Nyheter

Stablecoin Synergy: Bridging Traditional and Decentralized Finance

Publicerad

6 månader sedanden

Stablecoins have swiftly become the backbone of the crypto world, driving 50% of all on-chain activity. Bridging the gap between volatile cryptoassets and fiat, they provide stability and a trusted medium for transactions. Seamlessly integrated into platforms like Stripe and PayPal, they empower users to engage with crypto without technical know-how. With fast, low-cost payments, stablecoins are revolutionizing remittances and cross-border transactions, especially in regions facing currency challenges, like 70% of the African continent. Their unique appeal to crypto veterans and newcomers fuels widespread adoption, positioning them as a key driver in the evolution of finance.

What Are Stablecoins?

Stablecoins are cryptoassets designed to maintain a stable value, usually pegged 1:1 to a commodity like gold or a fiat currency like the dollar. This design makes them ideal for everyday transactions and remittances.

• Fiat-collateralized: backed by fiat currencies, they represent the wholesome of this segment’s adoption. (Examples: Tether’s USDT and Circle’s USDC)

• Crypto-collateralized: backed by crypto, and to account for their volatility, they are often overcollateralized. (Example: MakerDAO’s DAI)

• Algorithmic: backed by algorithms and smart contracts to maintain their peg without any reserves. Instead, the peg is maintained by programmed mint and burn mechanisms. (Example: Aave’s GHO)

How Do Stablecoins Collateralize Their Assets?

Stablecoins maintain a peg through specific collateralization strategies and market mechanisms designed to defend against price fluctuations.

Fiat-Collateralized Stablecoins

USDT and USDC are issued by centralized entities like Tether and Circle and are backed mostly by fiat reserves held in off-chain bank accounts. Tether invests around 15% of its reserves in assets like Bitcoin and secured loans to drive revenue while keeping most of its holdings in cash or equivalents to ensure it can meet redemptions, as outlined in its Transparency Report.

• Operates on a 1:1 model, where each token is backed by an equivalent amount of fiat or cash equivalent (e.g., 1 USDC = $1).

• Issuers can liquidate reserves when needed, ensuring sufficient collateral to cover all outstanding tokens and maintain stability.

• Their straightforward design makes them highly efficient for trading and as collateral in DeFi, where liquidity is essential.

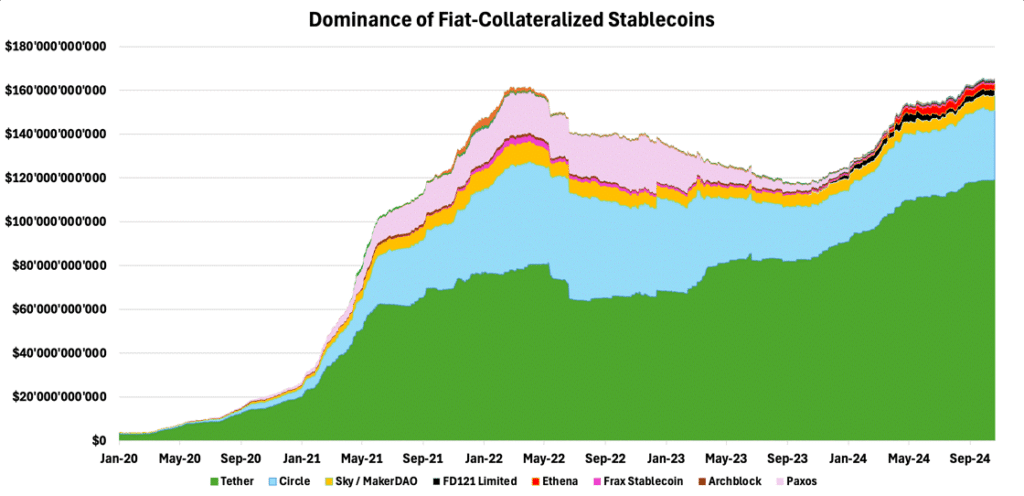

Thanks to their simplicity and reliability, fiat-backed stablecoins dominate the market—USDT and USDC alone boast over $140B, controlling over 90% of the market, as shown in Figure 1.

Figure 1 – Dominance of Fiat-Collateralized Stablecoins

Source: TokenTerminal, 21Shares

Crypto-Collateralized Stablecoins

Often operating without centralized oversight, they rely on smart contracts and cryptoassets as collateral to maintain stability.

• Typically, over-collateralized means users must lock up more value in crypto than the stablecoins they mint, creating a buffer to ensure stability even in volatile markets.

• If collateral falls below the threshold, users forfeit it to the protocol, protecting the peg. Price oracles automatically trigger liquidations to maintain solvency.

• While decentralized, this model requires a robust system of smart contracts. Interactions between smart contracts introduce technological risks that must be carefully managed to prevent potential failures.

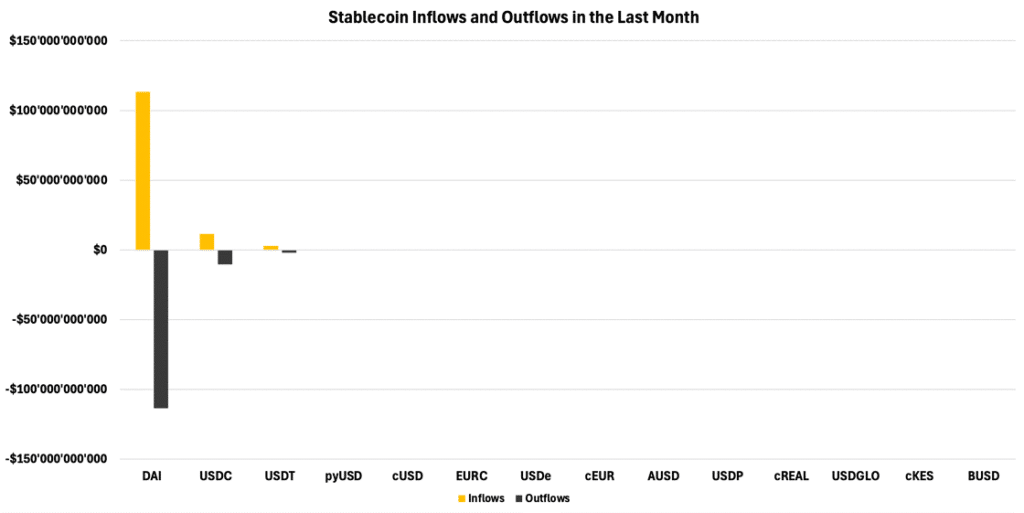

A prime example is MakerDAO’s DAI, where users lock up ETH as over-collateralized debt. MakerDAO adjusts interest rates through on-chain governance, balancing supply and demand to maintain the peg. Due to its decentralized nature and internal management, DAI processed over $113B in inflows and outflows last month, as shown in Figure 2.

Figure 2 – Supply Inflow vs. Outflow due to DAI’s Decentralized Operations

Source: Artemis, 21Shares

Algorithmic Stablecoins

Aiming to maintain stability without using collateral, they rely instead on smart contracts and supply adjustments.

• Protocols like Ampleforth (AMPL) target a CPI-adjusted dollar by adjusting token supply based on price changes. If the price rises above the peg, the supply increases; if it falls below, the supply contracts through a process called rebasing.

• Some designs, like UST, used a second ”bond” token, LUNA, to expand and contract supply.

While innovative, these attempts have proven less reliable than collateral-backed models. Miscalculations or design flaws can lead to Black Swan events, as seen in the UST collapse.

So, How Are They Used?

- Trading / Exchange

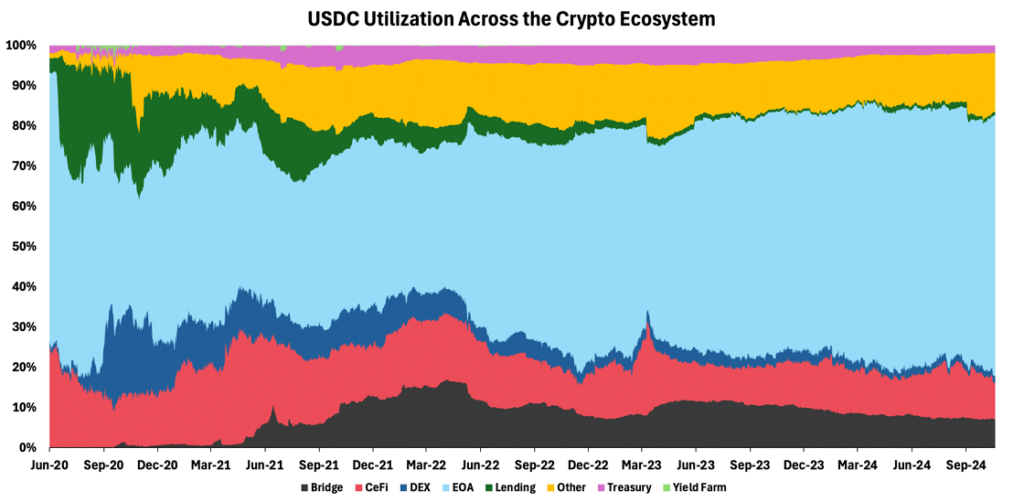

Due to their stability, stablecoins have become integral to crypto trading, serving as both a store of value and a medium of exchange. Analyzing the two largest fiat-collateralized stables by market cap echoes this pattern. For USDC, approximately 60% of its supply resides in Externally Owned Accounts (EOAs), with 11% in Centralized Finance (CeFi) platforms, as demonstrated in Figure 3.

Figure 3 – USDC Utilization Across the Crypto Ecosystem

Source: Dune, 21Shares

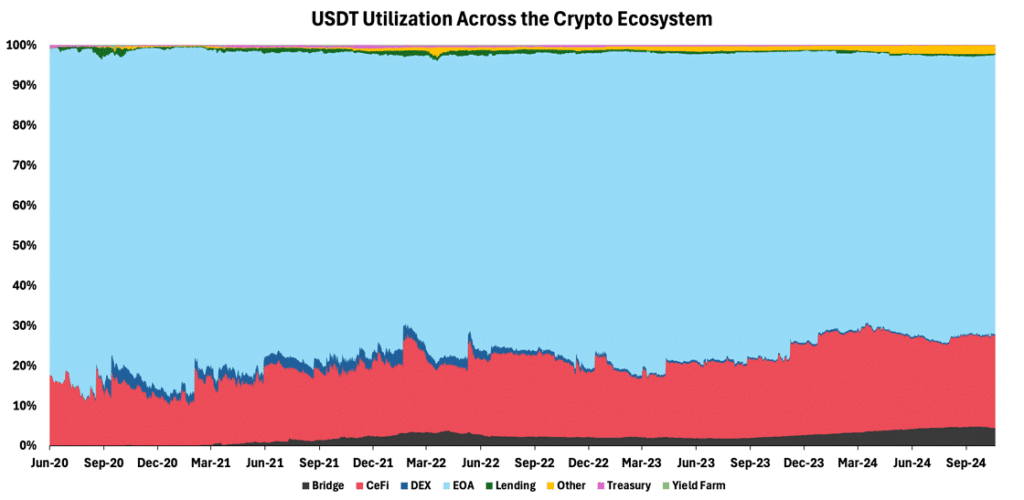

USDT shows an even stronger trend, with 70% in EOAs and 25% in CeFi platforms, as depicted below. USDT is more popular, as Tether is quicker to deploy to lesser-known blockchains and integrate with a broader swath of centralized platforms.

Figure 4 – USDT Utilization Across the Crypto Ecosystem

Source: Dune, 21Shares

This distribution underscores stablecoins’ key value: providing stability. EOAs (non-custodial wallets like Metamask and Phantom) often serve as havens where users convert crypto to stable assets. CeFi platforms, including major exchanges like Binance and Coinbase, offer similar conversion options but also facilitate cross-border transactions. This is particularly relevant as they support USDT’s widespread presence on various networks, particularly Tron, which makes it a preferred choice for users in emerging economies across Latin America and Africa. This highlights stablecoins’ dual role in both investment preservation and global financial accessibility.

- DeFi

Fiat-collateralized stablecoins, like those from Circle and Tether, often have a limited presence in DeFi compared to decentralized alternatives such as Aave’s GHO or Maker’s DAI. This difference stems from the latter’s incentive strategies, which typically involve distributing native protocol tokens (e.g., AAVE or MKR) to boost adoption. PayPal’s PYUSD, however, stands out as an exception among centralized stablecoins.

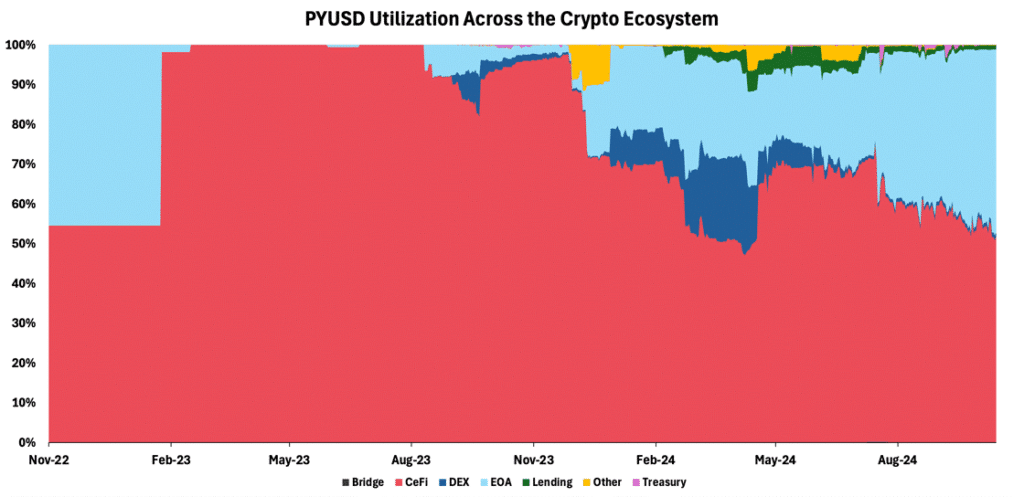

In its push into the Solana ecosystem, PayPal partnered with Kamino Finance, offering yields of up to 17% annually on PYUSD deposits—significantly higher than competitors like USDC’s 9% on Solana. This approach initially proved successful, driving PYUSD’s market cap to nearly $1B, with almost 20% of its value distributed across decentralized exchanges (DEXs) as users leveraged it to generate yield by providing liquidity. Yet, when these incentives scaled back, the stablecoin’s market cap declined by almost 40% from the peak in August, highlighting the critical role of yield-driven strategies in shaping the adoption of stablecoin beyond the incumbents.

