Nyheter

Deep Dive into Pyth Network

Publicerad

6 månader sedanden

Blockchains in and of themselves are useful already, for trustless and permissionless transactions without censorship. What if certain transactions require reliable and real-time data from external sources that do not necessarily have a global consensus or can be stored on the same decentralised ledger?

What are Oracles?

Blockchains in and of themselves are useful already, for trustless and permissionless transactions without censorship. No trust or verification from the user is required because it is stored on a decentralised ledger with global consensus. What if certain transactions require reliable and real-time data from external sources that do not necessarily have a global consensus or can be stored on the same ledger? For example:

• Products that rely on price feeds of assets from other blockchains or real-world markets: Many decentralized finance (DeFi) applications, like decentralized exchanges or lending platforms, need accurate and timely information about asset prices (e.g., stocks, cryptocurrencies, commodities). Since these prices are continuously changing in real-world markets, blockchains need a way to securely access this off-chain data.

• Products that require verifiable and secure random numbers: Randomness is crucial for a variety of blockchain use cases, such as lotteries, gaming, and even secure cryptographic protocols. However, generating truly random numbers on-chain is challenging without introducing bias or predictability. Off-chain randomness, when provided by a reliable source, is often needed.

• Products dependent on historical price data: Some DeFi platforms and financial products might need access to archived price data for risk assessment, backtesting trading strategies, or offering historical analysis. Since blockchains primarily focus on storing current state information, they need external sources to provide this historical data efficiently.

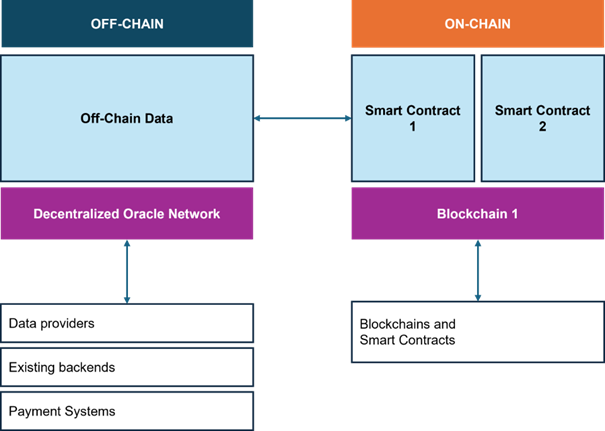

To address these challenges, Oracles were introduced. Oracles serve as bridges between blockchains and the external world, providing smart contracts with access to off-chain data. They connect external data providers—such as market data owners, web APIs, or IoT devices—to decentralized applications across multiple blockchains. Oracles enable these applications to securely and reliably obtain real-time data, execute transactions based on external events, and interact with data that cannot be directly stored on-chain.

Why can this data be trusted? Oracles provide a robust mechanism for ensuring the integrity and reliability of off-chain data before it is used on the blockchain. An oracle network verifies the:

• Authenticity: To ensure that the data is genuine and comes from a legitimate source, oracle networks source data from multiple trusted providers or verifiable APIs. This process reduces the risk of malicious or false information being introduced into smart contracts.

• Accuracy: Accurate data is crucial for smart contracts to function correctly. Oracles achieve this by aggregating data from several independent sources. Instead of relying on a single provider, an oracle network will query multiple data sources and compare their responses.

• Reliability: Oracle networks enhance reliability by using decentralized nodes, which increases resilience against failures or malicious activity. If one data source or node fails or provides incorrect information, the other nodes in the network can continue to operate and provide valid data.

Source: VanEck Research

The demand for accurate and reliable off-chain data is growing as the number of real-world use-cases and adoption of blockchain increases. Users of applications are more than willing to pay for an oracle service that is accurate and reliable and covers a large variety of use-cases.

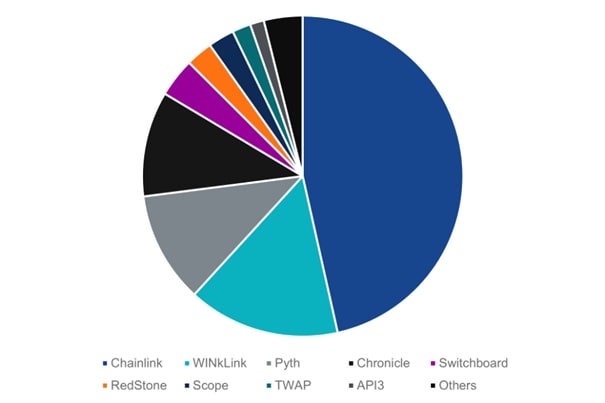

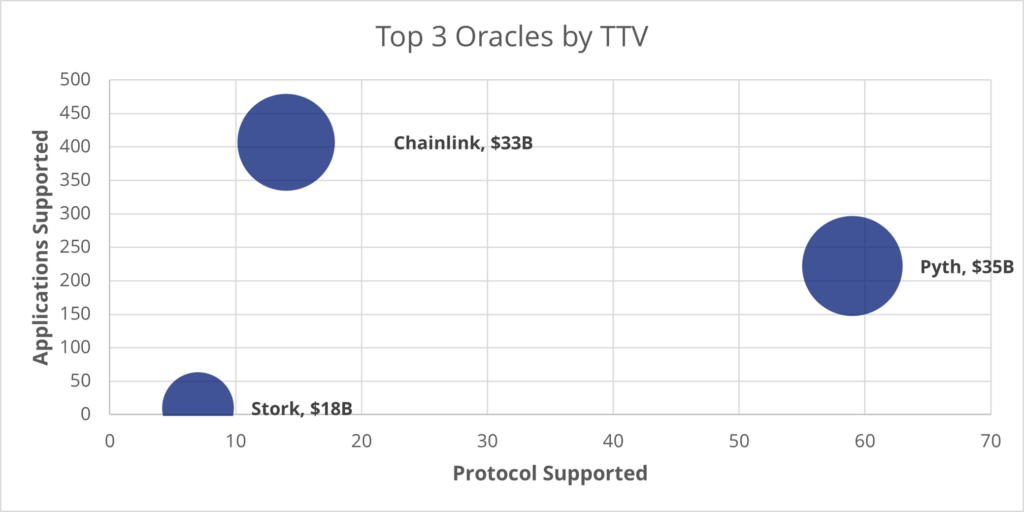

Pyth Network versus Other Oracles

Read the blog post of Battle of the Oracles to learn more about the different oracles solutions. To recap, Pyth Network is a high-frequency oracle leveraging Solana’s technology, offering a robust solution for off-chain data sharing for primarily decentralized finance applications (DeFi). It provides services like real-time price feeds and benchmarks, accessible to a wide range of financial service providers. PYTH is the governance token and utility token of the Pyth Network. Supply and demand for the PYTH token is directly related to level of usage and total demand of Pyth’s services and Pyth Network’s Tokenomics.

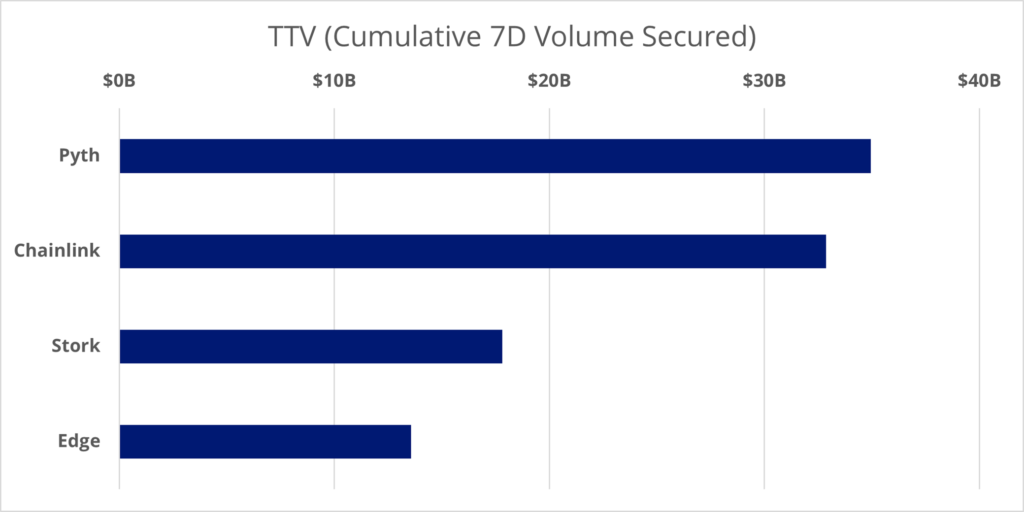

Total Value Secured by Oracles

Source: Defillama.com, Data as of 19/08/2024. Historical performance is no guarantee for future results. This should not be understood as financial advice for any of the digital assets mentioned in the figure.

While Chainlink holds the lion’s share of the total value secured by oracles, Pyth has shown by far the largest growth in terms of TVS, number of protocols supported and number of DApps. Pyth is expanding rapidly, across different networks and protocols, supporting more DApps, data providers and integration partners every day. In the same time frame, Chainlink’s marketshare has decreased. Comparing the main metrics of MCAP/TVS ratio and MCAP/TTV ratio, we notice that based on market capitalization (circulating supply), Pyth is undervalued whereas the TVS ratio based on fully diluted value paints a different picture. This is because only 37% of PYTH tokens are unlocked, the next significant PYTH token unlock takes place in May of 2025 and happens yearly thereafter on the same date until the full amount of tokens has been unlocked by 2027.

| Chainlink | Pyth | ||

| Market Capitalization (circulating supply) | $6.715B | $1.221B | |

| Market Capitalization (fully diluted) | $10.758B | $3.397B | |

| Total Value Secured (TVS) | $24.788B | $4.740B | Potential growth (in %) if Pyth would have Chainlink’s MCAP/TVS ratio |

| MCAP/TVS (circulating) | 0.271 | 0.248 | +5.2% |

| MCAP/TVS (diluted) | 0.434 | 0.717 | -39.4% |

| Total Transaction Volume (TTV) | $31.679B | $34.846B | Potential growth (in %) if Pyth would have Chainlink’s MCAP/TTV ratio |

| MCAP/TTV (circulating) | 0.212 | 0.0350 | +504.9% |

| MCAP/TTV (diluted) | 0.340 | 0.0975 | +248.4% |

Source: Defillama, Coingecko, data as of 05/11/2024. Historic performance is not a guarantee for future results. This should not be understood as investment advice for any of the digital assets mentioned in the table above.

Pyth’s Unique Advantages

| Data providers publish directly | Transparant & easily auditable aggregation | Sub-second updates | Confidence intervals | All symbols on all chains | Crypto assets | Tradfi assets | |

| Pyth | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Chainlink | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ | ❌ |

| Uniswap TWAP | ❌ | N/A | ❌ | ❌ | ❌ | ✔️ | ❌ |

| Band Protocol | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ |

| API3 | ✔️ | N/A | ❌ | ❌ | ❌ | ✔️ | ❌ |

| Switchboard | ❌ | ✔️ | ❌ | ❌ | ❌ | ✔️ | ❌ |

Source: Pyth, Data as of 19/08/2024. This should not be understood as investment advice for any of the digital assets mentioned in the table above.

Use-cases Enabled by Pyth

Products and Services:

• Price Feeds: real-time market data for smart contracts, blockchains, and applications

• Benchmarks: historical market data for smart contracts, blockchains, and applications

• Express Relay: smart contracts or protocols that need protection against MEV (Express Relay)

• Express Relay is one of a kind product that offers developers to auction off valuable transactions directly to MEV searchers without validator interference

• Entropy: smart contracts that require secure on-chain random numbers. Secure and verifiable random numbers are incredibly important for creating a fair and unpredictable on-chain actions (e.g., for games)

• Pyth DAO Governance model

Examples:

• Decentralised Exchanges (DEXs) require reliable real-time price feeds to provide users accurate trades.

• Pyth’s data pull model provides data directly from the source, such as exchanges, market makers or DeFi protocols. Because data is pulled only on demand and not pushed at a given interval, it scales efficiently, and costs are offloaded to users where updates are demand-based.

Case Study: Drift (DEX)

Refresher: What is a DEX?

Decentralized Exchange (DEX) allows users to trade cryptocurrencies directly, without intermediaries, using smart contracts on a blockchain. DEXes operate peer-to-peer, providing greater privacy and control over assets compared to centralized exchanges.

There are two main types of DEXes:

- Order Book DEXes: These platforms match buy and sell orders using a live order book, similar to traditional exchanges. Examples include dYdX.

- Automated Market Makers (AMMs): AMMs use liquidity pools and algorithms to determine asset prices, allowing users to trade instantly without needing a counterparty. Examples include Uniswap and SushiSwap.

Context

Drift is a perpetual trading DEX built on Solana. Speed, reliability, and performance make or break a perpetual trading ecosystem. Drift is a perpetual trading platform that allows traders to create leveraged positions against the performance of synthetic assets.

Why Pyth?

Drift seeks to offer the most feature-rich, powerful perpetual DEX with lightning-fast execution. This ambition necessitates a robust Oracle solution. Legacy oracles are slow and susceptible to front and back running.

Pyth and Drift partnered to rapidly deploy a proof-of-concept. This successful relationship satisfies the ultra-fast network requirements of Drift’s execution tools and is capable of supporting thousands of users and hundreds of assets.

This is only one of many examples of an effective partnership and integration that gives Web3 users an enhanced user experience than DApps that use other Oracle solutions. There are presently over 410 integration partners supporting the transition from push to pull Oracles with Pyth Networks.

Pyth versus Chainlink

| Pyth | Chainlink | |

| Core Mission | Pyth’s mission is to provide high-fidelity, high-frequency financial market data to end users securing their DeFi protocols. | Chainlink’s mission is to expand the capabilities of smart contracts by enabling access to real-world data and off-chain computation. |

| Data Providers & Source | Pyth uses first-party data that comes from exchanges, trading firms and financial institutions. | Chainlink’s data comes from relayers (often referred to as node operators). |

| Availability | 74+ Blockchains 205+ Protocols Secured | 19+ Blockchains 401 Protocols Secured |

| Performance During Black Swan Events | During the LUNA/UST incident in May ‘22, Pyth managed to track the LUNA price very accurately during the UST de-peg. | During the LUNA/UST incident in May ‘22, Chainlink had a “circuit breaker” that stopped updating the price of an asset if it went below 0.1 USD. This caused certain protocols to potentially receive inaccurate prices. |

Source: Pyth, Data as of 19/08/2024. This should not be understood as investment advice for any of the digital assets mentioned in the table above.

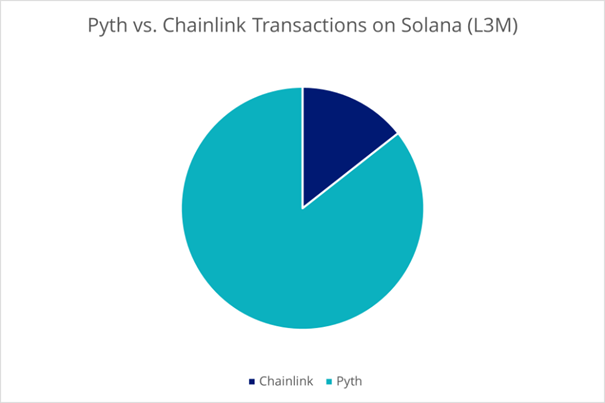

Case Study: Pyth and Chainlink on Solana

Source: Defillama, Data as of October 2024. Historical performance is not a guarantee for future results. This should not be understood as investment advice for any of the digital assets mentioned in the figure above.

We compare Chainlink and Pyth Network with two main metrics: Total Value Secured (TVS) and Total Transaction Volume (TTV)

Total Value Secured

Pyth’s Total Value Secured (TVS) is more distributed across different blockchains and applications compared to Chainlink, offering greater resilience and diversification. Here’s how the comparison breaks down:

• Blockchain Distribution: Pyth’s TVS shows a broader spread across multiple blockchains. For instance, only 61.1% of Pyth’s TVS is concentrated on the Solana blockchain, which means the remaining value is distributed across other blockchains, contributing to its decentralized footprint. In contrast, 97.1% of Chainlink’s TVS is concentrated on Ethereum, creating a higher dependence on a single blockchain. This heavy reliance on Ethereum makes Chainlink more vulnerable to network-specific issues, such as scalability concerns or market downturns affecting Ethereum.

• Application Distribution: Pyth also demonstrates a healthier diversification across different applications. Only 23.8% of Pyth’s TVS is tied to its top application, meaning the remaining value is distributed among various other applications. This broader application spread lowers the risk of one dominant app affecting the network’s overall performance. Chainlink, however, has 48.8% of its TVS tied to its top application, meaning nearly half of its secured value relies on a single application. This concentration creates a potential single point of failure, making Chainlink more sensitive to shifts in the usage or success of that key application.

Pyth’s more balanced distribution of TVS across different blockchains and applications enhances its resilience. With a healthier spread of its value, Pyth is better positioned to withstand market fluctuations or downturns that may affect individual blockchains or applications, making it less exposed to risks associated with dependency on any single network or product. This diversified approach gives Pyth a structural advantage in terms of long-term stability and adaptability.

Total Transaction Volume

Another, perhaps better, metric to measure the true market share and usage of an Oracle network is TTV (Total Transaction Volume). TTV is strongly correlated with the frequency of oracle price updates and therefore oracle revenue and true demand for its products and services. TVS can overstate or understate an application’s demand for price updates, because an application could have a disproportionate amount of locked value relative to the amount of Oracle interactions one would expect to observe.

Source: Defillama, Data as of October 2024. Historical performance is not a guarantee for future results. This should not be understood as investment advice for any of the digital assets mentioned in the figure above.

Source: Defillama, Data as of October 2024. Historical performance is not a guarantee for future results. This should not be understood as investment advice for any of the digital assets mentioned in the figure above.

Chainlink, the traditional market leader of oracle networks, is losing ground after being slow to serve customers needing faster data updates, though they’ve recently launched a new high-speed service. Pyth has become a successful competitor by focusing on rapid data delivery across multiple platforms, making it easier for financial applications to access real-time price information. Large trading platforms are increasingly building their own internal price tracking systems rather than paying external providers, suggesting cost is a major factor in their decisions.

The key to future success in digital trading will be speed – traditional exchanges currently have an advantage with their centralized systems, but new platforms are starting to close this gap by developing faster price update capabilities.

Pyth Network Governance

The Pyth Network operates a decentralized governance system that empowers the community by allowing all PYTH token holders to have a direct say in the network’s development and decision-making processes. This decentralized governance model ensures that control of the network is distributed among its users, promoting transparency and inclusion.

To participate in governance, token holders must stake their PYTH tokens through the Pyth staking program. By staking their tokens, users gain the ability to vote on community governance proposals, ensuring that they have a voice in the key decisions shaping the future of the Pyth Network.

In addition to voting, any PYTH token holder has the right to submit proposals to the Pyth DAO, provided they meet the requirement of holding and staking at least 0.25% of the total PYTH tokens staked. The proposals that can be brought to the DAO are diverse and impact many critical aspects of the network’s functionality, including:

• Determining the size of update fees: Proposals can influence the fees charged for updates to the network, ensuring that they remain fair and competitive.

• Reward distribution mechanisms for publishers: The community can vote on how rewards are allocated to data publishers, ensuring that those contributing accurate and reliable data are fairly compensated.

• Approving software updates across blockchains: The Pyth Network operates across multiple blockchains, and governance participants have the power to approve essential updates to on-chain programs, ensuring the network remains up to date and secure.

• Listing price feeds and determining their reference data: Token holders can vote on which price feeds are listed on Pyth, as well as set the technical parameters for these feeds, such as the number of decimal places in the prices and the reference exchanges used to determine the data.

• Selecting data publishers: The governance system allows the community to permission publishers, or select which entities are allowed to provide data for each price feed. This ensures that only trusted and verified data sources are contributing to the network.

Diversify Crypto Exposure to Decentralized Oracles with the VanEck Pyth ETN

Key features of the VanEck Pyth ETN

• Fully-collateralized by PYTH in cold-storage

• Exposure to one of the fastest growing decentralized oracle networks

• Total return of PYTH: Tracks the MarketVector™ Pyth Network VWAP Close Index (MVPYTHV)

Why VanEck Crypto ETNs? Here’s why:

• Crypto is only a small part of our total assets, so we can weather bear markets without drastic measures, protecting your investments.

• With nearly 70 years in asset management and a strong track record in crypto, we bring deep industry knowledge and proven reliability.

• We combine traditional financial strengths with cutting-edge crypto innovation, backed by a CEO who truly believes in crypto’s future.

• We ensure clarity in our product structures and avoid high-risk or opaque practices, with assets fully backed by cryptocurrency in secure cold storage.

• Our products, VBTC and VETH, are among the most traded on Xetra, offering you exceptional liquidity and tight spreads for seamless trading.

• Our assets are secured by a licensed European bank in Liechtenstein, providing top-tier compliance and security.

• We use the safest institutional custody setup available, prioritizing your security over cost savings.

Crypto is an asset class with high potential returns but investing in digital assets comes with great risk, why choose products that potentially introduce even more risks? Choose VanEck for a secure, transparent, and expertly managed crypto investment experience.

Main Risk Factors:

• Technology Risk: Trading and transaction systems may be hacked or malfunctioning, causing loss of digital assets.

