Nyheter

Cryptoassets of the Month: November 2023

Publicerad

1 år sedanden

Every month, 21Shares research team will present the cryptoassets of the month that increased or dropped in value by more than 15%. With a data-driven approach, we highlight the most important developments and events causing price movements.

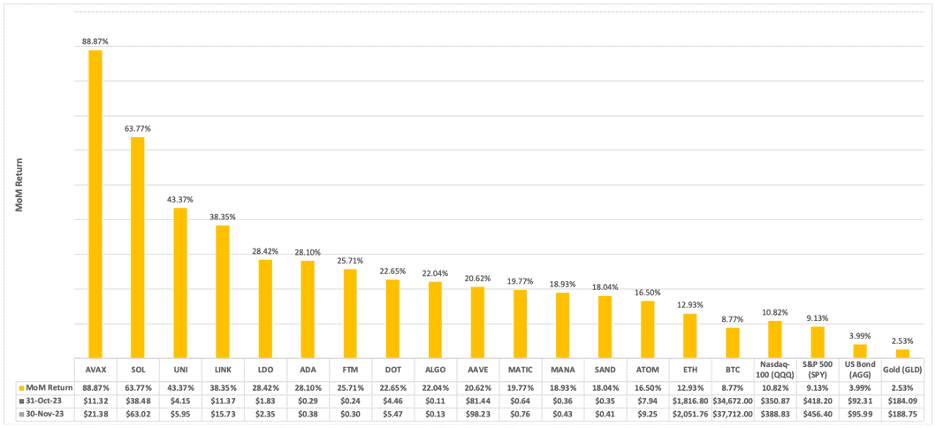

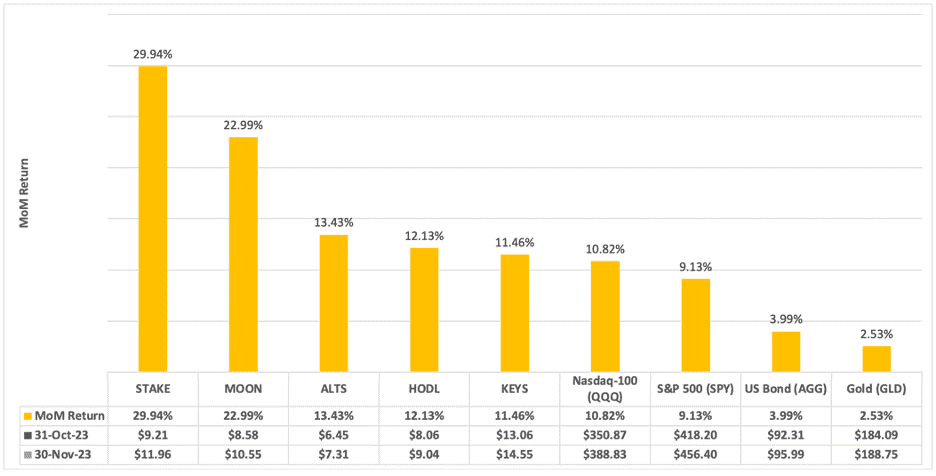

Figure 1 – 30-Day Performance: Cryptoassets of the Month vs. Traditional Asset Classes

Source: 21Shares, CoinGecko, and Yahoo Finance, from 31-Oct-2023 to 30-Nov-2023 (Close Price)

Avalanche (AVAX)

Avalanche’s native token AVAX traded up 88.87% over the past month as a narrative around growing institutional adoption of the platform has been getting traction. On November 16, Ava Labs’ AvaCloud, a launchpad that allows businesses to deploy custom, fully managed blockchains using an intuitive no-code portal, was used by Citi to price and execute simulated bilateral spot foreign-exchange (FX) trades on-chain. In addition, JP Morgan and Apollo Global announced a collaborative effort leveraging a permissioned Avalanche Evergreen Subnet to build an on-chain portfolio management solution. Both proofs of concept are part of the Monetary Authority of Singapore’s (MAS) Project Guardian.

Solana (SOL)

Solana (SOL) rallied 63.77% in November as on-chain activity exploded. In November, trading volume on Solana’s decentralized exchanges (DEXs) hit an all-time high of $7.3 billion. The current wave of ”airdrops” across Solana’s applications is a critical factor contributing to the rise in on-chain activity. Pyth Network – an oracle that provides a variety of price feeds for apps – airdropped PYTH tokens to over 100k users on Solana. Other notable applications like Jupiter (JUP), a DEX aggregator offering unique features such as limit orders and dollar-cost averaging, or Jito (JTO), a liquid staking provider that accrues both staking and MEV rewards, have confirmed upcoming airdrops. Undoubtedly, the wealth effect of meaningful airdrops to the community can have a reflexive impact on Solana’s ecosystem, similar to what Ethereum experienced during the summer of 2020.

Uniswap (UNI)

Uniswap (UNI) rose 43.37% over the past month. On October 17, Uniswap Labs – core contributors of the Uniswap protocol – began charging a 0.15% swap fee on specific tokens in their web interface and mobile wallet. Since then, Uniswap Labs has accrued more than $1.8 million through the fee mechanism, which is highly promising for the sustainability and long-term development of the decentralized exchange. On another note, Thalos, a technology provider for institutions to trade digital assets, partnered with Uniswap Labs to provide its clients with the deepest liquidity venue in DeFi. The partnership will expand opportunities for clients to achieve the best trade execution as they can seamlessly tap into centralized and decentralized liquidity venues.

Chainlink (LINK)

Chainlink (LINK) rallied 38.35% over the past month. Regarding fundamentals, Chainlink Staking v0.2 went live on November 28, with a pool size capped at 45 million LINK. The upgrade is designed to improve the security of the Chainlink network by introducing new features, such as slashing (i.e., losing a portion of the principal staked balance due to being deemed a ”bad actor” on the network). In other words, slashing creates a negative incentive to prevent node operators from behaving maliciously. Another crucial addition of Staking v0.2 is the introduction of a dynamic rewards mechanism that can support new external sources of revenue in the future, such as user fees. For instance, stakers could accrue a portion of the >$150k that Chainlink has generated thanks to CCIP in the past five months.

Lido (LDO)

Lido (LDO) rose 28.42% over the past month. On November 27, the Lido DAO approved the deployment of the ”Distributed Validator Technology” or Simple DVT Module. Rather than relying on a single node operator, DVT relies on multiple node operators, each managing distinct nodes that communicate and collectively reach consensus to fulfill validator responsibilities. As such, it represents a crucial step in significantly enhancing the protocol’s decentralization, distribution, and resilience. Lido estimates it could see over 200 net new operators by Q2 2024, from just 35 today. Regarding fundamentals, Lido’s staked ETH grew 5.23% from 8.80 million on October 31 to 9.26 million ETH (~$19 billion) on November 30. Lido retains 10% of staking rewards, registering ~$6.18 million in revenue in November, and is on track to surpass $60 million in annual revenue for 2023.

Cardano (ADA)

Cardano’s native token ADA traded up 28.10% over the past month. Despite its positive price performance, Cardano’s fundamentals have stayed the same, with only 35.5k daily active users as of November 30, 2023, a fraction of competing smart contract platforms like Solana (384k) and Polygon (329k). Cardano must offer differentiated applications to attract new users and bridge the education gap for developers to learn the Haskell programming language, which is the basis of Cardano’s native smart contract language, Plutus. If we observe the derivatives market, ADA funding rates have been increasing consistently since October, suggesting that many traders are positioned to the upside.

Fantom (FTM)

Fantom’s native token FTM rose 25.71% over the past month. Fantom’s total value locked (TVL) – a crypto-native metric akin to assets under management – was sitting at ~$61 million as of November 30, 2023, still down 99% from its peak in February 2022. Fantom is still struggling to attract liquidity, especially after the Multichain bridge hack in July 2023, which resulted in a ~$120 million loss for the ecosystem. It remains to be seen whether the mainnet launch of Fantom Sonic, the network’s latest upgrade expected to enhance Fantom’s throughput to 2,000 transactions per second (TPS), has any material impact on the user demand for the network.