Figure 5 – PYUSD Utilization Across Crypto Ecosystem

Source: Dune, 21Shares

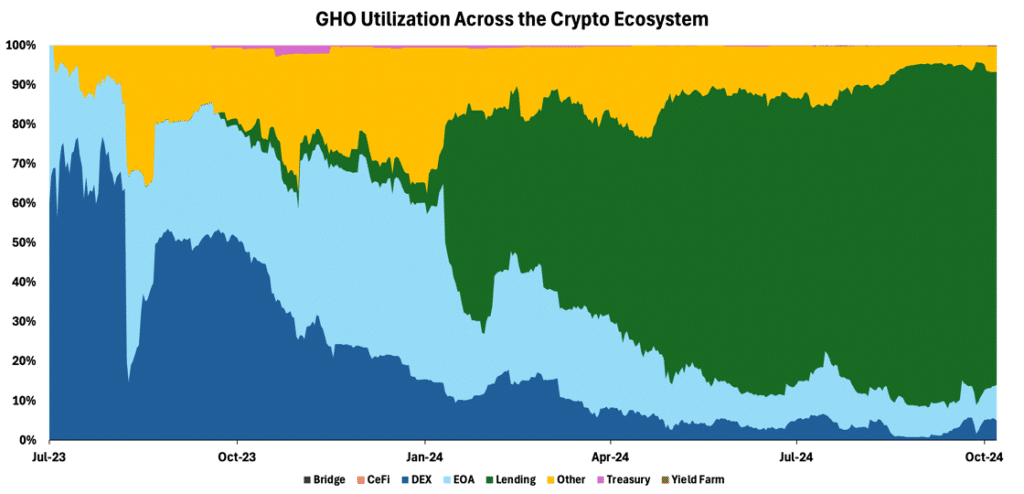

Similarly, GHO, Aave’s over-collateralized stablecoin, gained significant traction in DeFi, largely due to Aave’s strategic incentive structure. Notably, about 80% of GHO’s supply is utilized in lending, with another 5% distributed across DEXs. This distribution aligns with Aave’s strategy to position GHO at the core of its lending market, reinforcing the stablecoin’s role in the broader DeFi ecosystem and driving its adoption.

Figure 6 – GHO Utilization Across Crypto Ecosystem

Source: Dune, 21Shares

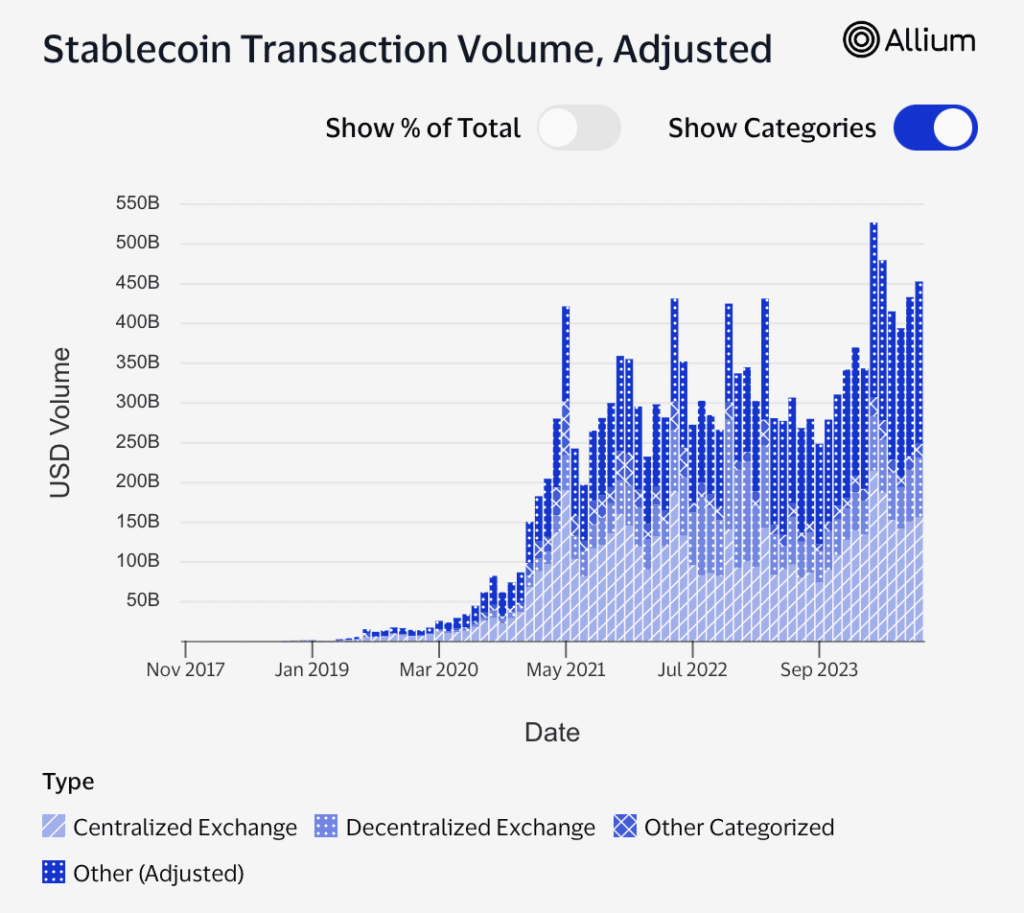

To recap, stablecoins’ general utilization makes up about 25% of DeFi, including DEXs, lending, and other types of financial engagement activities, as shown in Figure 7 below.

Figure 7 – Stablecoin Transaction Volume Classified by Type of Financial Activity

Source: Visa

- Remittance and Payments

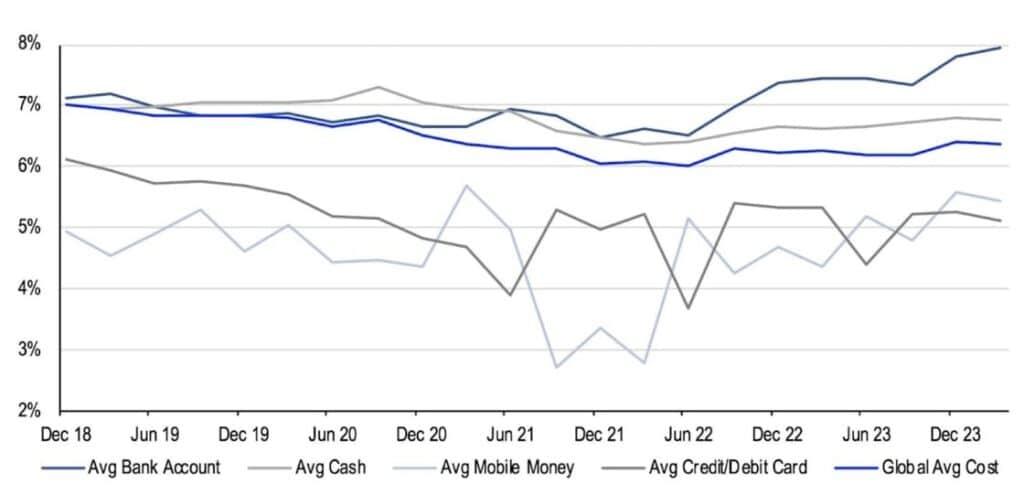

As seen below, stablecoins offer a compelling cost advantage for cross-border payments compared to traditional international money transfer services, which charge an average of 6% per transaction.

Figure 8 – Average Remittance Cost by Funding Instrument (% of Transfer)

Source: Bloomberg, The World Bank and Coinbase

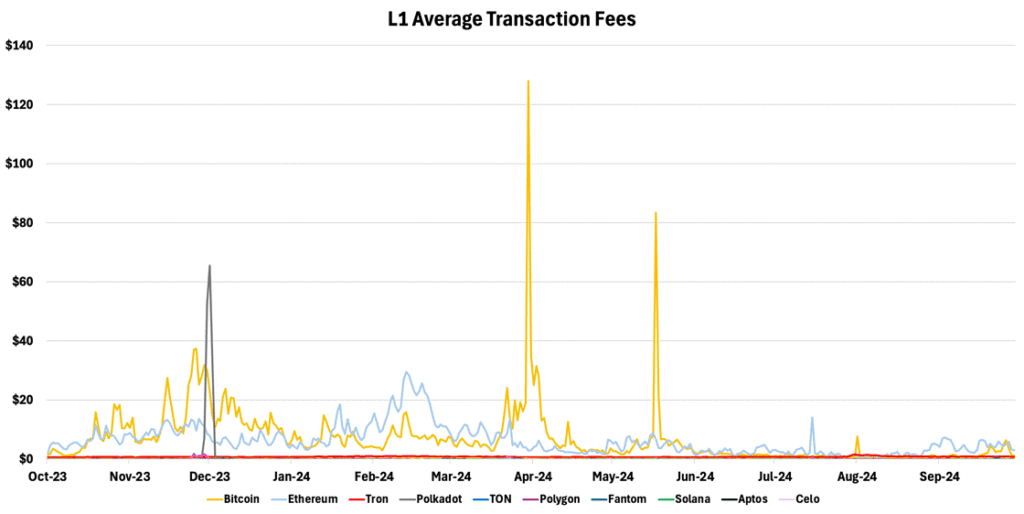

Transaction fees across blockchain networks vary significantly, ranging from fractions of a cent to several dollars—scalable blockchains like Solana, Fantom, Polygon, and TON offer average fees below one cent. In contrast, older-generation networks such as BNB, Tron, and Ethereum can incur fees from 10 cents to three dollars, as shown in Figure 9. However, Ethereum’s ecosystem has evolved with the introduction of Layer 2 solutions. Platforms like Base, Arbitrum, and Optimism, operating atop Ethereum, have now drastically reduced transaction costs to less than a cent, especially after the Dencun upgrade. This development has significantly enhanced Ethereum’s user cost efficiency.

Figure 9 – Average Transaction Fee of Leading Layer-1 Blockchains

Source: TokenTerminal, 21Shares

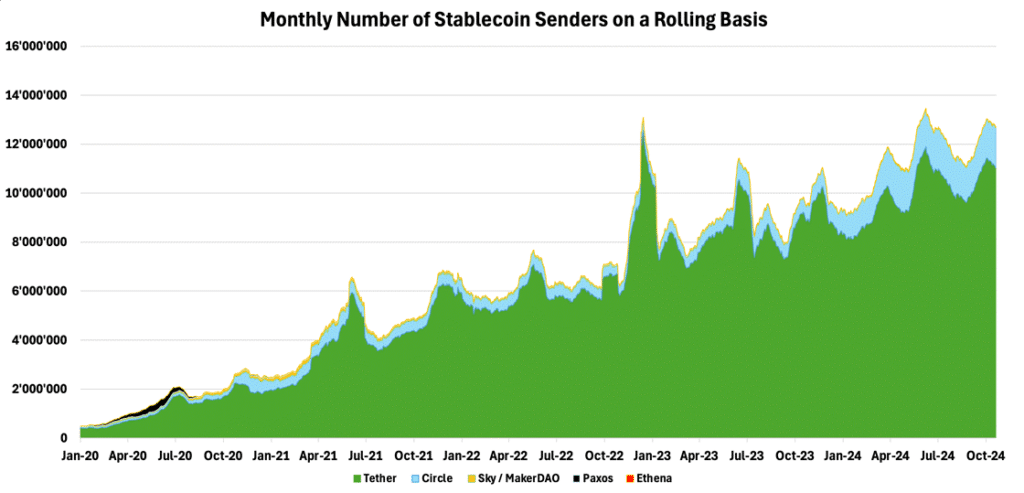

As seen, even with higher costs on networks like Ethereum, crypto transactions remain significantly cheaper than traditional payment systems. This cost-effectiveness is reflected in the unfazed growth of stablecoin usage, which has persisted through crypto’s cyclical nature over the past four years. Despite experiencing a bull market from Q3 2020 to late 2021, followed by a bear market from 2022 to Q3 2023, the number of stablecoin senders has continued to rise unabated. Remarkably, monthly stablecoin senders have surged by nearly 600%, as shown below, from approximately 2.3M in October 2020 to 12M today, underscoring the enduring appeal and utility of stablecoins beyond the confines of the crypto ecosystem.

Figure 10 – Monthly Number of Users Sending Stablecoins

Source: TokenTerminal, 21Shares

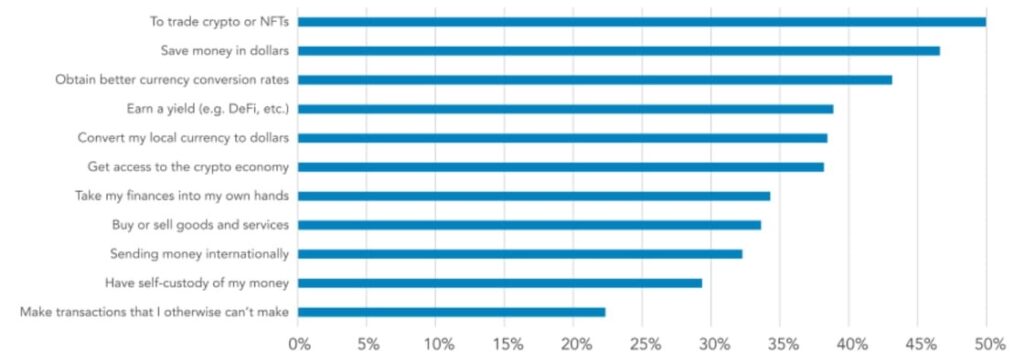

The evolving use of stablecoins is also evident in developing economies. A survey of 2,541 adults across Brazil, India, Indonesia, Nigeria, and Turkey, shows that 47% use stablecoins for better savings rates, 43% for improved currency conversion, and 37% to access dollars. Though limited in scope, this data suggests stablecoins are becoming versatile financial tools in emerging markets, addressing a range of economic needs beyond traditional crypto applications.

Figure 11 – Survey Inquiring “What are your primary goals when using stablecoins?”

Source: CastleIsland

Stablecoins’ Impact

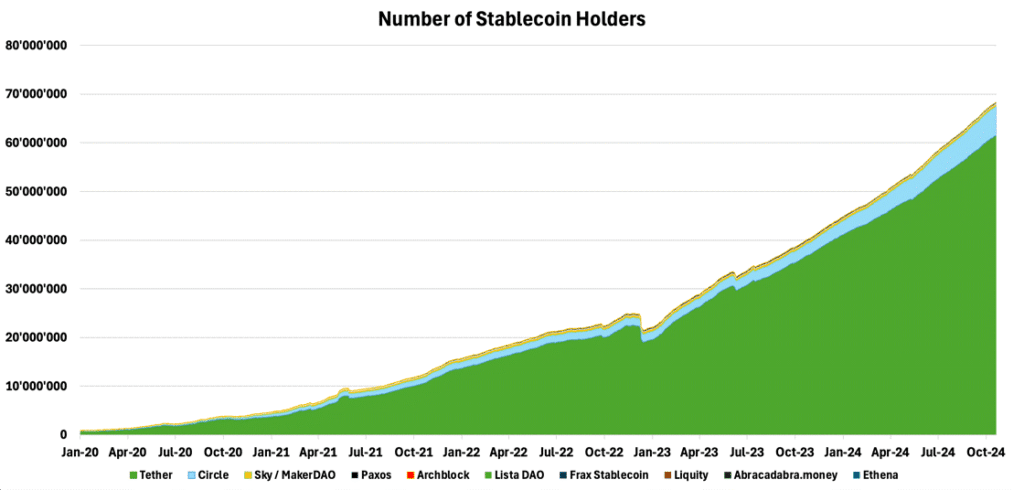

Tether’s effect on the crypto ecosystem is substantial, with nearly 60M users onboarded, as illustrated in Figure 12. This figure represents over 27% of the industry’s total active user base of 220M – underscoring stablecoins significant role in driving crypto’s adoption.

Figure 12 – Total Amount of Stablecoin Holders

Source: TokenTerminal, 21Shares

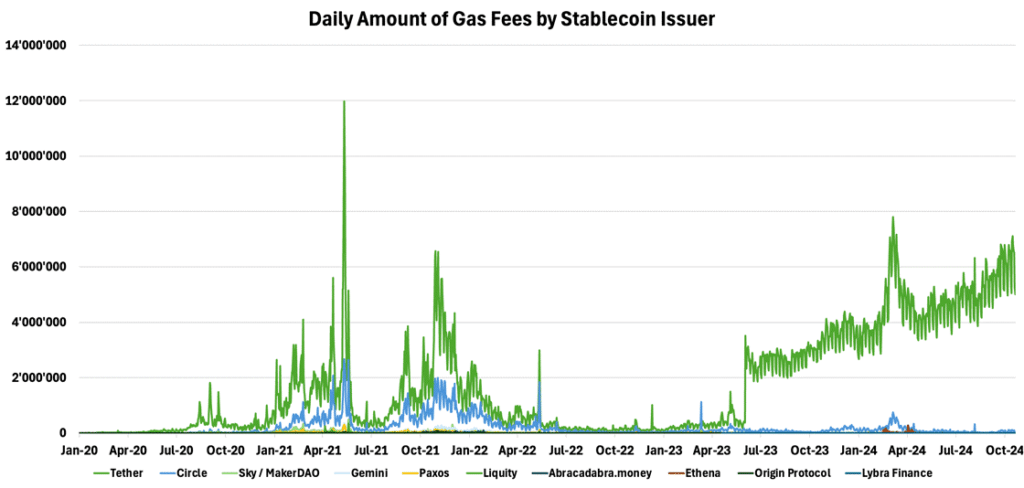

USDT is particularly proving to be a crucial driver of network activity. With their current high usage rates, USDT alone paid over $7M in fees across its deployed blockchains on October 21 alone. This substantial fee contribution underscores the vital role stablecoins play in driving the growth of blockchain ecosystems.

In fact, USDT ranks as the third highest gas consumer on Ethereum over the past month, contributing over 5% (2.31K ETH) of the network’s total fees (40.27K ETH), highlighting stablecoins’ vital role in driving the network’s economic activity. On Tron, USDT accounted for 96% of network activity last week. This level of fee generation directly supports network security by compensating validators, underscoring stablecoins’ significant economic impact on blockchain networks.

Figure 13 – Daily Amount of Gas Fees by Stablecoin Issuer

Source: TokenTerminal, 21Shares

The Regulatory Landscape of Stablecoins

Stablecoin issuers are the 18th largest holder of U.S. debt, surpassing Germany and South Korea. As they become more widely adopted, their role could expand to include significant uses like purchasing national debt, further integrating them into the financial system. This growing influence highlights the need for clear regulations such as the Clarity for Payment Stablecoins and the Lummis-Gillibrand Payment Stablecoin Act, introduced last year to ensure security and trust in this evolving sector. As regulatory clarity is prolonged in the U.S., coupled with geopolitics and macro factors, the dominance of dollar-denominated stablecoins could start being overshadowed by inevitable worldwide adoption.

• Europe’s Markets in Crypto Assets (MiCA) Regulation is entering full force on December 30, 2024. The gradual enactment of MiCA started with its “Stablecoin Regime”, which went into effect in July, providing much-needed clarity over stablecoins. Issuers must have a MiCA license for publicly offering or trading asset-referenced tokens or e-money tokens within the European Union, without a transitional period. These restrictions on centralized issuers could lead stablecoins like USDT to be delisted from EU exchanges if Tether does not meet compliance by December 2024. Additionally, to protect its future monetary sovereignty, MiCA mandated some limits on the use of stablecoins pegged to foreign currencies, where issuance has to cease when the daily usage “as a means of exchange within a single currency area is higher than 1M transactions and €200M.”

• Thailand’s oldest bank is launching the island’s first stablecoin: Siam Commercial Bank (SCB), just partnered with fintech company Lightnet to launch Thailand’s first stablecoin for cross-border payments and remittances.

• The UAE’s Central Bank has granted in-principle approval to AED Stablecoin under its Payment Token Service Regulation framework. If fully approved, AED Stablecoin’s AE Coin could serve as a local trading pair for cryptocurrencies in exchanges and decentralized platforms while allowing merchants to accept it for goods and services. This regulatory development comes a few months after Tether announced its plans to launch an AED stablecoin, “creating an optionality towards the U.S. dollar,” as Tether’s CEO said at the time of the announcement.