• Regulatory Risk: Disruptions and interventions may render digital assets illegal.

• Risk of Total Loss: No guarantee regarding custody due to hacking risk, counterparty risk and market risk.

• Risk of Extreme Volatility: Trading prices of digital assets may experience extreme volatility.

Other risks specific to this ETN’s Digital Assets can also be found on the VanEck Crypto Academy.

• The PYTH token is an SPL token, live on the Solana mainnet as well as Pythnet (Pyth Network’s application specific blockchain based on Solana). Pyth Network can suffer from Price Manipulation Attacks. This involves attempts by malicious actors to manipulate the oracle price through various means. This can have severe negative effects on the Pyth Network and PYTH token.

• The Pyth Network can also suffer from reputation and trust issues as some level of trust is required for applications using Pyth’s services. If trust or reputation is damaged, it can negatively impact the Pyth Network and PYTH token.

Because Pyth is based on Solana, it also exposed to the specific risk factors of the Solana network such as regulatory risk, adoption risk and governance risk. Anything that could negatively impact Solana can therefore also negatively impact Pyth Network and the PYTH token.

This is not financial research but the opinion of the author of the article. We publish this information to inform and educate about recent market developments and technological updates, not to give any recommendation for certain products or projects. The selection of articles should therefore not be understood as financial advice or recommendation for any specific product and/or digital asset. We may occasionally include analysis of past market, network performance expectations and/or on-chain performance. Historical performance is not indicative for future returns.

Important information

For informational and advertising purposes only.

This information originates from VanEck (Europe) GmbH, Kreuznacher Strasse 30, 60486 Frankfurt am Main. It is intended only to provide general and preliminary information to investors and shall not be construed as investment, legal or tax advice. VanEck (Europe) GmbH and its associated and affiliated companies (together “VanEck”) assume no liability with regards to any investment, divestment or retention decision taken by the investor on the basis of this information. Views and opinions expressed are current as of the date of this information and are subject to change with market conditions. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. VanEck makes no representation or warranty, express or implied regarding the advisability of investing in securities or digital assets generally or in the product mentioned in this information (the “Product”) or the ability of the underlying Index to track the performance of the relevant digital assets market.

The underlying Index is the exclusive property of MV Index Solutions GmbH, which has contracted with CC Data Limited to maintain and calculate the Index. CC Data Limited uses its best efforts to ensure that the Index is calculated correctly. Irrespective of its obligations towards the MV Index Solutions GmbH, CC Data Limited has no obligation to point out errors in the Index to third parties.

Investing is subject to risk, including the possible loss of principal up to the entire invested amount and the extreme volatility that ETNs experience. You must read the prospectus and KID before investing, in order to fully understand the potential risks and rewards associated with the decision to invest in the Product. The approved Prospectus is available at www.vaneck.com. Please note that the approval of the prospectus should not be understood as an endorsement of the Products offered or admitted to trading on a regulated market.

Performance quoted represents past performance, which is no guarantee of future results and which may be lower or higher than current performance.

Current performance may be lower or higher than average annual returns shown. Performance shows 12 month performance to the most recent Quarter end for each of the last 5yrs where available. E.g. ’1st year’ shows the most recent of these 12-month periods and ’2nd year’ shows the previous 12 month period and so on. Performance data is displayed in Base Currency terms, with net income reinvested, net of fees. Brokerage or transaction fees will apply. Investment return and the principal value of an investment will fluctuate. Notes may be worth more or less than their original cost when redeemed.

Index returns are not ETN returns and do not reflect any management fees or brokerage expenses. An index’s performance is not illustrative of the ETN’s performance. Investors cannot invest directly in the Index. Indices are not securities in which investments can be made.

No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

© VanEck (Europe) GmbH

Du kanske gillar

-

VBTC ETN spårar priset på kryptovalutan Bitcoin

-

Q2 2025 Outlook: In the Middle of the 3% Reckoning

-

Virtune AB (publ) lanserar Virtune Chainlink ETP på Nasdaq Helsinki

-

Investerarnas intresse kraftigt förändrat under februari 2025

-

De mest eftersökta ETFerna i januari 2025

-

Börshandlade produkter som ger exponering mot PYTH

Nyheter

Fem spanska fonder som har ökat med +12% under 2025

Publicerad

10 timmar sedanden

25 april, 2025

År 2025 visar sig bli ett tufft år för finansmarknaderna. Med det första kvartalet fortfarande att avslutat upplever de stora internationella aktieindexen kraftiga nedgångar, där indexfonder baserade på S&P 500 och Nasdaq-100 drabbas särskilt hårt. Det finns dock en kategori som står sig starkt: Ibex 35 indexfonder, som har blivit en av årets mest räddningsvärda tillgångar. Det finns fem spanska fonder som har ökat med +12% under 2025.

Mer specifikt har fonder som investerar i spanska aktier (både indexfonder och aktivt förvaltade) ackumulerat en genomsnittlig avkastning på 14,29 % hittills under 2025. Denna siffra gör kategorin till den mest lönsamma bland aktiefonder, och den näst mest lönsamma av alla investeringsfondkategorier, efter endast guld- och ädelmetallfonder, som har skjutit i höjden med en omvärdering på mer än 40 %.

Inom den spanska kategorin upplever Ibex 35 indexfonder en stark utveckling, med avkastning överstigande 12 % under 2025. Nedan granskar vi årets fem mest lönsamma Ibex indexfonder, rangordnade från lägst till högst avkastning:

BBVA Bolsa Índice FI

Denna Ibex 35 indexfond, som förvaltas av BBVA Asset Management, har stigit med 12,03 % hittills i år. Under de senaste 5 åren har den erbjudit en genomsnittlig avkastning på 16,12 %.

Den har tillgångar på 116,5 miljoner euro och följer Ibex 35 Net Return-indexet, vilket inkluderar utdelningar. Dess nuvarande kostnader är 1,21 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,57% |

| Banco Santander S.A. | 13,16% |

| Iberdrola S.A. | 12,39% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,32% |

| CaixaBank S.A. | 5,36% |

| Amadeus IT Group S.A. | 4,57% |

| Ferrovial SE | 4,42% |

| Futuro sobre IBEX 35 | 3,75% |

| Aena SME S.A. | 3,60% |

| Telefónica S.A. | 3,40% |

Santander Indice España FI Openbank

Santander Asset Managements indexfond Ibex 35 har en avkastning på 12,08 % år 2025. Under fem år har den ackumulerat en avkastning på 16,20 %.

Den förvaltar tillgångar till ett värde av 961,7 miljoner euro, vilket gör den till en av de största fonderna i detta urval. Förvaltningsavgiften är 0,70 % och de löpande kostnaderna är 1,11 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 14,18% |

| Iberdrola S.A. | 12,70% |

| Banco Santander S.A. | 10,82% |

| Futuro sobre Ibex 35 (venc. 02/2025) | 9,90% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 9,16% |

| Bono España 0,65% | 5,57% |

| CaixaBank S.A. | 4,84% |

| Amadeus IT Group S.A. | 4,60% |

| Ferrovial SE | 4,40% |

| Aena SME S.A. | 3,60% |

ING Direct Fondo Naranja Ibex 35 FI

Fondo Naranja Ibex 35 de ING, som förvaltas av Amundi Iberia, har hittills under 2025 haft en avkastning på 12,13 %. Under femårsperioden har den ackumulerat en avkastning på 16,31 %.

Denna fond har tillgångar på 268,4 miljoner euro och replikerar Ibex 35 Net Return. Förvaltningsavgiften är 0,99 % och de löpande kostnaderna är 1,1 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,90% |

| Banco Santander S.A. | 13,48% |

| Iberdrola S.A. | 12,69% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,57% |

| CaixaBank S.A. | 5,49% |

| Amadeus IT Group S.A. | 4,68% |

| Ferrovial SE | 4,53% |

| Aena SME S.A. | 3,68% |

| Telefónica S.A. | 3,49% |

| Cellnex Telecom S.A. | 3,48% |

Caixabank Bolsa Índice España Estándar FI

Caixabank AM-fonden har hittills under 2025 redovisat en ökning på 12,23 %. Dess genomsnittliga avkastning under de senaste fem åren har varit 16,72 %.

Dess förvaltade tillgångar uppgår till 335,5 miljoner euro, och det motsvarar Ibex 35 Net Return. Din provision är i detta fall 1 % och dina nuvarande utgifter är 1,03 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Iberdrola S.A. | 13,61% |

| Banco Santander S.A. | 13,28% |

| Inditex (Industria de Diseño Textil S.A.) | 12,13% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,22% |

| CaixaBank S.A. | 5,82% |

| Amadeus IT Group S.A. | 4,49% |

| Ferrovial SE | 4,25% |

| Aena SME S.A. | 3,68% |

| Telefónica S.A. | 3,49% |

| Cellnex Telecom S.A. | 3,28% |

Bindex España Índice FI

Och den mest lönsamma fonden bland de som är indexerade mot Ibex 35 år 2025 (även om vi talar om tiondelar och hundradelar jämfört med resten) är Bindex Spain Index, från BBVA Asset Management. Denna fond har hittills i år haft en avkastning på 12,35 % och en 5-årsavkastning på 17,35 %.

Med tillgångar på 146,4 miljoner euro har denna fond etablerat sig som det billigaste alternativet av de fem (förvaltningsavgift på 0,11 % och löpande kostnader på 0,14 %). Den replikerar också Ibex 35 Total Return.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,62% |

| Banco Santander S.A. | 13,20% |

| Iberdrola S.A. | 12,43% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,35% |

| CaixaBank S.A. | 5,38% |

| Amadeus IT Group S.A. | 4,59% |

| Ferrovial SE | 4,44% |

| Aena SME S.A. | 3,61% |

| Telefónica S.A. | 3,42% |

| Cellnex Telecom S.A. | 3,41% |

Nyheter

ASRP ETF ett spel på medtech företag världen över

Publicerad

11 timmar sedanden

25 april, 2025

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR (ASRP ETF) med ISIN LU2365457410, försöker följa ECPI Global ESG Medical Tech-index. ECPI Global ESG Medical Tech-index spårar företag från utvecklade marknader över hela världen som är aktiva inom medicinteknikbranschen. Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning). De utvalda värdepapperen viktas lika i indexet.

Den börshandlade fondens (total cost ratio) uppgår till 0,30 % p.a. BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR är den billigaste och största ETF som följer ECPI Global ESG Medical Tech-index. ETF:n replikerar det underliggande indexets prestanda genom full replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR är en mycket liten ETF med tillgångar på 12 miljoner euro under förvaltning. Denna ETF lanserades den 10 december 2021 och har sin hemvist i Luxemburg.

Handla ASRP ETF

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR (ASRP ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Borsa Italiana.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Nyheter

Europafokuserade ETPer ser större andel av flödena under första kvartalet

Publicerad

12 timmar sedanden

25 april, 2025

HANetf har släppt sin rapport om börshandlade europeiska ETPer för första kvartalet 2025, som avslöjar banbrytande insikter i den snabba utvecklingen av den europeiska ETF-marknaden.

Tillgångar i europeiska ETPer nådde 2,4 biljoner dollar under första kvartalet, varav ETFer stod för 2,28 biljoner dollar. Kärnaktions-ETFer ledde flödena (45,70 miljarder dollar) medan räntebärande ETFer ökade med 15,19 miljarder dollar.

Viktiga data

- Europeiska ETPer överstiger 2,4 biljoner dollar i förvaltat kapital under första kvartalet 2025

- Flöden omdirigerades till Europafokuserade ETPer jämfört med USA-fokuserade mitt i tullkrisen

- Kärnaktions-ETFer överstiger milstolpen på 1 biljon dollar i förvaltat kapital med 45,70 miljarder dollar i nettoflöden under första kvartalet

- Aktiva ETFer i förvaltat kapital ökade med 11,65 % under första kvartalet och optionsbaserade ETFer i förvaltat kapital med 54,55 %.

- Antalet europeiska ETP-varumärken fortsätter att öka och uppgår nu till totalt 131.

- Europa godkänner semitransparenta ETFer, vilket potentiellt uppmuntrar fler aktiva förvaltare i USA att gå in på den europeiska ETF-marknaden.

- Försvars-ETFer såg flöden på 4,16 miljarder dollar under första kvartalet, vilket motsvarar 4,5 % av de totala ETF-flödena i Europa och en 5-faldig ökning jämfört med föregående kvartal.

Läs hela rapporten för att upptäcka kvartalsdata, ETF-marknadens utveckling, tillväxten inom nya områden som optionsbaserade ETFer och mer.

Fem spanska fonder som har ökat med +12% under 2025

ASRP ETF ett spel på medtech företag världen över

Europafokuserade ETPer ser större andel av flödena under första kvartalet

JAAA ETF an aktiv satsning på säkerställda obligationer

Can crypto outperform amidst the current market turmoil?

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa