Nyheter

New Year, Same Old Risks?

Publicerad

3 månader sedanden

As we step into what many hail as one of crypto’s most promising years, it’s essential to keep a balanced perspective on the potential challenges that lie ahead:

• Macro Backdrop: volatile inflation and geopolitical tensions and how it could impact the global market.

• The “MicroStrategy Trade” and its associated leveraged Bitcoin strategy and its impact on the market.

• The risk of presidential promises if they are to be unfulfilled.

• The centralization of liquid staking and restaking and its risk on the Ethereum economy.

• MICA’s impact on the European stablecoin market.

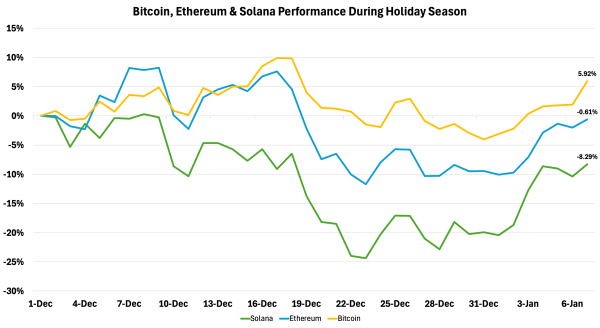

Before we get into the risks above, let’s take a quick look at how the market fared during the holiday season. Bitcoin led the charge with a 5.92% gain, while Ethereum lagged slightly, slipping by 0.61%. Solana faced a tougher time, enduring an 8.29% decline amid the seasonal lull. Despite these mixed performances, the overall crypto market saw a 5.21% increase, signaling that momentum in the industry remains strong as we move into the new year.

Figure 1: Bitcoin, Ethereum, Solana Performance During Holiday Season

Source: 21Shares, Coingecko

As shown in Figure 1, the broader crypto market experienced a downturn in momentum during the holiday season, with trading volumes dropping significantly as investors took time off. This slowdown was compounded by unexpected hawkish comments from the Federal Reserve Chair at the latest FOMC meeting. Contrary to market expectations of four rate cuts in 2025, the Fed signaled only two potential cuts, introducing a note of caution. This stance triggered a sharp rise in the 10-year Treasury yield, which surged to 4.62%, its highest level in six months. Remarkably, this yield now exceeds the Fed’s current rate of 4.25%, as illustrated below, a striking inversion that underscores how concerned the market is about the long-term outlook.

Figure 2: 10-year Treasury Yield vs FED’s Funds Rate

Source: MacroMicro

This unusual dynamic reflects renewed fears that restrictive monetary policy will persist longer than anticipated as investors demand higher returns for holding longer-term debt in an uncertain environment. Elevated bond yields further erode the appeal of riskier assets like cryptoassets, pulling capital toward safer, more predictable returns. The spike in the 10-year Treasury yield has thus become a major driver behind the recent downturn.

In light of these insights, let’s delve into the pivotal elements that may pose challenges for the market as we step into the new year.

Macro Backdrop

The global economy faces uncertainty as central banks grapple with interest rate decisions amid potential slowdowns. In the U.S., the incoming administration’s policies present a mixed economic outlook. Trump’s proposed tariffs may cause short-term inflation but offer long-term benefits, while expedited drilling permits could increase oil supply and potentially lower energy costs.

Concerns about U.S. inflation took center stage at the latest FOMC meeting, where Jerome Powell signaled a more hawkish outlook for 2025. This shift in expectations quickly dampened market sentiment and is a key factor behind the recent downturn for BTC, ETH, and other risk assets. BTC erased almost a month of price gains following the FOMC meeting, retracing $14K from $108K to $92K.

The European Union also faces a critical juncture in 2025, with political instability in Germany and France weakening the bloc’s core, thereby creating a leadership vacuum. The weakened Franco-German axis undermines the EU’s ability to respond cohesively to economic and geopolitical challenges and could result in inconsistent and conflicting crypto policies across the region. Alternatively, Japan’s central bank is poised for more rate hikes in 2025, with Governor Kazuo Ueda indicating readiness to tighten policy if economic conditions warrant. This move could impact global carry trades, reminiscent of the August 2024 market reaction.

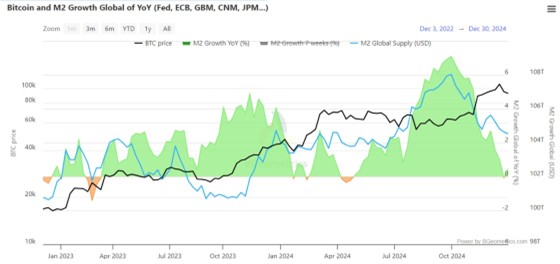

Another metric to be mindful is Bitcoin’s historical correlation with M2. Despite recent interest rate cuts, M2 has been declining since October, potentially negatively impacting Bitcoin. This decline may be due to banks adjusting balance sheets – such as by reducing lending, which decreases deposits—or turning to alternative funding methods not included in M2, like repo markets or money market funds. The lag between rate cuts and their impact on broader money supply measures adds to this complexity. As Bitcoin’s adoption grows, 2025 will be crucial in determining whether its price becomes less dependent on global liquidity or maintains its strong correlation with M2. If the correlation persists, continued M2 decline could negatively affect Bitcoin throughout the year.

Figure 3: Bitcoin vs M2 Money Supply Growth

Source: Bgeometrics

Geopolitical tensions remain another key risk factor for crypto in 2025. While Trump’s Administration is expected to adopt a less aggressive military stance, the U.S.’s strong alignment with Israel raises concerns about potential escalation in the Middle East, particularly regarding Iran. Such conflicts could undermine investor confidence in high-risk assets like crypto. Meanwhile, the situation in Ukraine appears more containable, with both Zelensky and Putin signaling a willingness to negotiate. However, failure to achieve meaningful progress could still pose a significant threat to global markets, including crypto, despite the generally favorable outlook for the industry under the Trump Administration.

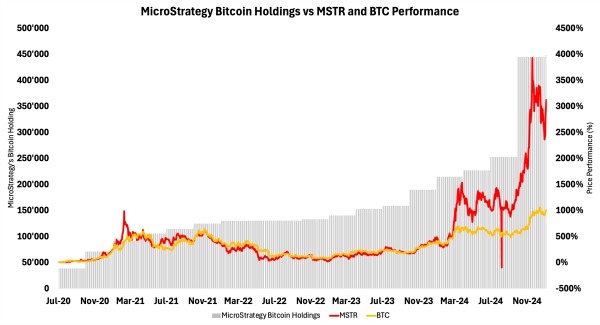

MicroStrategy has positioned itself as a proxy for Bitcoin exposure, holding a significant portion of its treasury in BTC. Their large Bitcoin holdings, which currently sit at 447,470 BTC or $45B, attract investors seeking beta to Bitcoin. For reference, MicroStrategy currently has a market cap of around $88B, almost 2x its Bitcoin holdings. With an average purchase price of approximately $62K, over $7B of outstanding debt used to purchase Bitcoin, a NAV premium of 1.91x, and holding roughly 2.5% of all Bitcoin circulating, a forced liquidation from MicroStrategy could send the crypto market tumbling. Before we go into how this could happen, let’s first describe how we got here.

How the MicroStrategy Flywheel Works: The MicroStrategy Bitcoin Flywheel operates as a self-reinforcing cycle centered around Bitcoin accumulation. Initially, the company allocated existing cash reserves to purchase Bitcoin, positioning it as a key corporate strategy that generated significant market attention. To fund further acquisitions, MicroStrategy raises capital through debt issuance (e.g., convertible or senior secured notes) or equity offerings (MSTR stock), often on favorable terms due to market enthusiasm for its Bitcoin-focused approach. As BTC’s price appreciates, the value of its holdings increases, strengthening its balance sheet and allowing the company to raise additional funds to purchase more BTC. This reinvestment process perpetuates the cycle, as depicted below.

Figure 4: Approximate # of BTC held by MicroStrategy at the End of Each Quarter

Source: 21Shares, Yahoo Finance, Investopedia

What is the current size of their Bitcoin holdings, and how does it compare to their debt levels?

Liquidation Risk: Estimating MicroStrategy’s liquidation risk is complex, but a rough calculation suggests a potential liquidation price of $16.5K/BTC. This is derived by dividing the company’s total debt outstanding by its total Bitcoin holdings, which would require an 85% drawdown in Bitcoin’s value to levels last seen during the FTX collapse in late 2022. However, this estimate is far from definitive since MicroStrategy’s debt is unsecured. Creditors, therefore, lack the authority to force the company to sell its Bitcoin holdings to repay the debt. That said, if MicroStrategy’s stock price were to decline significantly, it could trigger a scenario where debt holders exercise their rights to convert their debt into equity. This forced conversion might pressure the company to take drastic measures to meet its financial obligations, potentially including selling its Bitcoin.

• If MicroStrategy did decide to repay the entirety of its debt, it would only need to liquidate around 15% of its total Bitcoin holdings at current prices. While any sale of Bitcoin by MicroStrategy would undoubtedly make headlines and cause a temporary market dip, the actual amount of BTC they would need to sell adds up to $6.8B and would have a relatively limited effect on the broader market, and the market would likely recover after a few weeks, as we saw with the selling pressure from the German government, Mt.Gox, and Genesis during the summer of 2024.

Price Risk: When Bitcoin undergoes significant drawdowns, MicroStrategy, effectively acting as a leveraged Bitcoin proxy, often sees its stock decline faster. This amplified volatility is driven by its large Bitcoin holdings and the market’s view of MSTR as a high-beta play on Bitcoin, currently trading at around 2x its BTC NAV. A sharp decline in MSTR’s stock can trigger broader sell-offs in the company’s bonds and equities as investors worry about its ability to service debt tied to Bitcoin-backed loans or convertible bonds. Notably, one tranche of convertible debt is tied to MSTR’s price, with a margin call threshold of roughly $140–$180. If breached, this could force MicroStrategy to liquidate Bitcoin at depressed prices to maintain liquidity, further pressuring Bitcoin prices and fueling a self-reinforcing cycle of fear and selling. This feedback loop underscores the systemic risk of MicroStrategy’s leveraged Bitcoin strategy during periods of severe market stress.

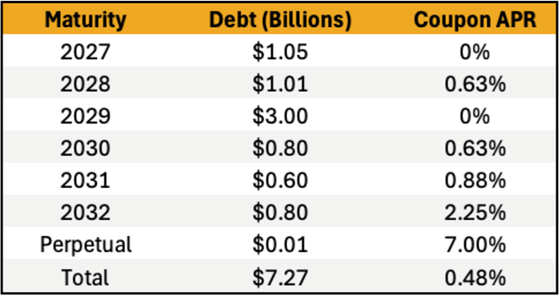

Outstanding Debt Risk: Much of MicroStrategy’s outstanding debt is long-term and carries relatively low interest rates. However, the key risk lies in the potential inability to cover rising interest payments if market conditions worsen. Fortunately, the company produces sufficient revenue from its business intelligence software segment to service this debt, with approximately $500M in revenue for 2023, with similar projections for 2024. Nevertheless, the previously mentioned price and liquidation risks would still directly impact its ability to manage these interest obligations effectively.

Figure 5: MicroStrategy Bond Maturity Table, Coupon Total as a Weighted Average

Source: 21Shares, Real Investment Advice

Option and Relative Performance Trade Risk: In equity markets, as option expiration dates approach, an asset’s price often gravitates toward its ”max pain” level—the price where the most options expire worthless, minimizing payouts for options writers. For the 17JAN25 contracts, this level is $195, while for the 24JAN25 and 31JAN25 contracts, it is $345. If these contracts expire worthless, it could amplify market consequences due to unhedging activity by market participants. This phenomenon ties into the relative-value pair trade between MicroStrategy and Bitcoin. MSTR might currently be perceived as overpriced relative to the NAV of its Bitcoin holdings. A relative-value trade, such as shorting MSTR and longing BTC, aims to profit from the eventual alignment of MSTR’s stock price with its Bitcoin NAV. However, this trade carries significant risk in bullish markets where momentum often overshadows fundamentals. If options linked to MSTR or BTC expire worthless, this could trigger a liquidation or reallocation of positions by investors, driving price instability. A significant dip in MSTR’s price could have a reflexive impact on BTC, creating a feedback loop.

