Nyheter

Cosmos (ATOM) Research Primer

Publicerad

1 år sedanden

Cosmos was co-founded by Jae Kwon and Ethan Buchman in 2014, with the support of the Interchain Foundation (ICF), a Swiss company that supports R&D for secure, scalable, open, and decentralized networks. The ICO of the cosmos’ native token ATOM was released in 2017, and the network was ready to use two years later. So far, Cosmos raised a total of $17M in its seven rounds of funding led by Paradigm and followed by 1confirmation, IOSG Ventures, Yield Ventures, Cardinal Capital in addition to Kenneth Bok, managing director of Blocks, a Web 3 advisory based in Singapore.

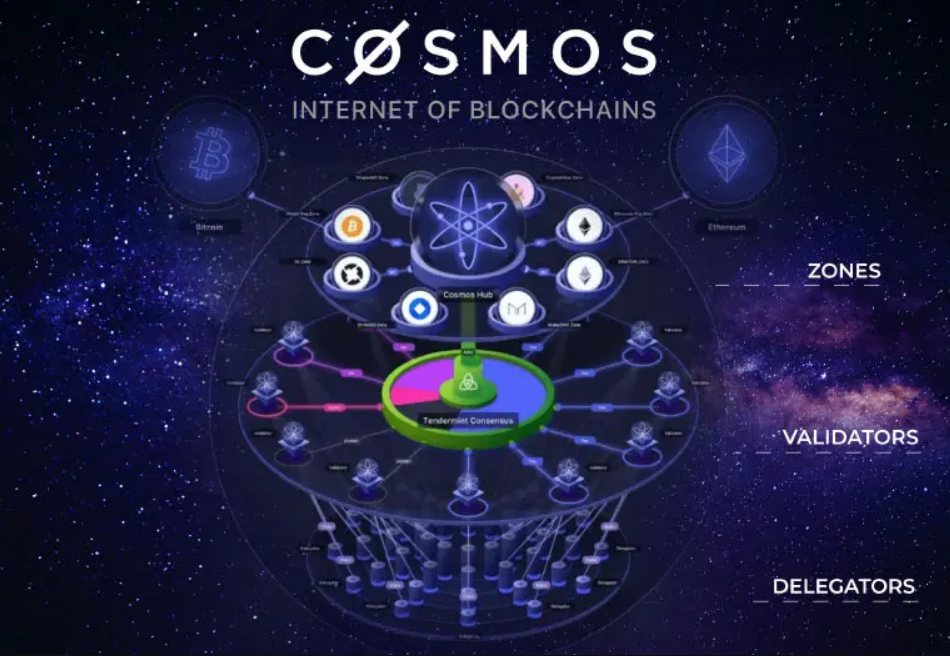

Cosmos is building a network of crypto networks, which all have access to open-sourced tools for streamlining transactions between them. Customizability and interoperability are its two main selling points. Fueled by BFT consensus algorithms like Tendermint (also co-founded by Kwon and Buchman) and its token — Cosmos wants to be home for an ecosystem of networks that can exchange data and tokens programmatically and in a decentralized manner.

In this report, we will offer an exhaustive overview of the Cosmos network, ATOM as a crypto asset, and discuss the various investment risks associated with ATOM — in addition to how an investor can think about the future value of its underlying cryptoasset. In addition, this report offers exhaustive coverage of Cosmos and

ATOM available on the market.

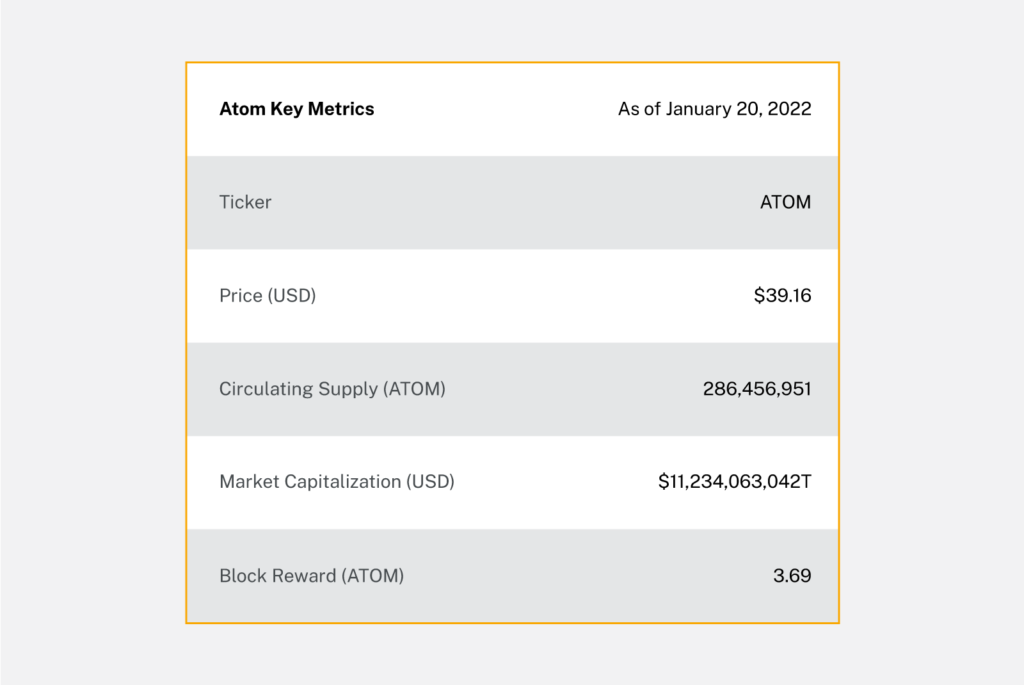

Figure 1: ATOM Key Metrics (Source: CoinGecko)

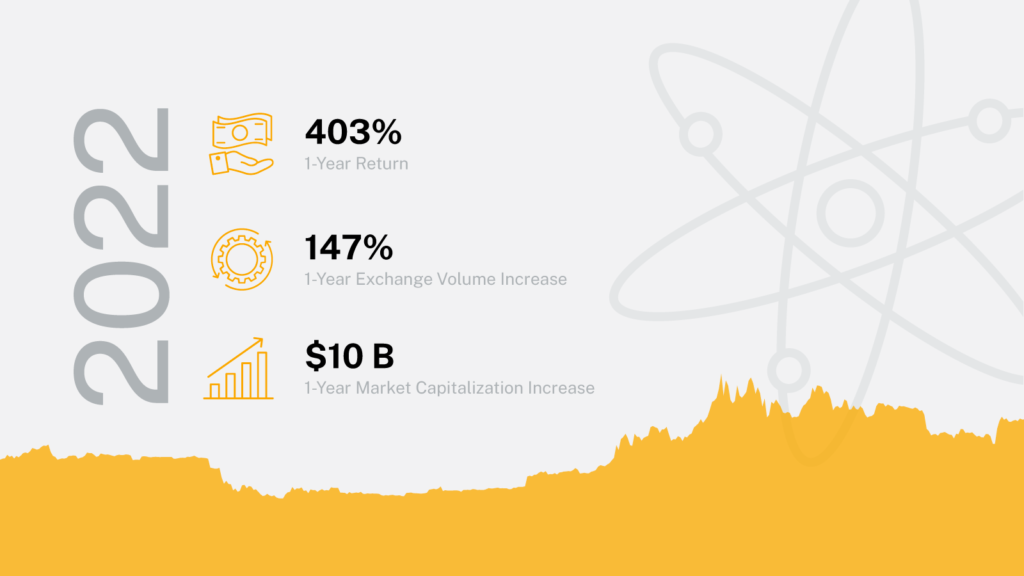

Figure 2: 1-Year Historical Performance (Source: CoinMetrics)

How Cosmos Works

The founders behind Cosmos came to find blockchains working in silos, unable to communicate with each other and struggling to make big transactions at once. Cosmos wanted to fix these problems by proposing a system with two classes of blockchains, Hubs and Zones. Zones are regular heterogeneous blockchains that are kept connected by the Hubs.

To make the vision of interoperability and customization work, Cosmos has three foundation stones in place, Tendermint, Inter-blockchain Communications Protocol (IBC) and Cosmos SDK.

• Tendermint helps developers build blockchains without having to code them from scratch, powered by the Tendermint Core, which is a PoS governance mechanism that keeps blockchains, or Zones, run in sync within the Cosmos Hub, the first Hub to be launched on Cosmos.

• IBC is a mechanism that makes information travel freely and securely between the Zones.

• To keep complexity to the minimum, the Cosmos SDK provides the Zones with most common functions like governance, tokens, and staking. If need be, developers can also add plugins for additional features or services.

A Zone is only required to create an IBC connection with a Hub, to exchange data and assets with other Zones connected to that Hub. That means Zones only need to establish a limited number of connections with a restricted set of Hubs instead of having to make a connection with each and every Zone. This system prevents double spending among Zones, because when a Zone receives a token from a Hub, it only needs to trust the origin Zone of this token and the Hub.

The Hub maintains and tracks the state of each Zone thanks to a steady stream of block commits from each zone that is connected to the Hub. Similarly, each Zone maintains track of the Hub’s status, however the Zones themself only keep up with each other indirectly through the Hub. Powered by the IBC protocol, information packets are then exchanged from one Zone to another by publishing Merkle-proofs as proof that the data was sent and received.

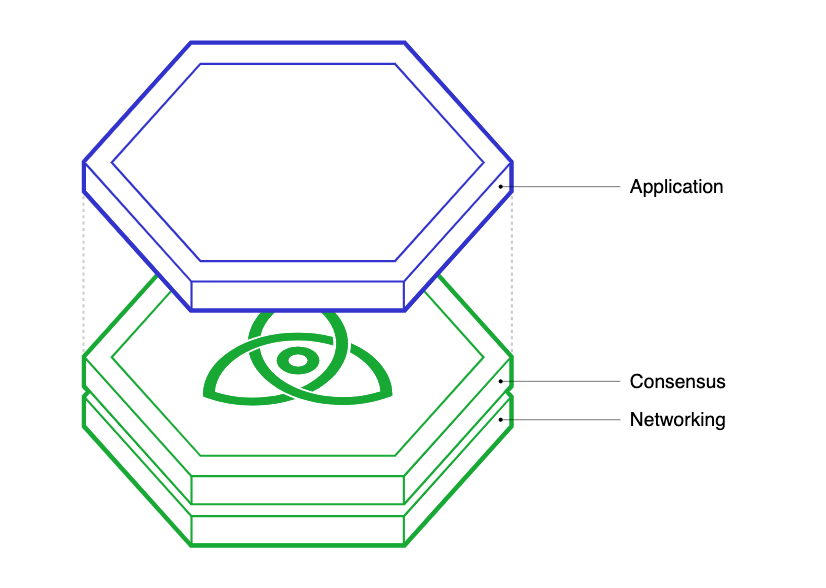

Blockchains are composed of three layers, Application, Consensus, and Networking.

Application – Responsible for updating the state given a set of transactions, i.e. processing transactions.

Networking – Responsible for the propagation of transactions and consensus-related messages.

Consensus – Enables nodes to agree on the current state of the system.

Tendermint takes care of the last two layers, packaging them into a generic engine, the Tendermint Byzantine Fault Tolerance (BFT) engine, to give developers space to concentrate on building their application layers. The Tendermint BFT solution also fixes the limitation of sovereignty, that way developers don’t need to wait in long queues to get their transactions or other requests validated, as it is for application layers built on top of Ethereum for example. The Tendermint BFT engine is also connected to application layers by the Application Blockchain Interface (ABCI), a socket protocol that can understand any programming language developers wish to choose to meet their needs.

Blockchains that use fast-finality chains, or in other words Proof of Stake, can connect with Cosmos using the IBC protocol. However, blockchains that use probabilistic finality chains, or Proof of Work mechanisms, would find it challenging to connect to the network such as Bitcoin and Ethereum. That is exactly why Cosmos created a special proxy-chain called the Peg-Zone that bridges non-Tendermint blockchains by tracking the state of the blockchain in question. Peg-Zones have fast-finality and are therefore compatible with the IBC protocol allowing it to establish finality for the non-Tendermint blockchain it bridges.

The ATOM Token

ATOM is the native token of the Cosmos Hub, the very first blockchain that has been launched within the Cosmos network. However, due to the architecture of Cosmos, which potentially represents an ecosystem of thousands of different blockchains, each chain that is plugged into the Cosmos network will be able to use its own native token, which means Cosmos will be supporting many tokens in the future.

ATOM itself works similar to other Layer 1 utility tokens and allows stakeholders of the network to:

- Pay network fees when transferring assets or interacting with applications

- Staking, by bonding ATOM in order to earn block rewards, while securing the network

- Participate in governance and vote on proposals

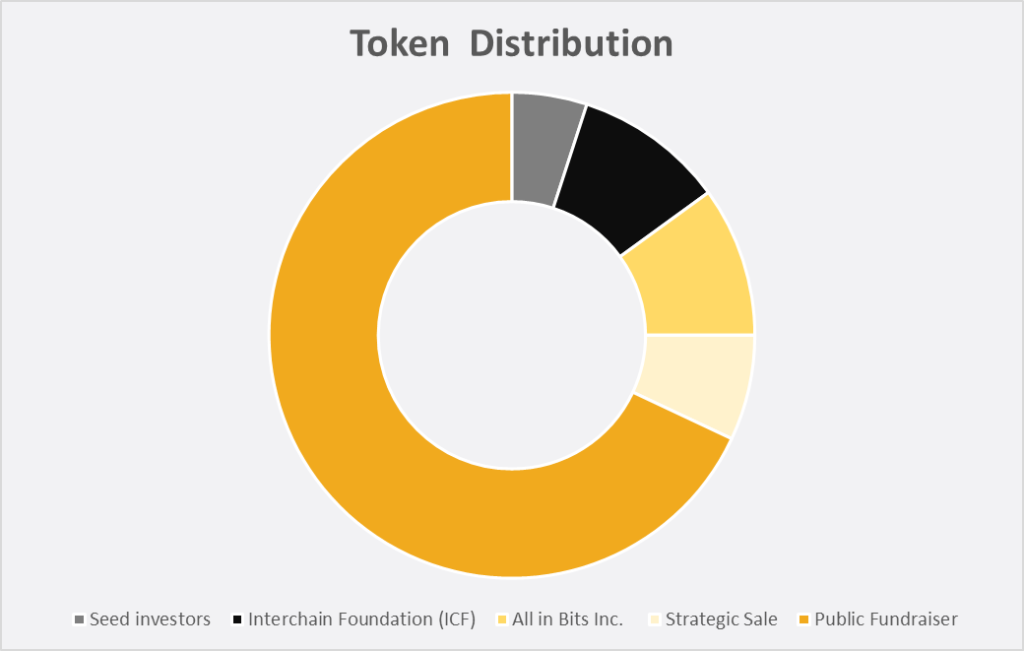

Token Distribution

In 2017, the Interchain Foundation had several private sales, followed by a public sale in April for roughly $17.6M.

The initial token distribution looked like the following:

5% went to the ICF’s initial donors

10% went to the Interchain Foundation (ICF).

10% went to All in Bits, Inc. (AIB), the corporation behind Tendermint.

75% has been distributed according to the results of the private (68%) and public fundraisers (7%).

The State of Cosmos

Cosmos has rolled up its sleeves for a series of partnerships as well as new project launches to amplify its user experience and add more value to its network, making it more interoperable and easy to integrate. As of 30th of September 2020, eligible users on Coinbase have the opportunity to stake ATOM on the cryptocurrency exchange platform, collecting 5% rewards on their holdings. CoinDesk reported in October 2020, Cosmos gained some traction at Vellore Institute of Technology in southern India among students that compose “Cosmos India,” a community that grew from only a few members to more than a thousand in less than nine months.

In March 2021, Tendermint announced the launch of the biggest investment vehicle for the Cosmos ecosystem, a $20 million venture fund to boost development. The announcement came right after the activation of the IBC protocol, changing the game of DeFi on the network. In July, Cosmos got its own DEX protocol, Gravity launched to enable DeFi across multiple chains. Secured by over $3 billion in digital assets, swaps and pools between any connected blockchains are made possible on the Cosmos Hub.

In July, Tendermint announced it was building a crypto app store called Emeris that would allow access to a range of decentralized applications, such as lending protocols and decentralized exchanges, all in the Cosmos ecosystem. The beta version of Emeris launched in September 2021 and is set to publicly launch in spring 2022. Emeris is said to lift the Cosmos user experience to new heights, help unleash the potential of Cosmos DeFi and take it to a wider audience.

On Emeris beta, users can transfer and trade assets between 12 different chains for the first time, access a decentralized exchange, with a trusted, stable and audited DEX protocol. Users can also earn competitive yield by participating in liquidity pools. As of writing, the average swap speed is 00.07 seconds and the average transaction fee is $0.08 in addition to a swap fee of 0.3%. Emeris aims to be the first one-stop portal to provide integrated wallet and multi-wallet support, access to multiple DeFi trading platforms, staking on multiple chains, and also a mobile wallet app.

Also in July, Cosmos announced it’s banding with cross-chain data oracle Band Protocol to integrate with Starport, a development tool for the Cosmos blockchain allowing third-party developers to gain access to numerous new data feeds, such as token information, real-world events, sports, weather, and random number generation. This partnership meant that newly created chains in the Cosmos ecosystem would be able to exchange data via the IBC protocol, making the network even more interoperable and accessible.

Cosmos’ cross-chain DEX Osmosis announced in January 2022 that it’s expanding its horizons with the launch of a new bridge, the Gravity Bridge, that would enable trading for Ethereum-based assets. The Gravity Bridge will act as an IBC to Ethereum translator, it will be built by internet services provider Althea.

Cosmos Ecosystem

As mentioned before, the first blockchain resident in the Cosmos ecosystem was the Cosmos Hub, launched by Cosmos itself and under which Zones run in sync. There’s an accelerating number of projects growing within the Cosmos network, including Terra (LUNA), ThorChain, Secret Network, Compound Gateway, Osmosis, Kava, and Akash.

The Future of Cosmos

There are quite some exciting milestones on the Cosmos roadmap for the year 2022. Obviously, one of the most important objectives is to onboard more blockchains that will plug into the Cosmos Network and ensure a seamless communication between them using IBC. However, there are also some powerful updates and features down the road, including Interchain Accounts, Interchain Security, Liquid Staking, and an expansion of its DeFi and NFT ecosystem.

The first upgrade that is expected in Q1 2022 is the Theta Upgrade. This will introduce Interchain Accounts, Liquid Staking and an NFT module, which will set the base for Cosmos’ NFT ecosystem. Interchain Accounts will leverage IBC and allow users to own, manage and transfer their tokens throughout the entire interoperable ecosystem and access blockchain-specific applications from one single account. One account to rule them all!

Currently almost 60% of all ATOM in circulation is being staked, rewarding contributors with a yield up to 13% per year. With the introduction of the first version of Liquid Staking, which is planned to be released as early as February 2022, this number is most likely to increase. Liquid Staking will allow users to stake their ATOM with no lock-up period, while also receiving a derivative of their bonded assets, which they ultimately can use for liquidity mining or other DeFi activities.

Interchain Security is another key feature that will be implemented with the Rho Upgrade, which is expected to take place in Q2 2022. It will enable Cosmos chains to effectively lease a set of security services to one another, allowing new chains to bootstrap their ecosystems, while enjoying solid security features right from the start. By staking ATOM on the Cosmos Hub, validators and delegators will be able to collect rewards on multiple chains in different tokens. ATOM stakers will therefore benefit from early access to new and innovative projects and greater token utility, while at the same time allowing new chains to get exposure of their tokens to Cosmos community members early on.

Cosmos’ ambition is to connect 200 blockchains in the year 2022. This would obviously unlock an unprecedented amount of liquidity and capital flows throughout all connected blockchains, which would be a massive tailwind for Cosmos’ DeFi. Moreover, UX and UI is still a massive challenge in DeFi and the crypto space in general, however, with the implementation of Emeris, the internet of blockchains will get a professional looking interface to track and manage assets. Emeris currently focuses on portfolio visualization, digital asset management and service discovery and will soon bring features like auto-compounding staking, airdrop tracker and cross-chain DEX aggregation.

On paper, the future Cosmos looks bright. If the internet of blockchains potentially solves one of the biggest obstacles in crypto, the lack of interoperability, and succeeds in connecting thousands of layer 1s and applications, this could mean a massive boost not only for the Cosmos network but for the entire crypto space.

Valuing Cosmos

A quantitative and qualitative evaluation of a crypto asset’s intrinsic value can be derived from a few key fundamentals. The first way we can think of when assessing the potential value of Cosmos’ native asset, ATOM, is carrying out a market sizing exercise to compare its value to that of its main competitors as its target market. By also looking at the total addressable market, we would be able to evaluate the factors that contribute to ATOM’s value. The final method would be using two metrics, number of transactions and their respective fees, to compare the revenue share.

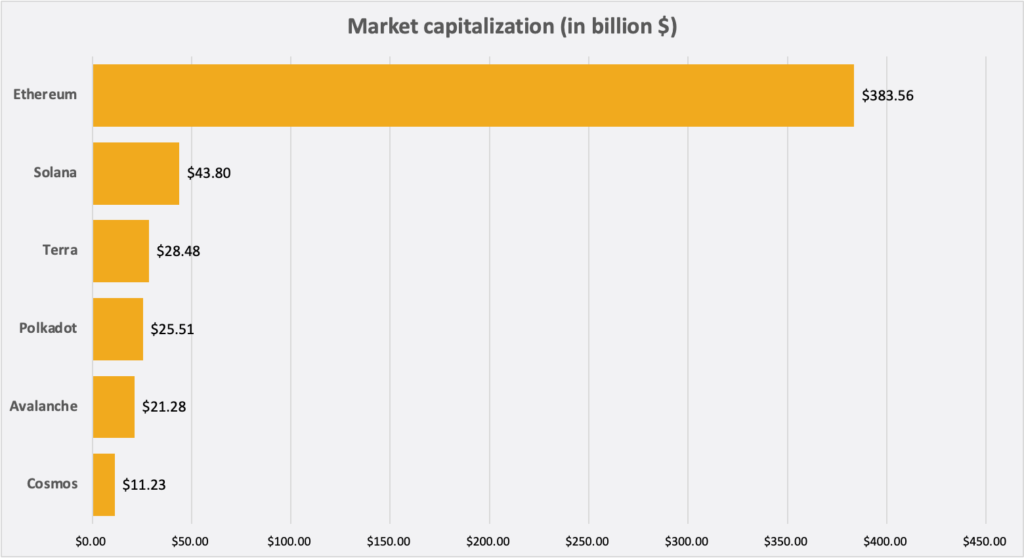

Market sizing

The chart below shows the current market capitalization of Cosmos compared to Ethereum, Solana, Terra, Avalanche and Polkadot. Ethereum represents what the market has judged as the current best use-case of blockchain technology while the smart contracts use case can be argued to be just as valuable in the long term. However, Avalanche with its Subnets or Polkadot with its Parachains are comparable projects with a more similar network architecture and serve as comparison for ecosystem development.

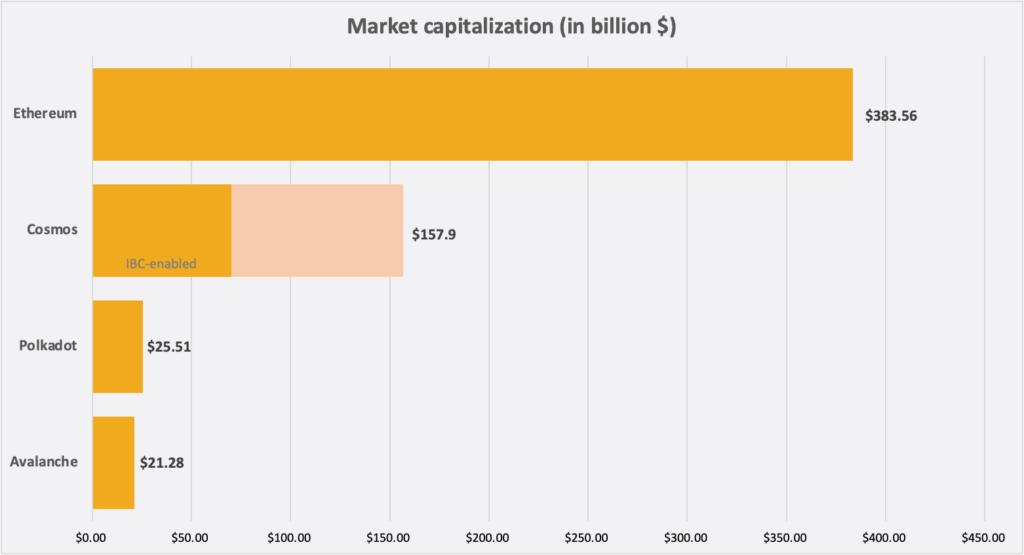

The bull case for Cosmos is that it fulfills its vision as the “Internet of Blockchains’’ connecting thousands of crypto asset networks such as Ethereum, Solana, Fantom or even Polkadot; in a similar way to the internet is a decentralized network that connects individual platforms such as Facebook, Amazon and Google. Even though applications can be deployed on the Cosmos Hub blockchain itself, the majority of value and the future potential is derived from the rate of adoption of Comos as the primary hub for interoperability between various Layer 1s. Looking at the current blockchains and projects that are plugged into the Cosmos network, which includes prominent players like Terra and Binance, we can see that the combined market cap, according to the Cosmos website, sits at $157B with a total of 49 apps and services. Although only 28 of those are currently active and IBC-enabled, this theoretically still makes it the second biggest ecosystem after Ethereum, which as of writing this report holds a market capitalization of $380B. Comparing the price and the state of the network to its closest competitor Polkadot, we could assume that Cosmos is currently undervalued.

Total Addressable Market

It’s important to note that Cosmos doesn’t necessarily compete with other projects, unlike the current rivalry between Layer 1s. It’s potential total addressable market is therefore the entire crypto market, leveraging the Cosmos Network as the underlying Layer 0, tying everything together. If we would assume Metcalfe’s law, which states that the value of a network is proportional to the square of the number of connected users, that means that Cosmos could see exponential growth when continuing to plug in new blockchains into its ecosystem. This ultimately wouldn’t only increase the value of ATOM, but every crypto network that’s being part of the network. This is a win-win situation for all parties involved.

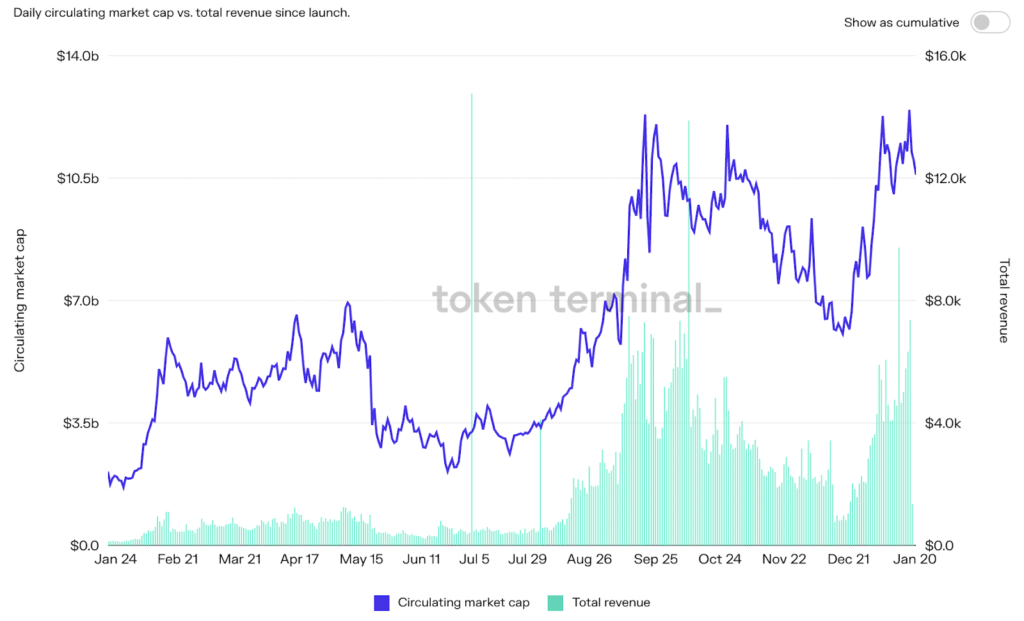

Revenue

Revenue generation is often a key metric when assessing network value. By assessing the total number of transactions and the average cost per transaction we are able to estimate the total revenue generated. Fees and revenue are a good signal for the overall demand for a given smart contract platform and arguably the strongest barometer of fundamental growth. Cosmos’ estimated total annualized revenue currently sits at around $1.38M, which is obviously minor compared to Ethereum’s $15B, yet an indication of the potential upside for the project. Taking into account the various upgrades and upcoming milestones on the roadmap, the probability of this trend to continue seems very likely in tandem with increased demand and therefore more economic activity on the Cosmos Hub.

Risks

Technology Risks

Even though the Cosmos mainnet launched in March 2019, the network itself is still in an embryonic state. The network is still evolving by implementing new upgrades and changes to the protocol, which could introduce bugs, code vulnerabilities, or adversely affect the crypto network. These smart contract failures and other technical issues that will only be fathomable in hindsight not in foresight due to the fact that this is a novel technology. This is a risk that essentially all crypto projects are exposed to. However, at 21Shares, we’ve monitored the Cosmos ecosystem and saw how the Tendermint consensus mechanism was widely battle tested. With LUNA being the largest real-world application alongside Cosmos, our thesis is that only time, and the development that happens underway, will prove how efficient consensus becomes.