Risks and Challenges

• Centralization: Fiat-backed stablecoins like USDT and USDC are issued by centralized entities, requiring users to trust custodians to maintain proper reserves. This centralization introduces counterparty risk, where inadequate collateralization could lead to liquidity issues that could ice users out. Additionally, centralization brings vulnerabilities such as regulatory intervention, mismanagement, or freezing of funds.

• Transparency: Essential for maintaining trust in fiat-backed stablecoins, as issuers hold their reserves off-chain, backed by cash or cash equivalents. To address this, issuers like Tether and Circle conduct regular audits, providing documentation of their reserves, as with Tether’s transparency reports, to ensure confidence in their solvency. Transparency is less of an issue for crypto-backed stablecoins since all assets are verifiable on-chain. These protocols often provide dashboards, such as MakerDAO’s DAI Stats Dashboard, which detail collateralization rates, total debt, collateral types, and loan stability.

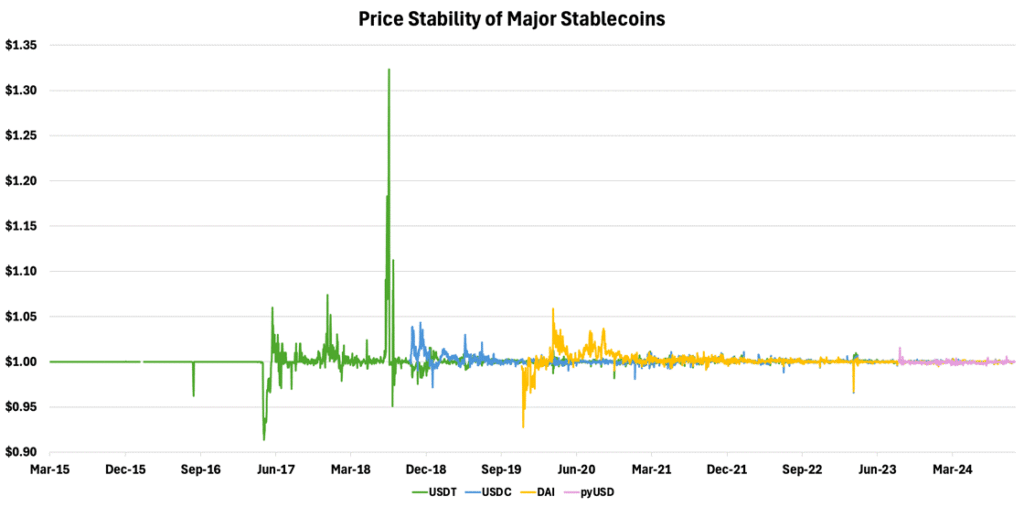

• De-pegging events: When a stablecoin’s value significantly deviates from its intended peg. The most infamous de-pegging event involved the collapse of UST and LUNA in May 2022, which revealed severe risks tied to algorithmic stablecoins. As mentioned earlier, please check out our breakdown of this event here.

While stablecoins still experience de-pegs from time to time—they become more stable, as shown in Figure 14. This increased stability is driven by a growing influx of liquidity, a reflection of the industry’s maturation, and more battle-tested protocols. Stablecoins are now better equipped to withstand liquidity shocks, thanks to the large reserves built up by issuers or thriving on-chain communities that drive governance.

Figure 14 – Price Stability of Major Stablecoins

Source: Artemis, 21Shares

Why Now, and Where Do We Go From Here?

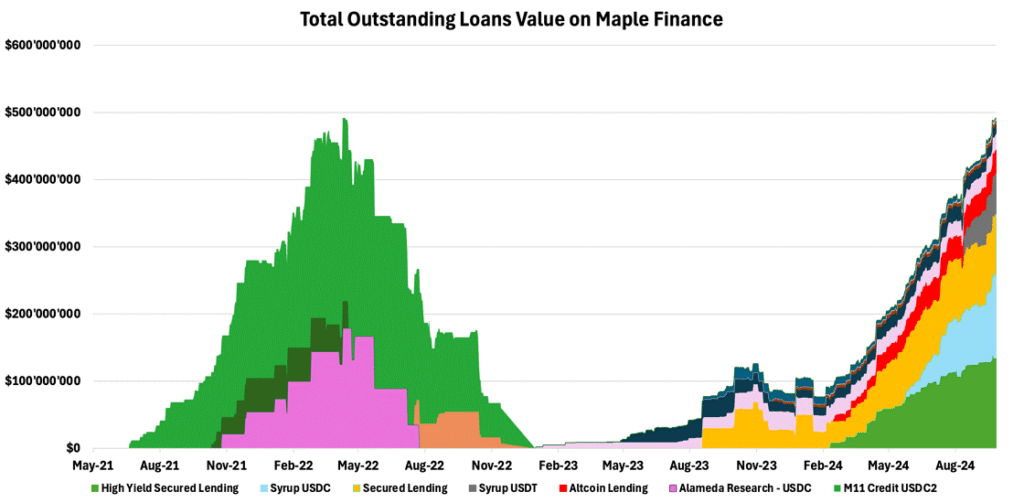

We’ve dedicated this report to stablecoins as we believe it’s timely considering the declining central bank interest rates, which will lead investors to chase higher yields. This has already begun to materialize with the total amount of loans on one of crypto’s unsecured lending platforms reaching an all-time high, as illustrated below.

Figure 15 – Total Outstanding Loans Value on Maple Finance

Source: Dune, 21Shares

That said, we believe the stablecoin market is poised for innovation, particularly in yield-generating models. The success of Ondo Finance’s USDY and Angle’s stEUR tokens, which utilize tokenized money market funds to provide daily dividends, is likely to inspire other issuers to adopt similar profit-sharing models. This trend aims to challenge established players like Tether and Circle, who currently retain profits from reinvesting user deposits into government securities. Emerging competitors are likely to leverage revenue-sharing mechanisms to capture market share, potentially reshaping the stablecoin ecosystem and offering users more lucrative alternatives such as Bitgo’s upcoming stablecoin. However, these innovative models may face regulatory scrutiny in the near term, as authorities work to establish clear frameworks that balance innovation with consumer protection and financial stability.

We also anticipate further innovation in delta-neutral strategies inspired by Ethena’s model. Despite unresolved issues around sustaining their strategy during market downturns, upcoming iterations will likely continue to leverage the maturing futures and options markets. The goal is to simplify these complex strategies, making them accessible to retail investors without requiring deep financial knowledge. This evolution aims to capitalize on the growing sophistication of crypto derivatives while democratizing access to advanced financial products.

Finally, we anticipate a potential shift in CBDC development. Central banks have varied motivations for exploring CBDCs, from enhancing financial inclusion to improving payment efficiency, but face complex design choices. Given the simplicity and proven effectiveness of fiat-backed stablecoins—which have facilitated nearly $35T in trading volume over the past decade—central banks may opt to integrate these solutions into traditional financial systems for now. As seen in Canada, Singapore, and the U.K., this pragmatic approach could serve as a temporary measure until consensus on optimal CBDC model designs is reached.

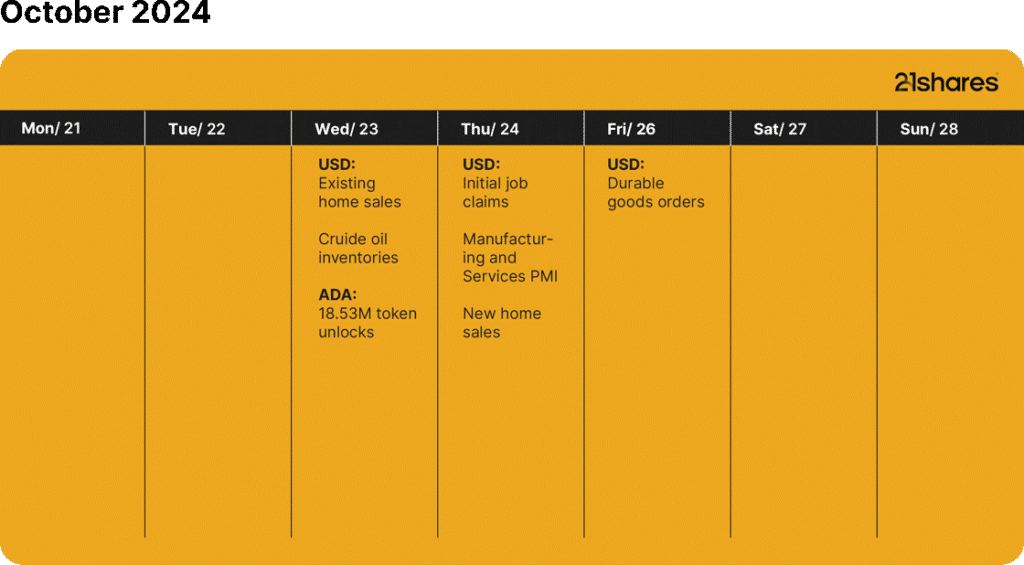

What’s happening this week?

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Dogecoin, the meme that made it

-

Stablecoins: The real powerhouse of crypto

-

Dogecoin in a portfolio: A small 1% allocation has a loud bark!

-

Trump’s trade war puts Bitcoin in the spotlight

-

Bitcoin supply on crypto exchanges hits 5-year low and that’s a good sign

-

Markets Swing Wildly After Tariff Shock – Bitcoin Rebounds Strongly

Nyheter

Europeisk försvars-ETF når 10 miljoner dollar under den första noteringsveckan

Publicerad

15 timmar sedanden

20 april, 2025

HANetf, Europas första och enda oberoende white-label UCITS ETF och ETC-plattform, och ledande leverantör av digitala tillgångs-ETPer, är glada att kunna meddela att Future of Defence UCITS ETF (ticker: ASWC) nu har ackumulerat 2,00 miljarder dollar i förvaltat kapital (AUM).

Bara under 2025 har ETFen attraherat 1,07 miljarder dollar i nya nettotillgångar. Detta, tror vi, till stor del har drivits av Europas kapplöpning att återupprusta sig mitt i växande frågor kring tillförlitligheten i USA:s stöd. USA pausade nyligen militärt bistånd till Ukraina, vilket ledde till att underrättelsedelningen pausades och Kiev blev oförmöget att använda vissa amerikanska vapen. Detta var en tydlig varning till europeiska ledare – USA kan överge dem när som helst.

Efter ett decennium av att inte ha uppnått 2 %-målet av BNP har Europa tillsammans underutnyttjat med uppskattningsvis 850 miljarder euro. Men nu, med ökande geopolitiska spänningar och ifrågasatt amerikanskt militärt stöd, ser de europeiska NATO-medlemmarna över sina försvarsstrategier och ökar sina militära utgifter kraftigt. För att återuppbygga och modernisera sina väpnade styrkor riktar regeringarna dessa förnyade investeringar mot europeiska försvarsföretag – vilket stärker kontinentens strategiska självförsörjning.

Europas upprustning handlar inte bara om att spendera mer – det handlar om att bygga europeiskt oberoende och autonomi inom försvaret. För att minska beroendet av amerikansk utrustning prioriterar EU europeiskt tillverkade vapen, fordon och system, vilket ger den europeiska försvarssektorn en stark medvind.

ASWC ETF syftar till att ge exponering mot NATO och NATO+-allierades försvars- och cyberförsvarsutgifter. Unikt nog använder försvars-ETF en ”NATO-skärm”, vilket begränsar exponeringen mot företag med säte i NATO eller NATO+-allierades medlemsstater.

På detta sätt försöker ETFen att anpassa sig till värderingarna hos investerare som kan ha oro över försvarsinvesteringar, men inte kan ignorera det rådande politiska klimatet och därför söker en smartare och mer genomtänkt strategi. NATO är en defensiv allians och anger själva att ”avskräckning och försvar är en av dess kärnuppgifter” – att fokusera på företag som är verksamma i NATO-allierade länder begränsar möjligheten att ETFens beståndsdelar är företag som är verksamma i länder som en dag skulle kunna bli motståndare till alliansen.

HANetf lanserade nyligen Future of European Defence UCITS ETF (ticker: (8RMY) som exkluderar USA och syftar till att fånga upp Europas upprustning. Som ett europeiskt företag anser HANetf att det är en plikt att stödja investeringar i europeiskt försvar i takt med att kontinenten försöker stärka sin säkerhet. 8RMY ETF har sedan dess överstigit 10 miljoner dollar i förvaltat kapital under sin första noteringsvecka.

På liknande sätt använder 8RMY ”NATO-skärmen” för att begränsa exponeringen mot företag med säte i NATO eller NATO+-allierade medlemsstater.

Hector McNeil, medgrundare och VD för HANetf, kommenterar:

”USA har skickat ett budskap till Europa och det har mottagits tydligt och tydligt. Amerikanskt militärt bistånd, som en gång ansågs vara en garanti, är nu osäkert – och med den osäkerheten kommer ett tydligt direktiv. Europa måste anpassa sig till en värld där USA inte är garant för säkerhet; Europa måste förbereda sig på att försvara sig ensamt.

”Detta har inte gått investerare obemärkt förbi, med stark kursutveckling för europeiska försvarsaktier. Företag som tyska Rheinmetall, brittiska BAE Systems och franska Thales har potentiellt nytta av det. Future of Defence UCITS ETF (ticker: ASWC) gör det möjligt för investerare att få exponering mot dessa företag (och andra) på ett diversifierat sätt.” ”ETFens NATO-screening skiljer den från sina konkurrenter genom att säkerställa att investerare får exponering mot NATO och NATO+-allierade försvarsföretag, samtidigt som de undviker företag som är verksamma i länder som en dag skulle kunna bli motståndare till alliansen. Ingen annan försvarsfokuserad ETF inkluderar denna NATO-screening och som sådan är NATO-ETF:n verkligen unik.

”För de som söker mer fokuserad exponering lanserade vi nyligen Future of European Defence UCITS ETF (ticker: 8RMY), och den har överstigit 10 miljoner dollar i förvaltat kapital under sin första handelsvecka. Vi är ett europeiskt företag, och som sådan anser vi att det är vår plikt att stödja investeringar i europeiskt försvar i ett så avgörande ögonblick. Denna ETF exkluderar amerikanska aktier och syftar till att fånga upp Europas upprustning.”

Handla 8RMY ETF

Future of European Defence UCITS ETF (ticker: 8RMY) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Euronext Paris. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Handla ASWC ETF

HANetf Future of Defence UCITS ETF (ASWC ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Nyheter

Hur investerar jag i ETFer som fokuserar på breda vallgravar?

Publicerad

16 timmar sedanden

20 april, 2025

Vissa företag har lyckats skapa en strategisk fördel gentemot sina konkurrenter. Metaforiskt kallas detta för breda vallgravar, vilket återspeglar dessa företags starkt befästa marknadsposition. Sådana konkurrensfördelar kan bero på ett varumärkes särprägel eller på en forsknings- och utvecklingsfördel baserad på patent. En vallgrav kan också vara resultatet av territoriell distribution eller produktionsrättigheter som ett företag kan göra anspråk på. En annan möjlighet är en stark position genom den utbredda användningen av företagets produkter bland kunderna, vilket gör det svårt för de senare att byta till andra leverantörer. Dessutom kan vissa företag producera sina varor mycket billigare än sina konkurrenter.

För att kunna utvärdera sådana konkurrensfördelar måste analytiker noggrant undersöka verksamheten, konkurrenssituationen och företagens strategiska tillvägagångssätt. Resultaten kan sedan användas för att skapa ett index som kan spåras med ETFer.

I den här investeringsguiden hittar du alla ETFer som fokuserar på företag med en bred vallgrav. Vi har identifierat sex index som spåras av sex olika börshandlade fonder. Den årliga förvaltningskostnaden ligger på mellan 0,39 och 0,52 procent per år.

Breda vallgravar ETFer i jämförelse

När man väljer en ETF med fokus på breda vallgravar bör man överväga flera andra faktorer utöver metodiken för det underliggande indexet och prestanda för en ETF. För bättre jämförelse hittar du en lista över alla breda vallgrav ETFer med detaljer om namn, kortnamn, förvaltningskostnad, utdelningspolicy, hemvist och replikeringsmetod. För ytterligare information om någon av de olika börshandlade fonderna klicka på kortnamnet i tabellen nedan.

| Namn ISIN | Kortnamn | Avgift % | Utdelnings- policy | Hemvist | Replikerings- metod |

| VanEck Morningstar US Sustainable Wide Moat UCITS ETF IE00BQQP9H09 | GMVM | 0.49% | Ackumulerande | Irland | Fysisk replikering |

| VanEck Morningstar Global Wide Moat UCITS ETF IE00BL0BMZ89 | VVGM | 0.52% | Ackumulerande | Irland | Fysisk replikering |

| Frankfurter UCITS ETF Modern Value LU2439874319 | C9DF | 0.52% | Utdelande | Luxemburg | Fysisk replikering |

| VanEck Morningstar US Wide Moat UCITS ETF A IE0007I99HX7 | WMOT | 0.46% | Ackumulerande | Irland | Fysisk replikering |

| L&G Global Brands UCITS ETF USD Acc IE0007HKA9K1 | TOPB | 0.39% | Ackumulerande | Irland | Fysisk replikering |

| VanEck Morningstar US SMID Moat UCITS ETF A IE000SBU19F7 | SMTV | 0.49% | Ackumulerande | Irland | Fysisk replikering |

Nyheter

WELL ETF för den som tror på den globala IT-sektorn

Publicerad

17 timmar sedanden

20 april, 2025

Amundi S&P Global Information Technology ESG UCITS ETF DR EUR (D) (WELL ETF) med ISIN IE000GEHNQU9, försöker följa S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Information Technology-index. Det S&P-utvecklade ex-Korea LargeMidCap Sustainability Enhanced Information Technology-indexet spårar stora och medelstora företag från IT-sektorn. Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,18 % p.a. Amundi S&P Global Information Technology ESG UCITS ETF DR EUR (D) är den billigaste ETF som följer S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Information Technology-index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen delas ut till investerarna (Årligen).

Amundi S&P Global Information Technology ESG UCITS ETF DR EUR (D) är en liten ETF med tillgångar på 27 miljoner euro under förvaltning. ETF:n lanserades den 20 september 2022 och har sin hemvist i Irland.

Investeringsmål

AMUNDI S&P GLOBAL INFORMATIONSTEKNOLOGI ESG UCITS ETF DR – EUR (D) strävar efter att replikera, så nära som möjligt, resultatet för S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Information Technology Index (Netto Total Return Index). Denna ETF har exponering mot stora och medelstora företag i utvecklade länder. Den innehåller uteslutningskriterier för tobak, kontroversiella vapen, civila och militära handeldvapen, termiskt kol, olja och gas (inkl. Arctic Oil & Gas), oljesand, skiffergas. Den är också utformad för att välja ut och omväga företag för att tillsammans förbättra hållbarhet och ESG-profiler, uppfylla miljömål och minska koldioxidavtrycket

Handla WELL ETF

Amundi S&P Global Information Technology ESG UCITS ETF DR EUR (D) (WELL ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

Största innehav

Denna fond använder fysisk replikering för att spåra indexets prestanda.

| Namn | Valuta | Vikt % | Sektor |

| NVIDIA CORP | USD | 20.01 % | Informationsteknologi |

| MICROSOFT CORP | USD | 19.23 % | Informationsteknologi |

| APPLE INC | USD | 17.34 % | Informationsteknologi |

| ASML HOLDING NV | EUR | 6.30 % | Informationsteknologi |

| SAP SE / XETRA | EUR | 2.48 % | Informationsteknologi |

| SALESFORCE COM | USD | 2.20 % | Informationsteknologi |

| ADOBE INC | USD | 2.06 % | Informationsteknologi |

| ADVANCED MICRO DEVICES | USD | 2.02 % | Informationsteknologi |

| QUALCOMM INC | USD | 1.94 % | Informationsteknologi |

| CISCO SYSTEMS INC | USD | 1.88 % | Informationsteknologi |

Innehav kan komma att förändras.

Europeisk försvars-ETF når 10 miljoner dollar under den första noteringsveckan

Hur investerar jag i ETFer som fokuserar på breda vallgravar?

WELL ETF för den som tror på den globala IT-sektorn

Dogecoin, the meme that made it

VSUI ETN spårar priset på kryptovalutan SUI

Fonder som ger exponering mot försvarsindustrin

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Warren Buffetts råd om vad man ska göra när börsen kraschar

Svenskarna har en ny favorit-ETF

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFonder som ger exponering mot försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFastställd utdelning i MONTDIV mars 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSju börshandlade fonder som investerar i försvarssektorn