Trade Idea – Foreign Exchange – Loonie set for near term tumble

Highlights

- The tentative agreement reached by OPEC last Wednesday has sent oil prices to the top of their recent range and lent support to oil linked currencies.

- In practice the production limit will be hard to implement and oil prices will likely retrace gains in coming months.

- The CAD looks to continue its downtrend as extended positioning corrects lower and monetary conditions are eased.

- OPEC surprises markets

Global crude benchmarks and oil linked currencies jumped last Wednesday on news that members of OPEC had tentatively agreed to implement a production target for the first time in seven years. Both commodity and currency markets responded positively to the surprise deal that was viewed broadly as an unlikely prospect due to long standing differences between key group members, Saudi Arabia and Iran. While the deal certainly marks a shift in stance of the oil exporting group, we do not believe it is enough to sustain support for the CAD which is at risk from a confluence of bearish factors, specifically underwhelming economic performance, stretched speculative positioning and technical resistance. We therefore see current levels as an attractive point to gain long exposure to the USD/CAD and EUR/CAD currency pairs which are set to benefit from near term oil weakness.

Symbolic but not practical

We believe the uplift in the oil market provided by the latest OPEC agreement will not last for long as the practicalities of the arrangement and wider concerns over slowing global oil demand growth keep oil prices contained. The deal itself, while an important move symbolically, did not provide a definite promise to remove a significant amount of output from the global oil market (removing anywhere from 200-700k barrels per day (bpd)) and requires the implementation of country level quotas. This is a large and politically sensitive task and is unlikely to be completed before the next OPEC meeting in November. In addition, the deal failed to provide clarity over conditions for countries under duress such as Venezuela, Nigeria and Libya where production is currently far below capacity, but has the potential to increase in the interim. Thus, support from oil prices is therefore likely to be absent for the CAD in the coming months.

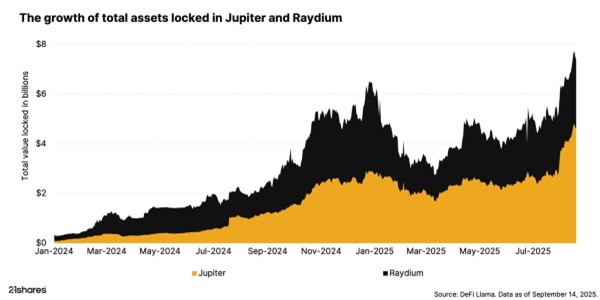

(Click to enlarge)

CAD underperforms NOK

While both the NOK and CAD are heavily linked to the oil price, prospects for the two currencies have recently diverged. Latest growth and inflation data from Norway has surpassed the expectations of its central bank, causing the Norges bank’s

Executive Board to deliver a more hawkish policy message and raise its projected rate path. In contrast, lacklustre inflation, retail sales and manufacturing data has prompted a more dovish tone from the Bank of Canada (BoC), which makes it increasingly likely to ease monetary policy at its upcoming meetings. This has been reflected in the relative outperformance of the NOK in the past month, which has rallied by 2.8% relative to CAD on a trade weighted basis (see Figure 1).

Positioning stretched

The USD/CAD and EUR/CAD are on strong longer term upward trends (CAD weakening) which look well placed to continue. Net speculative positioning underpinning the CAD is hovering at record highs and looks increasingly subject to a correction. A fall in oil prices or further easing by the BoC could see CAD longs (which are at the strongest level in two years) fall sharply and shorts gather momentum, exacerbating any rise in USD/CAD and EUR/CAD.

Investors wishing to express the investment views outlined above may consider using the following ETF

Securities ETPs:

Currency ETPs

EUR Base

ETFS Long CAD Short EUR (ECAD)

ETFS Short CAD Long EUR (CADE)

GBP Base

ETFS Long CAD Short GBP (GBCA)

ETFS Short CAD Long GBP (CAGB)

USD Base

ETFS Long CAD Short USD (LCAD)

ETFS Short CAD Long USD (SCAD)

3x

ETFS 3x Long CAD Short EUR (ECA3)

ETFS 3x Short CAD Long EUR (CAE3)

5x

ETFS 5x Long CAD Short EUR (ECA5)

ETFS 5x Short CAD Long EUR (CAE5)

Currency Baskets

ETFS Bullish USD vs Commodity Currency Basket Securities (SCOM)

ETFS Bearish USD vs Commodity Currency Basket Securities (LCOM)

Important Information

This communication has been provided by ETF Securities (UK) Limited (“ETFS UK”) which is authorised and regulated by the United Kingdom Financial Conduct Authority (the “FCA”). The products discussed in this document are issued by ETFS Foreign Exchange Limited (“FXL”). FXL is regulated by the Jersey Financial Services Commission.

This communication is only targeted at professional investors. In Switzerland, this communication is only targeted at Regulated Qualified Investors.

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan