Nyheter

Trump 2.0: The Art of the Crypto Deal

Publicerad

3 månader sedanden

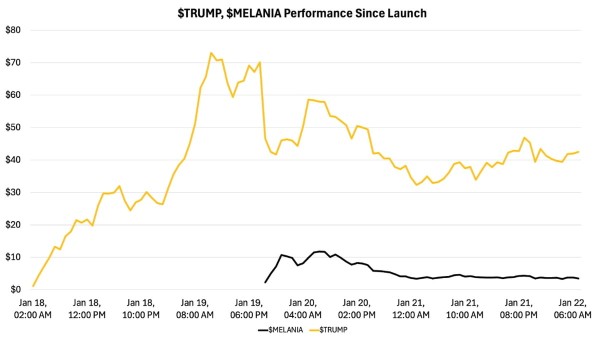

• $TRUMP & $MELANIA: The launch of both memecoins dominated headlines, with $TRUMP reaching a $73B fully diluted valuation. These launches are indicative of a late-stage bull market, often characterized by speculative exuberance.

• Solana Continues to Outperform: Solana reached an all-time high of $286, cementing its role as the leading blockchain for retail activity due to its high performance, low costs, and user-friendly ecosystem.

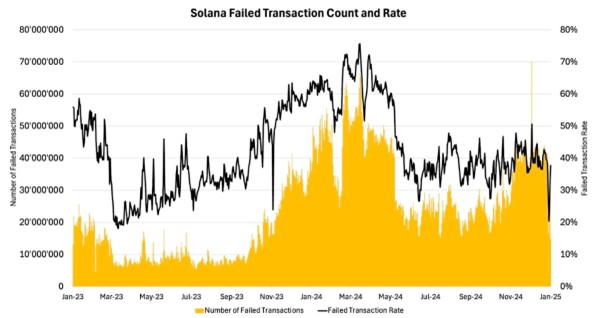

• Solana Remained Robust: Despite congestion and the rate of failed transactions rising by 20%, the network remained stable compared to prior years, avoiding outages even under unprecedented demand.

• Bitcoin Quietly Hits ATH: Ahead of the inauguration, Bitcoin surged to a new ATH just shy of $109K, largely under the radar amidst the memecoin frenzy.

• DeFi Momentum Builds: Trump’s World Liberty Fund continued its aggressive crypto accumulation, totaling $350M in cryptoasset holdings. This signals potential regulatory leniency for DeFi under the new administration.

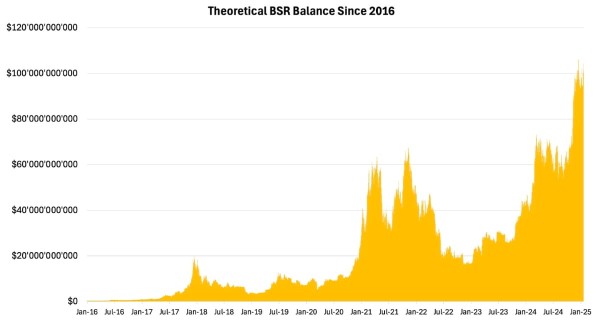

• A New Crypto Era Dawns: With crypto-friendly cabinet nominees, initiatives such as the Bitcoin Strategic Reserve (BSR), a Presidential Crypto Council, an SEC-driven crypto task force, and moves to simplify regulations, the administration signals its intent to foster innovation while solidifying the U.S.’s leadership in the cryptoasset industry.

The crypto market surged in anticipation of Trump’s inauguration, especially following the launch of his official memecoin, $TRUMP, in the early hours of Saturday. The token’s fully diluted valuation soared to $73B, attracting around 850K holders and significantly boosting Trump’s net worth in Solana-based assets. Following this, First Lady Melania Trump introduced her own memecoin, $MELANIA, on Sunday. It briefly reached a market cap of approximately $2B before experiencing a 75% retracement, as seen below in Figure 1. The frenzy surrounding these tokens propelled Solana to reach an ATH of around $286 as investors rushed to buy the asset and participate in the ecosystem. However, it’s important to remember that this level of market exuberance typically signals the late stages of a bull market, warranting a more strategic approach from investors. Nevertheless, while vigilance is called for, it’s crucial to recognize that markets still have room for growth, particularly as asset prices often exhibit explosive upside movements in the latter stages of a bull market.

Figure 1: TRUMP & MELANIA Price Performance

Source: 21Shares, Dune

Despite $TRUMP’s questionable tokenomics and potential risks for inexperienced investors, its launch likely signals a shift toward a more crypto-friendly regulatory environment under the new administration. Further, the token’s controversial success highlights memecoins’ role as an effective tool for onboarding crypto newcomers. Unlike complex blockchain projects, memecoins offer a simpler entry point into the crypto world. They can serve as a ”trojan horse,” attracting retail investors with their accessibility and cultural appeal. This initial engagement can then potentially lead users to explore more sophisticated aspects of the crypto ecosystem, including decentralized finance (DeFi) applications and AI-based projects.

That said, their extreme volatility poses significant risks as inexperienced traders may suffer losses from the tokens’ wild price swings, potentially discouraging them from further engaging with crypto.

Despite the mixed short-term and long-term effects, last week’s events revealed a clear beneficiary: Solana. Thanks to its high performance and low costs, the network has now cemented its position as the go-to platform for retail activity. Despite intense usage over the weekend, it avoided typical outages seen in 2022 and 2023, demonstrating improved stability. While some applications, like Coinbase and Phantom, faced challenges with unprecedented demand, causing temporary transaction failures to increase by almost 20%, as seen below, Solana’s network remained robust compared to previous years. What’s worth remembering is that Solana’s resilience during this surge of activity, marked by zero outages, bodes well for its ambitious goal of becoming the ”NASDAQ on the Blockchain.”

Figure 2: Solana Failed Transaction Rate

Source: 21Shares, Dune

It’s worth noting that Solana’s robust performance during this activity surge, handling up to $45B in transactions on January 20 without any outages, demonstrates the network’s progress towards their North Star of becoming ”NASDAQ on the Blockchain.” This feat is particularly impressive when compared to Nasdaq’s average daily volume of $120B, underscoring Solana’s growing capacity to handle significant financial throughput.

As depicted below, even with a significant fee increase, Solana maintains cost-effectiveness, reinforcing its appeal to retail users. However, it’s crucial to look beyond its association with speculative activities. The network is now making significant inroads in diverse sectors, demonstrating its versatility and real-world utility. Notable examples include Decentralized Physical Infrastructure (DePIN) projects like Helium, Render, and HiveMapper; AI initiatives such as Griffain and Ai16z; and tokenization efforts supported by traditional financial institutions, including Franklin Templeton, Hamilton Lane’s SCOPE, and Ondo Finance. This broad spectrum of applications underscores Solana’s potential as a robust platform for innovation across multiple industries.

Figure 3: Solana Transaction Fees

Source: 21Shares, Dune

Similarly, Trump’s endorsed DeFi initiative, World Liberty Financial, has steadily expanded its cryptoasset holding over the recent weeks. In its latest round of acquisitions over the weekend, the project added $47M in ETH and WBTC and $4.7M each in Aave, LINK, TRX, and ENA to its portfolio. This takes the total amount of World Liberty’s holdings up to $350M worth of cryptoassets. It is worth noting that the yet-to-launch protocol is staking ETH with Lido, further echoing the idea that Trump is bullish on DeFi and that the industry will likely grow under his administration.

In this context, despite widespread anticipation, crypto was not mentioned in President Trump’s inaugural address or a leaked Republican policy document outlining national priorities. This omission contrasts with earlier speculation that crypto would become a central focus of the administration. However, it’s crucial to maintain a long-term perspective: Trump’s administration remains one of the most crypto-friendly globally, as evidenced by key pro-crypto appointments and proposed policies. In the following sections, we will explore these initiatives and their potential impact on the digital asset industry.

Bitcoin Strategic Reserve

While it may have gone under the radar, BTC also reached a new ATH, just shy of $109K, ahead of Inauguration Day. Relatedly, Trump’s administration has proposed creating a Bitcoin Strategic Reserve (BSR) to position Bitcoin as a critical financial and strategic asset, similar to gold reserves. The reserve would utilize approximately 80K Bitcoin seized by the U.S. Marshals, redirecting these assets into national holdings rather than auctioning them. Expanding the reserve to a rumored 1M BTC would require Congressional approval for market purchases or over-the-counter acquisitions, potentially funded by U.S. gold reserves.

Figure 4: Theoretical Bitcoin Strategic Reserve If 1M BTC Held Since 2016

Source: 21Shares, Coingecko

The BSR would classify Bitcoin as a strategic asset, held for at least 20 years and only sold to address U.S. debt. Advocates argue this could hedge against inflation, stabilize the dollar, and leverage Bitcoin’s appreciation to reduce national debt. Additionally, it could trigger a global race among nations to accumulate Bitcoin, driving its price higher and positioning the U.S. as a leader in the emerging digital economy. However, such a move would require significant regulatory changes and face challenges like volatility and opportunity costs.

Presidential Crypto Council

Trump’s administration plans to form a presidential crypto council of about 20 industry leaders, including CEOs and founders of major crypto companies. This advisory group would provide insights into the digital asset landscape and help shape innovation-friendly policies while addressing regulatory concerns. Rumored members include Michael Saylor (MicroStrategy), Brian Armstrong (Coinbase), Jeremy Allaire (Circle), Charles Hoskinson (Cardano/Ethereum), and Brad Garlinghouse (Ripple). The council aims to ensure crypto regulation reflects real-world challenges and opportunities, demonstrating the administration’s commitment to industry engagement and positioning the U.S. as a global blockchain leader.

SEC Repeal of SAB 121

A key rumored executive order from Trump’s administration involves repealing SAB 121, an SEC accounting rule requiring companies to treat client cryptoassets as balance sheet liabilities. This repeal would:

- Reduce operational risks for firms

- Encourage broader institutional participation

- Accelerate crypto service adoption in finance

- Signal a business-friendly regulatory approach

By easing regulatory friction, this move could enhance U.S. crypto firms’ competitiveness and position the country as a global leader in cryptoasset custody and management.

SEC and CFTC Joint Collaboration on Crypto Market Structure

Another key executive order reportedly under consideration by Trump’s administration involves directing the SEC and CFTC to collaborate on a crypto market structure bill, building on the foundation laid by the FIT21 framework. This initiative aims to establish a unified regulatory framework for digital assets, addressing long-standing jurisdictional ambiguities that have left cryptoassets caught between classifications as securities or commodities. The bill would create clear and consistent rules by fostering cooperation between these two agencies, reducing regulatory uncertainty, and fostering innovation.

Ending Operation Chokepoint 2.0: Restoring Banking Access for U.S. Crypto Companies

Trump’s administration plans to address the FDIC’s debanking of crypto companies and end ”Operation Chokepoint 2.0,” a controversial initiative that restricted banking access for the crypto industry with the likes of Kraken, Coinbase, Signature Bank, Paxos, and Binance.US all sharing a similar experience. The administration aims to restore fair treatment and financial access for crypto companies by instructing federal agencies to cease discriminatory practices. This move would provide stability, attract institutional players to the U.S. crypto market, and reaffirm the administration’s commitment to fostering a competitive financial environment.

SEC’s Shift in Stance Could Pave the Way for Expanded Crypto Spot ETPs

A revamped SEC under the new administration is set to redefine crypto regulations, legitimizing the industry and fostering innovation. Clear and fair rules would signal that the U.S. is open for business, attracting top talent and projects. This regulatory clarity is expected to unlock institutional capital as traditional finance gains the confidence to invest in digital assets with legal protections. The SEC’s progressive stance increases the likelihood of approving multiple spot crypto ETPs, enabling broader adoption and integration into traditional investment portfolios. This shift validates the crypto industry and positions the U.S. as a leader in financial innovation. Further, the newly established crypto-focused task force led by Commissioner Hester Pierce is designed to establish clear regulatory guidelines, practical registration paths, and sensible disclosure frameworks for crypto companies. Thus, this new body could help approve a broader range of ETPs.

Trump Cabinet Members

While Trump’s proposed appointees are yet to go through Senate approvals, here’s a quick overview of key pro-crypto members.

• Robert F. Kennedy Jr. (Secretary of Health and Human Services): A Bitcoin advocate who views it as the ”currency of freedom” and hedge against inflation, with most of his net worth invested in Bitcoin.

• David Sacks (Crypto and AI Czar): Early Bitcoin investor and backer of projects like Solana and dYdX, bringing deep expertise to blockchain innovation.

• Paul Atkins (Chair of the SEC): Former SEC commissioner with extensive experience helping crypto-native companies navigate regulatory compliance.

• JD Vance (Vice President): A Bitcoin supporter and venture capitalist with investments in blockchain startups and a crucial advocate for pro-crypto legislative initiatives.

• Elon Musk (Co-Head of D.O.G.E): A vocal supporter of blockchain innovation, holding Bitcoin, Ethereum, and Dogecoin, with Tesla’s $1.5B Bitcoin investment under his leadership.

• Vivek Ramaswamy (Co-Head of D.O.G.E): A vocal crypto advocate and co-founder of Strive Asset Management, Ramaswamy launched the Strive Bitcoin Bond ETF, proposed backing the U.S. dollar with Bitcoin, and champions clear regulations and wallet protections to drive innovation and financial freedom.

• Howard Lutnick (Secretary of Commerce): CEO of Cantor Fitzgerald, managing Tether’s U.S. treasury portfolio while acquiring a 5% stake, and holds personal Bitcoin investments worth hundreds of millions.

• Scott Bessent (Secretary of the Treasury): Founder of Key Square Group, Bessent advocates for balanced crypto regulations and has made sizable personal investments of $250K–$500K in Bitcoin ETPs.

For a deeper dive into their backgrounds and potential impact, check out our full breakdown on our latest blog.

All in all, while Trump did not address crypto in his inauguration speech or through executive orders, he has already begun appointing key figures supportive of the industry. Thus, he is starting to follow through with his promises. It seems he’s headed towards fostering a pro-crypto environment that provides a clearer path for companies to operate within the U.S.

Nevertheless, with the exuberant market activity we’ve seen in the last few days, it’s an opportune time for investors to stay mindful and ensure their positions remain aligned with their long-term objectives and risk tolerance.

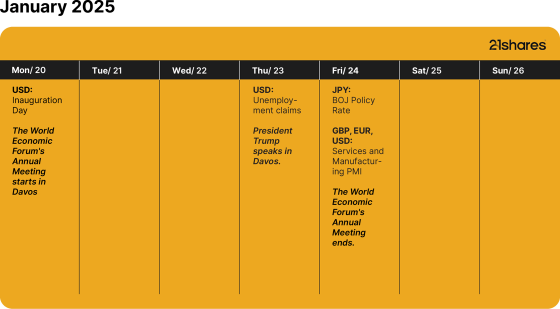

What’s happening this week?

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Stablecoins: The real powerhouse of crypto

-

Dogecoin in a portfolio: A small 1% allocation has a loud bark!

-

Trump’s trade war puts Bitcoin in the spotlight

-

Bitcoin supply on crypto exchanges hits 5-year low and that’s a good sign

-

Markets Swing Wildly After Tariff Shock – Bitcoin Rebounds Strongly

-

21Shares Dogecoin ETP: Drivs av community, omdefinierar kryptolandskapet

Stablecoins are digital currencies tied to assets like the U.S. dollar, offering the price stability needed for payments. They maintain their peg by being backed 1:1 by their underlying fiat currency, with issuers holding equivalent amounts in cash and cash equivalents, making stablecoins a digital representation of those reserves. Their market has doubled to over $235 billion, with daily usage nearly doubling in two years.

Why are stablecoins making headlines now?

Due to their clear product-market fit and growing mainstream adoption, stablecoins have become a top priority for regulation, with both industry leaders and policymakers calling for swift action.

On April 4, the Securities and Exchange Commission’s Division of Corporation Finance finally clarified that stablecoins are not securities if backed one-for-one by USD or similar assets and used for payments or value storage. These “Covered Stablecoins” are not marketed as investments, lack profit incentives, and include protections like reserves, making securities law registration unnecessary for issuance or redemption.

The GENIUS Act, introduced in February and advanced by the U.S. Senate Banking Committee in March, marks a major step toward creating a clear legal framework for stablecoin issuance and oversight. This clarity is driving momentum as Fidelity is set to launch its own stablecoin, and Bank of America is preparing to follow it once legislation is finalized.

Globally, the European Union’s Markets in Crypto Assets (MiCA) framework has already come into effect, reinforcing a broader shift toward formal integration of stablecoins into traditional finance. These developments reflect a growing consensus that stablecoins are emerging as essential infrastructure for global payments, treasury management, and digital asset adoption.

What are the benefits of stablecoins?

Stablecoins are digital currencies designed for fast, low-cost, and stable transactions. Since their launch in 2014, they’ve become a go-to tool for online payments, especially cross-border transfers. As they’re pegged to stable assets like the U.S. dollar or euro, they avoid the wild price swings seen in other cryptocurrencies.

They’re accessible to anyone with internet, making them especially valuable in regions with high inflation or limited banking access, like Argentina or Turkey.

With some built on public blockchains, stablecoins offer transparency, letting users track transfers and supply in real time. For institutions, they also simplify treasury management by acting as efficient digital cash that can be deployed instantly.

Who are the major players in the stablecoin race?

Tether (USDT) and Circle (USDC), the two largest stablecoin issuers, collectively hold over $204 billion in U.S. Treasuries, making them the 14th largest holders globally. Their combined treasury holdings surpass those of entire nations, including Norway and Brazil.

USDT leads with $144 billion in circulation; USDC, backed by Coinbase and known for compliance, has become a trusted digital dollar across global finance.

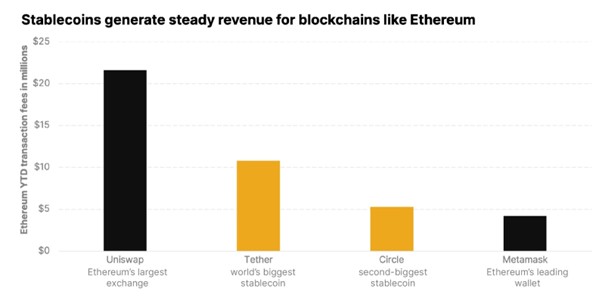

Why stablecoins matter: A revenue engine for blockchains

Stablecoins generate steady revenue for blockchains like Ethereum and Solana by driving transaction fees with each transfer. With trillions in annual volume, they help sustain network activity beyond speculation.

On Ethereum, for example, USDT and USDC transactions are major contributors to daily gas fees. Year to date, Tether ranks #3 and USDC ranks #5 in terms of total gas consumed. Tether and Circle also dominate daily transaction activity on Ethereum, averaging approximately 12 million and 6 million transactions per day, respectively, making them the top two entities on the network by daily transaction count.

Meanwhile, on Solana, stablecoin activity has surged, helping sustain validator rewards and strengthen protocol economics. In addition to the mainstream utility, stablecoins represent reliable, protocol-level cash flow, making them crypto’s killer use case.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

BE29 ETF är en portfölj företagsobligationer med förfall 2029

Publicerad

4 timmar sedanden

19 april, 2025

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis (BE29 ETF) med ISIN IE000ZC4C5Q1, försöker följa Bloomberg 2029 Maturity EUR Corporate Bond Screened-index. Bloomberg 2029 Maturity EUR Corporate Bond Screened Index spårar företagsobligationer denominerade i EUR. Indexet speglar inte ett konstant löptidsintervall (som är fallet med de flesta andra obligationsindex). Istället ingår endast obligationer som förfaller under det angivna året (här: 2029) i indexet. Indexet består av ESG (environmental, social and governance) screenade företagsobligationer. Betyg: Investment Grade. Löptid: december 2029 (Denna ETF kommer att stängas efteråt).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,10 % p.a. Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis är den billigaste ETF som följer Bloomberg 2029 Maturity EUR Corporate Bond Screened index. ETFen replikerar resultatet för det underliggande indexet genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Ränteintäkterna (kuponger) i ETFen delas ut till investerarna (kvartalsvis).

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis är en mycket liten ETF med 1 miljon euro tillgångar under förvaltning. Denna ETF lanserades den 18 juni 2024 och har sin hemvist i Irland.

Produktbeskrivning

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF Dist syftar till att tillhandahålla den totala avkastningen för Bloomberg 2029 Maturity EUR Corporate Bond Screened Index (”Referensindexet”), minus avgifternas inverkan. Fonden har en fast löptid och kommer att upphöra på Förfallodagen. Fonden delar ut intäkter på kvartalsbasis.

Referensindexet är utformat för att återspegla resultatet för EUR-denominerade, investeringsklassade, fast ränta, skattepliktiga skuldebrev emitterade av företagsemittenter. För att vara kvalificerade för inkludering måste företagsvärdepapper ha minst 300 miljoner euro i nominellt utestående belopp och en effektiv löptid på eller mellan 1 januari 2029 och 31 december 2029.

Värdepapper är uteslutna om emittenter: 1) är inblandade i kontroversiella vapen, handeldvapen, militära kontrakt, oljesand, termiskt kol eller tobak; 2) inte har en kontroversnivå enligt definitionen av Sustainalytics eller har en Sustainalytics-kontroversnivå högre än 4; 3) anses inte följa principerna i FN:s Global Compact; eller 4) kommer från tillväxtmarknader.

Portföljförvaltarna strävar efter att uppnå fondens mål genom att tillämpa en urvalsstrategi, som inkluderar användning av kvantitativ analys, för att välja en andel av värdepapperen från referensindexet som representerar hela indexets egenskaper, med hjälp av faktorer som index- vägd genomsnittlig varaktighet, industrisektorer, landvikter och kreditkvalitet. När en företagsobligation som innehas av fonden når förfallodag kommer kontanterna som fonden tar emot att användas för att investera i kortfristiga EUR-denominerade skulder.

ETFen förvaltas passivt.

En investering i denna fond är ett förvärv av andelar i en passivt förvaltad indexföljande fond snarare än i de underliggande tillgångarna som ägs av fonden.

”Förfallodag”: den andra onsdagen i december 2029 eller annat datum som bestäms av styrelseledamöterna och meddelas aktieägarna.

Handla BE29 ETF

Invesco BulletShares 2029 EUR Corporate Bond UCITS ETF EUR Dis (BE29 ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Borsa Italiana.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Borsa Italiana | EUR | BE29 |

| XETRA | EUR | BE29 |

Största innehav

| Namn | CUSIP | ISIN | Kupongränta % | Vikt |

| AT&T Inc 2.35% 05/09/29 | 00206RHH8 | XS1907120791 | 2.350 | 2.22% |

| Holcim Finance Luxembourg SA 1.75% 29/08/29 | L4806FAH4 | XS1672151492 | 1.750 | 2.14% |

| Unibail-Rodamco-Westfield SE 1.5% 29/05/29 | F95094ST0 | XS1619568303 | 1.500 | 2.08% |

| Baxter International Inc 1.3% 15/05/29 | — | XS1998215559 | 1.300 | 2.08% |

| Euronext NV 1.125% 12/06/29 | N3113KAT5 | XS2009943379 | 1.125 | 2.06% |

| Blackstone Property Partners Europ 1.75% 12/03/29 | L1051PAD9 | XS2051670300 | 1.750 | 2.04% |

| Walmart Inc 4.875% 21/09/29 | U9311FAG3 | XS0453133950 | 4.875 | 1.72% |

| Banco Bilbao Vizcaya Argentaria SA 4.375% 14/10/29 | E118054J9 | XS2545206166 | 4.375 | 1.65% |

| Toyota Motor Credit Corp 4.05% 13/09/29 | U89233WV5 | XS2597093009 | 4.050 | 1.63% |

| Nykredit Realkredit AS 4.625% 19/01/29 | K74493TG0 | DK0030512421 | 4.625 | 1.62% |

Innehav kan komma att förändras

Nyheter

Guld-ETFer slår Bitcoin-ETFer kraftigt under första kvartalet 2025

Publicerad

5 timmar sedanden

19 april, 2025

Under hypervolatila marknader omvärderar investerare vanligtvis vad de äger. De ser också över vilka investeringar som är bäst lämpade för att navigera i svåra tider. Guld är alltid ett självklart val, och under den nuvarande turbulensen har det inte gjort dem besvikna. Faktum är att gammaldags guld-ETF, börshandlade fonder som investerar i guld slår till och med bitcoinfonder med en enorm marginal.

Marknadsreferenser som SPDR S&P 500 ETF såg stora dippar från 1 januari till 15 april 2025 SPDR-fonden föll med 7,99 procent under den tiden medan iShares Bitcoin Trust ETF sjönk med 10 procent. Samtidigt steg SPDR Gold Shares-fonden, världens största ETF med fysiskt guld som backas upp, med nästan 23 procent. Fonden har tillgångar på över 98 miljarder dollar.

Medan S&P 500 belönade investerare rikligt under 2023 och 2024, ”sedan befrielsedagen, den 2 april i år, har spelplanerna för 2025 ändrats lite”, säger John Kinnane, chef för nyckelkunder på Sprott Asset Management.

Mitt i de krympande marknaderna har det skett en översvämning av ETFer som fysiskt stöds av guld och silver. I april ökade ETFer för ädelmetaller med 6,6 miljarder dollar i nya tillgångar och vann de största nettoinflödena för månaden i råvarukategorin.

Även ETFer för gruvaktier har klarat sig bra. VanEck Gold Miners ETF, till exempel, avkastade över 49 procent för året fram till den 15 april.

Det finns också specialiserade strategier. USCF Gold Strategy Plus Income Fund erbjuder en unik inkomsttwist på guld genom att sälja täckta köpoptioner för att generera intäkter. Den har en 30-dagars SEC-avkastning på 3,36 procent och har hittills i år ökat med 20,72 procent.

”En av guldets bestående egenskaper är att det faktiskt är en okorrelerad tillgång. Investerare av alla slag letar efter låg korrelation så att de i tider av volatilitet – som vi befinner oss i just nu – får en jämnare avkastning för sin totala portfölj”, säger Kinnane.

I februari lanserade Sprott Sprott Active Gold & Silver Miners ETF. Den inkluderar aktier i guld- och silvergruvor i en ETF-ticker med en aktivt förvaltad strategi.

Medan guldlänkade fonder har blomstrat har varken bitcoin eller resten av kryptovalutamarknaden gett investerarna något särskilt skydd.

Bitwise 10 Crypto Index Fund, ett mått på 10 olika kryptovalutor, inklusive bitcoin, sjönk med 21,28 procent från 1 januari till 15 april. Mindre kryptovalutor, särskilt meme-mynt och tokens, har presterat usla.

Guldets överprestationer har hjälpts av den kraftigt ökande efterfrågan från investerare, men också av köp från centralbanker. 2024 var tredje året i rad som de lade till mer än 1 005 ton till sina globala guldreserver.

”Respondenterna var tydliga med att centralbanksgemenskapen skulle fortsätta att öka sina allokeringar till guld inom kort”, stod det i en rapport om reserver från World Gold Council från 2024.

Stablecoins: The real powerhouse of crypto

BE29 ETF är en portfölj företagsobligationer med förfall 2029

Guld-ETFer slår Bitcoin-ETFer kraftigt under första kvartalet 2025

INGH ETF är en satsning på global infrastruktur

SPFT ETF är en global satsning på teknikföretag

Fonder som ger exponering mot försvarsindustrin

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Warren Buffetts råd om vad man ska göra när börsen kraschar

Svenskarna har en ny favorit-ETF

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFonder som ger exponering mot försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFastställd utdelning i MONTDIV mars 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSju börshandlade fonder som investerar i försvarssektorn