Financial Risks

The cryptocurrency market is known for its tremendous volatility, making it a risky investment. If the price of a token declines suddenly, an investor stands to lose a lot of money. Crypto projects are still considered to be risk-on assets, therefore macroeconomic dynamics can have a significant impact on price movements and volatility. Investing in crypto assets is nothing for the fainthearted, as many investors are unable to cope with the severe ups and downs. The crypto space is continuously changing, with both benefits and problems. As mentioned above, the Cosmos network is still in its infancy, therefore investors will see themselves exposed to an innovative and bleeding edge technology, which obviously bears certain financial risks, while offering an attractive potential upside.

Regulatory Risks

Like many other crypto projects, Cosmos was initially funded by a private token sale and ICO and is therefore potentially vulnerable to some level of regulatory scrutiny. However, due to Cosmos’ decentralized network infrastructure and used as a payment mechanism,, it is less likely to be on the radar of regulatory authorities. Therefore the likelihood of serious regulatory scrutiny from any governmental body for Cosmos itself is relatively low. Although this doesn’t include regulations that might impact the crypto space as a whole, Cosmos sits in a relatively safe spot compared to other crypto assets.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

Nyheter

Fem spanska fonder som har ökat med +12% under 2025

Publicerad

3 timmar sedanden

25 april, 2025

År 2025 visar sig bli ett tufft år för finansmarknaderna. Med det första kvartalet fortfarande att avslutat upplever de stora internationella aktieindexen kraftiga nedgångar, där indexfonder baserade på S&P 500 och Nasdaq-100 drabbas särskilt hårt. Det finns dock en kategori som står sig starkt: Ibex 35 indexfonder, som har blivit en av årets mest räddningsvärda tillgångar. Det finns fem spanska fonder som har ökat med +12% under 2025.

Mer specifikt har fonder som investerar i spanska aktier (både indexfonder och aktivt förvaltade) ackumulerat en genomsnittlig avkastning på 14,29 % hittills under 2025. Denna siffra gör kategorin till den mest lönsamma bland aktiefonder, och den näst mest lönsamma av alla investeringsfondkategorier, efter endast guld- och ädelmetallfonder, som har skjutit i höjden med en omvärdering på mer än 40 %.

Inom den spanska kategorin upplever Ibex 35 indexfonder en stark utveckling, med avkastning överstigande 12 % under 2025. Nedan granskar vi årets fem mest lönsamma Ibex indexfonder, rangordnade från lägst till högst avkastning:

BBVA Bolsa Índice FI

Denna Ibex 35 indexfond, som förvaltas av BBVA Asset Management, har stigit med 12,03 % hittills i år. Under de senaste 5 åren har den erbjudit en genomsnittlig avkastning på 16,12 %.

Den har tillgångar på 116,5 miljoner euro och följer Ibex 35 Net Return-indexet, vilket inkluderar utdelningar. Dess nuvarande kostnader är 1,21 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,57% |

| Banco Santander S.A. | 13,16% |

| Iberdrola S.A. | 12,39% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,32% |

| CaixaBank S.A. | 5,36% |

| Amadeus IT Group S.A. | 4,57% |

| Ferrovial SE | 4,42% |

| Futuro sobre IBEX 35 | 3,75% |

| Aena SME S.A. | 3,60% |

| Telefónica S.A. | 3,40% |

Santander Indice España FI Openbank

Santander Asset Managements indexfond Ibex 35 har en avkastning på 12,08 % år 2025. Under fem år har den ackumulerat en avkastning på 16,20 %.

Den förvaltar tillgångar till ett värde av 961,7 miljoner euro, vilket gör den till en av de största fonderna i detta urval. Förvaltningsavgiften är 0,70 % och de löpande kostnaderna är 1,11 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 14,18% |

| Iberdrola S.A. | 12,70% |

| Banco Santander S.A. | 10,82% |

| Futuro sobre Ibex 35 (venc. 02/2025) | 9,90% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 9,16% |

| Bono España 0,65% | 5,57% |

| CaixaBank S.A. | 4,84% |

| Amadeus IT Group S.A. | 4,60% |

| Ferrovial SE | 4,40% |

| Aena SME S.A. | 3,60% |

ING Direct Fondo Naranja Ibex 35 FI

Fondo Naranja Ibex 35 de ING, som förvaltas av Amundi Iberia, har hittills under 2025 haft en avkastning på 12,13 %. Under femårsperioden har den ackumulerat en avkastning på 16,31 %.

Denna fond har tillgångar på 268,4 miljoner euro och replikerar Ibex 35 Net Return. Förvaltningsavgiften är 0,99 % och de löpande kostnaderna är 1,1 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,90% |

| Banco Santander S.A. | 13,48% |

| Iberdrola S.A. | 12,69% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,57% |

| CaixaBank S.A. | 5,49% |

| Amadeus IT Group S.A. | 4,68% |

| Ferrovial SE | 4,53% |

| Aena SME S.A. | 3,68% |

| Telefónica S.A. | 3,49% |

| Cellnex Telecom S.A. | 3,48% |

Caixabank Bolsa Índice España Estándar FI

Caixabank AM-fonden har hittills under 2025 redovisat en ökning på 12,23 %. Dess genomsnittliga avkastning under de senaste fem åren har varit 16,72 %.

