Nyheter

Avalanche9000 Explained: Scaling, Speed, and What’s Next

Publicerad

4 månader sedanden

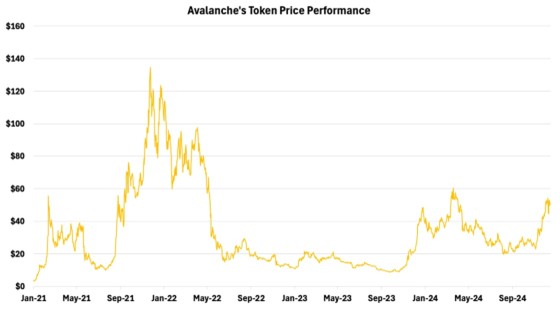

The prices of many smart contract platforms – existing and new – have reached all-time highs in this ongoing bull run. That said, one lagging platform is undergoing a crucial upgrade that just redefined the game, promising unmatched scalability, cost-efficiency, and decentralization. From dramatically lowering validator costs to enabling fully sovereign L1 blockchains, is Avalanche’s new upgrade too good to be true? Let’s break it down.

Figure 1 – Price Performance

Source: 21Shares, Coingecko

What is Avalanche?

Avalanche is a leading smart contract platform – 6th by market cap –- that supports a host of decentralized applications. It sets itself apart by leveraging a multi-chain architecture that allows it to push the limits of its scalability. These consist of:

• C-Chain: Handles smart contracts (EVM-compatible).

• P-Chain: Manages staking and validator coordination.

• X-Chain: Processes asset transfers.

Through this architecture, Avalanche manages its unique subnet model, allowing for building permissionless/permissioned customizable blockchains that are ultimately connected to a broader public network. Subnets are customizable networks within Avalanche that can operate independently while benefiting from the security and scalability of the main chain. This makes Avalanche ideal for institutions launching specialized business-focused networks.

For instance, Evergreen Subnets on Avalanche are specialized blockchain networks tailored for institutional and enterprise use cases. These subnets provide a controlled, private environment where organizations can explore blockchain technology while adhering to compliance, operational, and security requirements. In November 2023, JP Morgan partnered with Apollo Global to run its own proof-of-concept Evergreen Subnet on Avalanche, Kinexys (previously Onyx) offering forex transactions to serve its expanding list of global clients, with users growing 1000% year-over-year. Moreover, Spruce, another Evergreen Subnet, has also attracted other major TradFi players, including T. Rowe Price Associates, WisdomTree, Wellington Management, and Cumberland.

Avalanche also supports a broader range of industries, from Deloitte’s federal disaster reimbursement platform—designed to improve claim speed and transparency—to gaming subnets like GUNZ, which had its first impressive game called Off the Grid, driving the creation of 10 million player wallets in just 30 days.

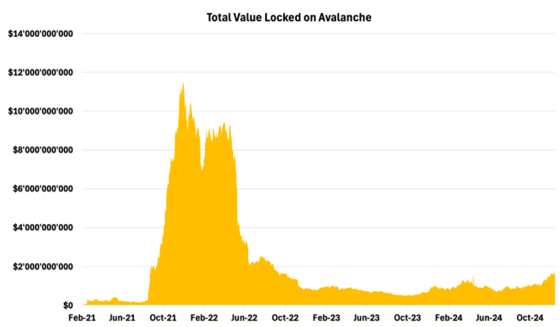

All in all, the subnets’ environment facilitates native interoperability between all the networks that end up building on Avalanche, yielding a seamless blockchain experience. However, Avalanche’s compatibility with Ethereum, enabling 100% of its smart-contract transactions via the EVM-powered C-Chain, has equally driven the growth of its diverse ecosystem. This trajectory helped Avalanche cement itself as the 10th largest blockchain by total value locked (TVL) at $1.6B, reflecting strong user engagement and confidence in its stability.

Figure 2 – Total Value Locked

Source: 21Shares, DeFiLlama

What is AVAX used for?

Avalanche’s native asset is used as a medium of exchange to transact across the network. For example, AVAX is used to secure the ecosystem through staking and for paying transaction fees. Also used as a governance token, the amount of AVAX staked by a node directly correlates to its voting power in network decisions.

What makes Avalanche stand out from other platforms offering similar architecture? Full Customizability over:

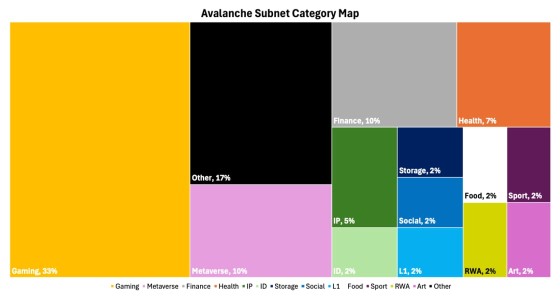

- The Nature of the Network: Blockchain plug-n-play frameworks on Layer 2s like Arbitrum’s Orbit or Optimism’s OpStack, and Layer 0 networks like (Polkadot, Cosmos) oblige businesses to build public networks interconnected with the main chain. Avalanche’s subnet architecture, however, offers a unique balance of privacy and interoperability. It allows companies to create either private or public blockchains anchored to the Avalanche P-Chain, catering to strict confidentiality needs while enabling selective interaction with other chains, if desired. This flexibility has fostered a diverse ecosystem of nearly 150 subnets, including 42 highly active ones across various sectors, as shown below.

Figure 3: Breakdown of Avalanche Subnets by Category

Source: 21Shares, SnowPeer

- Customizability over Governance, Security Model, and Operating System (VM): Subnets offer unparalleled flexibility, allowing businesses to tailor their governance approaches and security models to match their unique decision-making processes and operational needs. This adaptability means a gaming application can implement different security measures compared to a financial platform managing billions in assets, as both have disparate expectations for their security guarantees. Furthermore, companies can choose between leveraging Avalanche’s high-performance Avalanche Virtual Machine (AVM) or implementing custom VMs, enabling a wide array of application environments.

- Compliance-Centric: Avalanche subnets excel in regulatory compliance, particularly for financial applications, by integrating KYC and AML processes at the network level. They also allow for native implementation of compliance features like geofencing and whitelisting. The subnets’ ability to create isolated, permissioned environments that meet specific regulatory requirements while leveraging blockchain benefits has fostered a diverse range of experiments on Avalanche, extending beyond the tokenization-focused projects common in Ethereum and Solana ecosystems.

So, why has AVAX underperformed the rest of the L1 vertical in 2024 despite having such a superior offering?

The blockchain landscape in 2024 evolved significantly, with attention shifting from established Layer 1 networks like Avalanche to emerging ”Solana killers” such as Sui, Aptos, and TON. These newcomers gained traction through innovative approaches and focusing on user-friendly experiences:

- Capitalizing on the unparalleled power of distribution of Telegram, TON leveraged the messaging app’s 900M user base to build a WeChat-like super app that combines mini-apps, crypto payments, and decentralized services directly from the same interface.

- Sui and Aptos utilized the Move programming language, achieving theoretical throughput exceeding 120K transactions per second. Not only does it push the limits of scalability, but also improves developer safety, mitigating vulnerabilities inherent in earlier blockchain programming languages.

2024 also witnessed the rise of Rollup-as-a-Service (RaaS) providers like Gelato, Conduit, and AltLayer, simplifying L2 deployment on networks such as Arbitrum and Optimism. The Dencun upgrade made L2 transactions cost-competitive with alternative L1s. However, L2 proliferation led to fragmented liquidity and ecosystem saturation, potentially driving users back to unified blockchain ecosystems with consolidated infrastructure. This shift could benefit established networks like Avalanche, especially with its new upgrade.

So, what does Avalanche’s on-chain health look like?

Avalanche’s evolution mirrors Ethereum’s recent scaling journey, shifting from a monolithic to a distributed approach. Avalanche’s subnets, like Ethereum’s L2s, allow high-demand applications to operate on separate chains, reducing main chain congestion. While this fosters innovation and scalability, it potentially dilutes economic benefits flowing back to the primary chains, highlighting a common challenge in blockchain scaling: balancing ecosystem growth with maintaining the foundational layer’s relevance and economic vitality.

As shown below, the substantial drop in gas fees on the main Avalanche network highlights the evolving dynamics of the Avalanche ecosystem.

Figure 4 – Average Transaction Fee on Avalanche C-Chain

Source: 21Shares, Artemis

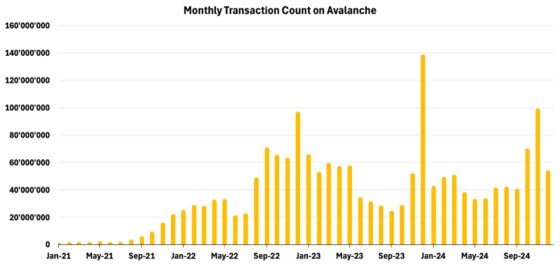

Despite declining direct revenue from C-Chain interactions, Avalanche’s ecosystem continues to thrive through the proliferation of subnets, which contribute to its economy. A more telling indicator of Avalanche’s growing influence is the surge in daily transactions, reaching the third highest monthly amount in its history, due to its role as the ultimate settlement layer for its subnet ecosystem—much like Ethereum’s position as a settlement network relative to its Layer 2 solutions execution layer.

Figure 5 – Monthly Transaction count

Source: 21Shares, Artemis

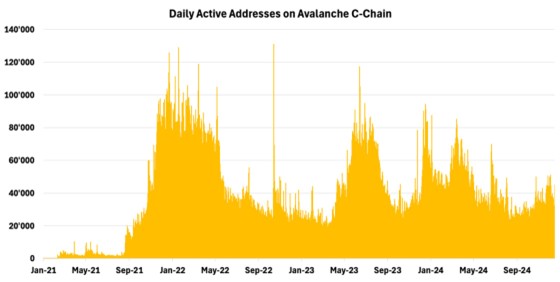

While Avalanche’s total user count on the C-Chain remains below its 2021 peak, as depicted below, this metric doesn’t fully reflect the network’s utilization. In fact, the ecosystem’s 150 subnets contribute an additional 100K daily active users on average, bringing the total daily active user count across the entire Avalanche ecosystem to at least over 150K.

Figure 6 – Total Number of Active Addresses on C-Chain

Source: 21Shares, Artemis

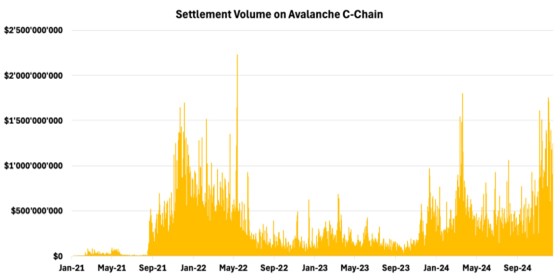

As echoed, despite declining users, Avalanche is experiencing a consolidation of economic activity, as evidenced by the increasing value of settlements on the main network. This trend suggests that certain decentralized applications have successfully identified their product-market fit, laying the groundwork for a potential resurgence in user engagement and adoption. One proxy could be the arrival of Blackrock’s tokenized money market fund BUIDL and Franklin and Templeton’s $420M Franklin OnChain U.S. Government Money Fund represented by its token BENJI on Avalanche’s mainnet.

Figure 7 – Settlement Volume on Avalanche C-Chain

Source: 21Shares/Artemis

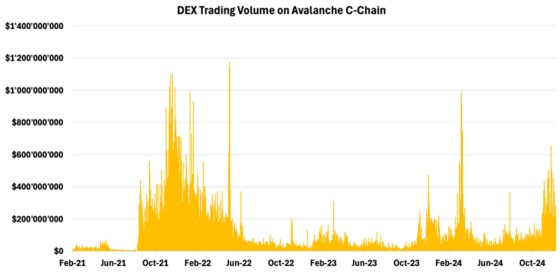

As illustrated in Figure 8, Avalanche’s DeFi activity has declined since its 2021 peak, with Solana and Ethereum L2s capturing more retail activity driven by the memecoin speculation. However, Avalanche is poised for a resurgence due to the upcoming 9000 upgrade, which will reduce transaction costs and make it cheaper to operate DeFi-focused chains. This should all help reinvigorate Avalanche’s DeFi ecosystem.

Figure 8 – Decentralized Exchanges Trading Volume on the Main Avalanche Network

Source: 21Shares/Artemis

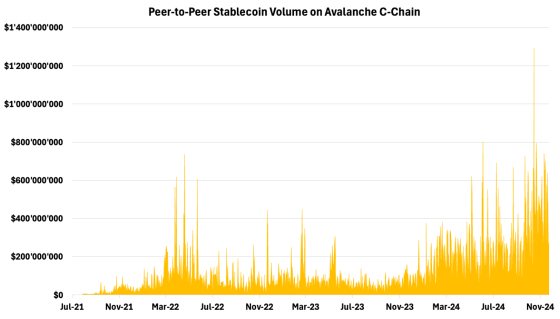

Nevertheless, there are promising signs that the network is playing a bigger role, particularly within the realm of stablecoins. As demonstrated below, the total volume of P2P stablecoin volume has been consistently growing on a trajectory of its own, adding more liquidity to the Avalanche ecosystem. The reason for this increase could be on the back of many factors, among them initiatives like the BOOST campaign, playing a crucial role in attracting liquidity to the platform. By offering AVAX token rewards, these programs have increased the supply of stablecoins within the ecosystem, indicating new capital inflows and overall growth.

Figure 9 – P2P stablecoin Transfer Volume

Source: Artemis/21shares

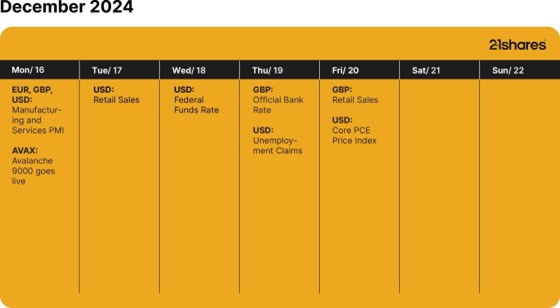

Avalanche9000 Upgrade, which went live on the Fuji Testnet on November 25, 2024, was also integrated into the Etna Mainnet on December 16, 2024.

Current Limitations and Solutions

Validators play a critical role by validating both the Primary Network and any subnets they opt into. This design was introduced to scale Avalanche horizontally. While this model unlocked new possibilities, it also introduced limitations that hindered scalability, cost-efficiency, and adoption across the ecosystem. Below, we break down these challenges and how Avalanche9000 resolves each one.

• High Capital Requirements: The current requirement for subnet validators to stake 2,000 AVAX (worth $100,000 at $50 per AVAX) on the Primary Network, plus additional subnet-specific stakes, creates a significant financial barrier. This high entry cost deters smaller projects and potential blockchain innovators, ultimately hindering wider adoption of the Avalanche ecosystem.

Solution: Subscription-Based Validator Model: ACP-77, introduced through Avalanche9000, replaces the hefty upfront staking requirement with a monthly subscription fee of 1-10 AVAX for validators. This pay-as-you-go model significantly reduces entry costs, enabling projects of all sizes to launch independent L1s on Avalanche. The proposal also implements a continuous P-Chain fee mechanism, enhancing cost-efficiency and sustainability in Subnet management, thus democratizing access to Avalanche’s infrastructure.

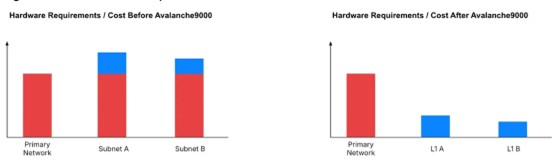

• High Running Costs: The current model requires validators to support both the Primary Network and their chosen subnets, significantly increasing hardware demands and operational costs. This dual responsibility, combined with high staking requirements, often forces validators to rely on centralized hosting providers like AWS, which now hosts 38.2% of Avalanche nodes. This trend towards centralization introduces risks of single points of failure and undermines the network’s decentralization goals.

Solution: Independent L1 Validation: Avalanche9000 separates Layer-1 blockchains (L1s) from the Primary Network, enabling validators to focus exclusively on their specific L1s. This upgrade introduces ValidatorManager smart contracts, giving L1 creators enhanced control over their validator sets. The result is a more streamlined system with reduced hardware requirements, lower operational costs, and decreased centralization risks. Ultimately, this fosters a more distributed, resilient, and cost-effective validator ecosystem.

Figure 10 – Hardware Requirements Before and After Avalanche9000

Source: Avalanche

• Compliance Barriers: While subnets can operate as private, permissioned networks, they still require validators to participate in the public, permissionless Primary Network. This poses challenges for institutions that require complete isolation to meet regulatory requirements. Partial workarounds, such as partial syncing of the Primary Network, exist but remain incomplete and insufficient for enterprise-grade solutions.

Solution: Independent L1 Validation: With ACP-77, Avalanche9000 enables L1s to operate independently of the Primary Network. Validators no longer need to participate in the Primary Network, allowing institutions to launch fully isolated networks tailored to their compliance and operational needs.

At the same time, these L1s remain part of the broader Avalanche ecosystem, benefiting from network effects. Through Interchain Messaging (ICM), institutions can seamlessly engage with other L1s when desired, enabling cross-chain communication and liquidity sharing while maintaining isolation when required.

• No Fault Isolation: Subnet validators are dependent and active on the Primary Network. If the Primary Network experiences congestion or faults, Subnet validators are exposed to the same disruptions, degrading performance and reliability for mission-critical applications.

Solution: Full Fault Isolation: Avalanche9000 introduces fault isolation by decoupling L1 validators from the Primary Network. Each L1 operates independently, ensuring that congestion or technical faults on the Primary Network do not impact their performance. This provides unparalleled reliability for high-stakes applications like institutional finance and real-time payments.

Finally, Avalanche9000 introduces additional improvements, including major cost savings on transaction fees. It reduces the base gas fee on the Avalanche C-Chain by 96% with a new update (ACP-125), lowering the minimum cost for transactions during less busy times from 25 nAVAX to just 1 nAVAX. This makes using the blockchain cheaper for developers and users, encouraging more people to use and build on the platform.

Where is Avalanche going with this upgrade?

Avalanche9000 resolves existing limitations and introduces a new era of flexibility, cost-efficiency, and scalability for L1s in its ecosystem. By enabling independent chains with decentralized management, full fault isolation, and seamless compliance, Avalanche is positioned as a go-to platform for enterprises looking to experiment with blockchain-based solutions. The upgrade is already driving adoption, with 500+ Layer 1 chains (formerly subnets) in development across sectors like gaming, finance, and enterprise solutions and thus we should expect the price action to reflect the improving fundamentals over the coming months.

What’s else is happening this week?

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

Nyheter

8RMY ETF köper bara aktier i europeiska försvarsföretag

Publicerad

8 minuter sedanden

26 april, 2025

HANetf Future of European Defence UCITS ETF Accumulating (8RMY ETF) med ISIN IE000I7E6HL0 försöker att följa VettaFi Future of Defence Ex US-indexet. VettaFi Future of Defence Ex US-indexet följer resultatet för företag som är verksamma inom militär- eller försvarsindustrin. Amerikanska företag är exkluderade. Vikten av europeiska företag i indexet är minst 90 procent.

De börshandlade fondens TER (total expense ratio) uppgår till 0,39 % per år. HANetf Future of European Defence UCITS ETF Accumulating är den enda ETFen som följer VettaFi Future of Defence Ex US-indexet. ETFen replikerar resultatet för det underliggande indexet genom fullständig replikering (genom att köpa alla indexkomponenter). Utdelningarna i ETFen ackumuleras och återinvesteras.

Denna ETF lanserades den 7 april 2025 och har sitt säte i Irland.

Future of European Defence UCITS ETF

En europeisk försvars-ETF, från ett europeiskt företag, utan exponering mot USA.

Europa åtar sig att göra stora försvarsinvesteringar: Efter årtionden av underutnyttjande återupprustar Europa äntligen. EU har lagt fram en försvarsplan på 800 miljarder euro, medan enskilda europeiska NATO-medlemmar snabbt ökar sina egna militära budgetar.

Strategisk autonomi innebär att köpa europeiskt: Europas upprustning handlar inte bara om att spendera mer – det handlar om att bygga försvarsoberoende. För att minska beroendet av amerikansk utrustning prioriterar EU europeiskt tillverkade vapen, fordon och system, vilket ger den europeiska försvarssektorn en stark medvind.

Europeisk försvars-ETF från ett europeiskt företag

Detta är den första europeiska försvars-ETF som lanserats av ett europeiskt företag – och stöds av teamet bakom den snabbt växande NATO-ETFen.

Europeisk försvars-ETFens mål

Future for European Defence UCITS ETF (8RMY) syftar till att ge exponering mot NATO och NATO+-allierades försvars- och cyberförsvarsutgifter, exklusive USA.

Med ökande hot och amerikanskt stöd som inte längre garanteras, ser europeiska NATO-medlemmar över sina försvarsstrategier och ökar kraftigt militära utgifter. Efter ett decennium av att inte ha uppnått 2 % av BNP-målet har Europa tillsammans underutnyttjat med uppskattningsvis 850 miljarder euro. För att återuppbygga och modernisera sina väpnade styrkor riktar regeringarna nu denna förnyade investering mot europeiska försvarsföretag – vilket stärker kontinentens strategiska självförsörjning.

European Defence ETF följer VettaFi Future of Defence Ex US Index, som är utformat för att fånga upp europeiska företag vars majoritet av sina intäkter kommer från militära utgifter.

Handla 8RMY ETF

HANetf Future of European Defence UCITS ETF Accumulating (8RMY ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Euronext Paris | EUR | ARMY |

| gettex | EUR | 8RMY |

| Borsa Italiana | EUR | ARMI |

| London Stock Exchange | GBX | NAVY |

| London Stock Exchange | USD | ARMY |

| XETRA | EUR | 8RMY |

Största innehav

| Namn | Vikt % |

| RHEINMETALL AG COMMON | 14,81% |

| THALES SA COMMON STOCK | 12,49% |

| LEONARDO SPA COMMON STOCK | 10,13% |

| BAE SYSTEMS PLC | 9,86% |

| SAAB AB COMMON STOCK SEK | 7,78% |

| SAFRAN SA COMMON STOCK | 7,06% |

| KONGSBERG GRUPPEN ASA | 6,27% |

| ROLLS-ROYCE HOLDINGS PLC | 4,37% |

| AIRBUS SE COMMON STOCK | 3,27% |

| DASSAULT AVIATION SA | 2,86% |

Innehav kan komma att förändras

Nyheter

Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

Publicerad

1 timme sedanden

26 april, 2025

The investment environment in 2025 has been marked by increased uncertainty, including evolving trade dynamics involving the U.S. and rising geopolitical risks, which have weighed on overall market sentiment. Notably, though, gold has shone, surging past the symbolic $3,100 per ounce mark for the first time in history.

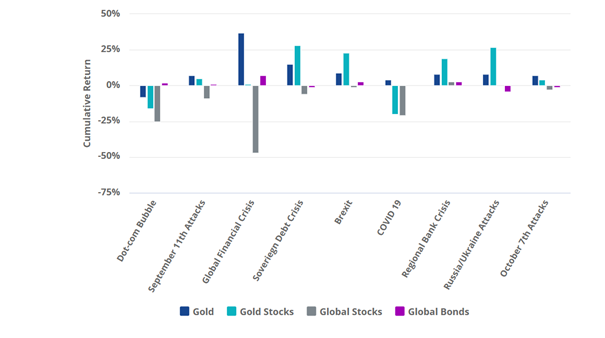

Gold has recently gained attention as investors seek potential hedges against rising inflation, currency fluctuations, and broader market volatility. Historical data suggests that both gold and gold mining equities have sometimes outperformed during periods of market stress, though such outcomes are not guaranteed and may vary depending on broader macroeconomic dynamics. The chart below displays historical episodes where gold and gold mining equities experienced relative strength during market corrections. However, such past performance should not be interpreted as a reliable indicator of future results.

Source: VanEck, World Gold Council.

The early months of 2025 have seen a resurgence in gold mining stock interest, with the VanEck Gold Miners ETF (GDX) receiving significant capital inflows. These flows reflect changing investor sentiment but should not be viewed as a guarantee of future returns.

Improved management

While gold mining stocks are a play on the gold price, they are much more than that. In the past, gold mining companies indulged in wanton value destruction. During gold’s last bull market that ended in 2011, mining companies borrowed heavily to fund new developments and extract gold from low quality mines. After the gold price dropped, they were forced to announce write-downs.

But since then, they have learned to keep costs under control. Indeed, for more than 10 years gold mining companies’ costs have grown by far less than a gold price that’s at least doubled. Despite the sharp rise in gold prices, especially in post 2020, miners have lagged significantly, likely reflecting ongoing capital and operating challenges noted between 2011 and 2015. This divergence may suggest a potential value opportunity if mining equities eventually re-rate closer to gold’s performance. Nevertheless, this is an assumption and may not turn out to be true, as structural issues or market dynamics could continue to weigh on miners’ valuations.

Gold Miner Premium/Discount to Gold

Source: Scotiabank. Data as February 2025.

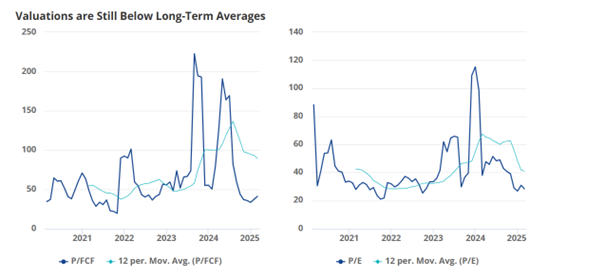

Gold miners are expanding their profit margins, generating cash and embarking on share buy backs. What’s more, many have strong balance sheets. Yet still they trade at valuations below historical averages. Valuation metrics such as price-to-free cash flow (P/FCF) and price-to-earnings (P/E) ratios remain below the 12-month moving average.

Valuations are Still Below Long-Term Averages

Source: Morningstar data.

Gold miners differentiate from gold because they are operating businesses influenced by company-specific factors such as management decisions, production efficiency, regulatory environments, and geopolitical risks. While gold is a passive asset driven by macroeconomic trends, miners add an additional layer of exposure to operational performance and cost structures.

A supportive macro backdrop

The performance of gold mining stocks is naturally influenced by the trajectory of gold prices. From a macroeconomic standpoint, factors such as inflation concerns and central bank policies continue to shape a cautiously optimistic outlook for gold, although the asset remains subject to volatility. Central banks continue to be net buyers, with 2023 marking a record year in terms of official sector demand. This trend has extended into 2024 and early 2025, underscoring institutional confidence in gold as a long-term store of value.

At the same time, the unfolding trade war is contributing to a more volatile global environment. These developments could support the case for gold and, by extension, gold mining equities. Moreover, recent efforts to improve transparency around global gold reserves, including audits of holdings in Fort Knox and London, have added credibility to the market, potentially reducing the perceived risk premium for miners.

Valuable portfolio diversification

From an investor’s perspective, gold mining stocks can be a useful diversifier in a broader equity portfolio, especially at a time of uncertainty for equity markets. Historically, gold mining stocks have exhibited a high sensitivity to changes in the price of gold, sometimes outperforming the metal itself during prolonged bull markets. However, they also tend to underperform during downturns, reflecting their leveraged exposure to gold price movements. Past performance is not indicative of future results. The table below shows the low correlation of the two VanEck gold miners UCITS ETFs with the MSCI World Index of global stock prices. This low correlation suggests that gold mining ETFs may perform differently than global equities, potentially helping to reduce overall portfolio volatility during periods of market stress. That said, they also carry equity-like risks, and investors should assess their portfolio objectives and risk tolerance accordingly.

Low Price Correlations with Stocks

| Investment | MSCI World | Gold Price | VanEck Junior Gold Miners ETF | VanEck Gold Miners ETF |

| MSCI World | 1.00 | |||

| Gold Price | 0.10 | 1.00 | ||

| VanEck Junior Gold Miners ETF | 0.38 | 0.76 | 1.00 | |

| VanEck Gold Miners ETF | 0.31 | 0.81 | 0.96 | 1.00 |

Source: Morningstar data.

A better way to play the rally?

When the VanEck Gold Miners UCITS ETF was introduced in 2015, it aimed to provide investors with a way to gain diversified exposure to gold mining equities. Early performance was tempered by concerns related to past capital discipline within the sector. Recent inflows into ETF may reflect renewed investor interest, although sentiment toward mining equities can remain sensitive to market and operational developments.

As gold glitters at a time of market volatility, there are good reasons to think gold miners may be a better way to play the rally. It should however be noted that while gold prices and mining companies are closely linked, investing in miners introduces additional layers of risk and complexity and investors should consider all the risk factors before investing.

IMPORTANT INFORMATION

This is marketing communication. Please refer to the prospectus of the UCITS and to the KID/KIID before making any final investment decisions. These documents are available in English and the KIDs/KIIDs in local languages and can be obtained free of charge at www.vaneck.com, from VanEck Asset Management B.V. (the “Management Company”) or, where applicable, from the relevant appointed facility agent for your country.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neudtadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from an IFA for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as Independent Financial Advisors (IFAs) and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under MiFID under the Markets in Financial Instruments Directive (“MiFiD). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the Management Company. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

”The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk for any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”), expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, noninfringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. It is not possible to invest directly in an index.”

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

VanEck Gold Miners UCITS ETF (the ”ETF”) is a sub-fund of VanEck UCITS ETFs plc, an open-ended variable capital umbrella investment company with limited liability between sub-funds. The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

VanEck Junior Gold Miners UCITS ETF (the ”ETF”) is a sub-fund of VanEck UCITS ETFs plc, an open-ended variable capital umbrella investment company with limited liability between sub-funds. The ETF is registered with the Central Bank of Ireland, passively managed and tracks an equity index. Investing in the ETF should be interpreted as acquiring shares of the ETF and not the underlying assets.

Investing is subject to risk, including the possible loss of principal. Investors must buy and sell units of the UCITS on the secondary market via a an intermediary (e.g. a broker) and cannot usually be sold directly back to the UCITS. Brokerage fees may incur. The buying price may exceed, or the selling price may be lower than the current net asset value. The indicative net asset value (iNAV) of the UCITS is available on Bloomberg. The Management Company may terminate the marketing of the UCITS in one or more jurisdictions. The summary of the investor rights is available in English at: complaints-procedure.pdf (vaneck.com). For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

Nyheter

Fem spanska fonder som har ökat med +12% under 2025

Publicerad

21 timmar sedanden

25 april, 2025

År 2025 visar sig bli ett tufft år för finansmarknaderna. Med det första kvartalet fortfarande att avslutat upplever de stora internationella aktieindexen kraftiga nedgångar, där indexfonder baserade på S&P 500 och Nasdaq-100 drabbas särskilt hårt. Det finns dock en kategori som står sig starkt: Ibex 35 indexfonder, som har blivit en av årets mest räddningsvärda tillgångar. Det finns fem spanska fonder som har ökat med +12% under 2025.

Mer specifikt har fonder som investerar i spanska aktier (både indexfonder och aktivt förvaltade) ackumulerat en genomsnittlig avkastning på 14,29 % hittills under 2025. Denna siffra gör kategorin till den mest lönsamma bland aktiefonder, och den näst mest lönsamma av alla investeringsfondkategorier, efter endast guld- och ädelmetallfonder, som har skjutit i höjden med en omvärdering på mer än 40 %.

Inom den spanska kategorin upplever Ibex 35 indexfonder en stark utveckling, med avkastning överstigande 12 % under 2025. Nedan granskar vi årets fem mest lönsamma Ibex indexfonder, rangordnade från lägst till högst avkastning:

BBVA Bolsa Índice FI

Denna Ibex 35 indexfond, som förvaltas av BBVA Asset Management, har stigit med 12,03 % hittills i år. Under de senaste 5 åren har den erbjudit en genomsnittlig avkastning på 16,12 %.

Den har tillgångar på 116,5 miljoner euro och följer Ibex 35 Net Return-indexet, vilket inkluderar utdelningar. Dess nuvarande kostnader är 1,21 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,57% |

| Banco Santander S.A. | 13,16% |

| Iberdrola S.A. | 12,39% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,32% |

| CaixaBank S.A. | 5,36% |

| Amadeus IT Group S.A. | 4,57% |

| Ferrovial SE | 4,42% |

| Futuro sobre IBEX 35 | 3,75% |

| Aena SME S.A. | 3,60% |

| Telefónica S.A. | 3,40% |

Santander Indice España FI Openbank

Santander Asset Managements indexfond Ibex 35 har en avkastning på 12,08 % år 2025. Under fem år har den ackumulerat en avkastning på 16,20 %.

Den förvaltar tillgångar till ett värde av 961,7 miljoner euro, vilket gör den till en av de största fonderna i detta urval. Förvaltningsavgiften är 0,70 % och de löpande kostnaderna är 1,11 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 14,18% |

| Iberdrola S.A. | 12,70% |

| Banco Santander S.A. | 10,82% |

| Futuro sobre Ibex 35 (venc. 02/2025) | 9,90% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 9,16% |

| Bono España 0,65% | 5,57% |

| CaixaBank S.A. | 4,84% |

| Amadeus IT Group S.A. | 4,60% |

| Ferrovial SE | 4,40% |

| Aena SME S.A. | 3,60% |

ING Direct Fondo Naranja Ibex 35 FI

Fondo Naranja Ibex 35 de ING, som förvaltas av Amundi Iberia, har hittills under 2025 haft en avkastning på 12,13 %. Under femårsperioden har den ackumulerat en avkastning på 16,31 %.

Denna fond har tillgångar på 268,4 miljoner euro och replikerar Ibex 35 Net Return. Förvaltningsavgiften är 0,99 % och de löpande kostnaderna är 1,1 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,90% |

| Banco Santander S.A. | 13,48% |

| Iberdrola S.A. | 12,69% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,57% |

| CaixaBank S.A. | 5,49% |

| Amadeus IT Group S.A. | 4,68% |

| Ferrovial SE | 4,53% |

| Aena SME S.A. | 3,68% |

| Telefónica S.A. | 3,49% |

| Cellnex Telecom S.A. | 3,48% |

Caixabank Bolsa Índice España Estándar FI

Caixabank AM-fonden har hittills under 2025 redovisat en ökning på 12,23 %. Dess genomsnittliga avkastning under de senaste fem åren har varit 16,72 %.

Dess förvaltade tillgångar uppgår till 335,5 miljoner euro, och det motsvarar Ibex 35 Net Return. Din provision är i detta fall 1 % och dina nuvarande utgifter är 1,03 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Iberdrola S.A. | 13,61% |

| Banco Santander S.A. | 13,28% |

| Inditex (Industria de Diseño Textil S.A.) | 12,13% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,22% |

| CaixaBank S.A. | 5,82% |

| Amadeus IT Group S.A. | 4,49% |

| Ferrovial SE | 4,25% |

| Aena SME S.A. | 3,68% |

| Telefónica S.A. | 3,49% |

| Cellnex Telecom S.A. | 3,28% |

Bindex España Índice FI

Och den mest lönsamma fonden bland de som är indexerade mot Ibex 35 år 2025 (även om vi talar om tiondelar och hundradelar jämfört med resten) är Bindex Spain Index, från BBVA Asset Management. Denna fond har hittills i år haft en avkastning på 12,35 % och en 5-årsavkastning på 17,35 %.

Med tillgångar på 146,4 miljoner euro har denna fond etablerat sig som det billigaste alternativet av de fem (förvaltningsavgift på 0,11 % och löpande kostnader på 0,14 %). Den replikerar också Ibex 35 Total Return.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,62% |

| Banco Santander S.A. | 13,20% |

| Iberdrola S.A. | 12,43% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,35% |

| CaixaBank S.A. | 5,38% |

| Amadeus IT Group S.A. | 4,59% |

| Ferrovial SE | 4,44% |

| Aena SME S.A. | 3,61% |

| Telefónica S.A. | 3,42% |

| Cellnex Telecom S.A. | 3,41% |

8RMY ETF köper bara aktier i europeiska försvarsföretag

Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

Fem spanska fonder som har ökat med +12% under 2025

ASRP ETF ett spel på medtech företag världen över

Europafokuserade ETPer ser större andel av flödena under första kvartalet

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa