Nyheter

ICYMI: Highlights from Token49 + Breakpoint

Publicerad

5 månader sedanden

• Solana introduced its FireDancer Validator client, enhancing network decentralization and performance, potentially achieving up to a million transactions per second.

• Major financial institutions like BlackRock, Franklin Templeton, and Coinbase are launching tokenization projects on Solana, driving increased network usage and reducing business costs.

• Several stablecoins, including EURCV and PHPC, are set to launch on Solana, which could significantly boost remittance markets and cross-border payments, especially in the Philippines.

• Citibank is exploring Solana’s capabilities for cross-border payments, a market projected to reach $250T by 2027, providing a huge adoption opportunity for Solana.

• Sui is making waves with its MoviePass partnership and gaming device launch, aiming to break into the gaming market and attract mainstream users by bridging Web2 and Web3 gaming.

Last week, Singapore hosted two of the most anticipated conferences revered by the crypto industry. From September 18 to 19, Token2049 took place followed by Solana’s flagship event Breakpoint, from September 20 to 21–both gushing with announcements.

Paving the Way for Tokenization on Solana

Unsurprisingly, Solana had the lion’s share of revelations, and not only at Breakpoint. They unveiled a slew of developments focused on refining the network’s infrastructure and supporting the DeFi landscape. However, the most consequential development was the launch of Solana’s FireDancer Validator client. In short, a “validator client” is the software that allows validators to participate in the network’s security by proposing new blocks and verifying transactions.

The Solana network currently operates with two primary clients: the Solana Labs software and Jito SOL. Jito SOL, being a slightly modified fork of the Solana Labs client, potentially shares vulnerabilities with its parent software. Thus, this lack of client diversity underscores the significance of FireDancer’s testnet launch. While some FireDancer features have already been implemented on the mainnet via FrankenDancer, its full deployment is crucial for:

• Increased decentralization and security: With a truly independent validator client, the network becomes more resilient to outages and issues across single client implementations.

• Enhanced performance: FireDancer is expected to significantly increase the network’s transaction throughput. Developers were able to achieve up to a million transactions per second in a testnet environment. While testnet doesn’t undergo the same stress tests of real world conditions, it does give a better sense of what a network is able to achieve.

Beyond infrastructure improvements, tokenization emerged as a significant focus, with several major players unveiling Solana-based initiatives.

• For instance, Securitize revealed plans to deploy Blackrock’s on-chain Money Market Fund (MMF), BUIDL, on Solana.

• Franklin Templeton followed suit, announcing its intention to launch its own MMF on the network, building on Hamilton Lane’s previous groundbreaking move as the first asset manager to introduce a fund on Solana.

• Brevan Howard’s tokenization firm, Libre, is also set to expand its offerings to the non-EVM network.

• Additionally, Coinbase plans to extend its Bitcoin-wrapped asset, cbBTC, to Solana, aiming to increase Bitcoin’s utility across the ecosystem and cater to its users who frequently engage with the Ethereum alternative network.

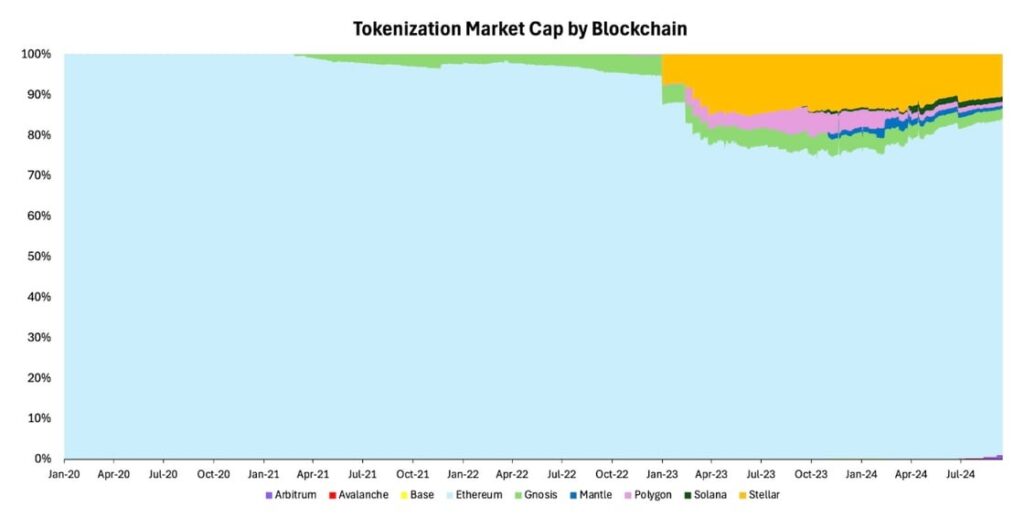

This surge in tokenization activity on Solana is particularly noteworthy, given that the network currently represents only a small fraction (1.2%) of the total tokenization market worth $3.7B, as depicted below. These developments are expected to drive increased utilization of the network across the nascent sector, while further reducing costs for companies adopting this high-performance blockchain and streamline their business processes.

Figure 1 – Tokenization by Blockchain

Source: Dune Analytics

The stablecoin and payments sector also saw significant developments. Societe Generale announced plans to expand its euro-denominated stablecoin, EURCV, to Solana. The Philippines’ largest crypto exchange revealed intentions to launch a peso-backed stablecoin (PHPC) on Solana in Q1 2025. This is particularly worthy as the Philippines is one of the top 5 countries receiving remittances in the world with more than $40B in 2023. Thus incorporating stablecoins could drive a lot of increased revenue to the network and equally benefit its citizens with less fees.

Finally, MakerDAO (now SKY) will deploy its USDS token on Solana via Wormhole integration. For context, DAI’s supply on Ethereum reached $5B, thus this could be an enticing event to attract more users and liquidity from the Ethereum ecosystem and help drive the growth of Solana’s DeFi sector.

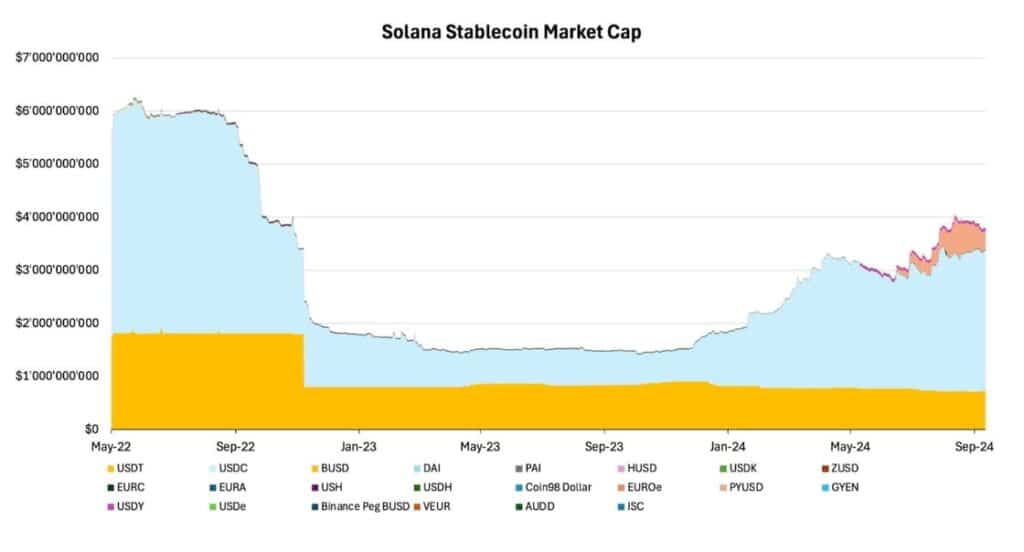

In addition, BitGo disclosed plans for a yield-bearing stablecoin in Q1 2025, aiming to challenge Tether and Circle’s market dominance. As a follow-up to Bitgo’s announcement, Fintech giant Revolut confirmed the advanced stages of its own stablecoin development. While it’s uncertain if BitGo and Revolut will choose Solana for their stablecoins, the platform’s appeal is evident given PayPal’s rapid success in achieving nearly $1B in total supply on Solana, as shown in Figure 2. Overall, BitGo’s yield-bearing feature and Revolut’s established user base could provide unique advantages over incumbent stablecoins. In a similar vein, it could help enhance the network’s revenue stream.

Figure 2 – Solana’s Stablecoins Marketcap

Source: 21Shares, DeFiLlama

Citibank, the primary U.S. banking subsidiary of CitiGroup, is investigating Solana’s capabilities in terms of smart-contract development and for revolutionizing cross-border transfers. This exploration comes at a crucial time, as the cross-border payments market is projected to reach a staggering $250T by 2027, presenting a massive opportunity for blockchain-based solutions. Solana’s technology offers significant advantages that make it particularly well-suited for financial applications, especially in the realm of stablecoins and payment systems.

All in all, this integration could benefit both parties:

• Citibank: Enhanced ability to offer faster, more cost-effective cross-border payment solutions to its +200M clients.

• Solana: Access to a significantly larger Total Addressable Market (200M), potentially accelerating its adoption in the banking sector.

For context around Solana’s rising popularity, its growth can be reflected in both its expanding user base and increasing revenue:

• Monthly active users have increased 20-fold since the 2021 bull run from ~610K to 13.38M.

• Revenue for the first 9 months of this year reached $173M, compared to a peak of $14M in 2021.

Thus, this surge in network utilization has significantly improved Solana’s valuation metrics. The Price to Fees ratio has dropped by nearly 90% over the past three years, from 1802X to 172X, indicating that Solana’s value proposition has strengthened considerably due to increased fee generation partly driven by growing stablecoins and payment use cases.

The last major announcement was related to the second installment of the Solana Saga phone, called Seeker. The new device is designed with crypto-specific features that make interacting with blockchain technology more seamless and user-friendly:

• A built-in seed Vault Wallet offering seamless self-custody, fingerprint unlock, and double-click transaction sending for seamless payments.

• An updated dApp store with improved navigation for better app discoverability.

• Enhanced data access for third-party apps, allowing them to access more of the phone’s ”digital exhaust” data, which is valuable for

Decentralized Physical Infrastructure Networks (DePIN) projects. DePIN is a sector that’s been recently proving its Product Market Fit, particularly on Solana.

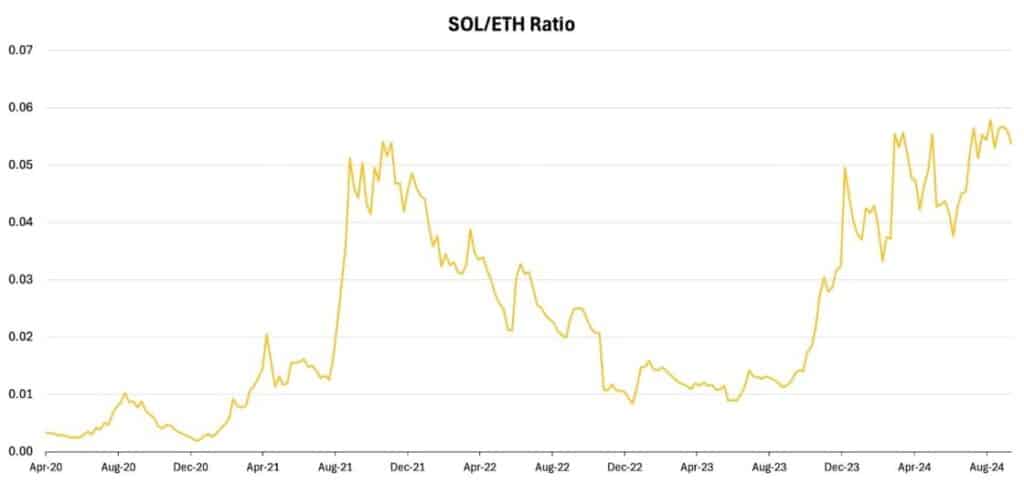

All in all, the device has the potential to catalyze the growth of blockchain-based applications by simplifying user interaction. By abstracting complex technical processes, it lowers the entry barrier for crypto-native applications, making them more accessible to a wider audience. To wrap up, SOL’s performance relative to ETH has reached new heights in recent weeks, as shown in Figure 3. This upward trend is expected to continue as the Solana network expands its use cases, driving increased demand for its native token.

Figure 3 – SOLETH Ratio

Source: CoinMarketCap

Unlocking New Use Cases on Sui

Solana’s direct rival Sui has also turned heads at Token2049, with its partnership with U.S.-based movie subscription platform MoviePass, as part of the latter’s comeback.

Coupled with this major development, the second largest stablecoin USDC is set to debut as the network’s second native stablecoin. This integration is expected to unlock new use cases, particularly in Sui’s partnership with MoviePass, where users will be able to sign up for the subscription service using the stablecoin. With nearly 3M subscribers, MoviePass is poised to boost Sui’s user base with this new integration.

Aside from Token2049’s announcement, Sui launched pre-sale orders for its new gaming device earlier this month. This would aim to diversify the use case of its blockchain together with its native token. Dubbed as Web3’s first handheld device, SuiPlay0X1 aims to take blockchain games to the mainstream, with native support for Sui games and Web2 publishers like Steam and Epic Games libraries, hoping to attract game developers to its user-friendly network.

Currently, there are over 85 dApps on Sui, entertaining over 25M accounts. To put Sui’s opportunity into perspective, with 2.6B gamers worldwide, SuiPlay0X1 is set to break into this massive market, bridging the gap between Web2 and Web3 gaming.

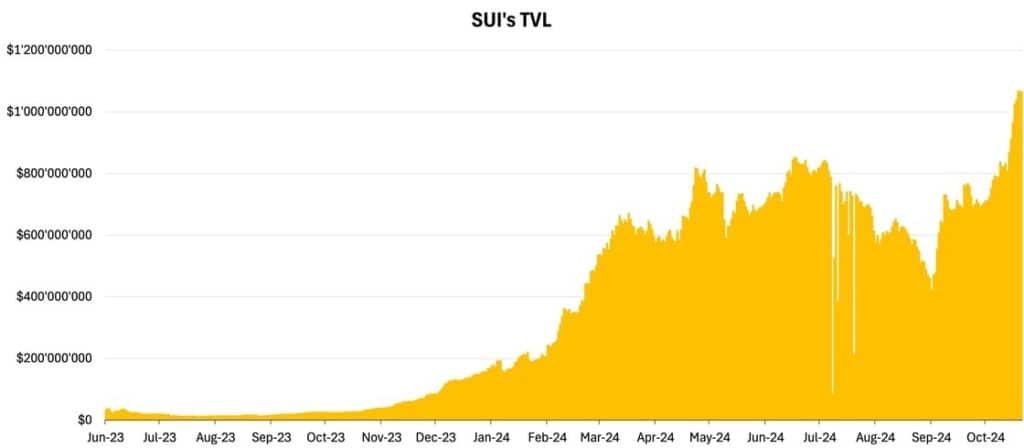

Finally, Sui added over 4 million new accounts over the past 30 days, enjoying over 760% monthly growth in new coins minted on the blockchain. This has evidently increased demand for its native token, which has pumped the token’s price by over 50% over the past month and drove total value locked (TVL) to break the $1B mark for the first time, as shown in

Figure 4 below.

Figure 4: SUI’s TVL Growth

Source: Artemis

Read our special Sui edition for more context about this booming network.

Overall, stablecoins have reached new highs this year, highlighting the growing demand that these initiatives have been targeting. Thus far, the stablecoins sub-sector has been crypto’s success story, with policymakers like Treasury Secretary Janet Yellen calling on Congress to provide regulatory clarity for stablecoins. As previously covered, the key role stablecoins played in increasing demand for U.S. debt is one of the primary reasons behind this political interest. Similarly, stablecoins are expected to drive more adoption to new use cases beyond decentralized finance.

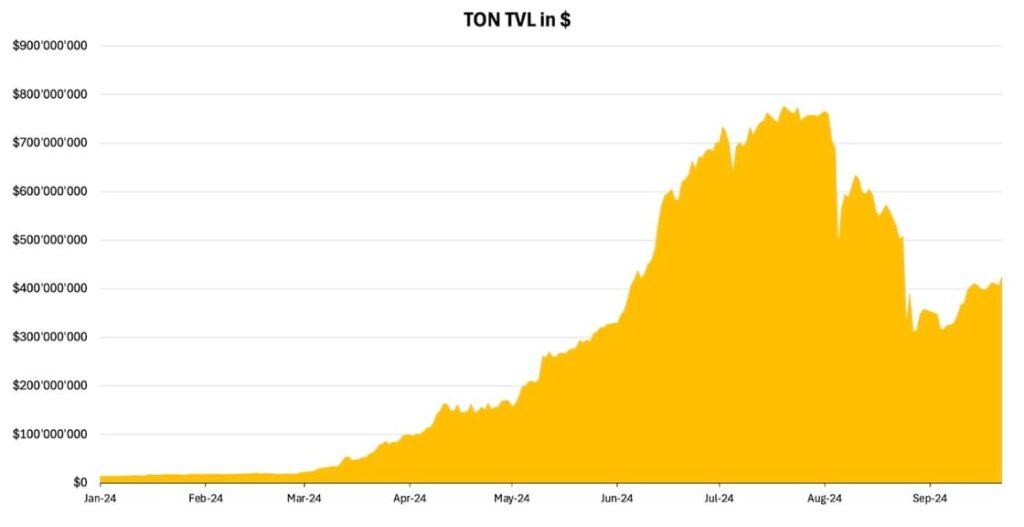

Shaking off recent turbulence, TON also had a few announcements set to amplify its adoption. TON, a layer-one blockchain originally developed by Telegram and now overseen by the TON Foundation, is known for its seamless integration with Telegram’s 900M-strong user base. For a deep dive into the project, see our previous newsletter.

TON’s rapid rise recently faced turbulence following the arrest of Telegram’s CEO Pavel Durov in August. This event temporarily stalled the network’s growth, especially in TVL, which peaked at $776M earlier this year. Toncoin, the network’s native token, dropped by 25% as market sentiment soured. However, the blockchain’s fundamentals remain strong. With a robust ecosystem of Mini-Apps tightly integrated into Telegram, TON’s scalability and adoption continue to progress despite external challenges.

Figure 5: TON’s TVL Growth

Source: Artemis

Riding with TON: TADA and Real-World Utility

A key development announced amid Token2049 was TON’s integration with TADA, a ride-sharing app operating across Southeast Asia, including Singapore, Thailand, Vietnam, and Cambodia. This partnership expands TON’s use case beyond crypto-native applications, bringing blockchain technology into mainstream, real-world services. TADA’s 3 million users can benefit from the advantages of blockchain—such as fast, secure transactions. This marks a major step forward for TON, as it abstracts away the complexities of blockchain and presents it as an easy-to-use tool embedded in everyday activities. It’s also another good step in onboarding new real-world applications to the MiniApp ecosystem that’s been focused mainly on tap-to-earn games so far.

That said, this collaboration has the potential to significantly increase the adoption of crypto and refine the ride-hailing market:

• It exposes TADA’s large user base in Southeast Asia to Web3 technology.

• By integrating with Telegram, which has over 900 million users, it provides a massive platform for introducing people to crypto payments.

• Instead of app downloads and subscription, users can book directly through Telegram and pay for their rides with TON or USDT.

• The zero-commission policy of TADA, coupled with blockchain-based payments, could lead to fairer pricing for both passengers and drivers.

Stepping Up TON’s DeFi Capabilities

Curve, known for its expertise in facilitating liquidity for similarly-priced assets, is set to help TON build a decentralized exchange (DEX) focused on stablecoin swaps using its stablecoin-focused automated market maker (AMM) model. Curve’s AMM is a crucial tool for minimizing stablecoin slippage, and is a cornerstone of any mature DeFi ecosystem. For context, Curve dominates almost 18% of all DEX volume, processing more than $80B in traded volume on a yearly basis.

Given its contribution to the DEX landscape, this integration is expected to significantly bolster TON’s DeFi capabilities, attracting both retail users and institutional investors looking for high-performance and low-fee environments.

By strategically expanding into both real-world applications like TADA and advancing its DeFi infrastructure through Curve Finance, TON continues to solidify its role as one of the most exciting projects in the blockchain space.

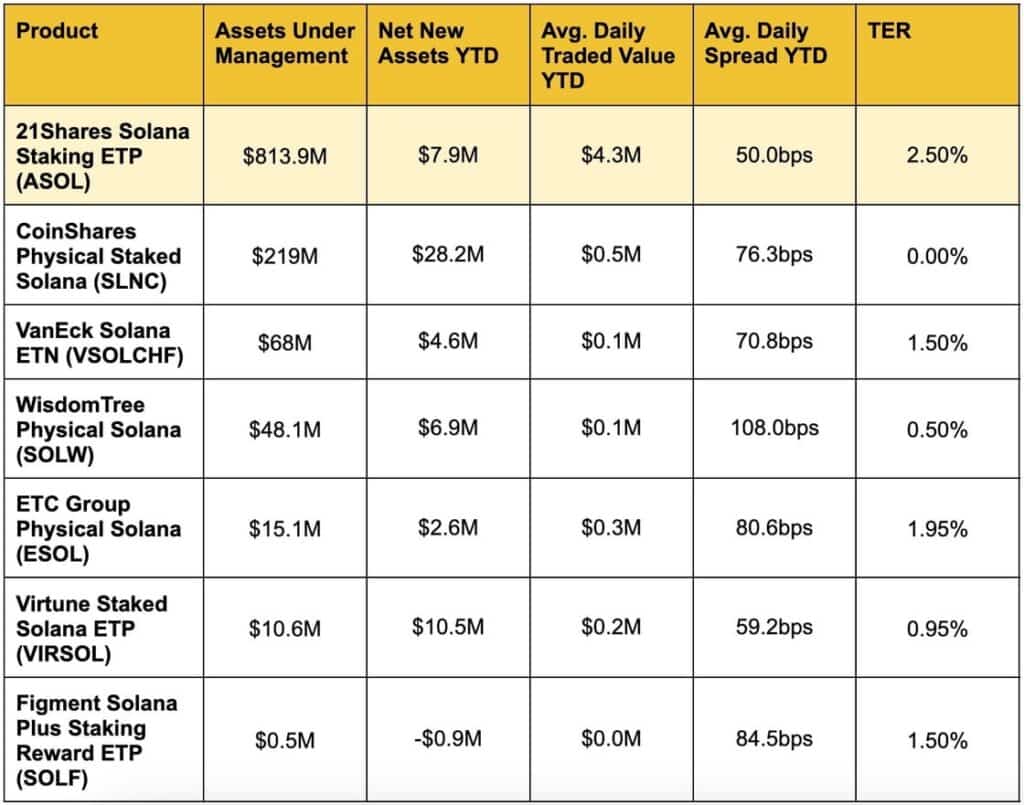

For investors looking to gain exposure to the latter-tail of the cryptoasset ecosystem and capitalize on the latest developments, 21Shares offers the following ETPs on the European market. These investment products provide a regulated way to capture growth opportunities within this rapidly evolving sector.

Figure 6 – Top Solana ETPs by Assets under Management

Source: Bloomberg, Data as of September 23, 2024.

Avg. Daily Spread YTD: refers to the best daily average bid/ask spread this year across European exchanges.

Figure 7 – Top Sui ETPs by Assets under Management

Source: Bloomberg, Data as of September 23, 2024.

Avg. Daily Spread YTD: refers to the best daily average bid/ask spread this year across European exchanges.

Figure 8 – Top TON ETPs by Assets under Management

Source: Bloomberg, Data as of September 23, 2024.

Avg. Daily Spread YTD: refers to the best daily average bid/ask spread this year across European exchanges.

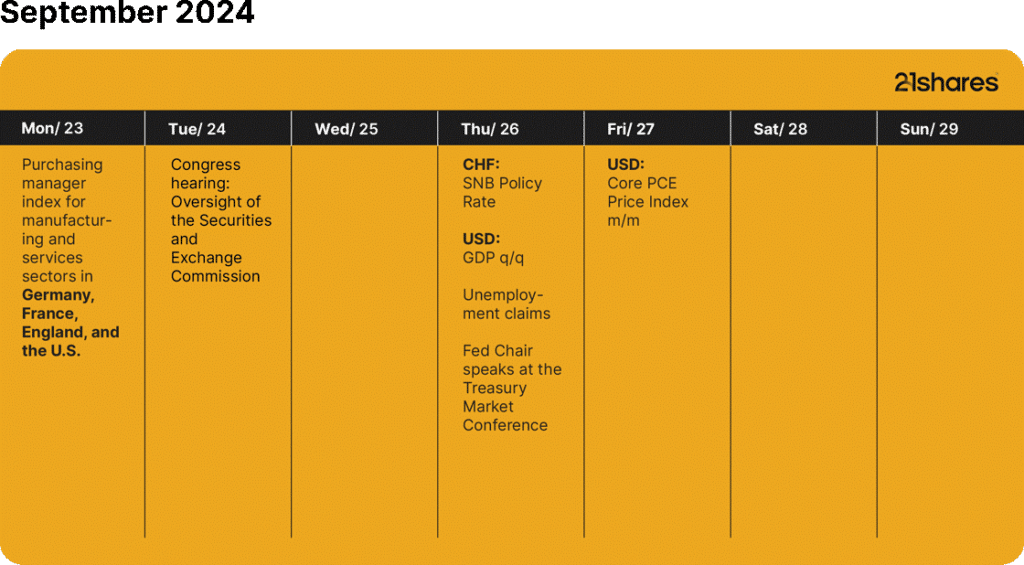

What’s happening this week?

The European Blockchain Convention is happening on Wednesday in Barcelona. If you’re attending, make sure to catch our very own Head of Research EMEA, Adrian Fritz, at 3:35 PM CET.

Source: Forex Factory, 21Shares

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

The Strategic Crypto Reserve: What You Need to Know

-

Valour utökar utbudet av digitala tillgångar med lanseringen på Börse Frankfurt

-

Investerarnas intresse kraftigt förändrat under februari 2025

-

Regulated Crypto Investing Starts Here

-

Bybit’s $1.5B Hack: The Largest in Internet History

-

ETN från WisdomTree ger tillgång till en korg med de 20 största kryptotillgångarna

Nyheter

GENDES ETF en valutasäkrad satsning på jämlikhet mellan könen

Publicerad

12 timmar sedanden

11 mars, 2025

UBS ETF (IE) Global Gender Equality UCITS ETF (hedged to CHF) A-acc (GENDES ETF) med ISIN IE00BDR5H412, strävar efter att spåra Solactive Equileap Global Gender Equality 100 (CHF Hedged)-index. Solactive Equileap Global Gender Equality 100 (CHF Hedged)-index spårar företag i utvecklade länder som är särskilt positiva när det gäller jämställdhet. Ingående lager vägs lika. Valuta säkrad till schweiziska franc (CHF).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,23 % p.a. UBS ETF (IE) Global Gender Equality UCITS ETF (hedged to CHF) A-acc är den billigaste och största ETF som följer Solactive Equileap Global Gender Equality 100 (CHF) Hedged) index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETF:n ackumuleras och återinvesteras.

UBS ETF (IE) Global Gender Equality UCITS ETF (hedged to CHF) A-acc har tillgångar på 155 miljoner euro under förvaltning. ETF lanserades den 19 december 2017 och har sin hemvist i Irland.

Översikt

Fonden investerar i allmänhet i Solactive Equileap Global Gender Equality 100 Leaders Net Total Return Index CHF Currency Hedged. Bolagens relativa viktning motsvarar deras viktning i index.

Investeringsmålet är att replikera pris- och avkastningsutvecklingen för Solactive Equileap Global Gender Equality 100 Leaders Netto Total Return Index CHF Valuta Hedged netto efter avgifter. Börskursen kan skilja sig från substansvärdet.

Fonden förvaltas passivt.

Handla GENDES ETF

UBS ETF (IE) Global Gender Equality UCITS ETF (hedged to CHF) A-acc (GENDES ETF) är en börshandlad fond (ETF) som handlas på SIX Swiss Exchange.

SIX Swiss Exchange är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| gettex | EUR | AW1A |

| SIX Swiss Exchange | CHF | GENDES |

Största innehav

| Värdepapper | ISIN | Sedol | Valuta | Vikt % |

| PINTEREST INC- CLASS A | US72352L1061 | BJ2Z0H2 | USD | 1.52 |

| META PLATFORMS INC-CLASS A | US30303M1027 | B7TL820 | USD | 1.51 |

| CITIGROUP INC | US1729674242 | 2297907 | USD | 1.29 |

| TELE2 AB-B SHS | SE0005190238 | B97C733 | SEK | 1.29 |

| SCHNEIDER ELECTRIC SE | FR0000121972 | 4834108 | EUR | 1.29 |

| BOSTON SCIENTIFIC CORP | US1011371077 | 2113434 | USD | 1.29 |

| XYLEM INC | US98419M1009 | B3P2CN8 | USD | 1.27 |

| AMERICAN EXPRESS CO | US0258161092 | 2026082 | USD | 1.25 |

| INTL FLAVORS & FRAGRANCES | US4595061015 | 2464165 | USD | 1.25 |

| PUBLICIS GROUPE | FR0000130577 | 4380429 | EUR | 1.23 |

Innehav kan komma att förändras

Nyheter

The US gets a Bitcoin Reserve and Digital Asset Stockpile

Publicerad

13 timmar sedanden

11 mars, 2025

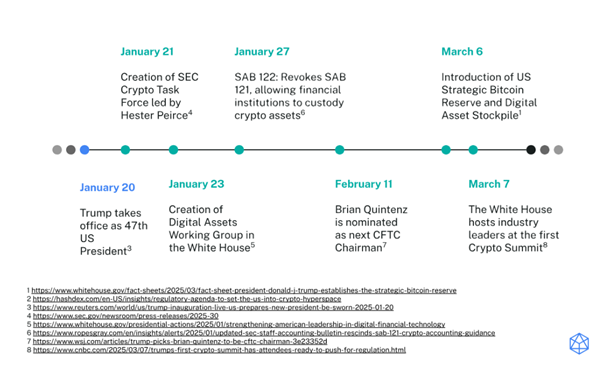

Digital assets continue to have a positive outlook in 2025 as the US regulatory and political environments aggressively shift to a pro-crypto stance. On March 6, President Trump signed an executive order establishing a Strategic Bitcoin Reserve and Digital Asset Stockpile.

Market Highlights

Bitcoin Strategic Reserve and crypto stockpile

The Bitcoin Reserve will be capitalized with BTC owned by the Department of Treasury, which could further increase via new budget-neutral acquisitions. The crypto stockpile will also include assets owned by the Treasury, without the possibility of future buys, with potential sells coming from strategic management of the stockpile.

This marks a major milestone for digital assets, with the US government starting to integrate major crypto assets, and continues the new administration’s work to lead the global crypto economy.

White house hosts first crypto summit

On March 7, the White House hosted the first Crypto Summit, bringing together key figures from the crypto industry and government officials to discuss the future of digital assets in the United States.

This underscores a shift towards a more collaborative approach to crypto regulation paving the way for more robust integration in the future.

SEC drops investigations on crypto companies

The SEC dropped investigations against Consensys and Yuga Labs, adding to recent dismissals against Coinbase, Kraken and Uniswap.

This highlights the new administration stance against regulation by enforcement of blockchain companies and investors.

Market Metrics

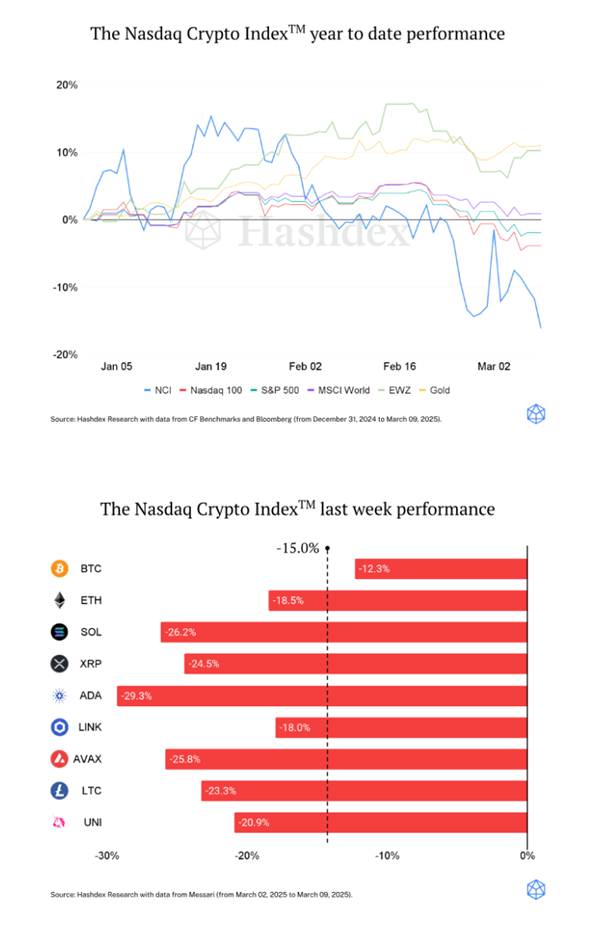

The NCITM faced challenges due to market uncertainty surrounding the escalation of a trade war, ending the week down 15% and underperforming other asset classes. Gold (+11%), in contrast, became the best-performing asset year-to-date, surpassing EWZ (+10.3%). Despite the recent negative momentum for the NCITM, crypto fundamentals continue to strengthen, as highlighted by Trump’s latest executive order, encouraging signs that could revert the negative trend of the past several weeks as we progress into 2025.

WisdomThree lanserar europeisk försvarsfond som noteras på Xetra i Tyskland. Samtidigt lanseras en ny fond med fokus på uran och kärnkraft-

WisdomTree, en global finansiell innovatör, har utökat sitt tematiska utbud genom att lansera två nya ETFer. WisdomTree Europe Defence UCITS ETF (EUDF) och WisdomTree Uranium and Nuclear Energy UCITS ETF (WNUC), noterade idag på Börse Xetra och Borsa Italiana med totalkostnadskvoter (TER) på 0,40% respektive 0,45%. ETFerna kommer att noteras på London Stock Exchange den 12 mars 2025.

| ETF namn | KORTNAMN | ISIN |

| WisdomTree Europe Defence UCITS ETF | EUDF | IE0002Y8CX98 |

| WisdomTree Uranium and Nuclear Energy UCITS ETF | WNUC | IE0003BJ2JS4 |

WisdomTree Europe Defence UCITS ETF (EUDF) strävar efter att spåra pris- och avkastningsutvecklingen, före avgifter och utgifter, för WisdomTree Europe Defence UCITS Index. Det proprietära indexet är utformat för att spåra prestanda för europeiska företag som är involverade i försvarsindustrin, vilket inkluderar tillverkare av civilförsvarsutrustning, delar eller produkter, försvarselektronik och rymdförsvarsutrustning. Indexet strävar efter att utesluta företag som är inblandade i kontroversiella vapen som är förbjudna enligt internationell lag, såsom klustervapen, antipersonella landminor och biologiska och kemiska vapen, samt företag som bryter mot UNGC-standarderna (United Nations Global Compact). EUDF är den första i sitt slag som enbart fokuserar på europeiska försvarsföretag.

Efter årtionden av underinvesteringar har europeiska nationer åtagit sig att öka försvarsbudgetarna för att uppfylla Nordatlantiska fördragets (NATO) mål på 2 % av BNP, med många som redan överskrider det. Ökningen av de europeiska försvarsutgifterna återspeglar en strategisk pivot för att hantera moderna hot och säkerställa regional säkerhet. Denna förändring skapar långsiktiga möjligheter inom områden som försvarstillverkning, teknisk innovation och rymdförsvar, och erbjuder betydande tillväxtpotential för både etablerade företag och nya aktörer inom branschen.

Kärnenergi återtar framträdande plats mitt i den ökande globala energiefterfrågan och det akuta behovet av att uppnå nettonollutsläpp. Urans exceptionella energitäthet, avancerade reaktorkonstruktioner, förnyat politiskt stöd och kärnenergins förmåga att tillhandahålla pålitlig, skalbar och ren energi är nyckelfaktorer som driver dess återuppkomst.

Pierre Debru, forskningschef för Europa, WisdomTree, sa: ”Kärnkraft ses i allt högre grad ha en viktig roll att spela i den framtida energimixen på grund av det politiska fokuset på energiomställningen, uppgången av geopolitiska spänningar med Ryssland och Kina, och den snabbt växande energiefterfrågan från datacenter, AI och kryptovalutor.” Kärnkraftstemat lades till WisdomTrees multitematiska strategi, WisdomTree Megatrends UCITS ETF, i april 2024.

Debru tillade, ”Försvar och säkerhet är underrepresenterade i många portföljer och har mött decennier av underinvesteringar i Europa, vilket resulterat i en betydande kapacitetsklyfta. En strukturell förändring pågår i Europa när nationer ökar försvarsbudgetarna för att möta Natos mål och svara på geopolitiska utmaningar. EUDF är den första ETF dedikerad till att ge exponering för den europeiska försvarsindustrin och är uppbyggd kring ett aktuellt och brådskande tema fokuserat på Europas strävan efter strategisk autonomi inom försvaret mitt i stigande geopolitiska spänningar.”

Alexis Marinof, VD, Europe, WisdomTree, tillade: ”Sedan vi lanserade vår första tematiska ETF 2018 har vi utvecklat klassens bästa forskningskapacitet som ger investerare högkvalitativa insikter om de teman vi erbjuder genom våra ETFer. Under åren har vår tematiska kapacitet vuxit avsevärt, vilket gör det möjligt för oss att producera grundläggande vitböcker som hjälper investerare att navigera i det tematiska universum och förstå hur dessa investeringar kan passa in i deras portföljer. Den verkliga omfattningen av vår forskningskapacitet återspeglas i dessa nya lanseringar, som utnyttjar proprietära index med aktieurval grundat på vår interna ämnesexpertis. Även om hyllplansindex spelar en roll i portföljer, är vårt fokus fortfarande på intelligent ETF-innovation – vilket ger investerarna renodlade, differentierade exponeringar.”

WisdomTree förvaltar 1,5 miljarder dollar i 14 olika tematiska ETFer.

ETF-information

| ETF Namn | TER | Börs | Valuta | Kortnamn | ISIN | Listningsdatum |

| WisdomTree Europe Defence UCITS ETF | 0.40% | Borsa Italiana | EUR | WDEF | IE0002Y8CX98 | 11 mars 2025 |

| 0.40% | Xetra | EUR | EUDF | IE0002Y8CX98 | 11 mars 2025 | |

| 0.40% | LSE | EUR | WDEF | IE0002Y8CX98 | 12 mars 2025 | |

| 0.40% | LSE | GBx | WDEP | IE0002Y8CX98 | 12 March 2025 | |

| WisdomTree Uranium and Nuclear Energy UCITS ETF | 0.45% | Borsa Italiana | EUR | NCLR | IE0003BJ2JS4 | 11 March 2025 |

| 0.45% | Xetra | EUR | WNUC | IE0003BJ2JS4 | 11 March 2025 | |

| 0.45% | LSE | USD | NCLR | IE0003BJ2JS4 | 12 March 2025 | |

| 0.45% | LSE | GBx | NCLP | IE0003BJ2JS4 | 12 March 2025 |

GENDES ETF en valutasäkrad satsning på jämlikhet mellan könen

The US gets a Bitcoin Reserve and Digital Asset Stockpile

WisdomThree lanserar europeisk försvarsfond.

Trumps återkomst får europeiska aktier att rusa

CBU5 ETF investerar i obligationer med förfall 2028

MONTDIV ETF är Sveriges första månadsutdelande ETF

Varför investera i indexfonder?

100 gånger pengarna, aktier som gör 10 000 kronor till 1 miljon

Montrose lanserar Sveriges första månadsutdelande ETF

BlackRock lanserar aktivt förvaltad Fixed Income UCITS ETF

Populära

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTDIV ETF är Sveriges första månadsutdelande ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVarför investera i indexfonder?

-

Nyheter1 vecka sedan

Nyheter1 vecka sedan100 gånger pengarna, aktier som gör 10 000 kronor till 1 miljon

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose lanserar Sveriges första månadsutdelande ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanBlackRock lanserar aktivt förvaltad Fixed Income UCITS ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanInvesterarnas intresse kraftigt förändrat under februari 2025

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSprotts Steve Schoffstall om kärnenergitrender, uranmarknaden och politiska effekter

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanNATO-anpassade Future of Defense ETF når en miljard USD i AUM