Nyheter

G20 summit in Rio: Lula enhances Brazil’s international reputation

Publicerad

6 månader sedanden

From 18 to 19 November 2024, Brazil will host the G20 summit in Rio for the first time as the focus of the world’s most important platform for global economic cooperation.

The coalition, which includes the USA, China, India, the E U and, most recently, the African Union, represents the world’s most important economies, which, according to OECD figures, account for around 80 per cent of global gross domestic product, 75 per cent of world trade and two thirds of the world’s population.

Since Brazilian President Luiz Inácio Lula da Silva (Lula) took up his third uninterrupted term of office at the beginning of 2023, he has spent a lot of time abroad to improve his country’s image in the world. His efforts could pay off. A recent Pew Research survey found that most Brazilian adults are optimistic about their country’s status as an international power.

In addition to the G20, Brazil is also set to host other high-profile events such as the UN Climate Change Conference (COP30) and the BRICS summit (Brazil, Russia, India, China and South Africa) in 2025, while also seeking membership of the Organisation for Economic Co-operation and Development (OECD).

In the almost three years since Brazil initiated its formal accession process for OECD membership, the country has achieved many milestones on the road to this goal. If successful, Brazil would be in a unique position to influence the increasing geopolitical and economic competition between industrialised and developing countries, as it is the only country to be represented in the BRICS, the G20 and the OECD simultaneously.

As the eighth largest economy in the world and the largest economy in Latin America, Brazil could be a strong link in the global discourse on key issues for the Global South (according to UN Trade and Development, the Global South essentially comprises Africa, Latin America and the Caribbean, Asia excluding Israel, Japan and South Korea, and Oceania excluding Australia and New Zealand).

These issues include, above all, the fight against hunger, poverty and inequality, sustainable development and the reform of global governance. If Brazil is able to achieve political and financial commitments to progress on priorities such as digital infrastructure, this could lead not only to an increase in Brazil’s GDP, but also to a narrowing of the economic and urban-rural divide and a reduction in gender inequality. Consider that the introduction of a relatively new instant money transfer platform operated by the central bank, known as Pix, has already promoted financial inclusion and increased access to banking services from around 70 per cent of the population to more than 84 per cent (source: Carnegie Endowment for International Peace).

We expect that an OECD seal of approval for Brazil will also encourage global investors seeking the assurance of the Coalition’s high standards for the ease of doing business. A seat at the table would give Brazil a stronger voice in shaping best practices and global frameworks for rapidly evolving technology standards. Brazilian companies specialising in artificial intelligence and financial technology are already among the largest in South America.

As the largest oil producer in Latin America, resource-rich Brazil is a leader in the energy sector, as it is one of the ten largest oil producers in the world (according to the U.S. Energy Information Administration, Brazil produced 4 per cent of the world’s total oil production at the end of 2023). However, the country’s largest sector is finance, with a weighting of more than 36 per cent according to the MSCI Brazil Index.

Central bank in interest rate hike mode

High government spending continues to be a major problem. In our opinion, any reduction in this spending would give the country’s capital markets cause for optimism. Meanwhile, Brazil is an exception to the global trend of falling interest rates: In September, Brazil’s central bank raised interest rates to curb inflationary pressures. The market expects the Brazilian real to remain stable or appreciate slightly in the near future, partly due to falling US interest rates. We see this as a potential advantage for foreign investors in Brazil.

It is also encouraging to see that progress is being made on Brazil’s long-awaited VAT reform, which could further boost the private sector as efficiency gains from a simpler tax system would favour investment.

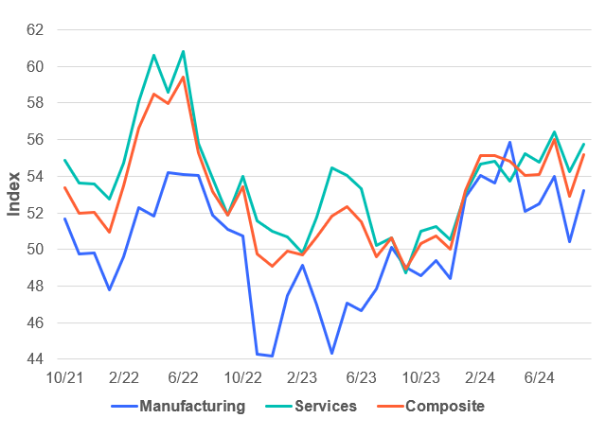

Growth in Brazil’s manufacturing and services sectors accelerated in September as output in both sectors increased, indicating strong growth in economic activity. In addition, the Brazilian market is currently trading at valuations that we consider favourable. Improved conditions in Brazil’s manufacturing sector have been driven by a resurgence in production, stronger job creation and a pick-up in sales growth, according to S&P Global. At the end of September, Brazil’s Manufacturing Purchasing Managers’ Index was surpassed only by India, rising to 53.2 (from 50.4 in August; readings above 50 indicate expansion).

Chart 1: Brazilian Purchasing Managers’ Index

Source: FactSet, Markit Economics

Expectations are also high that Brazil will experience an economic boost in 2027, having won the historic bid to host the FIFA Women’s World Cup – a first not only for Brazil, but for the whole of South America.

Over the near term, we believe investors should stay attuned to the opportunities in Brazil and may find what we consider an attractive entry point into this large and diverse market.

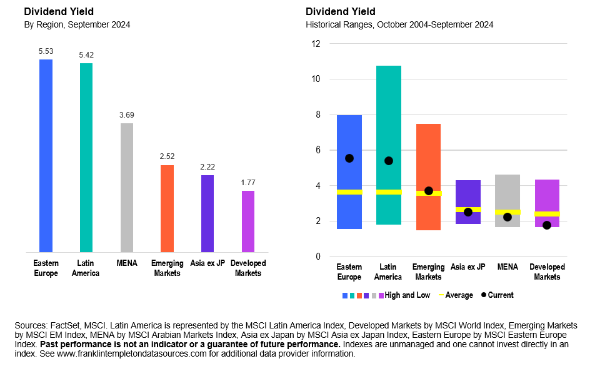

Chart 2: The valuations of Latin American equities look favourable

Attractive valuations compared to industrialised countries, emerging markets and own history

Chart 3: Latin American equities offer high dividends

High dividend yield compared to industrialised countries, emerging markets and own history

From Dina Ting, Head of Global Index Portfolio Management at Franklin Templeton

Du kanske gillar

-

Amerant Investments går in i Europa med lanseringen av en aktiv Latin American Debt ETF

-

De spanska fonder som gick bäst i januari

-

Investera i Latinamerika med hjälp av börshandlade fonder

-

Brazil’s BTC reserve proposal, US regulatory shifts, and Russia’s new crypto legislation

-

ALAU ETF ger en exponering mot aktiemarknaderna i Latinamerika

-

Börshandlade fonder gör det enkelt att kunna investera i Brasilien

Det enklaste sättet att investera på hela den sydkoreanska aktiemarknaden är att investera i ett brett marknadsindex. Detta kan göras till låg kostnad genom att använda ETFer för att investera i Sydkorea.

På den sydkoreanska aktiemarknaden finns det tre index som spåras av sex olika ETFer. Ett annat alternativ är att investera i index på Asien-Stillahavsområdet och tillväxtmarknader.

Index på sydkoreanska aktier

För en investering på den sydkoreanska aktiemarknaden finns det tre tillgängliga index som spåras av sex olika ETFer. På FTSE Korea 30/18 Capped-index finns en ETF. På MSCI Korea 20/35-indexet finns fyra olika ETFer. På MSCI Korea 20/35 Custom-indexet finns en ETF. Den totala kostnadskvoten (TER) för ETFer på dessa index är mellan 0,09 % p.a. och 0,74 % p.a.

| Index | Fokus | Antal ETFer | Antal aktier | Beskrivning |

| FTSE Korea 30/18 Capped | Sydkorea | 1 | 161 | FTSE Korea 30/18 Capped-index följer de största aktierna från Sydkorea. Det största bolaget i indexet är begränsat till högst 30 procent av indexkapitaliseringen, alla övriga indexkomponenter till högst 18 procent. |

| MSCI Korea 20/35 | Sydkorea | 4 | 111 | MSCI Korea 20/35-indexet följer koreanska aktier med stora och medelstora börser. Vikten av den största beståndsdelen är begränsad till 35 % och vikten av alla andra beståndsdelar är begränsad till maximalt 20 %. |

| MSCI Korea 20/35 Custom | Sydkorea | 1 | 111 | MSCI Korea 20/35 Custom-indexet spårar koreanska aktier med stora och medelstora börser. Vikten av den största beståndsdelen är begränsad till 35 % och vikten av alla andra beståndsdelar är begränsad till maximalt 20 %. En buffert på 10 % tillämpas på dessa limiter vid varje indexombalansering. |

Olika index kan ge olika utveckling

Att olika index kan ge olika resultat är klart. Ett av de mest klassiska exemplen på detta är S&P 500 och Nasdaq-100 i USA. Båda två är så kallade benchmarks som ofta nämns i nyhererna, men de spårar olika saker.

När det gäller Sydkorea så finns det tre index, FTSE Korea 30/18 Capped, MSCI Korea 20/35 och MSCI Korea 20/35 Custom, som båda omfattar sydkoreanska large och mid cap företag. De är olika viktade, men bör kunna anses fungera som en bra proxy för varandra.

Den som överväger att investera i någon av dessa fonder måste således bestämma sig för vilken del av den sydkoreanska ekonomin som de önskar exponering mot. Först därefter går det att välja vilken ETF att investera i.

Baserat på svaret är det sedan enkelt. Finns det sedan flera olika börshandlade fonder som täcker samma index eller segment är det förvaltningskostnaden som avgör. En halv procents skillnad, mer korrekt 0,65 procent är skillnaden mellan den billigaste av dessa Sydkoreafonder, Franklin Templetons ETF och den näst billigaste, den som iShares erbjuder.

Antar vi att dessa Sydkoreafonder ger samma avkastning kommer den som har lägst avgift att utvecklas bäst, allt annat lika. Grundregeln är alltså, betala aldrig för mycket då detta kommer att äta upp din avkastning.

De billigaste Sydkoreas ETFerna efter total kostnadskvot (TER)

| 1 | Franklin FTSE Korea UCITS ETF | +0.09% p.a. |

| 2 | Amundi MSCI Korea UCITS ETF Acc | +0.45% p.a. |

| 3 | Xtrackers MSCI Korea UCITS ETF 1C | +0.45% p.a. |

Franklin FTSE Korea UCITS ETF

Franklin FTSE Korea UCITS ETF investerar i aktier med fokus på Sydkorea. Utdelningarna i fonden återinvesteras (ackumuleras). FTSE Korea 30/18 Capped tillåter en bred investering med låga avgifter på ca. 150 aktier.

Den totala kostnadskvoten uppgår till 0,09 % per år. Fonden replikerar resultatet för det underliggande indexet genom att köpa alla indexbeståndsdelar (full replikering). Franklin FTSE Korea UCITS ETF har tillgångar på 312 miljoner GBP under förvaltning. FLXK ETF är äldre än 1 år och har sin hemvist i Irland.

Handla FLXK ETF

Franklin FTSE Korea UCITS ETF (FLXK ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Borsa Italiana, Deutsche Boerse Xetra, Euronext Amsterdam och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Lyxor MSCI Korea UCITS ETF – Acc

Lyxor MSCI Korea UCITS ETF – Acc (LKOR ETF) handlas också under kortnamnet KRW. Denna börshandlade fond kommer med en förvaltningskostnad på 0,45 procent. LKOR återinvesterar den erhållna utdelningen.

Amundi MSCI Korea UCITS ETF

Amundi MSCI Korea UCITS ETF – Acc är en UCITS-kompatibel börshandlad fond som syftar till att spåra indexindex MSCI Korea 20/35 Index ökat med möjlig utdelning från de aktier som utgör indexet. MSCI Korea 20/35 Index är ett index för free float marknadsvärde som representerar ungefär 85% av det totala kapitalet i Sydkorea.

Handla LKOR

Amundi MSCI Korea UCITS ETF – Acc är en europeisk ETF. Fonden handlas på flera olika börser, till exempel Borsa Italiana, Deutsche Boerse Xetra, Euronext Paris och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Xtrackers MSCI Korea UCITS ETF 1C

Xtrackers MSCI Korea UCITS ETF 1C (DBX8 ETF) investerar i aktier med fokus på Sydkorea. Utdelningarna i fonden återinvesteras (ackumulerar).

Den totala kostnadskvoten uppgår till 0,65 % per år. Fonden replikerar resultatet för det underliggande indexet genom att köpa alla indexbeståndsdelar (full replikering). Xtrackers MSCI Korea UCITS ETF 1C har tillgångar på 87 miljoner GBP under förvaltning. DBX8 ETF är äldre än 5 år och har hemvist i Luxemburg.

Handla DBX8 ETF

Xtrackers MSCI Korea UCITS ETF 1C (DBX8 ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Borsa Italiana, Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

HSBC MSCI Korea Capped UCITS ETF USD

HSBC MSCI Korea Capped UCITS ETF USD investerar i aktier med fokus på Sydkorea. Utdelningen i fonden delas ut till investerarna (halvårsvis).

Den totala kostnadskvoten uppgår till 0,50 % p.a. Fonden replikerar resultatet för det underliggande indexet genom att köpa alla indexbeståndsdelar (full replikering). HSBC MSCI Korea Capped UCITS ETF USD är en liten ETF med tillgångar på 36 miljoner GBP under förvaltning. H4Z9 ETF är äldre än 5 år och har sin hemvist i Irland.

Handla H4Z9 ETF

HSBC MSCI Korea Capped UCITS ETF USD (H4Z9 ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Borsa Italiana, Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

iShares MSCI Korea UCITS ETF (Acc)

iShares MSCI Korea UCITS ETF (Acc) (CSKR ETF) investerar i aktier med fokus på Sydkorea. Utdelningarna i fonden återinvesteras (ackumulerar).

Den totala kostnadskvoten uppgår till 0,65 % per år. Fonden replikerar resultatet för det underliggande indexet genom att köpa alla indexbeståndsdelar (full replikering). iShares MSCI Korea UCITS ETF (Acc) är en liten ETF med tillgångar på 85 miljoner GBP under förvaltning. CSKR ETF är äldre än 5 år och har sin hemvist i Irland.

Handla CSKR ETF

iShares MSCI Korea UCITS ETF (Acc) (CSKR ETF) är en börshandlad fond (ETF) som handlas på London Stock Exchange.

London Stock Exchange är en marknad som få svenska banker och nätmäklare erbjuder access till, men DEGIRO gör det.

iShares MSCI Korea UCITS ETF (Dist)

iShares MSCI Korea UCITS ETF (Dist) (IQQK ETF) investerar i aktier med fokus på Sydkorea. Utdelningen i fonden delas ut till investerarna (halvårsvis).

Den totala kostnadskvoten uppgår till 0,74 % per år. Fonden replikerar resultatet för det underliggande indexet genom att köpa alla indexbeståndsdelar (full replikering). iShares MSCI Korea UCITS ETF (Dist) har tillgångar på 306 miljoner GBP under förvaltning. IQQK ETF är äldre än 5 år och har sin hemvist i Irland.

Handla IQQK ETF

iShares MSCI Korea UCITS ETF (Dist) (IQQK ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Borsa Italiana, Deutsche Boerse Xetra, Euronext Amsterdam och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Alternativa investeringsmöjligheter

Asien-Stillahavsområdet index med en stor andel av Sydkorea

Förutom Sydkoreas ETFer kan du överväga ETFer i Asien-Stillahavsområdet. Totalt kan du investera i fem Asien-Stillahavsområdet-index, som spåras av 14 ETFer. Den totala kostnadskvoten (TER) för börshandlade fonder på Asien-Stillahavsområdet är mellan 0,12 % p.a. och 0,74 % p.a.

| Index | Fokus | Antal ETFer | Antal aktier | Beskrivning |

| FTSE Developed Asia Pacific ex Japan | Stillahavsområdet Sydkorea: 28.19% | 2 | 399 | FTSE Developed Asia Pacific ex Japan-index spårar stora och medelstora aktier från utvecklade länder i Asien och Stillahavsområdet exklusive Japan. |

| MSCI AC Asia Pacific ex Japan | Stillahavsområdet Sydkorea: 11.25% | 1 | 1,246 | MSCI AC Asia Pacific ex Japan-index spårar aktiemarknaderna i tillväxt- och utvecklade länder i Asien och Stillahavsområdet, exklusive Japan. |

| MSCI AC Asia ex Japan | Stillahavsområdet Sydkorea: 13.61% | 2 | 1,182 | MSCI AC Asia ex Japan-indexet spårar aktiemarknaderna i tillväxt- och utvecklade länder i Asien-regionen, exklusive Japan. |

| MSCI AC Far East ex Japan | Stillahavsområdet Sydkorea: 16.39% | 4 | 1,046 | MSCI AC Far East ex Japan-indexet spårar aktiemarknaderna i tillväxt- och utvecklade länder i den östasiatiska regionen, exklusive Japan. |

| MSCI Emerging Markets Asia | Stillahavsområdet Sydkorea: 15.31% | 5 | 1,131 | MSCI Emerging Markets Asia-index spårar stora och medelstora företag från asiatiska tillväxtmarknader. |

Tillväxtmarknadsindex med en stor andel av Sydkorea

Förutom Sydkoreas ETFer kan du överväga ETFer på tillväxtmarknader. Totalt kan du investera i ett tillväxtmarknadsindex, som spåras av 23 ETFer. Den totala kostnadskvoten (TER) för dessa ETFer på tillväxtmarknader är mellan 0,14 % p.a. och 0,66 % p.a.

| Index | Fokus | Antal ETFer | Antal aktier | Beskrivning |

| MSCI Emerging Markets | Stillahavsområdet Sydkorea: 11.95% | 23 | 1 376 | MSCI Emerging Markets-index spårar aktier från tillväxtmarknader över hela världen. |

Nyheter

WELR ETF för företag som arbetar med kommunikationstjänster

Publicerad

9 timmar sedanden

30 april, 2025

Amundi S&P Global Communication Services ESG UCITS ETF DR EUR (D) (WELR ETF) med ISIN IE000ANYHV73, strävar efter att spåra S&P-utvecklade Ex-Korea LargeMidCap Sustainability Enhanced Communication Services-index. Det S&P-utvecklade ex-Korea LargeMidCap Sustainability Enhanced Communication Services-indexet spårar stora och medelstora aktier. Alla värdepapper i indexet är klassificerade i sektorn Communication Services enligt Global Industry Classification Standard (GICS). Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,18% p.a.. Amundi S&P Global Communication Services ESG UCITS ETF DR EUR (D) är den billigaste ETF som följer S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Communication Services index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen delas ut till investerarna (Årligen).

Amundi S&P Global Communication Services ESG UCITS ETF DR EUR (D) är en mycket liten ETF med tillgångar på 7 miljoner euro under förvaltning. Denna ETF lanserades den 20 september 2022 och har sin hemvist i Irland.

Investeringsmål

AMUNDI S&P GLOBAL COMMUNICATION SERVICES ESG UCITS ETF DR – EUR (D) försöker replikera, så nära som möjligt, resultatet av S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Communication Services Index (Netto Total Return Index). Denna ETF har exponering mot stora och medelstora företag i utvecklade länder. Den innehåller uteslutningskriterier för tobak, kontroversiella vapen, civila och militära handeldvapen, termiskt kol, olja och gas (inkl. Arctic Oil & Gas), oljesand, skiffergas. Den är också utformad för att välja ut och omvikta företag för att tillsammans förbättra hållbarhet och ESG-profiler, uppfylla miljömål och minska koldioxidavtrycket.

Handla WELR ETF

Amundi S&P Global Communication Services ESG UCITS ETF DR EUR (D) (WELR ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Största innehav

Denna fond använder sig av fysisk replikering för att spåra utvecklingen av det underliggande indexet.

| Namn | Valuta | Vikt % | Sektor |

| ALPHABET INC CL A | USD | 18.49 % | Kommunikationstjänster |

| META PLATFORMS INC-CLASS A | USD | 17.21 % | Kommunikationstjänster |

| ALPHABET INC CL C | USD | 15.48 % | Kommunikationstjänster |

| SOFTBANK GROUP CORP | JPY | 7.77 % | Kommunikationstjänster |

| WALT DISNEY CO/THE | USD | 6.40 % | Kommunikationstjänster |

| NINTENDO CO LTD | JPY | 3.83 % | Kommunikationstjänster |

| SOFTBANK CORP | JPY | 2.81 % | Kommunikationstjänster |

| TAKE-TWO INTERACTIVE SOFTWARE | USD | 2.48 % | Kommunikationstjänster |

| PUBLICIS GROUPE SA | EUR | 2.40 % | Kommunikationstjänster |

| UNIVERSAL MUSIC GROUP NV | EUR | 2.19 % | Kommunikationstjänster |

Innehav kan komma att förändras

Nyheter

Investerarna söker fonder som ger exponering mot försvarsindustrin

Publicerad

10 timmar sedanden

30 april, 2025

De senaste månaderna har det varit större förändringar på denna lista än normalt. Under april 2025 förändrades listan på de mest eftersökta ETFerna kraftigt, vilket numera är ganska normalt. Denna månad var det mycket frågor om fonder som ger exponering mot försvarindustrin.

Den ständiga favoriten Xact Norden Högutdelande har petats ned från sin första plats. Även en tidigare vinnare 21Shares Sui Staking ETP (ASUI ETP) som spårar kryptovalutan SUI har rasat.

Istället är det Sveriges första månadsutdelande ETF Montrose Global Monthly Dividend MSCI World UCITS ETF (MONTDIV ETF) med IE000DMPF2D5, kombinerar månatliga utdelningar, global diversifiering i världens största bolag och en systematisk optionsstrategi som hamnar högst upp på listan. Det är emellertid mycket fler frågor om fonder som ger exponering mot försvarindustrin. Vem vet, kanske ser vi hur listan förändras nästa månad?

Det går att handla andelar i dessa ETFer genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

När kommer utdelningen från MONTDIV?

Sveriges första månadsutdelande ETF Montrose Global Monthly Dividend MSCI World UCITS ETF (MONTDIV ETF) förekommer på listan både med sitt fullständiga namn, kortnamn och till och med ISIN-kod. Ett helt nytt sökbegrepp är frågan om när utdelningen kommer och hur stor denna är. Får vi dessa uppgifter från Montrose så kommer vi att publicera detta på vår sida precis som vi gör med utdelningen från XACTs ETFer.

ETP, ETF, ETC, ETN, ETI och Eftmarknaden

Många är osäkra på terminologin när det gäller börshandlade produkter och vi ser dels hur de söker – och hittar många av de informativa artiklar som vi skrivit på Etfmarknaden.se, men också vår ordlista som förklarar det mesta som kan verkar förvirrande. En av våra äldre artiklar, Vad är vad? ETP, ETF, ETC, ETN och ETI från september 2012, har nu helt plötsligt dykt upp som en av de mer lästa artiklarna.

Månadsutdelande fonder tilldrar sig stort intresse

Den 6 november förra året, bara dagar efter att vi publicerat en artikel om månadsutdelande fonder, lanserade JP Morgan en helt ny variant av en månadsutdelande fond. JPMorgan US Equity Premium Income Active UCITS ETF USD (dist) (JEIP ETF) med ISIN IE000U5MJOZ6, är en aktivt förvaltad ETF.

Den börshandlade fonden investerar i företag från USA. Ytterligare intäkter söks genom användning av en överlagringsstrategi med derivatinstrument. Denna ETF strävar efter att generera en högre avkastning än S&P 500-index.

Detta ledde till att vi fick uppdatera vår artikel om månadsutdelande fonder med JEIP men också med JPMorgan Nasdaq Equity Premium Income Active UCITS ETF USD (dist) (JEQP ETF) med ISIN IE000U9J8HX9, som är en aktivt förvaltad ETF, men som mäter sig mot Nasdaq-100 istället.

Under den sista veckan i februari 2025 noterade Montrose den första svenska ETFen på fem år. MONTDIV ETF är Sveriges första månadsutdelande ETF och rusade snabbt på listan efter de mest eftersökta börshandlade fonderna på vår sida. Besök vår sida och läs mer om Montrose Global Monthly Dividend MSCI World UCITS ETF (MONTDIV ETF) fungerar.

Inte längre populärast av dem alla

XACT Norden Högutdelande är utan tvekan en av de mest populära av alla de ETFer som vi har skrivit om på vår sida. Den kvartalsvisa utdelningen och dess satsning på aktier med en låg volatilitet och hög direktavkastning gör det till en populär fond som återfinns i mångas depåer. Nyligen lämnades årets första utdelning från denna börshandlade fond.

Under mars 2025 förändrades listan på de mest eftersökta ETFerna kraftigt. Den största förändringen är att svenskarna har en ny favorit-ETF. Den ständiga favoriten Xact Norden Högutdelande har petats ned från sin första plats. Även förra månadens vinnare 21Shares Sui Staking ETP (ASUI ETP) som spårar kryptovalutan SUI har rasat. Istället är det Sveriges första månadsutdelande ETF Montrose Global Monthly Dividend MSCI World UCITS ETF (MONTDIV ETF) med IE000DMPF2D5, kombinerar månatliga utdelningar, global diversifiering i världens största bolag och en systematisk optionsstrategi som våra besökare letar information om.

Det betyder att det går att handla andelar i dessa ETFer genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Hur högt kommer vi när du Googlar på ordet ETF?

Under mars 2025 såg vi många sökningar på begreppen ETF, börshandlad fond och Etfmarknaden. Om det var vår egen sida eller om det var den totala marknaden för ETFer som besökarna sökte på vet vi inte, men efter att ha fått mail från en av de större emittenterna vet vi att de försöker kartlägga de svenska placerarnas exponering mot börshandlade fonder.

Om du söker på ordet ETF på Google, hur högt hamnar vi då?

Kraftigt ökat intresse för försvarsfonderna

Vilken ETF för försvarsindustrin är bäst och hur investerar man i denna sektor med hjälp av börshandlade fonder? I dag finns det tre ETFer som ger exponering mot flyg och försvar som följer tre olika index. De årliga förvaltningskostnaderna ligger 0,35 och 0,55 procent. Vi har skrivit en artikel om olika försvarsfonder. Du hittar mer om ETFer för försvarsindustrin här.

Utöver detta har Wisdomtree lanserat en försvarsfond som investerar i europeiska företag, och HANetf har meddelat att företaget har för avsikt att göra det samma. Namnet på HANetfs börshandlade fond är ännu inte känt, men kortnamnet kommer att vara ARMY i London och 8RMY på tyska Xetra.

Aktivt förvaltad fixed income ETF från iShares

BlackRock har lanserat iShares € Flexible Income Bond Active UCITS ETF (IFLX), en ny aktivt förvaltad Fixed Income UCITS ETF utformad för att maximera intäkter i portföljer samtidigt som den långsiktiga kapitaltillväxten bibehålls. IFLX ger kunderna det bästa av BlackRocks ränteinsikter i bekvämligheten med ETF-omslaget.

IFLX strävar efter att generera attraktiva intäkter genom en kärna av europeiska tillgångar genom att allokera över ränteuniversumet, utan begränsningar av traditionella riktmärken, samtidigt som de vanligtvis bibehåller ett IG-betyg. Fonden bygger på en diversifierad allokering till Investment Grade (IG)-krediter, High Yield (HY)-krediter och värdepapperiserade tillgångar, och strävar efter att maximera intäkter över marknadscykler.

Inte längre populärast av dem alla

XACT Norden Högutdelande är utan tvekan en av de mest populära av alla de ETFer som vi har skrivit om på vår sida. Den kvartalsvisa utdelningen och dess satsning på aktier med en låg volatilitet och hög direktavkastning gör det till en populär fond som återfinns i mångas depåer. Nyligen lämnades årets första utdelning från denna börshandlade fond.

Månadsutdelande fond från JPM tilldrar sig stort intresse

Den 6 november förra året, bara dagar efter att vi publicerat en artikel om månadsutdelande fonder, lanserade JP Morgan en helt ny variant av en månadsutdelande fond. JPMorgan US Equity Premium Income Active UCITS ETF USD (dist) (JEIP ETF) med ISIN IE000U5MJOZ6, är en aktivt förvaltad ETF.

Den börshandlade fonden investerar i företag från USA. Ytterligare intäkter söks genom användning av en överlagringsstrategi med derivatinstrument. Denna ETF strävar efter att generera en högre avkastning än S&P 500-index.

Detta ledde till att vi fick uppdatera vår artikel om månadsutdelande fonder med JEIP men också med JPMorgan Nasdaq Equity Premium Income Active UCITS ETF USD (dist) (JEQP ETF) med ISIN IE000U9J8HX9, som är en aktivt förvaltad ETF, men som mäter sig mot Nasdaq-100 istället.

Under den sista veckan i februari 2025 noterade Montrose den första svenska ETFen på fem år. MONTDIV ETF är Sveriges första månadsutdelande ETF och rusade snabbt på listan efter de mest eftersökta börshandlade fonderna på vår sida. Besök vår sida och läs mer om Montrose Global Monthly Dividend MSCI World UCITS ETF (MONTDIV ETF) fungerar.

Indien är en marknad som många söker information om

ETF Indien är inte en specifik börshandlad fond, men förekommer i en mängd olika varianter. Det finns tydligen ett stort intresse för att investera i indiska aktier bland sidan besökare, och då är kanske en ETF ett bra sätt att göra det. Vi skrev under i början av året en artikel om olika Indienfonder. Sedan dess har det dykt upp ytterligare ett par ETFer med fokus på Indien så vi har uppdaterat artikeln.

Halalfonder är nu hetare än ESG

Tidigare var det många som sökte på begreppet ESG, men detta sökord har fallit från listan under de senaste månaderna. En variant av ESG-fond är de fonder som har en islamistisk inriktning, så kallade halalfonder, och det är fortfarande något som våra besökare letar information om. En sådan fond är ASWE, som är en aktivt förvaltad shariafond men till exempel HSBC har en serie fonder med fokus på att investera enligt islam. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra.

Räntesänkningar ökar intresset för fastigheter

Ett annat begrepp på listan är ETF fastigheter. Allt fler investerare tror att vi kommer att få se ytterligare räntesänkningar, inte bara i Sverige och Europa, men även i USA. Lägre räntor gör det enklare att räkna hem en investering i fastigheter. Kan det vara så att våra besökare undersöker möjligheterna att positionera sig i en ETF för fastigheter innan räntorna sänks för att de tror att det kommer att leda till en uppvärdering av fastighetsbolagen? Vill du ha några idéer så skrev vi en text om börshandlade fonder som investerar i fastigheter.

Du kan även läsa den text vi skrev i januari 2025 som heter 10 ETFer för att investera i fastigheter.

Du kan handla Ripple med olika börshandlade produkter

Valour Ripple (XRP) SEK är en börshandlad produkt som spårar priset på XRP, Ripples infödda token. XRP förbättrar främst globala finansiella överföringar och utbyte av flera valutor. Snabb och miljövänlig, den digitala tillgången XRP designades för att fungera som den mest effektiva kryptovalutan för olika applikationer inom finanssektorn.

Valour Ripple (XRP) SEK ETP (ISIN: CH1161139584) är en börshandlad produkt som spårar priset på XRP, Ripples infödda token.

XRP har ett börsvärde på 29,57 miljarder USD och rankas på en sjätte plats bland alla kryptovalutor globalt. Ripple XRP är en nyckelspelare inom det digitala valutaområdet, känd för sin användning för att underlätta snabba och billiga internationella pengaöverföringar. XRP fungerar på RippleNet och fungerar som en bryggvaluta i Ripples betalningsnätverk, vilket möjliggör sömlösa valutaväxlingar över hela världen. Detta har positionerat XRP som ett föredraget val för finansiella institutioner som söker effektiva alternativ till traditionella gränsöverskridande betalningsmetoder.

I somras meddelade Virtune att företaget lanserat sin egen version, Virtune XRP ETP på Nasdaq Stockholm idag den andra juli 2024. Denna produkt dyker också upp men betydligt längre ned på vår lista. Det var länge sedan någon av Virtunes produkter hamnade på listan, så det är extra kul att se att de dyker upp igen även om det är långt ned.

Produkten erbjuder exponering mot XRP. ETPn är 100% fysiskt uppbackad, handlas i SEK och är tillgänglig för investerare i Sverige och övriga Norden på Avanza och Nordnet.

Är du nyfiken på vilka börshandlade produkter det finns för att investera i XRP? Vi har självklart skrivit en artikel om detta där vi jämför alla de börshandlade alternativ vi hittat.

Kraftigt ökat intresse för försvarsfonderna

Vilken ETF för försvarsindustrin är bäst och hur investerar man i denna sektor med hjälp av börshandlade fonder? I dag finns det tre ETFer som ger exponering mot flyg och försvar som följer tre olika index. De årliga förvaltningskostnaderna ligger 0,35 och 0,55 procent. Vi har skrivit en artikel om olika försvarsfonder. Du hittar mer om ETFer för försvarsindustrin här.

Utöver detta har Wisdomtree lanserat en försvarsfond som investerar i europeiska företag, och HANetf har lanserat en egen version. Namnet på HANetfs börshandlade fond är ARMY i London och 8RMY på tyska Xetra.

Stort intresse för relativt okänd kryptovaluta

En relativt okänd kryptovaluta som ger exponering mot Sui-blockkedjan har dykt upp på listan. Vi har bara hittat två emittenter som erbjuder en produkt på denna kryptovaluta, schweiziska 21Shares och Valour.

21Shares Sui Staking ETP (ASUI ETP), med ISIN CH1360612159, är 100 % fysiskt uppbackad av SUI-tokens och spårar resultatet av SUI för att erbjuda ett enkelt, reglerat och transparent sätt för investerare att få exponering mot Sui-blockkedjan. Sui är designad för att tillhandahålla snabba, säkra och skalbara decentraliserade applikationer (dApps) med sitt utvecklarvänliga programmeringsspråk och innovativa sätt att behandla transaktioner. 21Shares Sui Staking ETP erbjuder ett enkelt, reglerat och transparent sätt att dra nytta av nätverkets växande användning.

Under oktober 2024 har Valour noterat sin egen ETP på denna kryptovaluta, Valour Sui (SUI) SEK med ISIN CH1213604601.

Halalfonder är nu hetare än ESG

Tidigare var det många som sökte på begreppet ESG, men detta sökord har fallit från listan under de senaste månaderna. En variant av ESG-fond är de fonder som har en islamistisk inriktning, så kallade halalfonder, och det är fortfarande något som våra besökare letar information om. En sådan fond är ASWE, som är en aktivt förvaltad shariafond men till exempel HSBC har en serie fonder med fokus på att investera enligt islam. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra.

Räntesänkningar ökar intresset för fastigheter

Ett annat begrepp på listan är ETF fastigheter. Allt fler investerare tror att vi kommer att få se ytterligare räntesänkningar, inte bara i Sverige och Europa, men även i USA. Lägre räntor gör det enklare att räkna hem en investering i fastigheter. Kan det vara så att våra besökare undersöker möjligheterna att positionera sig i en ETF för fastigheter innan räntorna sänks för att de tror att det kommer att leda till en uppvärdering av fastighetsbolagen? Vill du ha några idéer så skrev vi en text om börshandlade fonder som investerar i fastigheter.

Du kan även läsa den text vi skrev i januari 2025 som heter 10 ETFer för att investera i fastigheter.

Montroses andra börshandlade fond etablerade sig snabbt

Den 10 april lanserade Montrose sin andra börshandlade fond, Montrose Global Leverage 125 MSCI World UCITS ETF (MONTLEV), Sveriges första globala ETF med hävstång. Den nya ETFen ger investerare en bred global exponering med en inbyggd hävstång på 1,25x.

Går det att handla ETFer hos Swedbank?

Swedbank ETF tror vi kan tolkas att det endera finns intresse för att veta om Swedbank har ETFer i sitt utbud, eller om det går att handla börshandlade fonder på Swedbank. Svaret på denna fråga återfinns här.

Dyrare kaffe skapar intresse för börshandlade produkter

Det stigande kaffepriset (som du kan följa här) har lett till ett ökat intresse bland investerarna för att köpa en ETF som spårar kaffepriset. Det finns emellertid ingen ETF som spårar kaffepriset, då Eus regler kräver att det finns minst 16 olika komponenter i en ETF. Det finns emellertid ett par ETCer som gör samma sak, till exempel WisdomTree Coffee (OD7B ETC).

Aktivt förvaltad fixed income ETF från iShares

BlackRock har lanserat iShares € Flexible Income Bond Active UCITS ETF (IFLX), en ny aktivt förvaltad Fixed Income UCITS ETF utformad för att maximera intäkter i portföljer samtidigt som den långsiktiga kapitaltillväxten bibehålls. IFLX ger kunderna det bästa av BlackRocks ränteinsikter i bekvämligheten med ETF-omslaget.

IFLX strävar efter att generera attraktiva intäkter genom en kärna av europeiska tillgångar genom att allokera över ränteuniversumet, utan begränsningar av traditionella riktmärken, samtidigt som de vanligtvis bibehåller ett IG-betyg. Fonden bygger på en diversifierad allokering till Investment Grade (IG)-krediter, High Yield (HY)-krediter och värdepapperiserade tillgångar, och strävar efter att maximera intäkter över marknadscykler.

EUDF ETF satsar på Europas försvarsindustri

WisdomTree Europe Defence UCITS ETF EUR Unhedged Acc (EUDF ETF) med ISIN IE0002Y8CX98, försöker spåra WisdomTree Europe Defence UCITS-index. WisdomTree Europe Defence UCITS-index spårar prestanda för europeiska företag som är engagerade i militär- eller försvarsindustrin.

Så här köper du den spanska aktiemarknaden med börshandlade fonder

Det enklaste sättet att investera på den spanska aktiemarknaden är att investera i ett brett marknadsindex. Detta kan göras till låg kostnad genom att använda ETFer. På den spanska aktiemarknaden hittar du tre index som spåras av fyra ETFer.

Förutom ETFer på Spanien, finns det inga regionala ETFer tillgängliga med en betydande vikt av spanska aktier. Även index för länder i euroområdet väger Spanien med mindre än tio procent.

Utdelningen i XACT Sverige

Under juni 2024 lämnade XACT Sverige sin årliga utdelning, något som fick många att söka information kring denna. XACT Sverige lämnar, till skillnad från XACT Norden Högutdelande, endast utdelning en gång per år. Av denna orsak blir det inte lika mycket skrivet om denna ETF. I år blir denna utdelning 25,10 SEK per andel vilket du kan läsa mer om här.

Indien är en marknad som många söker information om

ETF Indien är inte en specifik börshandlad fond, men förekommer i en mängd olika varianter. Det finns tydligen ett stort intresse för att investera i indiska aktier bland sidan besökare, och då är kanske en ETF ett bra sätt att göra det. Vi skrev under i början av året en artikel om olika Indienfonder. Sedan dess har det dykt upp ytterligare ett par ETFer med fokus på Indien så vi har uppdaterat artikeln.

Amerikanska large caps är något många vill veta mer om

Fonder som följer S&P 500 är, föga förvånande, en typ av fonder som det finns stort intresse kring. Det är ingen speciell enskild fond som sticker ut och lockar mer än andra. Det skall emellertid noteras att många sökningar sker på ord som ”Fond som följer S&P500 Avanza”. Vi skrev tidigare en artikel om S&P500 fonder, 26 börshandlade fonder som spårar S&P500 där vi jämförde alla de ETFer som spårar detta index i sin grundform.

En ny börshandlad fond från iShares lanserades under november. iShares S&P 500 Top 20 UCITS ETF (IS20) spårar resultatet för S&P 500 Top 20 Select 35/20 Capped-index. Fonden investerar direkt i de 20 största amerikanska företagen i S&P 500-indexet.

Valours Hedera ETP får många sökningar igen

I slutet av januari 2024 kommunicerade Valour att företaget hade för avsikt att lansera en fysiskt uppbackad börshandlad produkt (ETP) Valour HBAR Staking ETP i samarbete med The Hashgraph Association (THA) – en schweiziskbaserad produkt oberoende och ideell organisation fokuserad på att ge en digital framtid för alla genom att utnyttja Hederas miljövänliga distribuerade ledger-teknologi (DLT). Nu är denna kryptovaluta populär igen.

Kaspa kvar på listan trots ett minskat intresse

Valour Kaspa (KAS) SEK (Valour Kaspa SEK) med ISIN CH1108679379, är en börshandlad produkt (ETP) som spårar KAS, den infödda symbolen för Kaspa blockchain. Genom att använda sitt GhostDAG-protokoll bearbetar Kaspa block parallellt, vilket möjliggör snabb transaktionsavslutning och hög skalbarhet. KAS-tokenen används för transaktionsavgifter och nätverkssäkerhet genom mining. Med sin effektiva och decentraliserade design stöder Kaspa skalbara blockkedjeapplikationer, vilket ger både utvecklare och användare kraft.

Denna ETF ger exponering mot guldpriset – utan avgift

I och med att guldpriset har rört sig uppåt har intresset för guldfonder kommit att bli mer populärt överlag. Den mest populära fonden är 4GLD, Xetra-Gold som erbjuder investerare en optimal och enkel möjlighet att delta i utvecklingen av guldmarknaden. Dessutom är handel med Xetra-Gold också mycket kostnadseffektiv eftersom den till skillnad från andra värdepapper inte kommer med varken abonnemangsavgifter eller förvaltningsavgifter.

Holländska aktier ser ett ökat intresse

Vi har en kommande sammanställning på olika holländska aktier, men till dess går det att se närmare på börshandlade fonder som iShares AEX UCITS ETF (IAEX ETF) med ISIN IE00B0M62Y33, strävar efter att spåra AEX®-index. AEX®-indexet följer de 25 största och mest omsatta aktierna på den holländska aktiemarknaden och VanEck Vectors AEX UCITS ETF (TDT ETF) är en UCITS-kompatibel börshandlad fond som investerar i en portfölj av aktierelaterade värdepapper i syfte att ge investeringsavkastning som noggrant följer utvecklingen av AEX Index®.

Valour Solana ger börshandlad exponering mot denna kryptovaluta

Valour SOLANA (SOL) är en börshandlad produkt, som gör investeringar i SOL enkla, säkra och kostnadseffektiva. Solana är en decentraliserad blockchain och den snabbaste blockchain i världen, med mer än 400 projekt som spänner över DeFi, NFT, Web3 och mer.

Produkten är en strukturerad investering i form av ett tracker certifikat enligt svensk lag. Den handlas på Spotlight Stock Market som är den primära marknadsplatsen.

Det går att handla börshandlade fonder hos Nordea

Nordea har en plattform, och i denna handelstjänst erbjuder denna bank tusentals olika ETFer. Det går att handla ETFer med fokus på räntemarknaden, aktiemarknaden, landspecifika ETFer och börshandlade fonder med fokus på olika branscher. Att handla ETFer hos Nordea sker endera i Nordea Investor och nätbanken.

Investera i grekiska aktier med en börshandlad fond

Det enklaste sättet att investera på den grekiska aktiemarknaden är att investera i ett brett marknadsindex. Detta kan göras till låg kostnad genom att investera i Grekland med hjälp av en börshandlad fond. På den grekiska aktiemarknaden hittar du ett index som spåras av en ETF.

En bred satsning på råvarumarknaden

Fler och fler läsare söker information om råvarufonder. En av ETF som fått många sökningar är L&G Multi Strategy Enhanced Commodities UCITS ETF (EN4C ETF) syftar till att spåra resultatet för Barclays Backwardation Tilt Multi-Strategy Capped Total Return Index (”Indexet”).

Normalt sett är det samma fonder och börshandlade produkter som de nordiska investerarna söker på. Av den anledningen är det extra roligt att se att nya produkter hamnar bland de mest sökta. I detta fall är det Torbjörn Iwarsons nya råvarufond som lockar ett stort intresse. Det är Nordens enda riktiga råvarufond. Notera att just nu är råvarumarknaden är litet nedtryckt, så det är ett bra tillfälle att komma in billigt. Läs mer om Centaur Commodity Fund på deras hemsida.

VanEcks försvarsfond DFEN växer starkt

”Globala spänningar och ökande geopolitisk osäkerhet under de senaste åren har lett till att länder har prioriterat sin egen försvarskapacitet mycket högre”, säger Martijn Rozemuller, vd för VanEck Europe. ”Till exempel har diskussionen bland medlemsländerna om att öka försvarsutgifterna utöver Natos 2-procentsmål tagit fart mitt i aktuella händelser.” Du läser mer om DFEN här.

SAVRs ETF-satsning skapar stort intresse

SAVR har precis valt att lansera handel med börshandlande fonder. SAVR som tidigare varit kände för att erbjuda handel med traditionella fonder har nyligen valt att lansera handel med aktier, men också med ETFer på framför allt tyska Xetra. På denna marknad erbjuder nu SAVR med flera ETFer än vad både Nordnet och Avanza gör.

Samtidigt har SAVR valt att lansera en egen produkt tillsammans med amerikanska Vanguard, SAVR Global by Vanguard.

Dogecoin kryptovalutan med en hund som logotyp

Dogecoin (kod: DOGE, symbol: Ɖ och D) är en litecoinbaserad kryptovaluta. Dogecoin har sitt ursprung i internetmemen ’Doge’, och dess logotyp är en hund av rasen Shiba. Dogecoin har till skillnad från bitcoin ingen maximal mängd monetära enheter, utan når sin maximala tillväxthastighet vid 100 miljarder enheter.

I början av april 2025 meddelade 21Shares att företaget hade lanserat en börshandlad produkt DOGE ETP. 21Shares har ingått ett exklusivt partnerskap med House of Doge för att skapa 21Shares Dogecoin ETP, den enda Dogecoin ETP som godkänts av Dogecoin Foundation. Ännu så länge handlas denna ETP endast på SIX Swiss Exchange, men 21Shares brukar snabbt följa upp med handel på övriga börser i Europa.

Valour Dogecoin (DOGE) SEK, med ISIN CH1108679320, är en börshandlad produkt (ETP) som spårar priset på DOGE, den inhemska kryptovalutan i Dogecoin-nätverket. Dogecoin är känt för sina snabba transaktionshastigheter och låga avgifter och erbjuder en effektiv lösning för digitala betalningar, vilket gör det till ett praktiskt val för vardagliga transaktioner.

Stor skillnad på resultaten mellan sökmotorerna

Den svenska emittenten av börshandlade produkter, Virtune, som tidigare funnits med bland de hundra mest populära sökningarna har rasat kraftigt på listan och återfinns först på plats 147. Vi brukar ha med en eller ett par texter kring denna emittent varje månad på Etfmarknaden.se, och bolaget har under året lanserat sina produkter på den finska marknaden så detta fall förvånar oss. Precis som konkurrenten Valour noterar Virtune sina börshandlade kryptoprodukter i Sverige, och i svenska kronor.

Det skall emellertid noteras att när vi väljer att inte använda oss av Google utan istället av sökmotorn Bing så hamnar Virtune högt upp på listan. Det är emellertid en stor skillnad mellan antal sökningar hos Google och konkurrenten Bing. Hos Bing hamnar det felstavade sökbegreppet xrp virune avanza på femte plats medan virtune xrp etp avanza hamnar på elfte plats, vilket är högre än vad både både Xact Norden Högutdelande och Montrose placerar sig på denna sökmotor.

Investera i Sydkorea med börshandlade fonder

WELR ETF för företag som arbetar med kommunikationstjänster

Investerarna söker fonder som ger exponering mot försvarsindustrin

JCLS ETF – en högkvalitativ aktiv europeisk CLO-ETF

Kaffe och kakao är inte så elastiska råvaror som alla trott

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Världens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

Europeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanHANetfs Tom Bailey om framtiden för europeiska försvarsfonder

-

Nyheter6 dagar sedan

Nyheter6 dagar sedanFastställd utdelning i MONTDIV april 2025