Presidential Promises Unfulfilled

The 2024 election cycle brought optimism for clearer crypto regulation, with promises of support for innovation. Some of these are mentioned in our previous edition and include:

• Bitcoin as a Strategic Reserve Asset

• Favorable regulatory treatment for Decentralized Finance

• Jurisdictional clarity between the SEC and the CFTC via FIT21

• Closer integration between TradFi and crypto by rescinding SAB121

• Favorable tax treatments for U.S.-based crypto companies

• A more crypto-friendly regulatory environment

The realization of any of these initiatives will ensure that crypto maintains its momentum throughout the year. However, delays or opposition in implementing some of these pro-crypto policies could create extended uncertainty, hindering market confidence and institutional participation while dampening enthusiasm.

Liquid Staking and Restaking Centralization

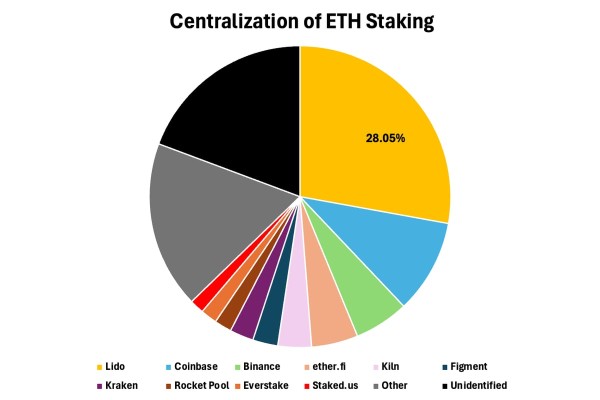

As a recap, Liquid Staking allows users to stake their ETH while maintaining liquidity by receiving tokenized representations of their staked ETH (e.g., stETH from Lido). These tokens can be used in DeFi, enabling users to earn additional yields while their ETH remains staked for network security. On that note, Lido, the largest liquid staking protocol, currently controls approximately 50% of Ethereum’s Total Value Locked (TVL), making it a dominant player in the network’s ecosystem.

The caveat is that Lido’s dominance in Ethereum staking—controlling over 28% of validators—presents a significant centralization risk to the network’s security and the principle of decentralization. While initiatives like community staking modules, permissionless validator sets, and a staking router leveraging Distributed Validator Technology aim to further diversify the validator set and mitigate these risks, Lido remains a single protocol. This concentration of power creates a potential single point of failure, where an exploit or external pressure on Lido could critically undermine Ethereum’s security.

Figure 6: Breakdown of Ethereum’s Staking Dominance Across Different Providers

Source: 21Shares, Dune Analytics

On the other hand, Restaking enables the security provided by staked ETH to be lent out to secure other protocols, amplifying the economic rewards derived from staking. The sector, which is led by services like EigenLayer, already manages approximately $15B in TVL, representing a substantial share of Ethereum’s staking economy, with over 10% already being restaked.

Restaking applies Ethereum’s security to other projects but also heightens systemic risk: a failure in any downstream protocol could compromise Ethereum’s core security. Moreover, restaking now extends beyond Ethereum—Babylon Finance, for instance, leverages a similar mechanism to secure networks with Bitcoin’s capital, with more than $6B in TVL. Thus, it’s not an embryonic sector anymore.

This cross-protocol risk could lead to instability in the broader ecosystem if not carefully managed. Namely, Ethereum’s founder, Vitalik Buterin, laid out three hypothetical scenarios which could prove harmful to Ethereum’s security:

• Overloading ETH security: Too many applications relying on the crypto-economic security of Ethereum could overburden the network and render it incapable of effectively reaching decisions, and potentially result in hard forks.

• Creating perverse motivations: Users could be tempted to secure the most profitable network, although it may not be the most secure. This can ultimately undermine ETH’s security.

• Introducing novel avenues for exploitation: Validators could be bribed from malicious actors to vote for a particular dishonest block on an external network.

MiCA’s Impact on the European Stablecoin Market

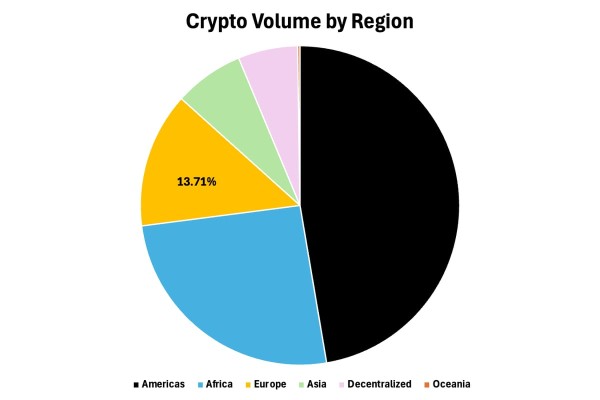

The MiCA Regulation came into full effect on December 30, 2024, ushering in a comprehensive framework for crypto oversight in the EU. Among its key provisions, MiCA mandates that stablecoin issuers secure licenses and adhere to strict reserve, transparency, and usage requirements. Non-compliant stablecoins, such as Tether’s USDT, faced delistings from major EU exchanges, raising concerns over potential liquidity risks as stablecoins are a proxy for investable capital. However, it’s worth noting that close to 87% of crypto’s trading volume exists outside of Europe, as shown in Figure 7, so the impact is rather limited.

Figure 7: Crypto’s Trading Volume on Exchanges by Region

Source: 21Shares, Messari

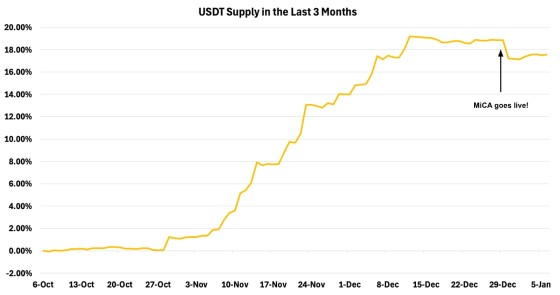

To that point, Tether’s circulating supply temporarily declined from its peak of $143B to $141.2B following these regulatory changes, as shown in Figure 8 below. However, the impact was largely contained, with USDT’s supply rebounding by $500M since the turn of the year. In fact, USDT supply has actually grown around 16% since early October, despite knowledge of MiCA’s formal implementation. Arbitrage opportunities briefly emerged when USDT dipped to $0.9954 on December 30, but its dollar peg held firm, demonstrating market resilience.

Figure 8: USDT Stablecoin Supply

Source: 21Shares, Artemis

While MiCA’s strict standards introduce challenges, they provide much-needed clarity for stablecoin issuance and service providers in the EU. By establishing a consistent regulatory environment, MiCA is poised to enhance stability and trust in the region’s crypto markets, paving the way for sustainable growth.

All in all, while the outlook for the new year seems overwhelmingly positive, the crypto market may face multiple headwinds this year that could stall its momentum.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Markets Swing Wildly After Tariff Shock – Bitcoin Rebounds Strongly

-

21Shares Dogecoin ETP: Drivs av community, omdefinierar kryptolandskapet

-

21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa

-

Michael Saylor’s bold Bitcoin bet and Strategy’s risk analysis

-

21Shares ringer i klockan på Nasdaq Stockholm

-

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Nyheter

HANetfs Tom Bailey om framtiden för europeiska försvarsfonder

Publicerad

9 timmar sedanden

15 april, 2025

HANetfs analyschef Tom Bailey pratade med Proactives Stephen Gunnion om lanseringen av den nya Future of European Defence UCITS ETF (LSE:ARMY, XETRA:8RMY, EURONEXT:ARMY). Bailey förklarade motivet bakom att lansera en regionalt fokuserad fond, efter framgången med HANetfs Global Future of Defence UCITS ETF (ASWC). Han sa: ”Vi tror att det för många investerare på sätt och vis resonerar med hela temat att bygga upp sin försvarssektor via en europeisk ETF med ett europeiskt företag.”

Bailey noterade att de europeiska försvarsutgifterna ökade med 11,7 % mellan 2023 och 2024, vilket överträffade den globala tillväxten på 7,5 %, medan Tysklands egna utgifter ökade med 23 %. Denna ökning tillskrivs geopolitiska förändringar och strävan efter strategisk autonomi. Bailey lyfte fram en växande preferens inom Europa att köpa in försvarsutrustning inhemskt, vilket minskar beroendet av amerikanska företag, som för närvarande står för cirka 60 % av den europeiska försvarsupphandlingen.

Han pekade också på den politiska utvecklingen i USA, inklusive nyligen genomförda tullmeddelanden och upplevd isolationistisk politik, som något som förstärker Europas behov av självförsörjning inom försvaret.

ARMY ETF är för närvarande noterat på Londonbörsen, Xetra (Tyskland) och Euronext Paris, med planer på att lanseras i Italien. Bailey betonade HANetfs identitet som ett europeiskt företag som central för ETFens attraktionskraft och anpassning till strategiska autonomimål.

Handla 8RMY ETF

Future of European Defence UCITS ETF (ticker: 8RMY) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Euronext Paris. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Handla ASWC ETF

HANetf Future of Defence UCITS ETF (ASWC ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Nyheter

Franklin Templeton lanserar två nya kärn-UCITS-ETFer för europeiska investerare

Publicerad

10 timmar sedanden

15 april, 2025

- Franklin S&P 500 Screened UCITS ETF och Franklin S&P World Screened UCITS ETF erbjuder investerare unika aktieallokeringar i amerikanska och globala aktier med låg spårningsfel

- Båda dessa indexerade ETFerna klassificeras som Artikel 8 enligt Sustainable Finance Disclosure Regulation (SFDR)

Franklin Templeton har nöjet att tillkännage lanseringen av två nya indexerade ETFer enligt Artikel 8, Franklin S&P 500 Screened UCITS ETF och Franklin S&P World Screened UCITS ETF. Detta erbjudande är ytterligare ett tillägg till utbudet av indexbaserade ETFer i Franklin Templeton ETF-sortimentet och gör att det totala antalet UCITS ETFer klassificerade som antingen artikel 8 eller 9 nu uppgår till 17. De nya ETFerna kommer att noteras på Deutsche Börse (XETRA) den 16 april 2025, London Stock Exchange (LSE) och Euronext Paris den 17 april 2025, samt Borsa Italiana den 24 april 2025. De är nu registrerade för distribution i Österrike, Danmark, Finland, Frankrike, Tyskland, Irland, Italien, Luxemburg, Nederländerna, Spanien, Sverige och Storbritannien.

Franklin S&P 500 Screened UCITS ETF och Franklin S&P World Screened UCITS ETF kommer att investera i aktier med stort och medelstort börsvärde i USA respektive globalt. De nya ETFerna kommer att följa S&P 500 Guarded Index och S&P Guarded World-indexet, vilka ger en screenad aktieexponering med en förbättrad ESG-profil och fokus på att minimera avvikelser i resultat jämfört med respektive moderindex (S&P 500 Index och S&P World Index), vilket ger centrala allokeringar med låg spårningsfel.

Caroline Baron, chef för ETF-distribution, EMEA, Franklin Templeton, kommenterade: ”Dessa nya ETF:er erbjuder ett kostnadseffektivt och transparent sätt att få tillgång till kärnaktieexponeringar med förbättrade ESG-profiler och minskat koldioxidavtryck, med en noggrann spårning mot traditionella kärnindex. Dessa ETF:er skulle vara lämpliga för investerare som vill investera i kärnexponeringar som är kompatibla med artikel 8 och de som söker en noggrann spårning jämfört med traditionella riktmärken som S&P 500 och S&P World. Dessa ETFer skulle kunna användas med traditionella kärnlösningar för att komplettera dem, till exempel.”

Viktiga funktioner hos Franklin S&P 500 Screened UCITS ETF och Franklin S&P World Screened UCITS ETF

- Marknadsliknande avkastning: ETFerna är konstruerade för att ge bred diversifierad marknadstäckning med vissa undantag och relativa viktningsbegränsningar som riktar sig mot marknadsliknande avkastning med låg spårningsfel i förhållande till S&P 500 respektive S&P World Index.

Viktiga funktioner hos Franklin S&P 500 Screened UCITS ETF

- Konkreta ESG-mål: De två nya fonderna siktar på en förbättring av koldioxidintensiteten med minst 10 % och en förbättring av ESG-betyget med minst 10 % jämfört med sina moderindex.

- Undantag från verksamheter: Företag som är involverade i kontroversiella verksamheter som termiskt kol, tobak, kontroversiella vapen och militära vapen är undantagna, liksom de företag som har varit inblandade i allvarliga ESG- eller FN:s Global Compact-relaterade kontroverser.

- Kostnadseffektivitet: Dessa artikel 8-ETF:er har ett konkurrenskraftigt pris på 0,09 %5 (Franklin S&P 500 Screened UCITS ETF) och 0,14 % (Franklin S&P World Screened UCITS ETF), vilket gör dem till attraktiva alternativ för investerare som letar efter en kostnadseffektiv artikel 8-lösning.

Båda de nya ETFerna kommer att förvaltas av Dina Ting, chef för Global Index Portfolio Management, och Lorenzo Crosato, ETF-portföljförvaltare, som har mer än tre decenniers kombinerad erfarenhet inom kapitalförvaltningsbranschen och dokumenterad meritlista inom hantering av ETF-strategier.

Rafaelle Lennox, chef för UCITS ETF-produktstrategi på Franklin Templeton, sa: ”Vi är glada över att ha samarbetat med S&P i skapandet av detta unika indexsortiment, S&P Guarded-indexfamiljen. Dessa index uppnår två mål, vilka inkluderar en förbättrad ESG- och koldioxidutsläppsprofil samtidigt som de bibehåller minimal avvikelse från moderindexen, S&P 500 respektive S&P World. Detta är unikt på marknaden och stöder våra kunders ständigt föränderliga behov och prioriteringar.”

Franklin Templetons globala ETF-plattform gör det möjligt för investerare att uppnå sina önskade investeringsresultat genom en rad indexerade och aktiva ETFer. Med stöd av styrkan och resurserna hos en av världens största kapitalförvaltare har den globala ETF-plattformen cirka 35 miljarder dollar i förvaltat kapital per den 31 mars 2025.

Nyheter

BE26 ETF investerar bara i företagsobligationer som förfaller 2026

Publicerad

11 timmar sedanden

15 april, 2025

Invesco BulletShares 2026 EUR Corporate Bond UCITS ETF EUR Dis (BE26 ETF) med ISIN IE000AYJ75E5, försöker följa Bloomberg 2026 Maturity EUR Corporate Bond Screened-index. Bloomberg 2026 Maturity EUR Corporate Bond Screened Index följer företagsobligationer denominerade i EUR. Indexet speglar inte ett konstant löptidsintervall (som är fallet med de flesta andra obligationsindex). Istället ingår endast obligationer som förfaller under det angivna året (här: 2026) i indexet. Indexet består av ESG (environmental, social and governance) screenade företagsobligationer. Betyg: Investment Grade. Löptid: december 2026 (Denna ETF kommer att stängas efteråt).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,10 % p.a. Invesco BulletShares 2026 EUR Corporate Bond UCITS ETF EUR Dis är den billigaste ETF som följer Bloomberg 2026 Maturity EUR Corporate Bond Screened index. ETFen replikerar resultatet för det underliggande indexet genom samplingsteknik (köper ett urval av de mest relevanta indexbeståndsdelarna). Ränteintäkterna (kuponger) i ETFen delas ut till investerarna (kvartalsvis).

Invesco BulletShares 2026 EUR Corporate Bond UCITS ETF EUR Dis är en mycket liten ETF med 1 miljon euro tillgångar under förvaltning. Denna ETF lanserades den 18 juni 2024 och har sin hemvist i Irland.

Produktbeskrivning

Invesco BulletShares 2026 EUR Corporate Bond UCITS ETF Dist syftar till att tillhandahålla den totala avkastningen för Bloomberg 2026 Maturity EUR Corporate Bond Screened Index (”Referensindexet”), minus avgifternas inverkan. Fonden har en fast löptid och kommer att upphöra på Förfallodagen. Fonden delar ut intäkter på kvartalsbasis.

Referensindexet är utformat för att återspegla resultatet för EUR-denominerade, investeringsklassade, fast ränta, skattepliktiga skuldebrev emitterade av företagsemittenter. För att vara kvalificerade för inkludering måste företagsvärdepapper ha minst 300 miljoner euro i nominellt utestående belopp och en effektiv löptid på eller mellan 1 januari 2026 och 31 december 2026.

Värdepapper är uteslutna om emittenter: 1) är inblandade i kontroversiella vapen, handeldvapen, militära kontrakt, oljesand, termiskt kol eller tobak; 2) inte har en kontroversnivå enligt definitionen av Sustainalytics eller har en Sustainalytics-kontroversnivå högre än 4; 3) anses inte följa principerna i FN:s Global Compact; eller 4) kommer från tillväxtmarknader.

Portföljförvaltarna strävar efter att uppnå fondens mål genom att tillämpa en urvalsstrategi, som inkluderar användning av kvantitativ analys, för att välja en andel av värdepapperen från referensindexet som representerar hela indexets egenskaper, med hjälp av faktorer som index- vägd genomsnittlig varaktighet, industrisektorer, landvikter och kreditkvalitet. När en företagsobligation som innehas av fonden når förfallodag kommer kontanterna som fonden tar emot att användas för att investera i kortfristiga EUR-denominerade skulder.

ETFen förvaltas passivt.

En investering i denna fond är ett förvärv av andelar i en passivt förvaltad indexföljande fond snarare än i de underliggande tillgångarna som ägs av fonden.

”Förfallodag”: den andra onsdagen i december 2026 eller sådant annat datum som bestäms av styrelseledamöterna och meddelas aktieägarna.

Handla BE26 ETF

Invesco BulletShares 2026 EUR Corporate Bond UCITS ETF EUR Dis (BE26 ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Borsa Italiana | EUR | BE26 |

| XETRA | EUR | BE26 |

Största innehav

| Namn | CUSIP | ISIN | Kupongränta | Vikt % |

| Danaher Corp 2.1% 30/09/26 | 235851AT9 | XS2147995299 | 2,100 | 2,28% |

| UBS AG/London 5.5% 20/08/26 | G315CSLQ1 | XS2589907653 | 5,500 | 1,67% |

| RCI Banque SA 4.625% 02/10/26 | F77341P94 | FR001400KXW4 | 4,625 | 1,61% |

| Societe Generale SA 4.25% 28/09/26 | F8586UWE8 | FR001400KZP3 | 4,250 | 1,60% |

| Booking Holdings Inc 4% 15/11/26 | 09857LAU2 | XS2555218291 | 4,000 | 1,59% |

| Volvo Treasury AB 3.875% 29/08/26 | W9863RZU9 | XS2671621402 | 3,875 | 1,59% |

| Deutsche Boerse AG 3.875% 28/09/26 | D1R73TBG7 | DE000A351ZR8 | 3,875 | 1,59% |

| Arval Service Lease SA/France 4% 22/09/26 | F47368BG3 | FR001400CSG4 | 4,000 | 1,59% |

| Volkswagen Bank GmbH 4.25% 07/01/26 | D9T638KG6 | XS2617442525 | 4,250 | 1,58% |

| Cie de Saint-Gobain SA 3.75% 29/11/26 | F2005MHC3 | XS2723549528 | 3,750 | 1,57% |

Innehav kan komma att förändras

HANetfs Tom Bailey om framtiden för europeiska försvarsfonder

Franklin Templeton lanserar två nya kärn-UCITS-ETFer för europeiska investerare

BE26 ETF investerar bara i företagsobligationer som förfaller 2026

Crypto correlations shift with tariff news

JSDM ETF aktiv förvaltning av aktier från emerging markets

Fonder som ger exponering mot försvarsindustrin

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Warren Buffetts råd om vad man ska göra när börsen kraschar

Svenskarna har en ny favorit-ETF

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Populära

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFonder som ger exponering mot försvarsindustrin

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetf lanserar Europa-fokuserad försvars-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFastställd utdelning i MONTDIV mars 2025