Polkadot (DOT)

Polkadot’s native token DOT increased by 22.65% over the past month. On November 24, Polkadot welcomed a new parachain to its ecosystem dubbed “Logion.” The application-specific blockchain aims to solve one of the critical challenges with tokenization today – a legal framework for the transfer of ownership. In other words, how to ensure that a token transfer means transferring the ownership of the underlying asset? Logion is operated by a network of judicial officers who must verify the source and integrity of tokenized assets, which are issued by verified counterparties. It remains to be seen whether Logion can succeed in its mission, but it’s positive to see experimentation on this front.

Algorand (ALGO)

Algorand’s native token ALGO rose 22.04% over the past month. On November 14, blockchain firm Quantoz Payments was granted a license as an electronic money institution (EMI) under the supervision of the Dutch Central Bank and was permitted to issue a regulated euro-pegged stablecoin (EURD) on the Algorand network. EURD must have a strong distribution plan to gather sufficient growth as the stablecoin space has become highly competitive. For instance, industry leaders Tether and Circle launched euro-backed stablecoins a while back, and both products have struggled to gain traction, with just about $50 million in market cap for each, compared to their U.S. dollar-pegged counterparts ($23.5 billion for USDC and $90 billion for USDT).

Aave (AAVE)

Aave (AAVE) rallied 20.62% over the past month. In response to an attack vector reported by a white hat (ethical security hacker), core developers took immediate steps to protect the Aave protocol by pausing and freezing the affected markets on November 4. No funds were affected, and an additional proposal was then submitted to disable the stable borrow rate for all assets across all pools on all networks and unfreeze assets. Regarding on-chain metrics, Aave’s decentralized stablecoin grew ~24% in November to 34.8 million GHO in circulation. GHO got within 2% of its $1 peg on November 28 after trading almost 5% below it for most of the month due to a lack of holding demand.

Polygon (MATIC)

Polygon’s native token MATIC traded up 19.77% over the past month. As part of the Polygon 2.0 roadmap, the upgrade to POL token upgrade was initiated on the Ethereum mainnet after months of development. The migration from MATIC to POL is expected to occur early in 2024. Regarding on-chain insights, Polygon’s total value locked (TVL) decreased by almost 10%, as measured in MATIC throughout November, from 1.211 to 1.095 billion. On the other hand, the trading volume on decentralized exchanges rose ~39%, from $3.53 billion in October to $5.81 billion in November, the highest figure since March 2023.

Decentraland (MANA)

Decentraland (MANA) rose 18.93% despite a sharp drop in platform usage. About 1,550 unique wallet addresses interacted with Decentraland throughout November, a ~55% decrease from October. The virtual world has struggled to gain user traction since the peak in activity in 2021. On another note, the Decentraland Foundation announced the first-ever community conference, which will take place in Argentina in May 2024. This initiative may be an excellent opportunity to forge better relationships and a deeper bond with creators and users, as exclusively focusing on virtual events has not had the desired effects on platform growth.

The Sandbox (SAND)

The Sandbox (SAND) traded up 18.04% in November. Like Decentralan’s situation, The Sandbox has struggled to gain user traction, a worrying trend for metaverse projects. About 5,550 unique wallet addresses interacted with the virtual world throughout November, down 65% from October. At this point, it’s fair to conclude that the notable partnerships that The Sandbox struck with recognizable names in 2021 and 2022, such as TIME, Lionsgate, or Snoop Dogg, had little material impact on the long-term growth of the project.

Cosmos (ATOM)

The Cosmos Hub’s native token ATOM rose 16.50% in the past month. On November 25, ATOM’s maximum annual inflation was reduced from 20% to 10% in a close community vote. Those favoring the proposal argued that the Cosmos Hub has overpaid for the network’s security. Another crucial argument was that the high historical inflation has damaged the perception of ATOM’s monetary premium throughout the ecosystem. In contrast, the biggest detractor of the proposal was Cosmos’ co-founder Jae Kwon, who now plans to launch a Cosmos fork dubbed ”AtomOne.” Throughout crypto’s history, contentious hard forks of this type have arisen due to disagreement within a network’s community. The risks of a controversial hard fork are significant, as stakeholders (validators, developers, users) must choose which blockchain they will support when it splits and two are created. Based on the governance forum’s discussions, Kwon’s influence has waned in the community, and most will likely continue supporting the Cosmos Hub, now more unified than ever.

Ethereum (ETH)

Ethereum rose 12.93% over the past month. ETH’s net issuance was negative in November, with a decrease of ~29k ETH in circulating supply, alongside an increase in the amount of ETH burned, a sign that the cryptoasset’s prospects as a deflationary asset depend heavily on network usage. Regarding fundamentals, the amount of staked ETH closed the month at 28.69 million ETH, equivalent to ~$59 billion securing the network. Lido remains the leader in market share, with ~32% of total staked ETH distributed across 35 node operators. Finally, Ethereum remains crypto’s most profitable protocol, registering $238 million in transaction fees during November.

Bitcoin (BTC)

Bitcoin traded up 8.77% over the past month. Regarding the derivatives market, the CME surpassed Binance in BTC futures open interest for the first time in history, with $4.04 billion in notional value as of November 30, 2023. The rise in CME open interest is a testament to the demand for regulated financial products from institutions to gain exposure to Bitcoin. In terms of network activity, fees accrued to miners increased by more than six times from $21.03 million in October to $142.5 million in November. The surge results from new use cases on the network, like Ordinals NFTs, which continue to gain traction. This trend has eased many investors’ concerns regarding the long-term security of the network.

Strategies of the Month: November 2023

Every month, our research team will also present the ten best-performing strategies of the month in our product suite. With a data-driven approach, we highlight the most important developments and events causing price movements.

Figure 2: 30-Day Performance: Strategies of the Month vs. Traditional Asset Classes

Data Source: 21Shares Data Hub and Yahoo Finance, from 31-Oct-2023 to 30-Nov-2023 (Close Price)

STAKE

The 21Shares Staking Basket Index ETP (STAKE) traded up 29.94% over the past month. STAKE seeks to track an index comprising the largest cryptoassets with institutional-grade support for staking. Staking is a process whereby investors, commonly referred to as validators, commit a portion of their cryptoassets (the “stake”) to secure a blockchain by confirming transactions – and gain access to a recurring value stream of native tokens to compensate them for their work. Staking is a core energy-friendly feature of Proof-of-Stake (PoS) blockchains, and each blockchain network has its own set of staking requirements. SOL remains the index’s largest constituent with a weight of 33.64% after strong price performances in October and November.

MOON

The Sygnum Platform Winners Index ETP (MOON) rose 22.99% over the past month. MOON seeks to track the investment results of an index composed of the native tokens of the most prominent blockchain protocols, including only the largest network in a family of forks. MOON’s weighting methodology goes beyond backward-looking metrics like market cap and liquidity. It also includes early and leading indicators of value creation in the underlying ecosystems, such as developer engagement and public interest via social media.

ALTS

The 21Shares Crypto Mid-Market Index ETP (ALTS) appreciated 13.43% over the past month. ALTS seeks to track the investment results of an index capturing the mid-cap portion of the cryptoasset market. BNB and XRP are the largest constituents of the index with weights of ~26% and ~24%, respectively. BNB underperformed the broader crypto market with an almost flat performance (0.45%), likely due to Binance’s ~$4 billion settlement with the Department of Justice (DOJ) and subsequent change in leadership.

HODL

The 21Shares Crypto Basket Index ETP (HODL) traded up 12.13% over the past month. HODL seeks to track the investment results of an index of the top 5 cryptoassets ranked by the 2050 market capitalization. The 2050 market capitalization is calculated using a projected 2050 supply number and current prices. Bitcoin and Ethereum’s weights are currently around 52% and 29%, respectively. Bitcoin’s weight in the index has increased over the past month due to its relative outperformance compared to other constituents like ETH, XRP, and DOT.

KEYS

The 21Shares Bitwise Select 10 Large Cap Crypto ETP (KEYS) rose 11.46% over the past month. KEYS seeks to track the investment results of an index of the top 10 cryptoassets ranked by inflation-adjusted market capitalization. Because Bitcoin and Ethereum’s weights in the index represent about 91%, the index’s performance tends to be highly correlated with both assets, as was the case over this period.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

Dogecoin, the meme that made it

-

Stablecoins: The real powerhouse of crypto

-

Guld-ETFer slår Bitcoin-ETFer kraftigt under första kvartalet 2025

-

Dogecoin in a portfolio: A small 1% allocation has a loud bark!

-

VBTC ETN spårar priset på kryptovalutan Bitcoin

-

Trump’s trade war puts Bitcoin in the spotlight

Nyheter

Europeisk försvars-ETF når 10 miljoner dollar under den första noteringsveckan

Publicerad

12 timmar sedanden

20 april, 2025

HANetf, Europas första och enda oberoende white-label UCITS ETF och ETC-plattform, och ledande leverantör av digitala tillgångs-ETPer, är glada att kunna meddela att Future of Defence UCITS ETF (ticker: ASWC) nu har ackumulerat 2,00 miljarder dollar i förvaltat kapital (AUM).

Bara under 2025 har ETFen attraherat 1,07 miljarder dollar i nya nettotillgångar. Detta, tror vi, till stor del har drivits av Europas kapplöpning att återupprusta sig mitt i växande frågor kring tillförlitligheten i USA:s stöd. USA pausade nyligen militärt bistånd till Ukraina, vilket ledde till att underrättelsedelningen pausades och Kiev blev oförmöget att använda vissa amerikanska vapen. Detta var en tydlig varning till europeiska ledare – USA kan överge dem när som helst.

Efter ett decennium av att inte ha uppnått 2 %-målet av BNP har Europa tillsammans underutnyttjat med uppskattningsvis 850 miljarder euro. Men nu, med ökande geopolitiska spänningar och ifrågasatt amerikanskt militärt stöd, ser de europeiska NATO-medlemmarna över sina försvarsstrategier och ökar sina militära utgifter kraftigt. För att återuppbygga och modernisera sina väpnade styrkor riktar regeringarna dessa förnyade investeringar mot europeiska försvarsföretag – vilket stärker kontinentens strategiska självförsörjning.

Europas upprustning handlar inte bara om att spendera mer – det handlar om att bygga europeiskt oberoende och autonomi inom försvaret. För att minska beroendet av amerikansk utrustning prioriterar EU europeiskt tillverkade vapen, fordon och system, vilket ger den europeiska försvarssektorn en stark medvind.

ASWC ETF syftar till att ge exponering mot NATO och NATO+-allierades försvars- och cyberförsvarsutgifter. Unikt nog använder försvars-ETF en ”NATO-skärm”, vilket begränsar exponeringen mot företag med säte i NATO eller NATO+-allierades medlemsstater.

På detta sätt försöker ETFen att anpassa sig till värderingarna hos investerare som kan ha oro över försvarsinvesteringar, men inte kan ignorera det rådande politiska klimatet och därför söker en smartare och mer genomtänkt strategi. NATO är en defensiv allians och anger själva att ”avskräckning och försvar är en av dess kärnuppgifter” – att fokusera på företag som är verksamma i NATO-allierade länder begränsar möjligheten att ETFens beståndsdelar är företag som är verksamma i länder som en dag skulle kunna bli motståndare till alliansen.

HANetf lanserade nyligen Future of European Defence UCITS ETF (ticker: (8RMY) som exkluderar USA och syftar till att fånga upp Europas upprustning. Som ett europeiskt företag anser HANetf att det är en plikt att stödja investeringar i europeiskt försvar i takt med att kontinenten försöker stärka sin säkerhet. 8RMY ETF har sedan dess överstigit 10 miljoner dollar i förvaltat kapital under sin första noteringsvecka.

På liknande sätt använder 8RMY ”NATO-skärmen” för att begränsa exponeringen mot företag med säte i NATO eller NATO+-allierade medlemsstater.

Hector McNeil, medgrundare och VD för HANetf, kommenterar:

”USA har skickat ett budskap till Europa och det har mottagits tydligt och tydligt. Amerikanskt militärt bistånd, som en gång ansågs vara en garanti, är nu osäkert – och med den osäkerheten kommer ett tydligt direktiv. Europa måste anpassa sig till en värld där USA inte är garant för säkerhet; Europa måste förbereda sig på att försvara sig ensamt.

”Detta har inte gått investerare obemärkt förbi, med stark kursutveckling för europeiska försvarsaktier. Företag som tyska Rheinmetall, brittiska BAE Systems och franska Thales har potentiellt nytta av det. Future of Defence UCITS ETF (ticker: ASWC) gör det möjligt för investerare att få exponering mot dessa företag (och andra) på ett diversifierat sätt.” ”ETFens NATO-screening skiljer den från sina konkurrenter genom att säkerställa att investerare får exponering mot NATO och NATO+-allierade försvarsföretag, samtidigt som de undviker företag som är verksamma i länder som en dag skulle kunna bli motståndare till alliansen. Ingen annan försvarsfokuserad ETF inkluderar denna NATO-screening och som sådan är NATO-ETF:n verkligen unik.

”För de som söker mer fokuserad exponering lanserade vi nyligen Future of European Defence UCITS ETF (ticker: 8RMY), och den har överstigit 10 miljoner dollar i förvaltat kapital under sin första handelsvecka. Vi är ett europeiskt företag, och som sådan anser vi att det är vår plikt att stödja investeringar i europeiskt försvar i ett så avgörande ögonblick. Denna ETF exkluderar amerikanska aktier och syftar till att fånga upp Europas upprustning.”

Handla 8RMY ETF

Future of European Defence UCITS ETF (ticker: 8RMY) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Euronext Paris. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Handla ASWC ETF

HANetf Future of Defence UCITS ETF (ASWC ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Nyheter

Hur investerar jag i ETFer som fokuserar på breda vallgravar?

Publicerad

13 timmar sedanden

20 april, 2025

Vissa företag har lyckats skapa en strategisk fördel gentemot sina konkurrenter. Metaforiskt kallas detta för breda vallgravar, vilket återspeglar dessa företags starkt befästa marknadsposition. Sådana konkurrensfördelar kan bero på ett varumärkes särprägel eller på en forsknings- och utvecklingsfördel baserad på patent. En vallgrav kan också vara resultatet av territoriell distribution eller produktionsrättigheter som ett företag kan göra anspråk på. En annan möjlighet är en stark position genom den utbredda användningen av företagets produkter bland kunderna, vilket gör det svårt för de senare att byta till andra leverantörer. Dessutom kan vissa företag producera sina varor mycket billigare än sina konkurrenter.

För att kunna utvärdera sådana konkurrensfördelar måste analytiker noggrant undersöka verksamheten, konkurrenssituationen och företagens strategiska tillvägagångssätt. Resultaten kan sedan användas för att skapa ett index som kan spåras med ETFer.

I den här investeringsguiden hittar du alla ETFer som fokuserar på företag med en bred vallgrav. Vi har identifierat sex index som spåras av sex olika börshandlade fonder. Den årliga förvaltningskostnaden ligger på mellan 0,39 och 0,52 procent per år.

Breda vallgravar ETFer i jämförelse

När man väljer en ETF med fokus på breda vallgravar bör man överväga flera andra faktorer utöver metodiken för det underliggande indexet och prestanda för en ETF. För bättre jämförelse hittar du en lista över alla breda vallgrav ETFer med detaljer om namn, kortnamn, förvaltningskostnad, utdelningspolicy, hemvist och replikeringsmetod. För ytterligare information om någon av de olika börshandlade fonderna klicka på kortnamnet i tabellen nedan.

| Namn ISIN | Kortnamn | Avgift % | Utdelnings- policy | Hemvist | Replikerings- metod |

| VanEck Morningstar US Sustainable Wide Moat UCITS ETF IE00BQQP9H09 | GMVM | 0.49% | Ackumulerande | Irland | Fysisk replikering |

| VanEck Morningstar Global Wide Moat UCITS ETF IE00BL0BMZ89 | VVGM | 0.52% | Ackumulerande | Irland | Fysisk replikering |

| Frankfurter UCITS ETF Modern Value LU2439874319 | C9DF | 0.52% | Utdelande | Luxemburg | Fysisk replikering |

| VanEck Morningstar US Wide Moat UCITS ETF A IE0007I99HX7 | WMOT | 0.46% | Ackumulerande | Irland | Fysisk replikering |

| L&G Global Brands UCITS ETF USD Acc IE0007HKA9K1 | TOPB | 0.39% | Ackumulerande | Irland | Fysisk replikering |

| VanEck Morningstar US SMID Moat UCITS ETF A IE000SBU19F7 | SMTV | 0.49% | Ackumulerande | Irland | Fysisk replikering |

Nyheter

WELL ETF för den som tror på den globala IT-sektorn

Publicerad

14 timmar sedanden

20 april, 2025

Amundi S&P Global Information Technology ESG UCITS ETF DR EUR (D) (WELL ETF) med ISIN IE000GEHNQU9, försöker följa S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Information Technology-index. Det S&P-utvecklade ex-Korea LargeMidCap Sustainability Enhanced Information Technology-indexet spårar stora och medelstora företag från IT-sektorn. Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,18 % p.a. Amundi S&P Global Information Technology ESG UCITS ETF DR EUR (D) är den billigaste ETF som följer S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Information Technology-index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen delas ut till investerarna (Årligen).

Amundi S&P Global Information Technology ESG UCITS ETF DR EUR (D) är en liten ETF med tillgångar på 27 miljoner euro under förvaltning. ETF:n lanserades den 20 september 2022 och har sin hemvist i Irland.

Investeringsmål

AMUNDI S&P GLOBAL INFORMATIONSTEKNOLOGI ESG UCITS ETF DR – EUR (D) strävar efter att replikera, så nära som möjligt, resultatet för S&P Developed Ex-Korea LargeMidCap Sustainability Enhanced Information Technology Index (Netto Total Return Index). Denna ETF har exponering mot stora och medelstora företag i utvecklade länder. Den innehåller uteslutningskriterier för tobak, kontroversiella vapen, civila och militära handeldvapen, termiskt kol, olja och gas (inkl. Arctic Oil & Gas), oljesand, skiffergas. Den är också utformad för att välja ut och omväga företag för att tillsammans förbättra hållbarhet och ESG-profiler, uppfylla miljömål och minska koldioxidavtrycket

Handla WELL ETF

Amundi S&P Global Information Technology ESG UCITS ETF DR EUR (D) (WELL ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

Största innehav

Denna fond använder fysisk replikering för att spåra indexets prestanda.

| Namn | Valuta | Vikt % | Sektor |

| NVIDIA CORP | USD | 20.01 % | Informationsteknologi |

| MICROSOFT CORP | USD | 19.23 % | Informationsteknologi |

| APPLE INC | USD | 17.34 % | Informationsteknologi |

| ASML HOLDING NV | EUR | 6.30 % | Informationsteknologi |

| SAP SE / XETRA | EUR | 2.48 % | Informationsteknologi |

| SALESFORCE COM | USD | 2.20 % | Informationsteknologi |

| ADOBE INC | USD | 2.06 % | Informationsteknologi |

| ADVANCED MICRO DEVICES | USD | 2.02 % | Informationsteknologi |

| QUALCOMM INC | USD | 1.94 % | Informationsteknologi |

| CISCO SYSTEMS INC | USD | 1.88 % | Informationsteknologi |

Innehav kan komma att förändras.

Europeisk försvars-ETF når 10 miljoner dollar under den första noteringsveckan

Hur investerar jag i ETFer som fokuserar på breda vallgravar?

WELL ETF för den som tror på den globala IT-sektorn

Dogecoin, the meme that made it

VSUI ETN spårar priset på kryptovalutan SUI

Fonder som ger exponering mot försvarsindustrin

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Warren Buffetts råd om vad man ska göra när börsen kraschar

Svenskarna har en ny favorit-ETF

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFonder som ger exponering mot försvarsindustrin

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFastställd utdelning i MONTDIV mars 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSju börshandlade fonder som investerar i försvarssektorn