Nyheter

Global Growth Spots in 2016

Publicerad

9 år sedanden

January 08, 2016 by Jan van Eck, CEO, Global Growth Spots in 2016. An innovator of investment solutions, Jan van Eck has created a multitude of strategies spanning international, emerging markets, and commodities opportunities. He plays an active role in shaping the firm’s actively managed and ETF investment offerings. Jan’s research focus is on developments in China and technology’s effect on the financial services industry.

2016 Investment Outlook

Jan van Eck, CEO, shares his 2016 investment outlook, Global Growth Spots in 2016.

Van Eck 2016 Investment Outlook

Special Note on Recent Market Activity:

Since the filming of this video at yearend 2015, we have seen some notable market moves. In the past week, we’ve experienced several “OMG days” as China’s stock market has taken a dramatic tumble. Although this has created a lot of negativity and confusion regarding China, particularly in the media, our long-term outlook for China remains positive.

Long-Term Commodities Momentum Suggests a Bottom in Q1

TOM BUTCHER: Jan, let’s discuss your outlook for 2016. First: Commodities.

JAN VAN ECK: 2015 was an awful year for commodities. It was really the culmination of a decade-long bull market, and this has ended and brought commodity prices and the prices of commodity equities really to where they were before 2000-2001, before the commodities bull market started. I think the difficulty for markets — and this has really affected psychology over the last few quarters– is that the supply decreases that are inevitable with the slowdown have not yet hit where demand is. There will be a period when supply and demand will meet. Maybe it’s in 2016 for some commodities; maybe early 2017 for other commodities. But investors just hate this current period of uncertainty. There has also been a big credit crunch that has impacted commodity producers, from Petrobras to Glencore, to the MLP [master limited partnership] sector.

It is really difficult right now to look at all the fundamentals and figure out what’s going on. We know we’re in a bear market, and we know there will be a turn. The typical commodity cycle does take about 18 months, and that would mean the current cycle should end in the first quarter of 2016. We believe that is a good a guide as to when we are likely to see the bottom of this commodity cycle.

Opportunities for 2016: Growth Spots in Emerging Markets

BUTCHER: If there’s uncertainty in commodities, what about the emerging markets?

VAN ECK: Some countries are affected much more than others by commodities among the emerging markets. It’s really funny because we’ve read so much this year about China and the stock market fall, but really, the country that had the most difficulty in 2015 was Brazil. Brazil was impacted by the fall in commodities, the over-leveraged commodities in its economy, political uncertainty, corruption, and a whole number of different factors that has led to a fall in not only Brazil’s financial markets, but also in its currency. We are likely to enter 2016 with a lot of uncertainty around Brazil.

Everyone knows now that China’s growth is slowing down. 2015 was a hugely pivotal year for China, in which it really entered the world’s capital markets. What I like to say is that 2001 and 2015 were the most important years for China in the last 30 years. In 2001, China entered the world trading system and trade interaction with other countries exploded. Last year, 2015, it became clear that there was enough money moving in and out of China, that China couldn’t separate its interest rate from its exchange rate. Given this, we know that China’s interest rate cycle is on a downward trajectory. That means China’s currency will probably weaken in 2016. We just don’t think it’ll be too chaotic. Perhaps something on the order of 10% to 15%, and it’s already started depreciating now.

For emerging markets, we like to focus on where there are growth spots, and there are a number of sectors and countries that are doing quite well in the emerging markets in this slow-growth world.

BUTCHER: Can you give me two examples of such growth spots?

VAN ECK: I think in 2016 and looking forward, that global growth is not going to accelerate, as we have said before. Monetary and fiscal policies in the U.S. are on the margin contractionary and will likely stay generally the same in 2016, and the same structural issues that the developed world has will likely continue to exist. Growth in the emerging markets is not even. But there are several industries that are growing relatively aggressively. There are growth spots that we are excited about in 2016. I will identify a couple of examples that represent trends that are less mainstream. Everyone knows about the more mainstream trends, like the internet consumption in China through Alibaba and other internet players. First, Turkey created some tax incentives for savings plans, like a 401(k) savings plan we have here in the United States. And that growth has been 20% to 40% a year, because it’s just taking off. Mobile payments in Africa are another trend. With several emerging markets, payment systems have leap frogged what we’ve done here in the United States, and people make most payments and transactions using mobile phones, and cell phone penetration in Africa is relatively high. A third example would be private banking in India, which is just another secular trend where the financial sector is reforming, and private players appear to be benefiting. Again, it has been a 20% growth industry. These are the types of emerging markets trends and sectors that investors can take advantage of, but are difficult to access. They are not always available through a mainstream index, so accessing them generally favors an active management approach.

Credit Markets are Historically Cheap and a New Asset Class Provides Opportunity

BUTCHER: Can you talk about fixed income investing?

VAN ECK: There are two points that we would make about fixed income investing. First, spreads have increased quite a bit over the last year. In fact, interest rate spreads for corporate debt are as high as they’ve really been over the last 15 years, putting aside the credit crunch of 2008-2009. This means you’re getting paid a lot to invest in high-yield debt, in MLPs, and other types of fixed-income closed-end funds. Is this the time to buy? Over the next 12 months or so, we think it could be pretty interesting to buy fixed income. That’s the first point. People talk about the rate increases, but really, spreads have been widening over the course of the year, and so we believe that makes fixed income more attractive.

Secondly, there is this new asset class that we’re very interested in that accesses loans that are originated from online lending platforms like Lending Club and Prosper. They’re called marketplace loans or online loans. And what this asset class does is allow investors, for the first time, to invest in consumer credit. If you think about it, there is bank lending, company bonds, and the bond market. Individual investors have always been able to invest in company bonds. But we’ve never been able to invest directly in the debt of individuals. It’s always been through financial institutions. But now, consumer debt can be invested in through online platforms. To me, this represents a new asset class, and it’s a trillion-dollar asset class, which is huge. We feel The American consumer is in pretty good shape, and currently that the asset class is relatively attractive.

BUTCHER: Wonderful, thank you.

IMPORTANT DISCLOSURE

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The views and opinions expressed are those of the speaker(s) and are current as of the posting date. Commentaries are general in nature and should not be construed as investment advice. Opinions are subject to change with market conditions. All performance information is historical and is not a guarantee of future results.

You can obtain more specific information on Van Eck Global strategies by visiting Investment Strategies.

Please note that Van Eck Securities Corporation offers investment products that invest in the asset class(es) and which may hold securities mentioned in this video. Commodities: You can lose money by investing in a commodities fund. Any investment in a commodities fund should be part of an overall investment program, not a complete program. Commodities are assets that have tangible properties, such as oil, metals, and agriculture. Commodities and commodity-linked derivatives may be affected by overall market movements and other factors that affect the value of a particular industry or commodity, such as weather, disease, embargoes or political or regulatory developments. The value of a commodity-linked derivative is generally based on price movements of a commodity, a commodity futures contract, a commodity index or other economic variables based on the commodity markets. Derivatives use leverage, which may exaggerate a loss. A commodities fund is subject to the risks associated with its investments in commodity-linked derivatives, risks of investing in wholly owned subsidiary, risk of tracking error, risks of aggressive investment techniques, leverage risk, derivatives risks, counterparty risks, non-diversification risk, credit risk, concentration risk and market risk. The use of commodity-linked derivatives such as swaps, commodity-linked structured notes and futures entails substantial risks, including risk of loss of a significant portion of their principal value, lack of a secondary market, increased volatility, correlation risk, liquidity risk, interest-rate risk, market risk, credit risk, valuation risk and tax risk. Gains and losses from speculative positions in derivatives may be much greater than the derivative’s cost. At any time, the risk of loss of any individual security held by a commodities fund could be significantly higher than 50% of the security’s value. Investment in commodity markets may not be suitable for all investors. A commodity fund’s investment in commodity-linked derivative instruments may subject the fund to greater volatility than investment in traditional securities. Emerging Markets: Investments in foreign securities involve a greater degree of risk including currency fluctuations, economic instability and political risk. Changes in currency rates and differences in accounting and taxation policies outside the U.S. can raise or lower returns. Investing in emerging markets, of which frontier markets is a subset, involve a heightened degree of risk, including smaller sized markets, less liquid markets and other risks associated with less established legal, regulatory, and business infrastructures to support securities markets. Due to these factors and others, the risks associated with emerging markets are increased in emerging markets. Fixed Income: Bonds and bond funds will decrease in value as interest rates rise. Please note that generally, unconstrained bond funds may have higher fees than core bond funds due to the nature of their strategies. Online-Sourced Loans: Online-sourced loans are subject to certain investment risks, including interest rate risk. When interest rates rise, the market value of a loan will generally fall. This risk may be particularly acute because market interest rates are currently at historically low levels. There is currently no active secondary trading market for platform loans. Online loans may be unsecured and have speculative characteristics and therefore may be high risk.

Investing involves risk, including possible loss of principal. An investor should consider investment objectives, risks, charges and expenses of any investment strategy carefully before investing. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Van Eck Securities Corporation.

© Van Eck Global.

IMPORTANT DISCLOSURE

The views and opinions expressed are those of the speaker and are current as of the posting date. Commentaries are general in nature and should not be construed as investment advice. Opinions are subject to change with market conditions. All performance information is historical and is not a guarantee of future results.

You can obtain more specific information on Van Eck Global strategies by visiting Investment Strategies.

Investing involves risk, including possible loss of principal. An investor should consider investment objectives, risks, charges and expenses of any investment strategy carefully before investing. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of Van Eck Securities Corporation.

Van Eck Securities Corporation, Distributor

666 Third Avenue

New York, NY 10017

800.826.2333

This message is intended only for the personal and confidential use of the designated recipient. If you are not the intended recipient of this message you are hereby notified that any review, dissemination, distribution, or copying of this message is strictly prohibited. This communication is for informational purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial product, an official confirmation of any transaction, or as an official statement of Van Eck Global or any of its subsidiaries. Email transmissions cannot be guaranteed to be secure or error-free. Therefore we do not represent that this information is complete or accurate and it should not be relied upon as such. All information is subject to change without notice. All emails at Van Eck Global are, in accordance with Firm policy, to be used for Van Eck Global business purposes only. Emails sent from or to the Firm are subject to review by the Firm in accordance with the Firm’s procedure for the review of correspondence.

©Van Eck Global. All rights reserved

Du kanske gillar

-

April in ETFs: Gold at New Highs, Crypto in Transition, and Moat Index Holding Steady

-

Introduction to Celestia

-

Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

-

JLOC ETF är obligationer från emerging markets i lokal valuta

-

JSDM ETF aktiv förvaltning av aktier från emerging markets

-

Q2 2025 Outlook: In the Middle of the 3% Reckoning

Nyheter

April in ETFs: Gold at New Highs, Crypto in Transition, and Moat Index Holding Steady

Publicerad

8 timmar sedanden

2 maj, 2025

As April winds down, markets remain on edge, with escalating tariffs and renewed trade tensions keeping volatility in focus. In this summary of our full-length newsletter, we spotlight gold and gold equities, both of which have surged to record levels. We also take a step back from the day-to-day noise in crypto to explore the broader shifts in the regulatory landscape in our latest Whitepaper and present Celestia in detail. Finally, we assess how Moat indexes have held up and evolved amid the turbulence.

Your VanEck Europe team wishes you a great read.

Featured Articles

🥇 Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

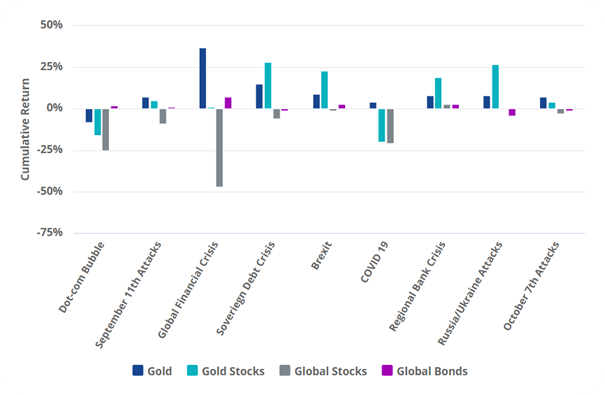

Gold & Gold mining equities tend to shine during stress periods

Source: VanEck, World Gold Council.

Gold has attracted renewed interest from investors amid concerns about inflation, currency volatility, and overall market uncertainty. Gold mining companies have recently reported improved profit margins and cash generation, with some initiating share buybacks and maintaining relatively strong balance sheets. Despite these developments, many continue to trade below their historical valuation averages.

While historical trends indicate that gold and gold mining equities have outperformed during certain periods of market stress, these patterns may not repeat under different economic conditions. Performance can be influenced by a range of factors including interest rates, central bank policy, geopolitical developments, and investor sentiment.

→ Read more

⚖️ Whitepaper Highlights: How New Crypto Regulations May Shape the Future

Cryptocurrencies are entering a new era. With the re-election of Donald Trump and the implementation of the European Union’s Markets in Crypto-Assets (MiCA) regulation, digital assets are moving into a landscape defined not just by innovation, but also by regulatory clarity.

MiCA’s structured and transparent approach aims to promote legitimacy, safeguard investors, and enhance trust in digital asset markets across Europe. It could also serve as a blueprint for other jurisdictions looking to regulate crypto effectively.

→ Read the Whitepaper Highlights

⛓️ Introduction to Celestia

Most blockchains, like Ethereum or Bitcoin, are monolithic which means they perform all major functions (consensus, data availability, and execution) on a single layer. This design ensures security but according to new modular networks, limits scalability and flexibility.

The modular blockchain thesis, which Celestia is leading, proposes separation of layers and respective responsibilities in the network.

→ Read more

Note: This article in not accessible to our UK readers.

🌊 Riding the Gold Wave

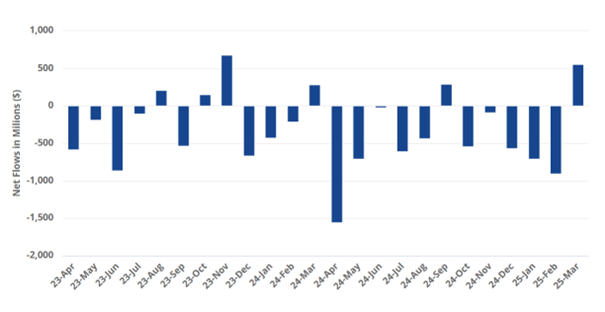

Chasing the Vein: Fund Flows into Gold Miners

Source: Mining.com. Data as of 21 March 2025. Note: Data covers 493 funds with combined assets under management of $62 billion.

U.S. equity markets experienced significant declines during the month of March. Meanwhile, spot gold price recorded new all-time highs, surpassing the $3,000 per ounce mark on 14 March and closing at a record price of $3123.57 on March 31, a 9.30% ($265.73) monthly gain. As of 31 March, gold prices have risen by 93.61% over the past five years (1). Investors should keep in mind that past performance is not representative of future results.

The gold miners, as represented by the NYSE Arca Gold Miners Index (GDMNTR), outperformed significantly, up 15.51% during March (2). This gain reflects both their operational leverage to rising gold prices and market perceptions of relative value. However, gold miners can also be subject to heightened volatility, operational risks, and sensitivity to commodity price swings.

While gold and gold equities may serve as diversifiers in a portfolio due to their historically low correlations with many asset classes, investors should remain mindful of the inherent risks, including price volatility, currency movements, and shifts in investor sentiment that can lead to rapid reversals in performance.

→ Read more

🌪️ Moat Stocks Weather Tariff Tumble

Market turbulence in March weighed on stocks. The Moat Index was not immune to the market turmoil, as it declined along with the broad U.S. equity market ending the month lower. However, the Moat Index showed resilience relative to the S&P 500—thanks in part to defensive sector resilience and underweight exposure to mega-caps.

At the same time, the SMID Moat Index lagged small and mid-caps in March. Smaller U.S. stocks were also impacted by global trade tensions and economic growth concerns with the broad small- and mid-cap benchmarks falling during the month. However, year-to-date, the SMID Moat Index remains ahead of the broader small- and mid-cap markets.

This is a preview of our monthly ETF insights email newsletter.

To receive the full version, sign up here.

(1) Source: World Gold Council, ICE Data Services, FactSet Research Systems Inc.

(2) Source: Financial Times.

IMPORTANT INFORMATION

This is marketing communication. Please refer to the prospectus of the UCITS and to the KID/KIID before making any final investment decisions. These documents are available in English and the KIDs/KIIDs in local languages and can be obtained free of charge at www.vaneck.com, from VanEck Asset Management B.V. (the “Management Company”) or, where applicable, from the relevant appointed facility agent for your country.

For investors in Switzerland: VanEck Switzerland AG, with registered office in Genferstrasse 21, 8002 Zurich, Switzerland, has been appointed as distributor of VanEck´s products in Switzerland by the Management Company. A copy of the latest prospectus, the Articles, the Key Information Document, the annual report and semi-annual report can be found on our website www.vaneck.com or can be obtained free of charge from the representative in Switzerland: Zeidler Regulatory Services (Switzerland) AG, Neudtadtgasse 1a, 8400 Winterthur, Switzerland. Swiss paying agent: Helvetische Bank AG, Seefeldstrasse 215, CH-8008 Zürich.

For investors in the UK: This is a marketing communication targeted to FCA regulated financial intermediaries. Retail clients should not rely on any of the information provided and should seek assistance from a financial intermediary for all investment guidance and advice. VanEck Securities UK Limited (FRN: 1002854) is an Appointed Representative of Sturgeon Ventures LLP (FRN: 452811), which is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, to distribute VanEck´s products to FCA regulated firms such as financial intermediaries and Wealth Managers.

This information originates from VanEck (Europe) GmbH, which is authorized as an EEA investment firm under MiFID under the Markets in Financial Instruments Directive (“MiFiD). VanEck (Europe) GmbH has its registered address at Kreuznacher Str. 30, 60486 Frankfurt, Germany, and has been appointed as distributor of VanEck products in Europe by the Management Company. The Management Company is incorporated under Dutch law and registered with the Dutch Authority for the Financial Markets (AFM).

This material is only intended for general and preliminary information and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision on the basis of this information. The views and opinions expressed are those of the author(s) but not necessarily those of VanEck. Opinions are current as of the publication date and are subject to change with market conditions. Information provided by third party sources is believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed.

Morningstar® Wide Moat Focus IndexSM, Morningstar® US Sustainability Moat Focus Index, Morningstar® US Small-Mid Cap Moat Focus IndexSM, and Morningstar® Global Wide Moat Focus IndexSM are trademarks or service marks of Morningstar, Inc. and have been licensed for use for certain purposes by VanEck. VanEck’s ETFs are not sponsored, endorsed, sold or promoted by Morningstar, and Morningstar makes no representation regarding the advisability of investing in the ETFs. Morningstar bears no liability with respect to the ETFs or any securities.

Effective December 15, 2023, the carbon risk rating screen was removed from the Morningstar® US Sustainability Moat Focus Index. Effective December 17, 2021, the Morningstar® Wide Moat Focus IndexTM was replaced with the Morningstar® US Sustainability Moat Focus Index. Effective June 20, 2016, Morningstar implemented several changes to the Morningstar® Wide Moat Focus Index construction rules. Among other changes, the index increased its constituent count from 20 stocks to at least 40 stocks and modified its rebalance and reconstitution methodology. These changes may result in more diversified exposure, lower turnover, and longer holding periods for index constituents than under the rules in effect prior to that date.

NYSE Arca Gold Miners Index is a service mark of ICE Data Indices, LLC or its affiliates (“ICE Data”) and has been licensed for use by VanEck UCITS ETF plc (the “Fund”) in connection with the ETF. Neither the Fund nor the ETF is sponsored, endorsed, sold or promoted by ICE Data. ICE Data makes no representations or warranties regarding the Fund or the ETF or the ability of the NYSE Arca Gold Miners Index to track general stock market performance. ICE DATA MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE NYSE ARCA GOLD MINERS INDEX OR ANY DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name “ICE Data”, and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data’s prior written approval. The Fund has not been passed on as to its legality or suitability, and is not regulated, issued, endorsed’ sold, guaranteed, or promoted by ICE Data.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Van Eck Associates Corporation. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, Inc., and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC. For more information on any of S&P Dow Jones Indices LLC’s indices please visit www.spdji.com. S&P® is a registered trademark of S&P Global and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors make any representation or warranty, express or implied, as to the ability of any index to accurately represent the asset class or market sector that it purports to represent and neither S&P Dow Jones Indices LLC, Dow Jones Trademark Holdings LLC, their affiliates nor their third party licensors shall have any liability for any errors, omissions, or interruptions of any index or the data included therein.

It is not possible to invest directly in an index.

Investing is subject to risk, including the possible loss of principal. Investors must buy and sell units of the UCITS on the secondary market via an intermediary (e.g. a broker) and cannot usually be sold directly back to the UCITS. Brokerage fees may incur. The buying price may exceed, or the selling price may be lower than the current net asset value. The indicative net asset value (iNAV) of the UCITS is available on Bloomberg. The Management Company may terminate the marketing of the UCITS in one or more jurisdictions. The summary of the investor rights is available in English at: complaints-procedure.pdf (vaneck.com). For any unfamiliar technical terms, please refer to ETF Glossary | VanEck.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH ©VanEck Switzerland AG © VanEck Securities UK Limited

Nyheter

BBVAE ETF är en spansk ETF som spårar Eurostoxx 50

Publicerad

9 timmar sedanden

2 maj, 2025

BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado (BBVAE ETF) med ISIN ES0105321030, strävar efter att spåra EURO STOXX® 50-index. EURO STOXX® 50-indexet följer de 50 största företagen i euroområdet.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,20 % p.a. ETFen replikerar resultatet av det underliggande indexet genom full replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen delas ut till investerarna (halvårsvis).

BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado har tillgångar på 133 miljoner euro under förvaltning. Denna ETF lanserades den 3 oktober 2006 och har sin hemvist i Spanien.

Beskrivning BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado

Med BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado deltar investerare i ökningen av värdet på aktierna i de 50 största konglomeraten i euroområdet (euroområdet). Euro Stoxx 50-indexet inkluderar aktier från 8 länder i euroområdet: Belgien, Finland, Frankrike, Tyskland, Irland, Italien, Nederländerna och Spanien.

Handla BBVAE ETF

BBVA Acción Eurostoxx 50 ETF FI Cotizado Armonizado (BBVAE ETF) är en börshandlad fond (ETF) som handlas på Bolsa de Madrid.

Bolsa de Madrid är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Bolsa de Madrid | EUR | BBVAE |

Största innehav

| Värdepapper | Vikt % |

| ASML Holding NVNL0010273215 | 8,59% |

| Lvmh Moet Hennessy Louis Vuitton SEFR0000121014 | 5,60% |

| SAP SEDE0007164600 | 5,16% |

| TotalEnergies SEFR0000120271 | 4,59% |

| Siemens AGDE0007236101 | 3,70% |

| Schneider Electric SEFR0000121972 | 3,46% |

| Future on Euro Stoxx 50 | 3,02% |

| Sanofi SAFR0000120578 | 2,99% |

| L’Oreal SAFR0000120321 | 2,98% |

| Allianz SEDE0008404005 | 2,93% |

Innehav kan komma att förändras

Nyheter

The Art of Meme-ing: How Dogecoin Redefined Value

Publicerad

10 timmar sedanden

2 maj, 2025

Explore Dogecoin’s impact on crypto, turning internet memes into cultural and financial assets.

𝕋𝕚𝕞𝕖 ℂ𝕠𝕕𝕖𝕤:

00:00 – Intro

00:27 – Where do Memes come from?

03:13 – What are some of the first Memes you remember?

10:28 – Do these things have value?

14:04 – The different types of cryptocurrencies

17:20 – How did Dogecoin start?

24:26 – What is some of the utility?

28:36 – How does it fit into the portfolio?

30:38 – Final thoughts

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

April in ETFs: Gold at New Highs, Crypto in Transition, and Moat Index Holding Steady

BBVAE ETF är en spansk ETF som spårar Eurostoxx 50

The Art of Meme-ing: How Dogecoin Redefined Value

VGGF ETF köper statsobligationer från hela världen

Vilka ETFer investerar i europeiska Small Cap-aktier?

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Världens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

Europeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanHANetfs Tom Bailey om framtiden för europeiska försvarsfonder

-

Nyheter1 vecka sedan

Nyheter1 vecka sedanFastställd utdelning i MONTDIV april 2025