Nyheter

Cryptoassets of the Month August 2023

Publicerad

2 år sedanden

Every month, our research team will present the cryptoassets of the month August 2023 that increased or dropped in value by more than 15%. With a data-driven approach, we highlight the most important developments and events causing price movements.

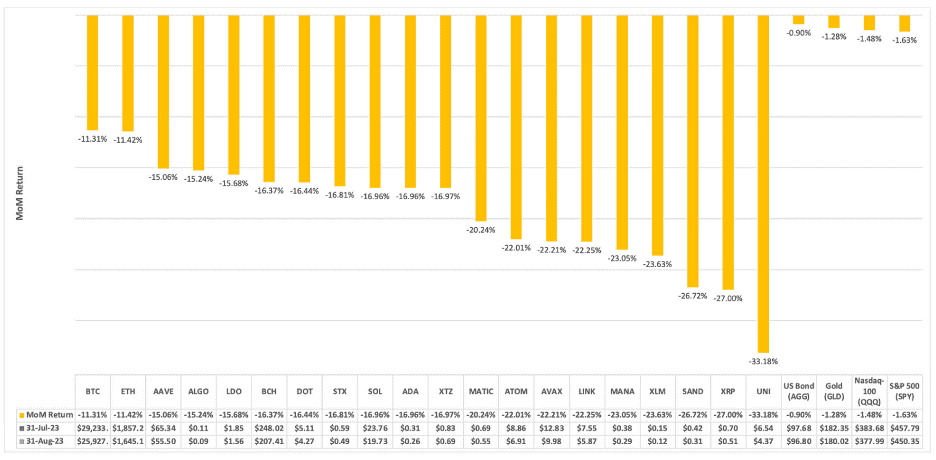

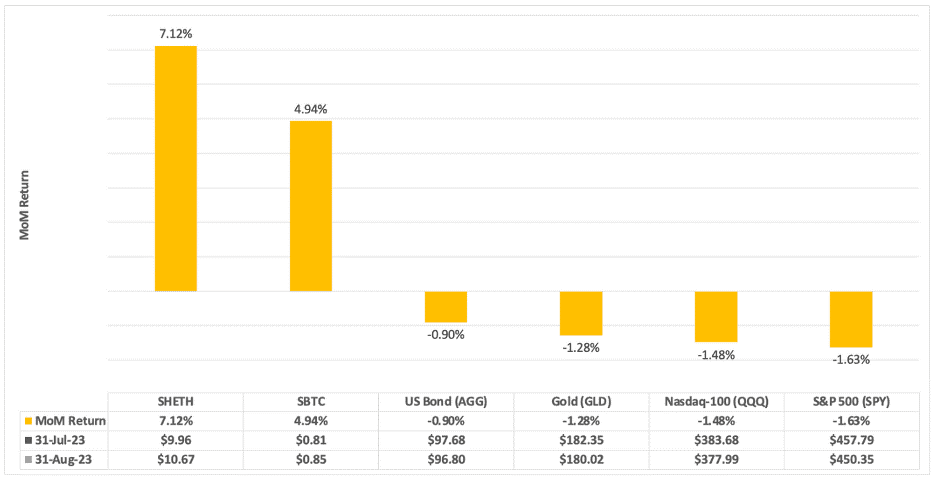

Figure 1 – 30-Day Performance: Cryptoassets of the Month vs. Traditional Asset Classes

Source: 21Shares, CoinGecko, and Yahoo Finance, from 31-July-2023 to 31-August-2023 (Close Price)

Bitcoin (BTC)

Bitcoin traded down 11.31% over the past month. On August 17, we saw ~$979 million of liquidations, of which ~$786 million were longs, as BTC dropped 7.50% in a single day. This event constituted the most significant long liquidations in more than a year (even higher than during the FTX collapse), indicating that many investors were positioned to the upside amidst last month’s price decline. In this regard, BTC futures perpetual open interest across centralized exchanges dropped 33% from $10.02 billion on August 8 to $6.71 billion on August 31. On another note, BTC on exchanges reached a five-year low of 2.25 million, a figure not seen since March 2018.

Ethereum (ETH)

Ethereum traded down 11.42% over the past month. On August 7, fintech giant PayPal launched its own stablecoin (PayPal USD) on the Ethereum network. The move could drive a significant influx of new users to Ethereum, as PayPal had 435 million active accounts at the end of 2022, compared to ~1 million active users on Ethereum and L2s. Moreover, it is a massive step toward integrating crypto with traditional payment methods. On the fundamentals side, Coinbase’s Base L2 network launched on August 9. Instead of launching a native token, users transacting on Base pay transaction fees in ETH, generating demand for the asset. Base’s network has already amassed over $400 million in assets and 100k daily active users throughout the month.

Aave (AAVE)

Aave (AAVE) traded down 15.06% over the past month. In July, Aave launched GHO – a fully collateralized dollar-pegged stablecoin governed by AAVE holders, already reaching over $23 million in circulation. In contrast to stablecoins issued by centralized companies like Circle’s USDC or Tether’s USDT, which are backed by physical U.S. dollars and short-term Treasury bills, GHO is mainly backed by Lido’s staked ETH (42%), ETH (23%), and wrapped BTC (15%). Moreover, instead of liquidity providers (LPs) receiving most of the interest paid, the Aave DAO collects 100% of GHO’s borrowed interest. As a result, Aave registered over $12 million in fees during August, a 71% increase from July.

Algorand (ALGO)

Algorand’s native token ALGO traded down 15.24% over the past month, making a new all-time low of $0.09 on August 17. Algorand launched in June 2019, but the network has struggled to gain user and developer traction. Electric Capital data shows that Agorand only had 34 monthly active developers as of June 2023, a 63% decrease from the previous year. In addition, Algorand’s ecosystem experienced a significant setback in July when Algofi, the largest DeFi application on the network, announced they would sunset the platform and put it in withdrawal-only mode due to a ”confluence of events that no longer makes building and maintaining the Algofi platform to the highest standards a viable path.”

Lido (LDO)

Lido (LDO) traded down 15.68% over the past month. On August 11, the Lido DAO voted to onboard two new node operators – African-based Launchnodes and Latin American-based SenseiNode, thus contributing to Ethereum’s geographic resilience. Launchnode, who has previously worked with UNICEF to pay for school internet connectivity and Save The Children funding tablets for refugee camps, has committed a portion of future staking rewards to fund similar long-term social impact projects in developing countries. Regarding fundamentals, Lido’s staked ETH grew 7.17% from 7.95 million on July 31 to 8.52 million ETH (~$14 billion) on August 31. Lido retains 10% of staking rewards, registering over $5.3 million in revenue in August, and is on track to surpass $60 million in annual revenue for 2023.

Bitcoin Cash (BCH)

Bitcoin Cash (BCH) traded down 16.37% over the past month. On August 17, Tether announced they would discontinue support for USDT on Kusama, Omni Layer, and Bitcoin Cash SLP due to a ”lack of significant traction over a significant period of time and no signs of recovery in usage indicators.” The low usage meant maintaining support became inefficient for Tether and jeopardized security oversight. For context, Bitcoin Cash SLP refers to ”Simple Ledger Protocol,” a blockchain token system that allows users to create, issue, and transfer digital tokens leveraging the security of the Bitcoin Cash network.

Polkadot (DOT)

Polkadot’s native token DOT decreased by 16.44% in August. During Decoded 2023, the ecosystem’s flagship conference, Polkadot founder Gavin Wood announced the network’s vision as a ”global, multi-core supercomputer” on which many applications run. Under the current architecture, projects that want to launch a ”parachain” (i.e., app-specific blockchain) on Polkadot need to lock up a significant amount of DOT, which token holders loan to lease their slot for two years. The new direction presented by Wood, which people are dubbing ”Polkadot 2.0,” would evolve Polkadot away from its current reliance on parachain slots to offer more flexible ways of launching applications on the network.

Stacks (STX)

Stacks’ native token STX traded down 16.81% over the past month. Hiro Systems, core contributors of the Stacks network, announced a new feature dubbed ”Chainhook” that will enable more efficient indexing of Bitcoin blockchain data and a novel way to add conditional logic to applications on Stacks. On another front, Pyth’s oracle network, which secures more than $1.2 billion in value across the Solana, BSC, and Optimism ecosystems, has enabled more than 300 price feeds on the Stacks network, including equities, exchange-traded products (ETPs), commodities, foreign exchange pairs, and cryptoassets. Because blockchains are isolated from their world outside their ledger, integrations with oracle networks feeding data external to the blockchain are essential for a thriving ecosystem.

Solana (SOL)

Solana (SOL) traded down 16.96% despite exciting ecosystem developments. Solana Pay, a decentralized payment protocol, has integrated its plug-in with e-commerce company Shopify, allowing millions of businesses on its platform to use Solana-based stablecoins like USDC for payment at checkout. In addition, Visa expanded its USDC cross-border settlement pilot to include the Solana blockchain to onboard more clients, citing ”significant demand to leverage newer, high-performance blockchains that can send and receive stablecoins with higher speed and lower costs” than Ethereum. Compared to a ~3-minute average settlement time on Ethereum, Solana settles transactions in just ~400 milliseconds. Solana’s integration with existing financial software players marks a crucial step toward the widespread adoption of stablecoins for merchant payments.

Cardano (ADA)

Cardano’s native token ADA traded down 16.96% over the past month. The education team of IOHK, the company behind Cardano’s architecture, conducted teach-in sessions on Haskell in Nairobi, Kenya, and the ITESO University in Guadalajara, Mexico. For context, Plutus – the language developed to write smart contracts on Cardano – is based on Haskell, commonly used in the banking and defense sectors. Education is essential to lower the barrier of entry of new builders to the Cardano ecosystem – Stack Overflow’s 2023 Developer Survey suggests that only 2.09% of worldwide developers use Haskell.

Tezos (XTZ)

Tezos’ native token XTZ traded down 16.97% in August despite some exciting developments. Following the activation of the Nairobi protocol upgrade on June 24 – which increased transactions per second (TPS) by ~8x – the Tezos team announced Oxford, the network’s 15th upgrade proposal. Among many improvements, Oxford will introduce a dynamic inflation mechanism for XTZ based on a target staking ratio of 50%. When the percentage of staked funds decreases from the target, emission rates will increase, incentivizing validators to stake funds to re-approach the target and vice versa.

Polygon (MATIC)

Polygon’s native token MATIC traded down 20.24% over the past month despite the number of brands with a footprint on the network continuing to grow. Japanese electronic manufacturing company Casio announced the launch of Virtual G-Shock on Polygon. The project will issue 15,000 limited-edition ”G-Shock Creator Pass NFTs,” granting holders access to exclusive Casio community projects and channels. Furthermore, German airline Lufthansa launched Uptrip, a mobile application that rewards travelers with NFT cards living on the Polygon network for every flight they take. With the cards, users can form collections that offer loyalty rewards like business lounge vouchers and free miles.

Cosmos (ATOM)

The Cosmos Hub’s native token ATOM traded down 22.01% in August despite signs of ecosystem traction. Last month marked the second implementation of Interchain Security (ICS) – liquid staking network Stride became a ”consumer chain,” joining Neutron in handing block production to the Cosmos Hub’s validator set and rewarding ATOM stakers for this service. As such, the Stride blockchain now has the same economic security as the Cosmos Hub (~$2 billion), a nearly 100x increase from Stride’s previous security. In addition, Circle will launch USDC on Cosmos via Noble – an ”appchain” purpose-built for native asset issuance in the Cosmos ecosystem by leveraging the Inter-Blockchain Communication (IBC) protocol.

Avalanche (AVAX)

Avalanche’s native token AVAX traded down 22.21% over the past month. On August 8, Circle launched its wallet-as-a-service platform for developers on Avalanche, Ethereum, and Polygon. The service allows developers to seamlessly embed wallets into their interface, with user-friendly features such as a PIN and social account recovery instead of lengthy private keys and mnemonic phrases. Regarding ecosystem developments, the Avalanche Foundation granted $3 million to Dexalot, a central limit order book (CLOB) Subnet, as part of Avalanche Multiverse, an up to $290 million incentive program to accelerate the growth of Avalanche Subnets.

Chainlink (LINK)

Chainlink (LINK) traded down 22.25% over the past month. In August, interbank messaging company Swift released a report on its year-long experiment using Chainlink’s Cross-Chain Interoperability Protocol (CCIP). The results showed that by combining Swift’s messaging standards with CCIP, financial institutions like BNP Paribas, BNY Mellon, and Citi successfully used their existing backend systems to interact with tokenized assets and transact across public and private blockchains. Increased adoption of CCIP would benefit Chainlink’s profitability as the protocol charges a fee on top of the gas cost overhead for every transaction. Since launching in July 2023, Chainlink has earned over $69,000 from CCIP.

Decentraland (MANA)

Decentraland (MANA) traded down 23.05% despite rising platform usage. About 3,820 unique wallet addresses interacted with Decentraland throughout August, a ~108% growth from July. On August 22, the Decentraland Foundation announced monthly event themes, starting from September 2023 through the end of 2024. The initiative aims to create a framework for the community and brands in the decentralized virtual world to launch their own events and experiences related to a specific theme, encouraging innovation and new content on Decentraland. For instance, the themes for the next three months will be design, artificial intelligence (AI), and music.

Stellar (XLM)

Stellar’s native token XLM traded down 23.63% over the past month. On August 15, the Stellar Development Foundation (SDF) acquired a minority stake in money transfer company MoneyGram International (MGI) to help expand its digital business with blockchain technology integrations. Thanks to a partnership with MoneyGram, USDC on Stellar already has over 81,000 on-ramp locations and over 320,000 off-ramp locations worldwide. The SDF’s investment could further benefit Stellar’s mission to provide seamless fiat-to-crypto on and off-ramps.

The Sandbox (SAND)

The Sandbox (SAND) traded down 26.72% in August, underperforming the broader market. Regarding ecosystem traction, the British Museum chose The Sandbox to establish its metaverse footprint. Through the partnership, the British Museum will create a range of digital collectibles and experiences showcasing its history – founded in 1753, it was the first public national museum to cover all fields of knowledge. On a less optimistic note, about 3,780 unique wallet addresses interacted with The Sandbox throughout August, down 17% from July.

XRP Ledger (XRP)

XRP traded down 27.00% in the past month. XRP’s relative strength index (RSI) was in the ”overbought” zone (>70) for the latter half of July as the cryptoasset rose ~47% on the back of the U.S. District Court’s summary judgment deeming that the XRP token, by itself, was not a security under U.S. law. In August, the SEC filed a motion to request an interlocutory appeal of the landmark decision from July, arguing it could have a ”substantial impact on a large number of pending litigations.” On another front, the Republic of Palau partnered with Ripple to pilot the launch of the Palau Stablecoin (PSC), backed by the U.S. dollar, on the XRP Ledger.

Uniswap (UNI)

Uniswap (UNI) traded down 33.18% over the past month, underperforming the broader market. Uniswap launched on Coinbase’s L2 Base on August 8 and is already the network’s most dominant decentralized exchange (DEX) with ~$46 million in weekly trading volume. On another note, the Uniswap Labs team hosted an internal 24-hour ”hackathon,” a coding event that gave life to sixteen new projects. The winning team created an end-to-end NFT ticketing system for venues that would allow Uniswap mobile wallet users to display a QR code for their NFT tickets, which they can sign in-app to prove ownership. The venue system would then scan the QR code, verify ownership, and mark attendance on the backend.

Strategies of the Month: August 2023

Every month, our research team will also present the ten best-performing strategies of the month in our product suite. With a data-driven approach, we highlight the most important developments and events causing price movements.

Figure 2: 30-Day Performance: Strategies of the Month vs. Traditional Asset Classes

Data Source: 21Shares Index Management Console and Yahoo Finance, from 31-June-2023 to 31-August-2023 (Close Price)

SHETH

The 21Shares Short Ethereum ETP (SHETH) rose 7.12% over the past month. SHETH seeks to provide a -1x return to the performance of Ethereum for a single day. This enables investors with stringent risk-management practices to benefit from tactical short-term inverse exposure to ETH during market downturns. The BitMEX Weekly Historical Ether Volatility Index (EVOL7D) hit an all-time low in the first half of the month before ETH dropped 7.8% on August 17, bringing volatility back.

SBTC

The 21Shares Short Bitcoin ETP (SBTC) rose 4.94% over the past month. SBTC seeks to provide a -1x return to the performance of Bitcoin for a single day. This allows sophisticated investors to hedge and benefit from tactical short-term inverse exposure to BTC. Despite outperforming all the major cryptoassets (with the exception of BNB), BTC still traded down 11.31% in August. The BitMEX Weekly Historical Bitcoin Volatility Index (BVOL7D) was near all-time lows during the first half of the month before BTC dropped 9.7% on August 17, bringing volatility back.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

This document is not an offer to sell or a solicitation of an offer to buy or subscribe for securities of 21Shares AG. Neither this document nor anything contained herein shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction. This document and the information contained herein are not for distribution in or into (directly or indirectly) the United States, Canada, Australia or Japan or any other jurisdiction in which the distribution or release would be unlawful.This document does not constitute an offer of securities for sale in or into the United States, Canada, Australia or Japan. The securities of 21Shares AG to which these materials relate have not been and will not be registered under the United States Securities Act of 1933, as amended (the “Securities Act”), and may not be offered or sold in the United States absent registration or an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act. There will not be a public offering of securities in the United States.This document is only being distributed to and is only directed at: (i) to investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (“FSMA”) (Financial Promotion) Order 2005 (the “Order”); or (ii) high net worth entities, and other persons to whom it may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”); or (iii) any other persons to whom this document can be lawfully distributed in circumstances where section 21(1) of the FSMA does not apply. The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.In any EEA Member State (other than the Austria, Belgium, Croatia, Denmark, Finland, France, Germany, Great Britain, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, The Netherlands, Norway, Poland, Romania, Slovakia, Spain and Sweden) that has implemented the Prospectus Regulation (EU) 2017/1129, together with any applicable implementing measures in any Member State, the “Prospectus Regulation”) this communication is only addressed to and is only directed at qualified investors in that Member State within the meaning of the Prospectus Regulation.Exclusively for potential investors in Austria, Belgium, Croatia, Denmark, Finland, France, Germany, Great Britain, Hungary, Ireland, Italy, Liechtenstein, Luxembourg, Malta, The Netherlands, Norway, Poland, Romania, Slovakia, Spain and Sweden the 2021 Base Prospectus (EU) is made available on the Issuer’s website under www.21Shares.com.The approval of the 2021 Base Prospectus (EU) should not be understood as an endorsement by the SFSA of the securities offered or admitted to trading on a regulated market. Eligible potential investors should read the 2021 Base Prospectus (EU) and the relevant Final Terms before making an investment decision in order to understand the potential risks associated with the decision to invest in the securities. You are about to purchase a product that is not simple and may be difficult to understand.This document constitutes advertisement within the meaning of the Swiss Financial Services Act (the “FinSA”) and not a prospectus. In accordance with article 109 of the Swiss Financial Services Ordinance, the Base Prospectus dated 12 November 2021, as supplemented from time to time and the final terms for any product issued have been prepared in compliance with articles 652a and 1156 of the Swiss Code of Obligations, as such articles were in effect immediately prior to the entry into effect of the FinSA, and the Listing Rules of the SIX Swiss Exchange in their version in force as of January 1, 2020. Consequently, the Prospectus has not been and will not be reviewed or approved by a Swiss review body pursuant to article 51 of the FinSA, and does not comply with the disclosure requirements applicable to a prospectus approved by such a review body under the FinSA.

Du kanske gillar

Nyheter

6PSE ETF ger exponering mot amerikanska aktier

Publicerad

17 timmar sedanden

26 april, 2025

Invesco MSCI USA UCITS ETF Dist (6PSE ETF) med ISIN IE00BK5LYT47, försöker följa MSCI USA-index. MSCI USA-index spårar de ledande aktierna på den amerikanska marknaden.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,05 % p.a. Invesco MSCI USA UCITS ETF Dist är den billigaste ETF som följer MSCI USA-index. ETFen replikerar resultatet för det underliggande indexet syntetiskt med en swap. Utdelningarna i ETFen delas ut till investerarna (kvartalsvis).

Invesco MSCI USA UCITS ETF Dist är en liten ETF med tillgångar på 27 miljoner euro under förvaltning. Denna ETF lanserades den 11 november 2019 och har sin hemvist i Irland.

Produktbeskrivning

Invesco MSCI USA UCITS ETF Dist syftar till att tillhandahålla den totala nettoavkastningen för MSCI USA Index (”Referensindex”), minus avgifternas inverkan. Fonden delar ut utdelning på kvartalsbasis.

Referensindexet är utformat för att mäta aktiemarknadens resultat i USA. Den fångar representation för stora och medelstora företag på den amerikanska marknaden och täcker cirka 85 % av det friflyttade marknadsvärdet i USA.

Fonden strävar efter att uppnå sitt mål genom att hålla en korg med aktier, som vanligtvis levererar det mesta av fondens avkastning men som vanligtvis inte skulle vara densamma som i referensindexet. Fonden kommer också att använda ofinansierade swappar, som är kontrakt där en eller flera godkända motparter samtycker till att utbyta med fonden eventuella skillnader mellan avkastningen på indexet och korgen med aktier. Syftet är att uppnå en närmare och mer konsekvent prestation i förhållande till index än vad som generellt skulle vara möjligt genom enbart fysisk replikering.

Medan fondens investeringsmål är att replikera nettototalavkastningsindexet, refererar de swappar som ingåtts av fonden till bruttototalavkastningsindexet. Swapavgiften som betalas av fonden är i förhållande till detta bruttototalavkastningsindex och som ett resultat av detta kommer ETF:ens prestanda sannolikt att överstiga avkastningen för nettoavkastningsindexet.

För att hjälpa till med att täcka en del av fondens kostnader kan förvaltaren få ett årligt avgiftsbidrag på upp till 0,04 % av det nominella swapbeloppet från swapmotparterna som är aktiva i denna fond. Detta avgiftsbidrag har ingen inverkan på fondens nettotillgångsvärde och representerar inte en inkrementell kostnad som bärs av investerare.

Denna ETF hanteras passivt.

En investering i denna fond är ett förvärv av andelar i en passivt förvaltad indexföljande fond snarare än i de underliggande tillgångarna som ägs av fonden.

Handla 6PSE ETF

Invesco MSCI USA UCITS ETF Dist (6PSE ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| gettex | EUR | 6PSE |

| Borsa Italiana | EUR | MXUD |

| London Stock Exchange | USD | MXUD |

| SIX Swiss Exchange | USD | MXUD |

| SIX Swiss Exchange | EUR | MXUD |

| XETRA | EUR | 6PSE |

Största innehav

| Namn | CUSIP | ISIN | Vikt % |

| MICROSOFT ORD | 594918104 | US5949181045 | 6.54% |

| APPLE ORD | 037833100 | US0378331005 | 6.01% |

| NVIDIA ORD | 67066G104 | US67066G1040 | 5.66% |

| AMAZON COM ORD | 023135106 | US0231351067 | 3.62% |

| META PLATFORMS CL A ORD | 30303M102 | US30303M1027 | 2.28% |

| ALPHABET CL A ORD | 02079K305 | US02079K3059 | 2.23% |

| ALPHABET CL C ORD | 02079K107 | US02079K1079 | 1.96% |

| ELI LILLY ORD | 532457108 | US5324571083 | 1.40% |

| BROADCOM ORD | 11135F101 | US11135F1012 | 1.35% |

| JPMORGAN CHASE ORD | 46625H100 | US46625H1005 | 1.25% |

Innehav kan komma att förändras

Nyheter

iShares noterar fond för flyg- och försvarssektorn på Xetra

Publicerad

18 timmar sedanden

26 april, 2025

iShares Global Aerospace & Defence UCITS ETF investerar i aktier i företag från utvecklade marknader som tillhör flyg- och försvarssektorn. Åtagandet inkluderar tillverkare av civil eller militär flyg- och försvarsutrustning, relaterade reservdelar eller produkter, försvarselektronik och rymdutrustning.

Sedan tidigare är denna börshandlade fond noterad på Euronext Amsterdam.

| Namn | ISIN Ticker | Avgift | Utdelnings- policy |

| iShares Global Aerospace & Defence UCITS ETF USD (Acc) | IE000U9ODG19 5J50 (EUR) | 0,35% | Ackumulerande |

Produktutbudet inom Deutsche Börses ETF- och ETP-segment omfattar för närvarande totalt 2 408 ETFer, 199 ETCer och 256 ETNer. Med detta urval och en genomsnittlig månatlig handelsvolym på cirka 23 miljarder euro är Xetra den ledande handelsplatsen för ETFer och ETPer i Europa.

Nyheter

8RMY ETF köper bara aktier i europeiska försvarsföretag

Publicerad

19 timmar sedanden

26 april, 2025

HANetf Future of European Defence UCITS ETF Accumulating (8RMY ETF) med ISIN IE000I7E6HL0 försöker att följa VettaFi Future of Defence Ex US-indexet. VettaFi Future of Defence Ex US-indexet följer resultatet för företag som är verksamma inom militär- eller försvarsindustrin. Amerikanska företag är exkluderade. Vikten av europeiska företag i indexet är minst 90 procent.

De börshandlade fondens TER (total expense ratio) uppgår till 0,39 % per år. HANetf Future of European Defence UCITS ETF Accumulating är den enda ETFen som följer VettaFi Future of Defence Ex US-indexet. ETFen replikerar resultatet för det underliggande indexet genom fullständig replikering (genom att köpa alla indexkomponenter). Utdelningarna i ETFen ackumuleras och återinvesteras.

Denna ETF lanserades den 7 april 2025 och har sitt säte i Irland.

Future of European Defence UCITS ETF

En europeisk försvars-ETF, från ett europeiskt företag, utan exponering mot USA.

Europa åtar sig att göra stora försvarsinvesteringar: Efter årtionden av underutnyttjande återupprustar Europa äntligen. EU har lagt fram en försvarsplan på 800 miljarder euro, medan enskilda europeiska NATO-medlemmar snabbt ökar sina egna militära budgetar.

Strategisk autonomi innebär att köpa europeiskt: Europas upprustning handlar inte bara om att spendera mer – det handlar om att bygga försvarsoberoende. För att minska beroendet av amerikansk utrustning prioriterar EU europeiskt tillverkade vapen, fordon och system, vilket ger den europeiska försvarssektorn en stark medvind.

Europeisk försvars-ETF från ett europeiskt företag

Detta är den första europeiska försvars-ETF som lanserats av ett europeiskt företag – och stöds av teamet bakom den snabbt växande NATO-ETFen.

Europeisk försvars-ETFens mål

Future for European Defence UCITS ETF (8RMY) syftar till att ge exponering mot NATO och NATO+-allierades försvars- och cyberförsvarsutgifter, exklusive USA.

Med ökande hot och amerikanskt stöd som inte längre garanteras, ser europeiska NATO-medlemmar över sina försvarsstrategier och ökar kraftigt militära utgifter. Efter ett decennium av att inte ha uppnått 2 % av BNP-målet har Europa tillsammans underutnyttjat med uppskattningsvis 850 miljarder euro. För att återuppbygga och modernisera sina väpnade styrkor riktar regeringarna nu denna förnyade investering mot europeiska försvarsföretag – vilket stärker kontinentens strategiska självförsörjning.

European Defence ETF följer VettaFi Future of Defence Ex US Index, som är utformat för att fånga upp europeiska företag vars majoritet av sina intäkter kommer från militära utgifter.

Handla 8RMY ETF

HANetf Future of European Defence UCITS ETF Accumulating (8RMY ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange. Av den anledningen förekommer olika kortnamn på samma börshandlade fond.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel Nordnet, SAVR, DEGIRO och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| Euronext Paris | EUR | ARMY |

| gettex | EUR | 8RMY |

| Borsa Italiana | EUR | ARMI |

| London Stock Exchange | GBX | NAVY |

| London Stock Exchange | USD | ARMY |

| XETRA | EUR | 8RMY |

Största innehav

| Namn | Vikt % |

| RHEINMETALL AG COMMON | 14,81% |

| THALES SA COMMON STOCK | 12,49% |

| LEONARDO SPA COMMON STOCK | 10,13% |

| BAE SYSTEMS PLC | 9,86% |

| SAAB AB COMMON STOCK SEK | 7,78% |

| SAFRAN SA COMMON STOCK | 7,06% |

| KONGSBERG GRUPPEN ASA | 6,27% |

| ROLLS-ROYCE HOLDINGS PLC | 4,37% |

| AIRBUS SE COMMON STOCK | 3,27% |

| DASSAULT AVIATION SA | 2,86% |

Innehav kan komma att förändras

6PSE ETF ger exponering mot amerikanska aktier

iShares noterar fond för flyg- och försvarssektorn på Xetra

8RMY ETF köper bara aktier i europeiska försvarsföretag

Are Gold Mining Equities Regaining Attention Amid Rising Gold Prices?

Fem spanska fonder som har ökat med +12% under 2025

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa