.27 (excluding Ethereum), similar to what Gold (GLD) offers, ranging from 0.06 to 0.23 from December 12, 2014 to September 30, 2023. This low level of correlation made both assets a vital diversification source for traditional portfolios, which are a mix of equities and bonds. However, there is almost no correlation (0.10) between gold and Bitcoin, making both unique diversification resources for investors’ portfolios.

Figure 1: Correlation matrix

Source: 21Shares. Data from Bloomberg and Yahoo Finance (BTC and ETH). From 31/12/2014 to 30/09/2023

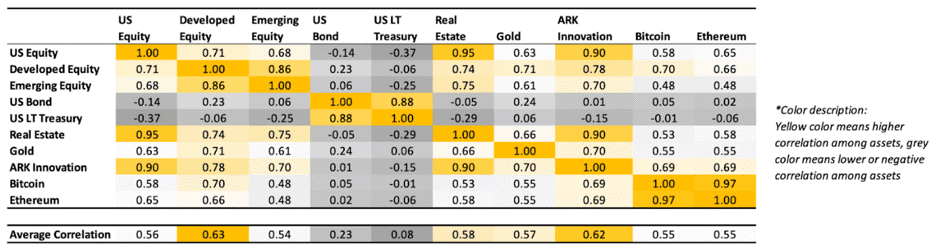

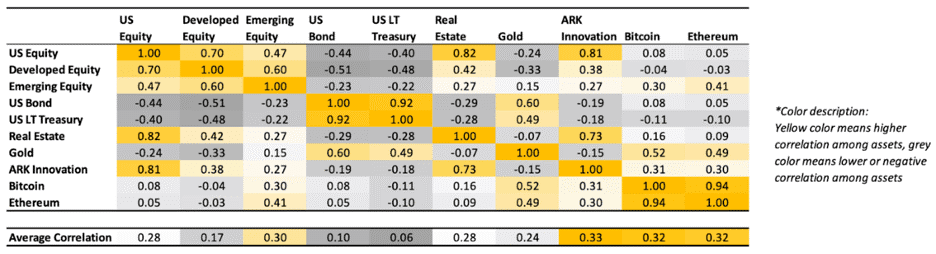

Correlation of Returns During Distressed Times

March 2020 (Covid Crash)

During distressed times, asset classes tend to show an increased correlation between them. The stock market crash and liquidity crisis caused by the COVID-19 pandemic exemplify this pattern. Figure 2 shows that the significant and sudden global event that began in March 2020 and ended in April caused both Bitcoin and gold to undergo a sudden rise in correlation.

Figure 2: Correlation of returns during March 2020 (Covid Crash)

Source: 21Shares. Data from Bloomberg and Yahoo Finance (BTC and ETH)

March 2023 (Banking Crisis)

Bitcoin rallied 23% in March 2023 on the back of a looming banking crisis in the U.S. On March 13, the Federal Reserve had to step in to protect all depositors of Silicon Valley Bank, which experienced a bank run two days before, and of crypto-friendly Signature Bank, controversially shut down by its state chartering authority. Then, on March 19, UBS agreed to buy Credit Suisse in an emergency rescue deal brokered by Swiss authorities. Meanwhile, Figure 3 shows that BTC decoupled from risk assets like stocks and showed an increased correlation to Gold as investors turned to it as a hedge against bank risk.

At its core, Bitcoin is a non-sovereign and global asset that exhibits unique characteristics (trustless, permissionless, and censorship-resistant, among others). Indeed, one of Satoshi Nakamoto’s primary motivations for creating Bitcoin was to have an alternative payment system outside central banks’ control.

Figure 3: Correlation of returns during March 2023 (Banking Crisis)

Source: 21Shares. Data from Bloomberg and Yahoo Finance (BTC and ETH)

Portfolio with different rebalancing frequencies

We choose a traditional 60/40 portfolio (60% allocated to stocks, 40% allocated to bonds) as the hypothetical benchmark, as it has been a guidepost for the average investor since Nobel laureate Harry Markowitz developed the principles of Modern Portfolio Theory (MPT) in the 1950s. For brevity, we assume the reader has a good understanding of MPT. Then, we backtest adding a 1% and 5% Bitcoin or Ether allocation to said diversified portfolio to understand the impact of a minor allocation to crypto across various performance metrics. Before diving into the results, the reader should be aware that this hypothetical portfolio was developed in hindsight, and past performance is no guarantee of future results.

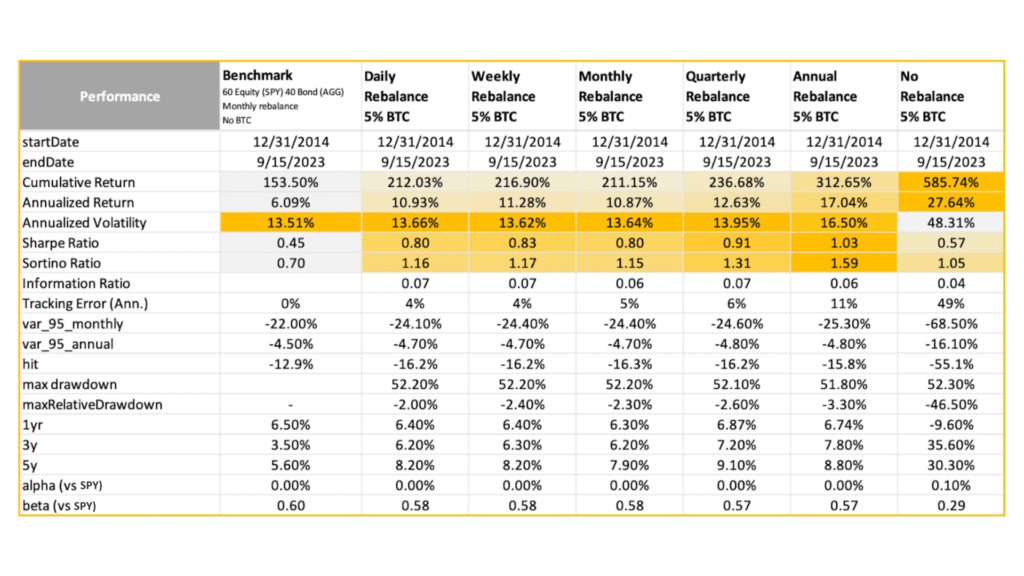

5% BTC allocation to a simple growth portfolio (60% US Equity, 40% US Bond)

We tested six types of rebalancing strategies by adding 5% constant BTC allocation to a simple growth portfolio (US Equity – 60% represented by SPY, US Bond – 40% represented by AGG): daily, weekly, monthly, quarterly, annually, and no rebalancing. These are the key takeaways:

• Improved risk-adjusted returns: The inclusion of cryptoassets in the diversified portfolio is noticeable with improved overall performance across all rebalance frequencies, improving annualized return from 6.09% to double digits range (from 10.87% to 27.64%) and enhancing Sharpe ratio from 0.45 to the 1.03 level.’

• Rebalancing is key: However, when adding Bitcoin without rebalancing, overall risk suffers with 48.31% annualized volatility, almost four times higher than the benchmark of 13.51%. The most efficient rebalancing schedule is annual. This strategy has historically proven to be maximizing cumulative returns (313%) and the Sharpe (1.03) and Sortino (1.59) ratios.

• Timing doesn’t really matter: As investors argue that timing matters in crypto investments, the research showed regardless of when to add bitcoin to their portfolio, 75% of the time, the strategy outperformed the benchmark in the next 1 year, and 100% of the time, the strategy exceeded it in the next 3 years.

Figure 4: Growth portfolio with different rebalancing frequencies (5% BTC allocation)

Source: 21Shares. Data from Yahoo Finance

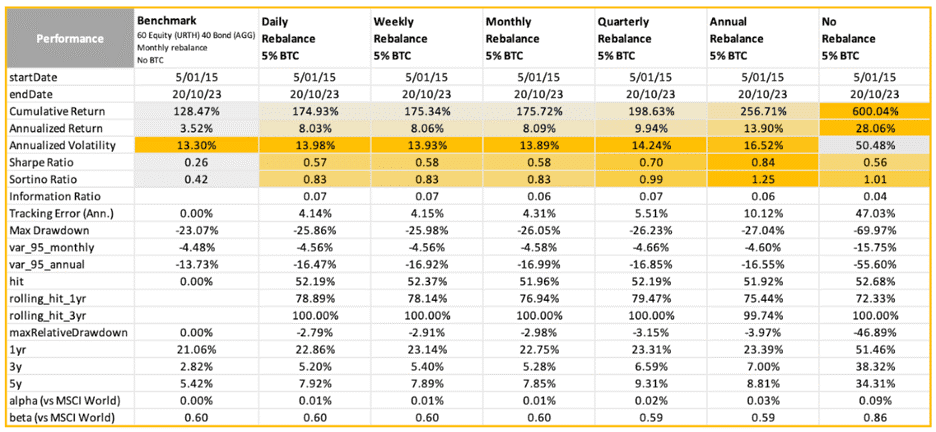

5% BTC allocation to another simple growth portfolio (60% MSCI World, 40% US Bond)

We also tested six types of rebalancing strategies by adding 5% constant BTC allocation to another growth portfolio (MSCI World – 60% represented by URTH, US Bond – 40% represented by AGG): daily, weekly, monthly, quarterly, annually, and no rebalancing. These are the key takeaways:

• Improved risk-adjusted returns: The inclusion of BTC in the diversified portfolio was noticeable with improved overall performance across all rebalance frequencies, improving annualized return from 3.52% to double digits range (13.90% with an annual rebalance) and enhancing Sharpe ratio from 0.26 to the 0.84 level.

• Rebalancing is key: However, when adding bitcoin without rebalancing, overall risk suffers with 50.48% annualized volatility, almost four times higher than the benchmark of 13.30%. The most efficient rebalancing schedule is annual. This strategy has historically proven to be maximizing cumulative returns (256.71%) and the Sharpe (0.84) and Sortino (1.25) ratios.

• Timing doesn’t really matter: As investors argue that timing matters in crypto investments, the research showed regardless of when to add bitcoin to their portfolio, 80% of the time, the strategy outperformed the benchmark in the next 1 year, and 100% of the time, the strategy exceeded it in the next 3 years.

Figure 5: Another growth portfolio with different rebalancing frequencies (5% BTC allocation)

Source: 21Shares. Data from Yahoo Finance

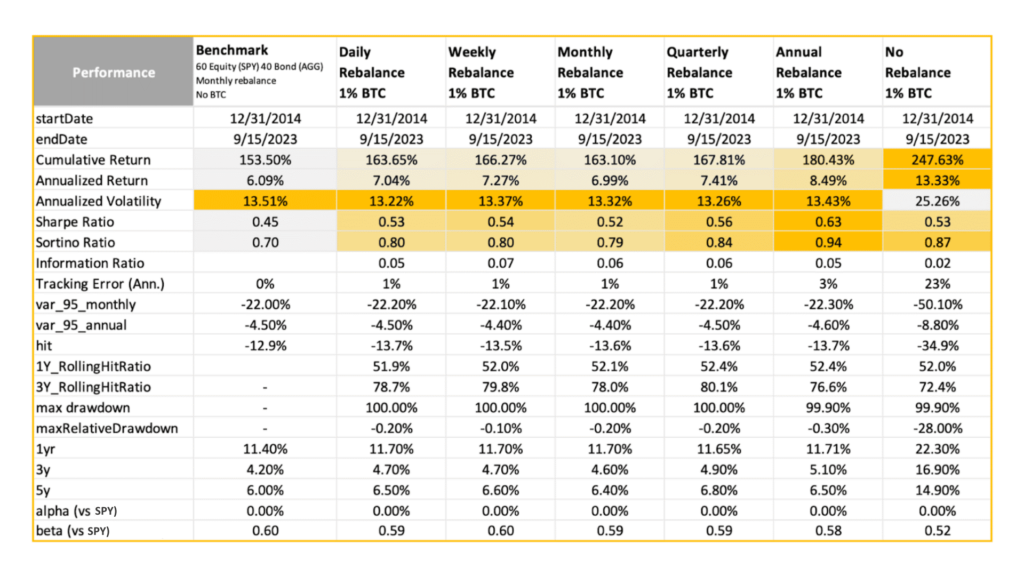

1% BTC allocation to a simple growth portfolio (60% US Equity, 40% US Bond)

We also tested six types of rebalancing strategies by adding just 1% constant bitcoin allocation to a simple growth portfolio (US Equity – 60%, US Bond – 40%): daily, weekly, monthly, quarterly, annually, and no rebalancing (see next slide). These are the key takeaways:

• Improved risk-adjusted returns: The inclusion of Bitcoin in the diversified portfolio is noticeable, with improved overall performance across all rebalance frequencies, improving annualized return and enhancing the Sharpe ratio from 0.45 to 0.63.

• Rebalancing is key: Surprisingly, adding just 1% constant bitcoin allocation also reduced annualized volatility across all rebalance frequencies, except no rebalancing, in which case overall risk suffers with 25.47% annualized volatility. The reduction in annualized volatility to bitcoin’s low correlation to equities and bonds.

• Timing doesn’t really matter: As investors argue that timing matters in crypto investments, the research showed regardless of when to add bitcoin to their portfolio, 75% of the time, the strategy outperformed the benchmark in the next 1 year, and 100% of the time, the strategy exceeded it in the next 3 years.

Figure 6: Portfolio with different rebalancing frequencies (1% BTC allocation)

Source: 21Shares. Data from Yahoo Finance

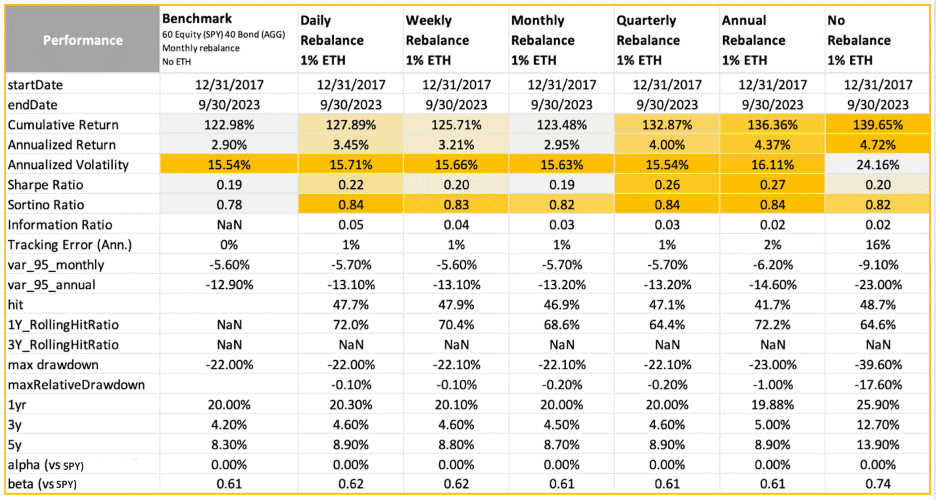

1% ETH allocation to a simple growth portfolio (60% US Equity, 40% US Bond)

In addition, we tested six types of rebalancing strategies by adding 1% constant ETH allocation to a simple growth portfolio (US Equity – 60%, US Bond – 40%): daily, weekly, monthly, quarterly, annually, and no rebalancing (see next slide). These are the key takeaways:

• Improved risk-adjusted returns: The inclusion of Ether in the diversified portfolio is noticeable with improved overall performance across all rebalance frequencies, improving annualized returns and enhancing the Sharpe ratio from 0.19 to 0.27.

• Rebalancing is key: However, when adding ETH without rebalancing, overall risk suffers with 24.16% annualized volatility, almost double the benchmark of 15.54%. The most efficient rebalancing schedule is quarterly. This strategy achieves the same volatility as the benchmark portfolio while improving the Sharpe (0.26) and Sortino (0.84) ratios.

• Timing doesn’t really matter: As investors argue that timing matters in crypto investments, the research showed regardless of when to add bitcoin to their portfolio, 70% of the time, the strategy outperformed the benchmark in the next 1 year, and 100% of the time, the strategy exceeded it in the next 3 years.

Figure 7: Portfolio with different rebalancing frequencies (1% ETH allocation)

Source: 21Shares. Data from Yahoo Finance

Dynamic Allocation with Blockchain Indicators

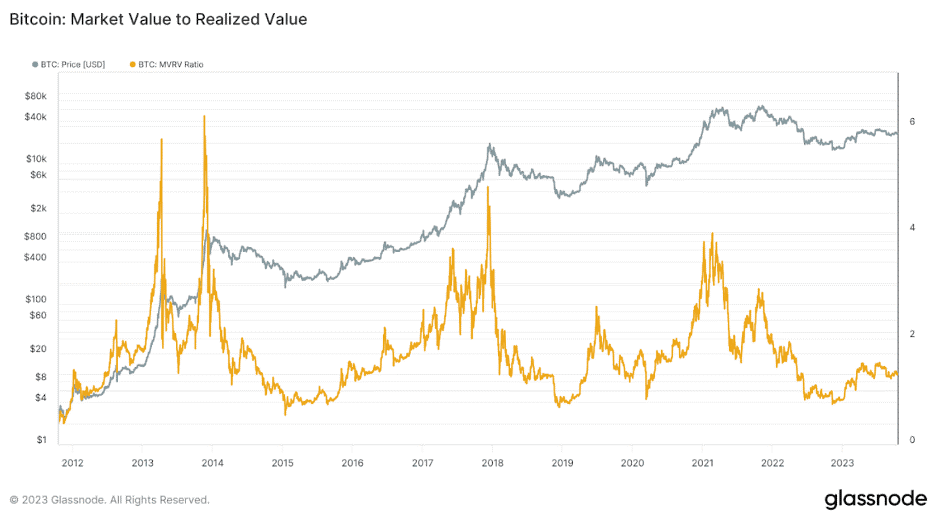

The Case for Market Value to Realized Value (MRVR)

Transparency of public blockchains has proven beneficial to gauging investor sentiment; though transactions are pseudonymous, timestamps and transaction values are visible and humanly readable. This certainly helps shed light on the potential psychology of BTC investors based on their cost basis. As mentioned in a book authored by Morgan Housel, The Psychology of Money, “Investing is not the study of finance. It’s the study of how people behave with money.”

The market-value-to-realized-value (MVRV) is a simple yet powerful blockchain (on-chain) multiple:

• ”Market value” refers to the current value of an asset (market cap).

• ”Realized value” refers to the aggregated cost basis of investors (realized cap). This metric was proposed by Nic Carter and Antoine Le Calvez in 2018. Using the vocabulary of the crypto industry, it is the aggregate value of all unspent transaction outputs (UTOXs) priced by their value when they last moved.

High MVRV values indicate a substantial degree of unrealized profits in the system. In contrast, values below ”1” indicate that a significant portion of BTC’s supply is near break-even or at a loss. Remember, investing is also the study of how people behave with money. Historically, high MRVR ratios have coincided with BTC market tops, while values below ”1” have preceded past cycles’ bottoms. BTC’s MVRV ratio broke above the ”1” mark in January this year. The last time this happened was in March 2020, marking the beginning of the previous cycle’s meteoric bull run.

Figure 8: Bitcoin’s Market Value to Realized Value (MVRV)

Source: Glassnode

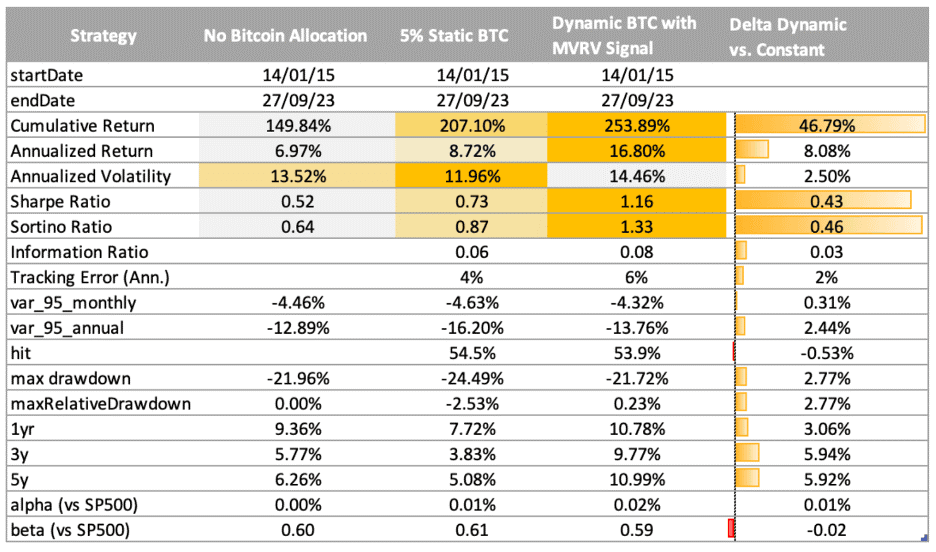

Here’s how we constructed a dynamic rebalancing strategy based on the MVRV ratio. Our algorithm sets a logic to gradually increase the rebalancing weight towards distress times and vice versa. Here is the breakdown of the MVRV strategy:

• Monthly rebalance.

• Benchmark is a 60/40 (60% allocated to SPY and 40% to AGG) portfolio with a 5% constant BTC allocation.

• Rebalancing: MVRV driven.

• 90% of the portfolio is allocated to a 60/40 strategy.

• 10% of the portfolio is allocated to BTC and cash based on the MVRV indicator. BTC allocation is higher when MVRV is at low levels relative to its historical average and vice versa.

As shown in the chart below (Figure 8), with the above strategy, a dynamic allocation strategy driven by the MVRV ratio enhances an ongoing BTC allocation strategy on almost all performance metrics. Annualized return improved by ~8% per year with a similar level of risk; both the Sharpe and Sortino ratios improved, which showed the effectiveness of the fundamental indicator in preserving capital during market downtrends.

Figure 9: MVRV-based dynamic allocation

Source: 21Shares. Data from Yahoo Finance

Conclusion

This report has demonstrated the benefits of allocating a portion of one’s portfolio to Bitcoin and Ethereum through a thorough backtest over history. The core reason is historical evidence that cryptoassets give investors a chance to diversify their portfolios further and maximize risk-adjusted returns. The unique dynamics of the cryptoasset industry ensure that the critical value drivers for Bitcoin or Ethereum bear little relationship to the value drivers of stocks, fixed incomes, or alternative investments. What makes cryptoasset investing considerable is its potential to improve the risk profile by magnitudes. The often-volatile risk profiles of cryptoassets must be judged as just one part of an investor’s whole portfolio. Rebalancing is needed to harvest the risk premium and maintain the portfolio’s risk profile without significant downside risk exposure during distress periods.

Moreover, our study demonstrated the benefits of dynamic allocation in crypto with fundamental indicators like the MVRV ratio. However, theoretical portfolio allocation is only one aspect of the investment process one must go through before investing; this report has purposely avoided associated topics such as valuation, as these are covered in other writings.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Trump’s trade war puts Bitcoin in the spotlight

-

Bitcoin supply on crypto exchanges hits 5-year low and that’s a good sign

-

Markets Swing Wildly After Tariff Shock – Bitcoin Rebounds Strongly

-

21Shares Dogecoin ETP: Drivs av community, omdefinierar kryptolandskapet

-

21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa

-

Michael Saylor’s bold Bitcoin bet and Strategy’s risk analysis

Nyheter

BE28 ETF företagsobligationer med förfall 2028 och inget annat

Publicerad

20 minuter sedanden

17 april, 2025

Invesco BulletShares 2028 EUR Corporate Bond UCITS ETF EUR Dis (BE28 ETF) med ISIN IE000LKGEZQ6, försöker följa Bloomberg 2028 Maturity EUR Corporate Bond Screened-index. Bloomberg 2028 Maturity EUR Corporate Bond Screened Index följer företagsobligationer denominerade i EUR. Indexet speglar inte ett konstant löptidsintervall (som är fallet med de flesta andra obligationsindex). Istället ingår endast obligationer som förfaller under det angivna året (här: 2028) i indexet. Indexet består av ESG (environmental, social and governance) screenade företagsobligationer. Betyg: Investment Grade. Löptid: december 2028 (Denna ETF kommer att stängas efteråt).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,10 % p.a.. Invesco BulletShares 2028 EUR Corporate Bond UCITS ETF EUR Dis är den billigaste ETF som följer Bloomberg 2028 Maturity EUR Corporate Bond Screened index. ETFen replikerar resultatet för det underliggande indexet genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Ränteintäkterna (kuponger) i ETFen delas ut till investerarna (kvartalsvis).

Invesco BulletShares 2028 EUR Corporate Bond UCITS ETF EUR Dis är en mycket liten ETF med 1 miljon euro tillgångar under förvaltning. Denna ETF lanserades den 18 juni 2024 och har sin hemvist i Irland.

Produktbeskrivning

Invesco BulletShares 2028 EUR Corporate Bond UCITS ETF Dist syftar till att tillhandahålla den totala avkastningen för Bloomberg 2028 Maturity EUR Corporate Bond Screened Index (”Referensindexet”), minus påverkan av avgifter. Fonden har en fast löptid och kommer att upphöra på Förfallodagen. Fonden delar ut intäkter på kvartalsbasis.

Referensindexet är utformat för att återspegla resultatet för EUR-denominerade, investeringsklassade, fast ränta, skattepliktiga skuldebrev emitterade av företagsemittenter. För att vara kvalificerade för inkludering måste företagsvärdepapper ha minst 300 miljoner euro i nominellt utestående belopp och en effektiv löptid på eller mellan 1 januari 2028 och 31 december 2028.

Värdepapper är uteslutna om emittenter: 1) är inblandade i kontroversiella vapen, handeldvapen, militära kontrakt, oljesand, termiskt kol eller tobak; 2) inte har en kontroversnivå enligt definitionen av Sustainalytics eller har en Sustainalytics-kontroversnivå högre än 4; 3) anses inte följa principerna i FN:s Global Compact; eller 4) kommer från tillväxtmarknader.

Portföljförvaltarna strävar efter att uppnå fondens mål genom att tillämpa en urvalsstrategi, som inkluderar användning av kvantitativ analys, för att välja en andel av värdepapperen från referensindexet som representerar hela indexets egenskaper, med hjälp av faktorer som index- vägd genomsnittlig varaktighet, industrisektorer, landvikter och kreditkvalitet. När en företagsobligation som innehas av fonden når förfallodag kommer de kontanter som fonden tar emot att användas för att investera i kortfristiga EUR-denominerade skulder utgivna av det amerikanska finansdepartementet.

ETFen förvaltas passivt.

En investering i denna fond är ett förvärv av andelar i en passivt förvaltad indexföljande fond snarare än i de underliggande tillgångarna som ägs av fonden.

”Förfallodag”: den andra onsdagen i december 2028 eller sådant annat datum som bestäms av styrelseledamöterna och meddelas aktieägarna.

Handla BE28 ETF

Invesco BulletShares 2028 EUR Corporate Bond UCITS ETF EUR Dis (BE28 ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Borsa Italiana.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Borsa Italiana | EUR | BE28 |

| XETRA | EUR | BE28 |

Största innehav

| Namn | CUSIP | ISIN | Kupongränta | Vikt % |

| Volkswagen Leasing GmbH 3.875% 11/10/28 | D9T70CNQ3 | XS2745725155 | 3.875 | 2.20% |

| Swedbank AB 4.25% 11/07/28 | W94240FJ7 | XS2572496623 | 4.250 | 1.63% |

| ABN AMRO Bank NV 4.375% 20/10/28 | N0R37XLP3 | XS2613658710 | 4.375 | 1.62% |

| Carlsberg Breweries AS 4% 05/10/28 | K3662HDY6 | XS2696046460 | 4.000 | 1.60% |

| RCI Banque SA 4.875% 14/06/28 | F7S48DSE5 | FR001400IEQ0 | 4.875 | 1.59% |

| Booking Holdings Inc 3.625% 12/11/28 | — | XS2621007231 | 3.625 | 1.59% |

| Banco Santander SA 3.875% 16/01/28 | E2R99DB46 | XS2575952697 | 3.875 | 1.58% |

| Nordea Bank Abp 4.125% 05/05/28 | X5S8VP8C3 | XS2618906585 | 4.125 | 1.58% |

| E.ON SE 3.5% 12/01/28 | D2T8J8CT1 | XS2574873266 | 3.500 | 1.57% |

| General Motors Financial Co Inc 3.9% 12/01/28 | U37047BA1 | XS2747270630 | 3.900 | 1.57% |

Innehav kan komma att förändras

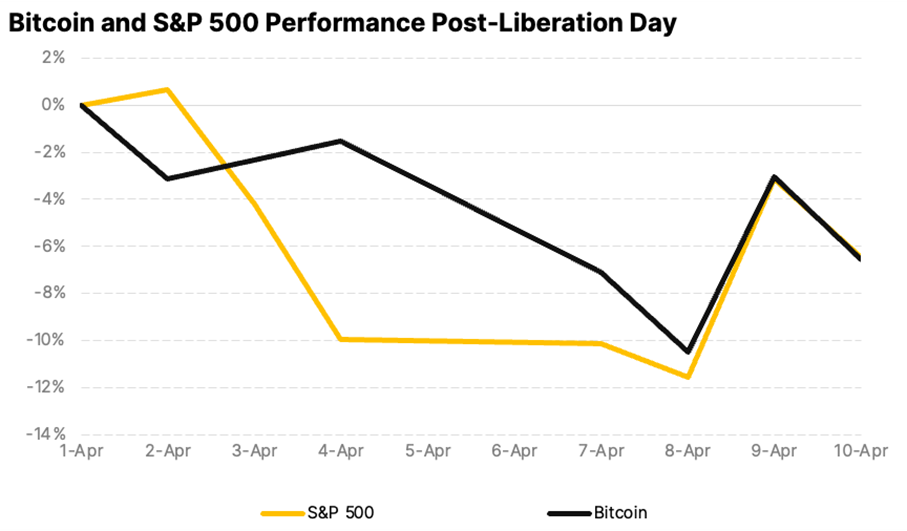

Since U.S. President Donald Trump announced tariffs on April 2, termed ”Liberation Day,” global markets have experienced significant volatility. The S&P 500 shed $5.83 trillion in market value over just four days, marking its steepest drop since the 1950s. Asian markets saw their worst session since 2008, reflecting widespread fears of an economic slowdown.

The U.S. 10-year Treasury yields initially fell below 4% as investors sought safety, but by April 8-9, they surged to a seven-week high of 4.515%. This spike, driven by bond market sell-offs potentially from basis trading or China’s strategic moves to pressure U.S. negotiations, suggests a precarious economic situation rather than risk-on sentiment.

On April 9, President Trump announced a 90-day pause on tariffs for most countries (excluding China, where tariffs jumped to 145%) in an effort to give markets time to absorb the changes and calm volatility. The move sparked a broad rally, with the S&P 500 surging 9.5% for its best day since 2008 and Bitcoin rebounding above $80,000 after a turbulent stretch.

Bitcoin is macro now

Despite persistent concerns about crypto volatility, Bitcoin’s price over the past two weeks has closely mirrored the S&P 500 and has actually been less volatile. This alignment reflects Bitcoin’s growing maturity as an asset class and highlights its resilience. As a highly liquid and accessible asset, it continues to attract investors looking for relative value in turbulent markets.

Sentiment shifts toward crypto ETFs

Spot Bitcoin ETFs recorded $700 million in outflows, while Ethereum ETFs lost $400 million since March, marking a sharp reversal after nine consecutive months of inflows. The pullback points to growing institutional caution amid broader macro uncertainty. Still, on-chain data reveals that long-term holders have been steadily accumulating since January lows, signaling continued confidence in the asset class.

Macroeconomic uncertainty takes center stage

The latest U.S. CPI print came in at 2.4%, which was lower than expected. A rate cut in May still seems premature as markets assess the full impact of new protectionist measures. Federal Reserve Chair Jerome Powell has warned that tariffs could raise inflation while slowing growth. As a result, the probability of three rate cuts in 2025 now exceeds 60%. Declining yields may be an early signal of future monetary easing, which could favor risk assets like crypto if economic pressures intensify.

Bitcoin: Dollar’s ally or alternative?

In the face of policy uncertainty, the debate around the U.S. dollar’s reserve currency status is gaining momentum. With its decentralized and censorship-resistant design, Bitcoin is emerging as both a potential complement and challenger to the dollar, especially as the U.S. increasingly wields its currency as a geopolitical tool through tariffs and sanctions.

Meanwhile, Bitcoin’s fundamentals remain solid. Hashrate is at all-time highs, regulatory clarity is improving, and long-term holders continue to accumulate. With prices consolidating above $80K, the current correction may offer a strategic opportunity for investors positioning for the next leg of growth, particularly as the macro picture evolves.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

YCSH ETF är en satsning på den europeiska dagslåneräntan

Publicerad

2 timmar sedanden

17 april, 2025

iShares EUR Cash UCITS ETF EUR (Acc) (YCSH ETF) med ISIN IE000JJPY166, är en aktivt förvaltad ETF. Denna börshandlade fond strävar efter att ge en avkastning i linje med penningmarknadsräntorna i EUR.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,10 % p.a. iShares EUR Cash UCITS ETF EUR (Acc) är den enda ETF som följer iShares EUR Cash-index. ETFen replikerar det underliggande indexets prestanda genom full replikering (köper alla indexbeståndsdelar).

Denna lanserades den 21 november 2024 och har sin hemvist i Irland.

Investeringsmål

Fondens mål är att ge en avkastning i linje med penningmarknadsräntorna. Detta mål är förenligt med att upprätthålla kapital och säkerställa att dess underliggande tillgångar lätt kan köpas eller säljas på marknaden (under normala marknadsförhållanden).

Handla YCSH ETF

iShares EUR Cash UCITS ETF EUR (Acc) (YCSH ETF) är en europeisk börshandlad fond. Denna fond handlas på ftill exempel Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| XETRA | EUR | YCSH |

Största innehav

| Ticker | Namn | Typ | Vikt (%) | ISIN | Förfall | Valuta |

| BNPNR | TRI-PARTY BNP PARIBAS | Cash | 9.98 | – | 28/Nov/2024 | EUR |

| BREDBP | BRED BANQUE POPULAIRE EURO | Cash | 9.48 | – | 28/Nov/2024 | EUR |

| KBC | KBC BANK (LONDON BRANCH) EURO | Cash | 9.48 | – | 28/Nov/2024 | EUR |

| ICSEALD | BLK LEAF FUND AGENCY ACC T0 EUR | Money Market | 4.49 | IE00B9346255 | – | EUR |

| RY | ROYAL BANK OF CANADA | Cash | 3.99 | XS2729198106 | 29/Nov/2024 | EUR |

| RENTEN | LANDWIRTSCHAFTLICHE RENTENBANK RegS | Cash | 3.99 | XS2930495309 | 28/Nov/2024 | EUR |

| NETHER | NETHERLANDS (KINGDOM OF) | Cash | 3.99 | XS2948452243 | 29/Nov/2024 | EUR |

| LBANK | LANDESKREDITBANK BADEN WUERTTEMBER RegS | Cash | 3.99 | XS2949365139 | 02/Dec/2024 | EUR |

| NEDWBK | NEDERLANDSE WATERSCHAPSBANK NV | Cash | 3.99 | XS2949278241 | 09/Dec/2024 | EUR |

| EIB | EUROPEAN INVESTMENT BANK RegS | Cash | 3.98 | XS2871036898 | 20/Dec/2024 | EUR |

Innehav kan komma att förändras

BE28 ETF företagsobligationer med förfall 2028 och inget annat

Trump’s trade war puts Bitcoin in the spotlight

YCSH ETF är en satsning på den europeiska dagslåneräntan

Crypto’s stress-tested resilience

BlackRock tar iShares S&P 500 3% Capped UCITS ETF till Europa

Fonder som ger exponering mot försvarsindustrin

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Warren Buffetts råd om vad man ska göra när börsen kraschar

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFonder som ger exponering mot försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetf lanserar Europa-fokuserad försvars-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFastställd utdelning i MONTDIV mars 2025