Dess förvaltade tillgångar uppgår till 335,5 miljoner euro, och det motsvarar Ibex 35 Net Return. Din provision är i detta fall 1 % och dina nuvarande utgifter är 1,03 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Iberdrola S.A. | 13,61% |

| Banco Santander S.A. | 13,28% |

| Inditex (Industria de Diseño Textil S.A.) | 12,13% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,22% |

| CaixaBank S.A. | 5,82% |

| Amadeus IT Group S.A. | 4,49% |

| Ferrovial SE | 4,25% |

| Aena SME S.A. | 3,68% |

| Telefónica S.A. | 3,49% |

| Cellnex Telecom S.A. | 3,28% |

Bindex España Índice FI

Och den mest lönsamma fonden bland de som är indexerade mot Ibex 35 år 2025 (även om vi talar om tiondelar och hundradelar jämfört med resten) är Bindex Spain Index, från BBVA Asset Management. Denna fond har hittills i år haft en avkastning på 12,35 % och en 5-årsavkastning på 17,35 %.

Med tillgångar på 146,4 miljoner euro har denna fond etablerat sig som det billigaste alternativet av de fem (förvaltningsavgift på 0,11 % och löpande kostnader på 0,14 %). Den replikerar också Ibex 35 Total Return.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,62% |

| Banco Santander S.A. | 13,20% |

| Iberdrola S.A. | 12,43% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,35% |

| CaixaBank S.A. | 5,38% |

| Amadeus IT Group S.A. | 4,59% |

| Ferrovial SE | 4,44% |

| Aena SME S.A. | 3,61% |

| Telefónica S.A. | 3,42% |

| Cellnex Telecom S.A. | 3,41% |

Nyheter

ASRP ETF ett spel på medtech företag världen över

Publicerad

4 timmar sedanden

25 april, 2025

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR (ASRP ETF) med ISIN LU2365457410, försöker följa ECPI Global ESG Medical Tech-index. ECPI Global ESG Medical Tech-index spårar företag från utvecklade marknader över hela världen som är aktiva inom medicinteknikbranschen. Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning). De utvalda värdepapperen viktas lika i indexet.

Den börshandlade fondens (total cost ratio) uppgår till 0,30 % p.a. BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR är den billigaste och största ETF som följer ECPI Global ESG Medical Tech-index. ETF:n replikerar det underliggande indexets prestanda genom full replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR är en mycket liten ETF med tillgångar på 12 miljoner euro under förvaltning. Denna ETF lanserades den 10 december 2021 och har sin hemvist i Luxemburg.

Handla ASRP ETF

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR (ASRP ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Borsa Italiana.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Nyheter

Europafokuserade ETPer ser större andel av flödena under första kvartalet

Publicerad

5 timmar sedanden

25 april, 2025

HANetf har släppt sin rapport om börshandlade europeiska ETPer för första kvartalet 2025, som avslöjar banbrytande insikter i den snabba utvecklingen av den europeiska ETF-marknaden.

Tillgångar i europeiska ETPer nådde 2,4 biljoner dollar under första kvartalet, varav ETFer stod för 2,28 biljoner dollar. Kärnaktions-ETFer ledde flödena (45,70 miljarder dollar) medan räntebärande ETFer ökade med 15,19 miljarder dollar.

Viktiga data

- Europeiska ETPer överstiger 2,4 biljoner dollar i förvaltat kapital under första kvartalet 2025

- Flöden omdirigerades till Europafokuserade ETPer jämfört med USA-fokuserade mitt i tullkrisen

- Kärnaktions-ETFer överstiger milstolpen på 1 biljon dollar i förvaltat kapital med 45,70 miljarder dollar i nettoflöden under första kvartalet

- Aktiva ETFer i förvaltat kapital ökade med 11,65 % under första kvartalet och optionsbaserade ETFer i förvaltat kapital med 54,55 %.

- Antalet europeiska ETP-varumärken fortsätter att öka och uppgår nu till totalt 131.

- Europa godkänner semitransparenta ETFer, vilket potentiellt uppmuntrar fler aktiva förvaltare i USA att gå in på den europeiska ETF-marknaden.

- Försvars-ETFer såg flöden på 4,16 miljarder dollar under första kvartalet, vilket motsvarar 4,5 % av de totala ETF-flödena i Europa och en 5-faldig ökning jämfört med föregående kvartal.

Läs hela rapporten för att upptäcka kvartalsdata, ETF-marknadens utveckling, tillväxten inom nya områden som optionsbaserade ETFer och mer.

Fem spanska fonder som har ökat med +12% under 2025

ASRP ETF ett spel på medtech företag världen över

Europafokuserade ETPer ser större andel av flödena under första kvartalet

JAAA ETF an aktiv satsning på säkerställda obligationer

Can crypto outperform amidst the current market turmoil?

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa