Nyheter

New U.S. President, New Bitcoin All-Time High

Publicerad

6 månader sedanden

A historic moment: the world’s first presidential race to have a unanimous recognition of the crypto industry. After years of regulatory headwinds and restrictions that isolated crypto service providers from traditional finance, the sector may finally see a path to more legitimacy under new leadership. This election could usher in an era of thoughtful regulation that allows cryptoassets to integrate with and enhance the existing financial system. The shift in attitudes represents a dramatic turnaround from previous administrations’ skepticism and adversarial approach. Where crypto firms once faced severe limitations on their operations, there is now hope for a regulatory framework that fosters innovation while addressing valid consumer protection concerns. This potential sea change could allow crypto to emerge from the shadows and realize its transformative potential in the global economy.

As the 2024 U.S. presidential election concludes, Republican candidate Donald Trump has been declared the winner in a decisive victory. Here’s how the race and its ripple effects on the crypto market are shaping up:

• The election has been called in Donald Trump’s favor, with a projected final electoral tally of 312 – 226, marking a sweeping victory for the Republican candidate.

• With a commanding 5M vote lead, Donald Trump is projected to win the popular vote by a margin of 1.5%—marking the first time a Republican has done so since George W. Bush’s victory in 2004.

• Key swing states—including Pennsylvania, Georgia, and North Carolina—have officially been called in Trump’s favor, solidifying the Republican’s clear path to victory. Three key states remain uncalled, including Arizona, Michigan, and Nevada, but the red wave shows no signs of slowing as they are set for a clean sweep.

• Crypto markets are responding swiftly to Trump’s anticipated victory and his well-documented pro-crypto stance:

o Bitcoin (BTC) surged to a new all-time high, reaching just shy of $76K in the early European hours.

o Dogecoin (DOGE) also rallied by 26%, driven by Elon Musk’s vocal support for both the asset and the Republican candidate.

o The SEC has actively pursued a regulation-by-enforcement approach in recent years, targeting specific projects with direct actions, including issuing Wells Notices to Uniswap (UNI) and Immutable (IMX). Both assets saw substantial gains on election night, with UNI rising 28% and IMX up 10%. This broad market reaction reflects optimism about the anticipated regulatory easing under the new administration, a trend we’ll explore in greater detail later in the report.

Looking back at election cycles

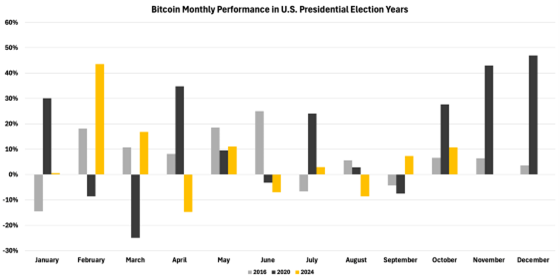

Bitcoin has demonstrated its nature as a non-partisan macroeconomic asset, with its performance during previous election cycles reinforcing this perspective. Excluding the current cycle, Bitcoin has only experienced three election cycles since its inception. Its political neutrality is evident in its robust performance across both Republican and Democratic administrations during these periods

Figure 1: Bitcoin Monthly Performance in U.S. Presidential Election Years

Source: 21Shares, Yahoo Finance

However, in this electron cycle, crypto has taken center stage, driven by its increasing mainstream acceptance and potential to revolutionize the U.S. economy. The focus has shifted to crypto’s capacity to innovate the financial system, address its inefficiencies, and potentially bolster the dollar’s global position through embracing US dollar-denominated stablecoins. Stablecoins are emerging as a crucial instrument for generating net new demand for U.S. Treasury securities, offering a potential remedy to the government’s mounting debt challenge that has recently reached $35T.

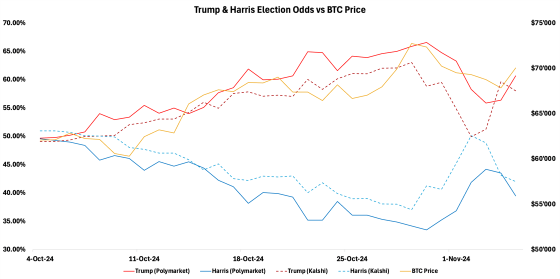

This evolving narrative can be observed with Bitcoin’s performance moving in tandem with Trump’s increasing likelihood of winning the presidency. Prediction markets like Polymarket and Kalshi showed Trump with a lead of over 20% ahead of Vice President Harris, as illustrated in Figure 2. This is where we saw Bitcoin’s price showing a strong correlation with Trump’s election odds on both Polymarket and Kalshi, with correlations of 0.83 and 0.89, respectively.

Figure 2: Bitcoin Price Performance vs. Presidential Candidate Odds

Source: 21Shares, Yahoo Finance

What does it mean for crypto under the Trump Administration?

With Trump now declared the winner, the crypto industry stands to benefit from a favorable outlook. His administration’s pro-crypto stance, along with a maturing regulatory environment for established assets like Bitcoin, points to a bright future for the sector. Under this new leadership, the deficit and inflation may continue to rise, strengthening the structural case for store-of-value assets like gold and Bitcoin and prompting an ongoing shift away from the dollar.

In this view, Trump outlined a clear strategy for treating the crypto industry. However, it’s crucial to approach such campaign promises with a degree of skepticism. Political candidates often present ambitious visions that may not fully materialize once in office, either due to changing circumstances or the complexities of governance. Their enacted policies frequently diverge from, or even contradict their initial campaign rhetoric. That said, here’s a breakdown of what he said so far:

Stablecoins and DeFi flourish:

• Trump’s lending platform, World Liberty Financial, has announced plans to launch its own stablecoin, a move that could bolster the credibility of this new financial instrument and drive further adoption.

• Consequently, DeFi stands to gain greater legitimacy, as Trump’s lending application is built on Aave—the largest lending protocol in crypto—effectively serving as a stamp of approval for the $90B sector.

• Yield-bearing stablecoins are likely to continue unlocking new utilities that traditional money market funds (MMFs) and other cash-like instruments can’t provide.

o Rather than investing in an MMF, investors can opt for stablecoins to earn yield while staying flexible and actively trading and engaging within decentralized finance (DeFi) ecosystems. Unlike MMFs, which require a full trading cycle for settlement, stablecoins offer instant liquidity, enabling users to seamlessly trade or deploy their assets as needed.

More institutional interest and new demand for Bitcoin:

• Under Trump’s presidency, increased government deficits and spending are likely to drive inflationary pressures higher, reinforcing Bitcoin’s store-of-value narrative. This environment would encourage investors to shift toward appreciating assets like equities and Bitcoin over the dollar.

o Trump’s policies would likely emphasize tax reductions and incentives for businesses, aiming to drive short-term market growth.

o His administration may also implement protectionist tariffs, aiming to support domestic industries but potentially impacting international trade relations. Tariffs however could result in higher prices for the end consumers as they are effectively a tax on imported goods that end up trickling down to the consumer.

o Tax cuts and tariffs could expand the deficit, heightening inflation risks and potentially leading to interest rate hikes to manage inflationary pressures.

• Trump’s administration would refrain from selling any Bitcoin currently held by the U.S. government, underscoring their confidence in its powerful store-of-value properties.

• Trump plans to bolster the domestic mining industry, aiming to position the U.S. as the global hub for Bitcoin. While this focus could raise concerns about centralization in the long term, it solidifies the industry’s foundation in the near term.

A favorable tax environment for crypto:

• There would be no capital gains taxes or elevated rates applied to Bitcoin and mining-related activities, creating a highly favorable tax environment for the crypto sector.

A clearer regulatory landscape:

• A push for deregulation would foster a favorable environment for crypto growth, potentially creating thousands of jobs domestically. This approach could also entice companies that previously left the U.S. to reconsider relocating back, strengthening the nation’s position in the global crypto market.

• Replace Gary Gensler at the SEC with a more pro-crypto advocate, bringing a supportive voice to the agency’s approach to regulating cryptoassets.

• Rescind impractical DeFi regulations that require intermediaries, such as decentralized exchanges (DEXs) and wallet providers, to collect user information—promoting a more privacy-focused and innovation-friendly environment.

• Set the stage for approving new ETFs in the U.S., opening up more avenues for retail and institutional investment via regulated financial products.

The global impact of Trump’s presidency:

• Trump’s push for crypto adoption could create a ripple effect, encouraging other countries to accelerate their own exploration of digital assets and integrate them into local financial markets.

• This influence could lead more nations to adopt favorable regulatory frameworks, potentially unleashing a wave of liquidity into the crypto market. With greater governmental endorsement, both institutional and retail investors would gain confidence, driving further growth in the sector.

What happens next?

Yes, the presidential election significantly influences the U.S. regulatory landscape, though it is not as hands-on or impactful as elections within Congress. The past four years have been turbulent for crypto companies, which have faced a regulation-by-enforcement approach amid legal uncertainty, as well as government agencies discouraging banks from providing services to crypto companies via what’s known as Operation ChokePoint 2.0. The presence of more crypto-friendly voices across regulatory bodies from both sides of the political aisle would expedite the establishment of clearer guidelines for this asset class.

House of Representatives (68.61% crypto-friendly):

• Tom Emmer Jr. (R) – 341 statements

• Warren Davidson (R) – 284 statements

• Mike Flood (R) – 66 statements

• French Hill (R) – 80 statements

• Josh Gottheimer (D) – 39 statements

• Ritchie Torres (D) – 30 statements

• Don Beyer Jr. (D) – 27 statements

• Jake Auchincloss (D) – 16 statements

Senate (60% crypto-friendly):

• Ted Cruz (R) – 57 statements

• Bernie Morino (R) – 23 statements

• Kirsten Gillibrand (D) – 18 statements

For years, the distinction has been blurry between the SEC’s jurisdiction over crypto and that of the Commodities and Futures Trading Commission (CFTC). Pending a Senate vote, the Financial Innovation and Technology for the 21st Century Act (FIT21) would provide the CFTC with new jurisdiction over digital commodities and clarify the SEC’s jurisdiction over digital assets offered as part of an investment contract. Additionally, the bill would establish a process to permit the secondary market trading of digital commodities if they were initially offered as part of an investment contract. With USD-pegged stablecoins now the 16th largest holder of U.S. debt, regulations like the Lummis-Gillibrand Act could also be pushed to the finish line, as it expands stablecoin adoption, reinforcing dollar demand.

We may also expect a price recovery within the longer tail of cryptoassets, especially those flagged with a Wells notice from the SEC.

• Immutable, the leading gaming platform, was the latest to receive a Wells notice for trading activities related to the sale of its native token IMX back in 2021. IMX rallied by 10% during election night as Trump looked increasingly favored to win.

• Uniswap Labs, the creator of the largest decentralized exchange (DEX) received a Wells notice in April, for allegedly running as an unregistered securities broker and unregistered exchange. UNI rallied by 28% during the closing periods of the election.

• Staking providers have also been flagged in a Wells notice sent to Consensys in June, for allegedly offering and selling unregistered securities, namely through its MetaMask Staking Service.

To recap, there has been a growing trend among DeFi protocols to implement revenue-sharing mechanisms for their token holders over the past several months. This movement is gaining momentum, as evidenced by Uniswap’s evolution into Unichain and Aave’s proposed activation of its fee switch. These developments mark the initial stages of a broader shift toward aligning protocol success with token holder benefits. To revisit our previous discussion, please review our summary for a comprehensive overview of our outlook.

With more crypto-friendly voices in Congress, supported by a crypto-friendly presidency, we believe the industry is set to finally meet the regulatory clarity that has been brewing for the past few years.

To bring it back all in, we believe that Trump’s presidency will bode well for Bitcoin and the broader crypto market. This will be supported by a more favorable regulatory environment, which should drive innovation and more investors into the space. His presidency will also exhibit a clearer understanding of crypto’s value proposition and its impact on the US economy. This would come in the form of broader acceptance of stablecoins and allow companies beyond banks to issue this new form of private money that would create new net demand for US debt while helping to strengthen the dollar’s position in the world. Finally, we expect DeFi, with tokenization at the forefront, to become more widely integrated to help address some of the current financial system’s shortcomings. This would address issues like slow settlement, exuberant fees, lack of transparency, democratizing access to financial markets, and accelerating financial inclusion.

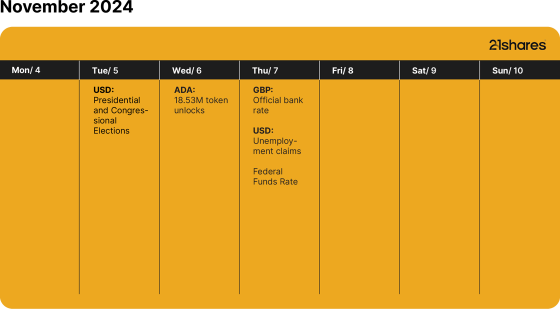

What’s happening this week?

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

From digital asset to safe haven: Why is Bitcoin acting like gold?

-

The Dogecoin story: The emerging “intrinsic value”

-

Can crypto outperform amidst the current market turmoil?

-

A pro-crypto agenda is underway

-

Bitcoin in the eye of the storm: A market shaped by two forces

-

Dogecoin, the meme that made it

Nyheter

Vilka ETFer investerar i europeiska Small Cap-aktier?

Publicerad

16 timmar sedanden

1 maj, 2025

Det är välkänt att företag med mindre börsvärden, Small Cap-aktier, genererar högre avkastning på lång sikt. Men de kommer också med högre risker som investerare bör hantera effektivt. Diversifiering av investeringar med ETFer är det säkraste alternativet för en oberoende investerare att närma sig småbolagsaktier. I denna artikel tittar vi på ETFer som investerar i europeiska Small Cap-aktier. Vi har hittat 9 index som spårar europeiska småbolag som spåras av 13 olika börshandlade fonder. Den årliga förvaltningskostnaden på dessa ETFer ligger mellan 0,20 och 0,58 procent.

Det finns i huvudsak fyra index tillgängliga för att investera med ETFer i europeiska Small Cap-aktier. Denna investeringsguide för europeiska småbolagsaktier hjälper dig att navigera mellan särdragen hos EURO STOXX® Small, MSCI EMU Small Cap, MSCI Europe Small Cap, STOXX® Europe Small 200 och ETFerna som spårar dem. Det gör att du kan hitta de mest lämpliga europeiska småbolags-ETFerna för dig genom att rangordna dem enligt dina preferenser.

Den största europeiska Small Cap ETFerna mätt efter fondstorlek i EUR

| 1 | Xtrackers MSCI Europe Small Cap UCITS ETF 1C | 1,611 m |

| 2 | iShares STOXX Europe Small 200 UCITS ETF (DE) | 874 m |

| 3 | iShares MSCI EMU Small Cap UCITS ETF (Acc) | 874 m |

Den billigaste europeiska Small Cap ETFen efter totalkostnadskvot

| 1 | iShares STOXX Europe Small 200 UCITS ETF (DE) | 0.20% |

| 2 | Amundi MSCI Europe Small Cap ESG Climate Net Zero Ambition CTB UCITS ETF Acc | 0.23% |

| 3 | BNP Paribas Easy MSCI Europe Small Caps SRI S-Series PAB 5% Capped UCITS ETF | 0.26% |

Jämförde index på europeiska småbolagsaktier

Metodik för de viktigaste indexen

| EURO STOXX® Small | MSCI EMU Small Cap | MSCI Europe Small Cap | STOXX® Europe Small 200 | |

| Antal ETFer | 1 ETF | 2 ETFs | 2 ETFs | 1 ETF |

| Antal aktier | 88 | 399 | 903 | 200 |

| Investeringsuniversum | EURO STOXX® index: ca. 300 företag från euroområdet | MSCI EMU Investable Market Index: ca. 700 företag från euroområdet | MSCI Europe Investable Market Index: ca. 1 400 företag från Europa | STOXX® Europe index: 600 företag från 17 europeiska länder |

| Indexrebalansering | Kvartalsvis | Kvartalsvis | Kvartalsvis | Kvartalsvis |

| Urvalskriterier | De minsta företagen (nedre tredjedelen) av det underliggande EURO STOXX®-indexet. | De minsta företagen (cirka 14 procent av det fria börsvärdet justerat) i MSCI EMU Investable Market Index. | De minsta företagen (cirka 14 procent av det fria flytande marknadsvärdet) i MSCI Europe Investable Market Index. | De 200 minsta företagen från STOXX® Europe 600-indexet (rankade från 401 till 600 efter deras marknadsvärde för fritt flytande) |

| Indexviktning | Market cap (free float) | Market cap (free float) | Market cap (free float) | Market cap (free float) |

EURO STOXX® Small index

EURO STOXX® Small-indexet består av små företag från det underliggande EURO STOXX®-indexet. EURO STOXX®-indexet är en delmängd av STOXX® Europe 600-indexet som endast omfattar företag från länder i euroområdet. Small caps bestäms som de 33 procent lägre företagen i det underliggande indexet rankat efter deras börsvärde. Aktierna som passerar urvalsskärmen viktas av deras fria marknadsvärde.

Metodik för EURO STOXX® Small Factsheet-metodik

88 småbolagsaktier från euroområdet

Indexomräkning sker kvartalsvis

Aktieurvalet baseras på företagens storlek

Urvalskriterier: den nedre tredjedelen av EURO STOXX®-index är vald

Indexviktat med fritt flytande marknadsvärde

MSCI EMU Small Cap-index

MSCI EMU Small Cap-index fångar småbolagsaktier i 10 utvecklade länder i euroområdet. Indexet representerar de minsta företagen (cirka 14 procent av det fria börsvärdet justerat) i MSCI EMU Investable Market Index. Aktierna som passerar urvalsskärmen viktas av deras fria marknadsvärde.

Metodik för MSCI EMU Small Cap Factsheet Metodik

- 399 småbolagsaktier från utvecklade länder i euroområdet

- Indexombalansering sker kvartalsvis

- Index har minimistorlek, free float, likviditet och handelslängd

- Aktieurvalet baseras på börsvärde med fritt flytande värde

- Urvalskriterier: minsta företag i MSCI EMU Investable Market Index

- Indexviktat med fritt flytande marknadsvärde

MSCI Europe Small Cap-index

MSCI Europe Small Cap-index inkluderar småbolagsaktier från 15 utvecklade länder i Europa. Indexet representerar de minsta företagen (cirka 14 procent av det fria floatjusterade börsvärdet) i MSCI Europe Investable Market Index. Aktierna som passerar urvalsskärmen viktas av deras fria marknadsvärde.

Metodik för MSCI Europe Small Cap Factsheet Methodology

- 903 småbolagsaktier från utvecklade europeiska länder

- Indexombalansering sker kvartalsvis

- Index har minimistorlek, free float, likviditet och handelslängd

- Aktieurvalet baseras på börsvärde med fritt flytande värde

- Urvalskriterier: minsta företag i MSCI Europe Investable Market Index

- Indexviktat med fritt flytande marknadsvärde

STOXX® Europe Small 200 index

STOXX® Europe Small 200-indexet spårar de 200 minsta företagen (mätt med fritt flytande marknadsvärde) från det underliggande STOXX® Europe 600-indexet, som består av 600 europeiska företag. Aktierna som passerar urvalsskärmen viktas av deras fria marknadsvärde.

Metodik för STOXX® Europe Small 200

- 200 småbolagsaktier från europeiska länder

- Indexombalansering sker kvartalsvis

- Aktieurvalet baseras på deras fria börsvärde

- Urvalskriterier: De 200 minsta aktierna (rankade från 401 till 600) från STOXX® Europe 600-indexet väljs ut

- Indexviktat med fritt flytande marknadsvärde

En jämförelse av olika ETFer som investerar i europeiska Small Cap-aktier

När man väljer en Europa Small Cap ETF bör man överväga flera andra faktorer utöver metodiken för det underliggande indexet och prestanda för en ETF. För bättre jämförelse hittar du en lista över alla amerikanska small cap-ETFer med information om namn, kortnamn, förvaltningskostnad, utdelningspolicy, hemvist och replikeringsmetod. För ytterligare information om respektive börshandlad fond, klicka på kortnamnet i tabellen nedan.

| Namn ISIN | Kortnamn | Avgift % | Utdelnings- policy | Hemvist | Replikerings- metod |

| Xtrackers MSCI Europe Small Cap UCITS ETF 1C LU0322253906 | XXSC | 0,30% | Ackumulerande | Luxemburg | Optimerad sampling |

| iShares STOXX Europe Small 200 UCITS ETF (DE) DE000A0D8QZ7 | EXSE | 0,20% | Utdelande | Tyskland | Fysisk replikering |

| iShares MSCI EMU Small Cap UCITS ETF (Acc) IE00B3VWMM18 | SXRJ | 0,58% | Ackumulerande | Irland | Optimerad sampling |

| iShares EURO STOXX Small UCITS ETF IE00B02KXM00 | IQQS | 0,40% | Utdelande | Irland | Optimerad sampling |

| Amundi MSCI EMU Small Cap ESG CTB Net Zero Ambition UCITS ETF LU1598689153 | LGWU | 0,40% | Utdelande | Luxemburg | Fysisk replikering |

| UBS ETF (LU) MSCI EMU Small Cap UCITS ETF (EUR) A-dis LU0671493277 | UEFD | 0,33% | Utdelande | Luxemburg | Fysisk replikering |

| SPDR MSCI Europe Small Cap Value Weighted UCITS ETF IE00BSPLC298 | ZPRX | 0,30% | Ackumulerande | Irland | Optimerad sampling |

| SPDR MSCI Europe Small Cap UCITS ETF IE00BKWQ0M75 | SMC | 0,30% | Ackumulerande | Irland | Optimerad sampling |

| Amundi MSCI Europe Small Cap ESG Climate Net Zero Ambition CTB UCITS ETF Dist LU2572257470 | X026 | 0,35% | Utdelande | Luxemburg | Fysisk replikering |

| BNP Paribas Easy MSCI Europe Small Caps SRI S-Series PAB 5% Capped UCITS ETF LU1291101555 | EESM | 0,26% | Ackumulerande | Luxemburg | Fysisk replikering |

| Amundi MSCI Europe Small Cap ESG Climate Net Zero Ambition CTB UCITS ETF Acc LU1681041544 | CEM | 0,23% | Ackumulerande | Luxemburg | Fysisk replikering |

| WisdomTree Europe SmallCap Dividend UCITS ETF Acc IE00BDF16114 | WTD7 | 0,38% | Ackumulerande | Irland | Fysisk replikering |

| WisdomTree Europe SmallCap Dividend UCITS ETF IE00BQZJC527 | WTES | 0,38% | Utdelande | Irland | Fysisk replikering |

iShares MSCI Global Telecommunication Services UCITS ETF USD (Acc) (TLCO ETF) med ISIN IE000E9W0ID3, strävar efter att spåra MSCI ACWI Telecommunication Services Screened 35/20 Capped-index. MSCI ACWI Telecommunication Services Screened 35/20 Capped-index spårar kommunikationstjänstesektorn på utvecklade och framväxande marknader över hela världen (GICS-sektorklassificering). Vikten av den största beståndsdelen är begränsad till 35 % och vikten av alla andra beståndsdelar är begränsad till maximalt 20 %.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,35 % p.a. iShares MSCI Global Telecommunication Services UCITS ETF USD (Acc) är den enda ETF som följer MSCI ACWI Telecommunication Services Screened 35/20 Capped-index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

iShares MSCI Global Telecommunication Services UCITS ETF USD (Acc) är en mycket liten ETF med tillgångar på 5 miljoner euro under förvaltning. ETF lanserades den 3 april 2024 och har sin hemvist i Irland.

Varför TLCO?

- Exponering för industrigruppen GICS telekommunikationstjänster som inkluderar företag vars huvudsakliga verksamhet innefattar tillhandahållande av fasta, mobila och/eller trådlösa telekommunikationstjänster; leverantörer av kommunikation och/eller högdensitetsdataöverföring; producenter av interaktiva spelprodukter och företag som ägnar sig åt innehåll och informationsskapande eller distribution.

- ”The Index” (MSCI ACWI Select Telecommunication Services Screened 35/20 Capped Index) exkluderar företag som klassificeras som brott mot FN:s Global Compact-principer och de som identifierats av indexleverantören som inblandade i kontroverser som har en negativ ESG-inverkan på deras verksamhet och/eller produkter och tjänster baserade på MSCI ESG-kontroverspoäng.

- Exponering mot stora och medelstora aktier i utvecklade och tillväxtmarknadsländer.

Investeringsmål

Fonden strävar efter att uppnå en total avkastning på din investering, genom en kombination av kapitaltillväxt och inkomst på fondens tillgångar, vilket återspeglar avkastningen från MSCI ACWI Select Telecommunication Services Screened 35/20 Capped Index (”Indexet”).

Handla TLCO ETF

iShares MSCI Global Telecommunication Services UCITS ETF USD (Acc) (TLCO ETF) är en börshandlad fond (ETF) som handlas på London Stock Exchange.

London Stock Exchange är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Euronext Amsterdam | USD | TLCO |

Största innehav

| Kortnamn | Namn | Sektor | Vikt (%) | ISIN | Valuta |

| VZ | VERIZON COMMUNICATIONS INC | Kommunikationstjänster | 17.32 | US92343V1044 | USD |

| T | AT&T INC | Kommunikationstjänster | 13.50 | US00206R1023 | USD |

| TMUS | T MOBILE US INC | Kommunikationstjänster | 9.65 | US8725901040 | USD |

| DTE | DEUTSCHE TELEKOM N AG | Kommunikationstjänster | 8.21 | DE0005557508 | EUR |

| 9984 | SOFTBANK GROUP CORP | Kommunikationstjänster | 6.68 | JP3436100006 | JPY |

| 9433 | KDDI CORP | Kommunikationstjänster | 4.06 | JP3496400007 | JPY |

| 9434 | SOFTBANK CORP | Kommunikationstjänster | 3.54 | JP3732000009 | JPY |

| 9432 | NIPPON TELEGRAPH AND TELEPHONE COR | Kommunikationstjänster | 2.90 | JP3735400008 | JPY |

| VOD | VODAFONE GROUP PLC | Kommunikationstjänster | 2.02 | GB00BH4HKS39 | GBP |

| TEF | TELEFONICA SA | Kommunikationstjänster | 1.93 | ES0178430E18 | EUR |

Innehav kan komma att förändras

Nyheter

Ny strategi riktar in sig på avkastning från terminskurvans dynamik

Publicerad

18 timmar sedanden

1 maj, 2025

WisdomTree, en global finansiell innovatör, har utökat sitt utbud av råvaru-ETPer med lanseringen av en marknadsneutral strategi. WisdomTree Enhanced Commodity Carry ETC (CRRY), noteras idag på Börse Xetra och Borsa Italiana med en förvaltningsavgift (MER) på 0,40. ETCen kommer att noteras på Londonbörsen den 1 maj 2025.

WisdomTree Enhanced Commodity Carry ETC syftar till att följa pris- och avkastningsutvecklingen, före avgifter och kostnader, för BNP Paribas Enhanced Commodity Carry ER Index. Indexet är utformat för att fånga skillnaden i carry-kostnader mellan olika punkter på terminskurvan genom att ge 3x hävstångsexponering mot skillnaden mellan det långa benet och det korta benet. Det korta benet replikerar BCOM[1] ex-precious metals-indexet, och det långa benet är en korg av enskilda råvaruindex för rullande terminer vars vikt speglar BCOM ex-precious metals-indexet, med kontrakt med upp till 12 månader till utgång.

På råvaruterminsmarknader är cost-of-carry skillnaden mellan terminspriset och spotpriset. Den återspeglar vanligtvis kostnaderna (lagring, finansiering etcetera) och fördelarna, tillsammans med förväntad marknadssentiment och riskpremie, som är förknippade med att hålla råvaran tills kontraktet löper ut.

Råvarustrategier för carry erbjuder ett systematiskt sätt att fånga avkastning från strukturen i råvaruterminskurvor, snarare än att förlita sig på prisrörelserna för själva de underliggande råvarorna. De erbjuder diversifierad exponering över ett spektrum av råvaror, vilket hjälper till att jämna ut avkastningen och hantera volatilitet. På störda marknader är det en metod som kan generera icke-korrelerad avkastning och stärka portföljens motståndskraft.

Nitesh Shah, chef för råvaru- och makroekonomisk analys i Europa på WisdomTree, sa: ”I en miljö som formas av ihållande inflation, politisk osäkerhet och fragmenterade leveranskedjor erbjuder carrystrategier en differentierad och skalbar avkastningskälla. Genom att fokusera på formen på terminskurvan, snarare än spotprisprognoser, ger de okorrelerad exponering som kan förbättra diversifieringen och komplettera både kärnräntebärande och alternativa allokeringar.”

Alexis Marinof, VD för WisdomTree i Europa, tillade: ”Vi fortsätter att utöka vårt marknadsledande utbud av råvaru-ETPer med innovativa strategier. Investerare letar efter okorrelerade avkastningskällor och denna lansering återspeglar deras utvecklande behov. WisdomTrees långvariga ledarskap inom råvaruområdet gör det möjligt för oss att förutse marknadsförändringar och leverera framåttänkande, forskningsdrivna lösningar. Varje produkt vi lanserar är utformad för att erbjuda precision, transparens och meningsfull exponering för att hjälpa kunder att bygga väldiversifierade portföljer.”

WisdomTree är den ledande leverantören av råvaru-ETPer i Europa och erbjuder över 120 råvaru-ETPer och förvaltar över 25 miljarder dollar inom sitt råvarusortiment.

Produktinformation

Vilka ETFer investerar i europeiska Small Cap-aktier?

TLCO ETF är en satsning på telekommunikation

Ny strategi riktar in sig på avkastning från terminskurvans dynamik

DOGE ETP är den enda Dogecoin ETP som godkänts av Dogecoin Foundation

Janus Henderson noterar CLO UCITS ETF på Xetra

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Världens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

Europeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanHANetfs Tom Bailey om framtiden för europeiska försvarsfonder

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanFastställd utdelning i MONTDIV april 2025