Nyheter

Cosmos (ATOM) Research Primer

Publicerad

2 år sedanden

Cosmos was co-founded by Jae Kwon and Ethan Buchman in 2014, with the support of the Interchain Foundation (ICF), a Swiss company that supports R&D for secure, scalable, open, and decentralized networks. The ICO of the cosmos’ native token ATOM was released in 2017, and the network was ready to use two years later. So far, Cosmos raised a total of $17M in its seven rounds of funding led by Paradigm and followed by 1confirmation, IOSG Ventures, Yield Ventures, Cardinal Capital in addition to Kenneth Bok, managing director of Blocks, a Web 3 advisory based in Singapore.

Cosmos is building a network of crypto networks, which all have access to open-sourced tools for streamlining transactions between them. Customizability and interoperability are its two main selling points. Fueled by BFT consensus algorithms like Tendermint (also co-founded by Kwon and Buchman) and its token — Cosmos wants to be home for an ecosystem of networks that can exchange data and tokens programmatically and in a decentralized manner.

In this report, we will offer an exhaustive overview of the Cosmos network, ATOM as a crypto asset, and discuss the various investment risks associated with ATOM — in addition to how an investor can think about the future value of its underlying cryptoasset. In addition, this report offers exhaustive coverage of Cosmos and

ATOM available on the market.

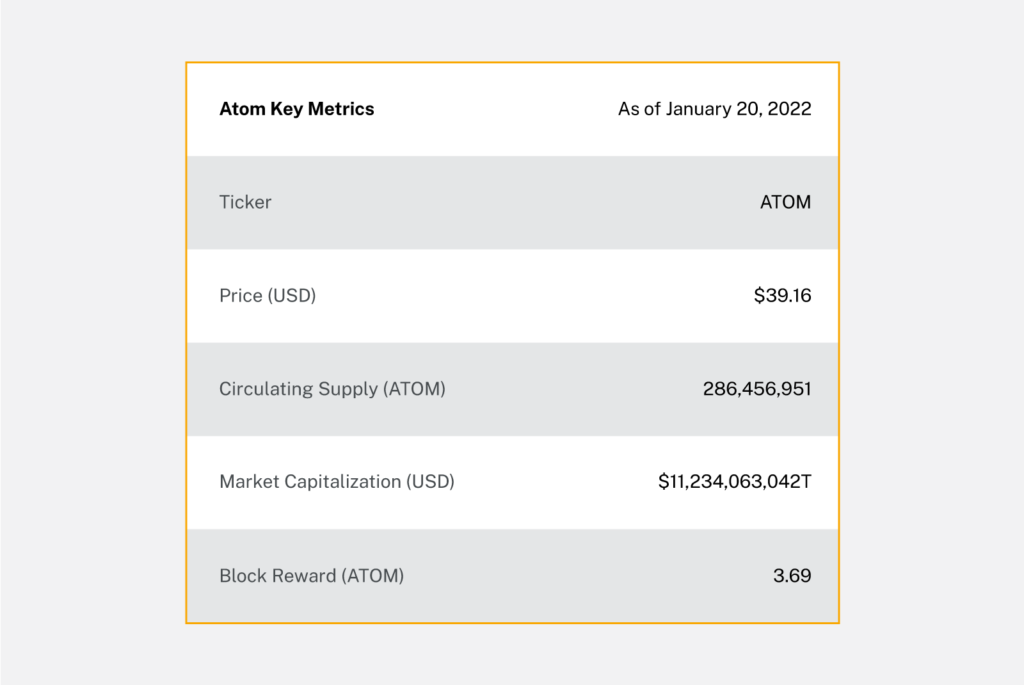

Figure 1: ATOM Key Metrics (Source: CoinGecko)

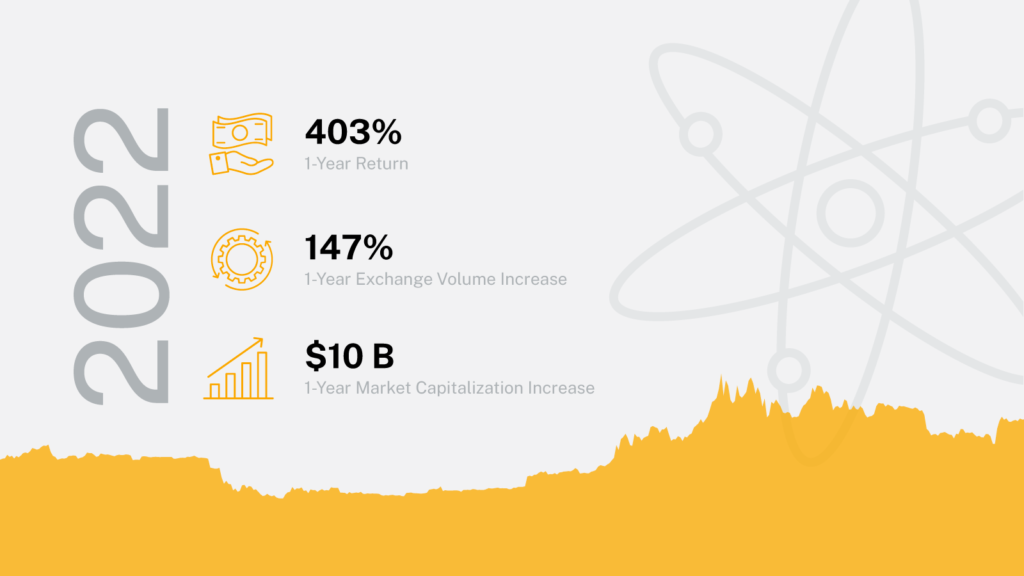

Figure 2: 1-Year Historical Performance (Source: CoinMetrics)

How Cosmos Works

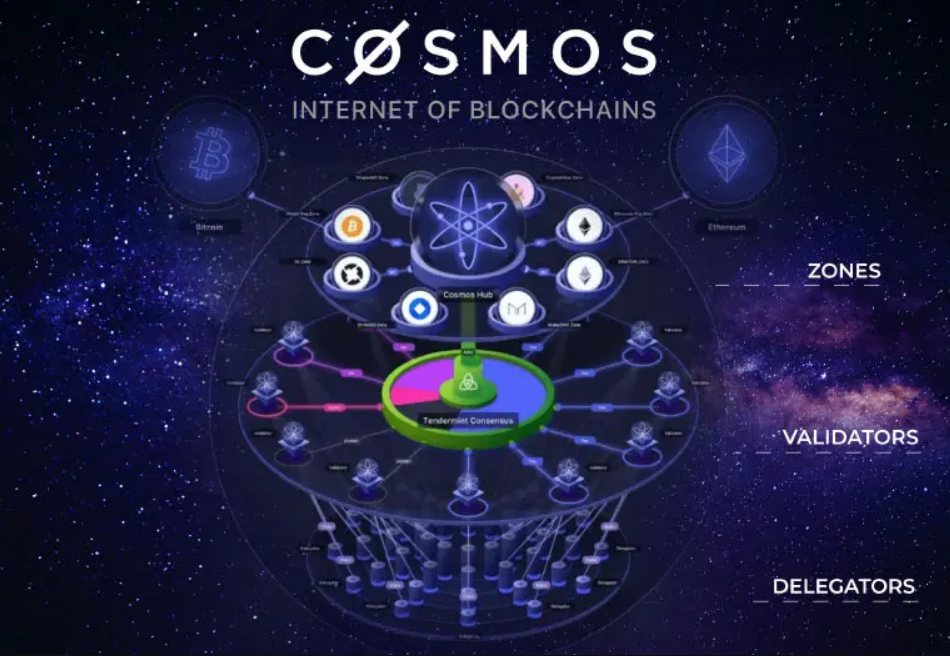

The founders behind Cosmos came to find blockchains working in silos, unable to communicate with each other and struggling to make big transactions at once. Cosmos wanted to fix these problems by proposing a system with two classes of blockchains, Hubs and Zones. Zones are regular heterogeneous blockchains that are kept connected by the Hubs.

To make the vision of interoperability and customization work, Cosmos has three foundation stones in place, Tendermint, Inter-blockchain Communications Protocol (IBC) and Cosmos SDK.

• Tendermint helps developers build blockchains without having to code them from scratch, powered by the Tendermint Core, which is a PoS governance mechanism that keeps blockchains, or Zones, run in sync within the Cosmos Hub, the first Hub to be launched on Cosmos.

• IBC is a mechanism that makes information travel freely and securely between the Zones.

• To keep complexity to the minimum, the Cosmos SDK provides the Zones with most common functions like governance, tokens, and staking. If need be, developers can also add plugins for additional features or services.

A Zone is only required to create an IBC connection with a Hub, to exchange data and assets with other Zones connected to that Hub. That means Zones only need to establish a limited number of connections with a restricted set of Hubs instead of having to make a connection with each and every Zone. This system prevents double spending among Zones, because when a Zone receives a token from a Hub, it only needs to trust the origin Zone of this token and the Hub.

The Hub maintains and tracks the state of each Zone thanks to a steady stream of block commits from each zone that is connected to the Hub. Similarly, each Zone maintains track of the Hub’s status, however the Zones themself only keep up with each other indirectly through the Hub. Powered by the IBC protocol, information packets are then exchanged from one Zone to another by publishing Merkle-proofs as proof that the data was sent and received.

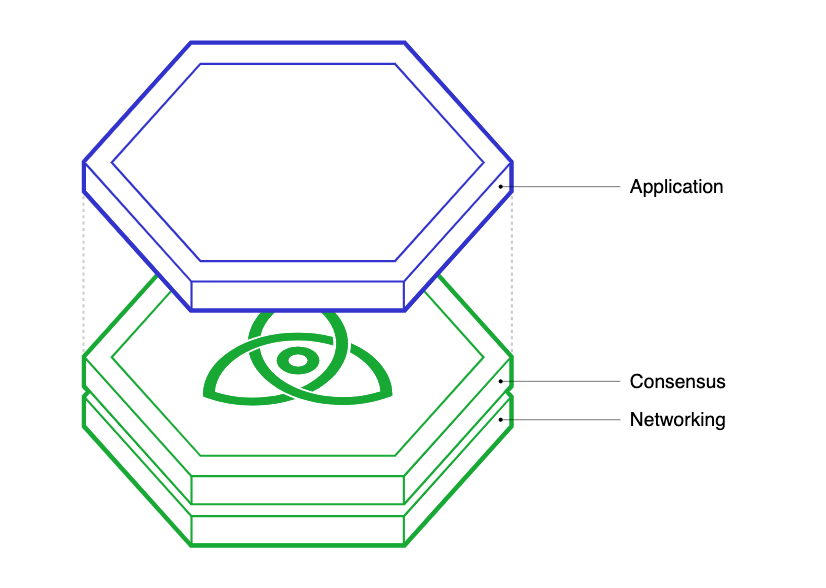

Blockchains are composed of three layers, Application, Consensus, and Networking.

Application – Responsible for updating the state given a set of transactions, i.e. processing transactions.

Networking – Responsible for the propagation of transactions and consensus-related messages.

Consensus – Enables nodes to agree on the current state of the system.

Tendermint takes care of the last two layers, packaging them into a generic engine, the Tendermint Byzantine Fault Tolerance (BFT) engine, to give developers space to concentrate on building their application layers. The Tendermint BFT solution also fixes the limitation of sovereignty, that way developers don’t need to wait in long queues to get their transactions or other requests validated, as it is for application layers built on top of Ethereum for example. The Tendermint BFT engine is also connected to application layers by the Application Blockchain Interface (ABCI), a socket protocol that can understand any programming language developers wish to choose to meet their needs.

Blockchains that use fast-finality chains, or in other words Proof of Stake, can connect with Cosmos using the IBC protocol. However, blockchains that use probabilistic finality chains, or Proof of Work mechanisms, would find it challenging to connect to the network such as Bitcoin and Ethereum. That is exactly why Cosmos created a special proxy-chain called the Peg-Zone that bridges non-Tendermint blockchains by tracking the state of the blockchain in question. Peg-Zones have fast-finality and are therefore compatible with the IBC protocol allowing it to establish finality for the non-Tendermint blockchain it bridges.

The ATOM Token

ATOM is the native token of the Cosmos Hub, the very first blockchain that has been launched within the Cosmos network. However, due to the architecture of Cosmos, which potentially represents an ecosystem of thousands of different blockchains, each chain that is plugged into the Cosmos network will be able to use its own native token, which means Cosmos will be supporting many tokens in the future.

ATOM itself works similar to other Layer 1 utility tokens and allows stakeholders of the network to:

- Pay network fees when transferring assets or interacting with applications

- Staking, by bonding ATOM in order to earn block rewards, while securing the network

- Participate in governance and vote on proposals

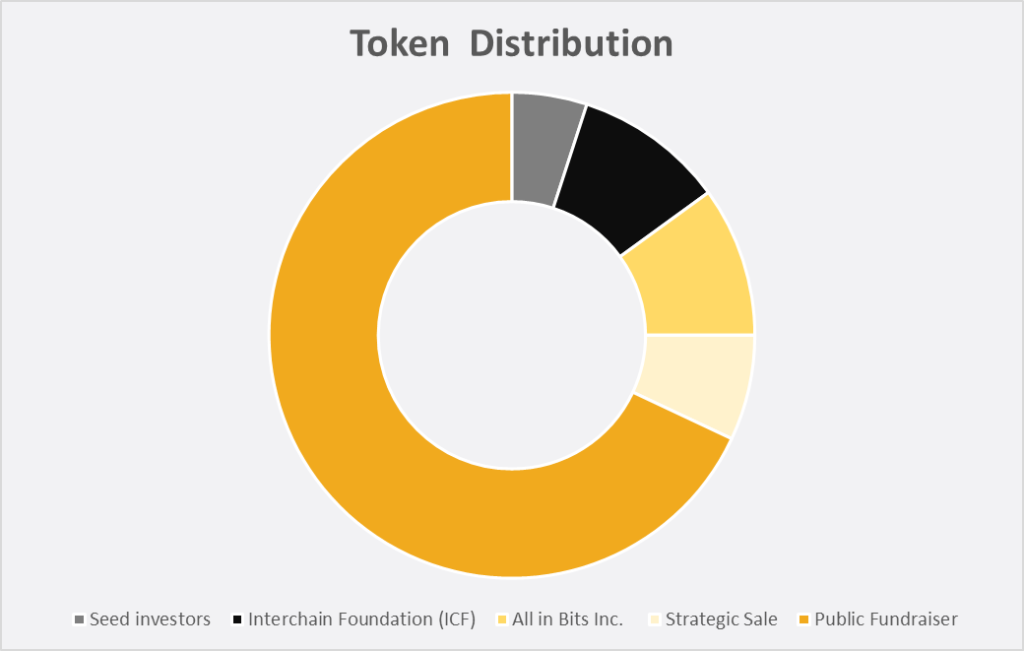

Token Distribution

In 2017, the Interchain Foundation had several private sales, followed by a public sale in April for roughly $17.6M.

The initial token distribution looked like the following:

5% went to the ICF’s initial donors

10% went to the Interchain Foundation (ICF).

10% went to All in Bits, Inc. (AIB), the corporation behind Tendermint.

75% has been distributed according to the results of the private (68%) and public fundraisers (7%).

The State of Cosmos

Cosmos has rolled up its sleeves for a series of partnerships as well as new project launches to amplify its user experience and add more value to its network, making it more interoperable and easy to integrate. As of 30th of September 2020, eligible users on Coinbase have the opportunity to stake ATOM on the cryptocurrency exchange platform, collecting 5% rewards on their holdings. CoinDesk reported in October 2020, Cosmos gained some traction at Vellore Institute of Technology in southern India among students that compose “Cosmos India,” a community that grew from only a few members to more than a thousand in less than nine months.

In March 2021, Tendermint announced the launch of the biggest investment vehicle for the Cosmos ecosystem, a $20 million venture fund to boost development. The announcement came right after the activation of the IBC protocol, changing the game of DeFi on the network. In July, Cosmos got its own DEX protocol, Gravity launched to enable DeFi across multiple chains. Secured by over $3 billion in digital assets, swaps and pools between any connected blockchains are made possible on the Cosmos Hub.

In July, Tendermint announced it was building a crypto app store called Emeris that would allow access to a range of decentralized applications, such as lending protocols and decentralized exchanges, all in the Cosmos ecosystem. The beta version of Emeris launched in September 2021 and is set to publicly launch in spring 2022. Emeris is said to lift the Cosmos user experience to new heights, help unleash the potential of Cosmos DeFi and take it to a wider audience.

On Emeris beta, users can transfer and trade assets between 12 different chains for the first time, access a decentralized exchange, with a trusted, stable and audited DEX protocol. Users can also earn competitive yield by participating in liquidity pools. As of writing, the average swap speed is 00.07 seconds and the average transaction fee is $0.08 in addition to a swap fee of 0.3%. Emeris aims to be the first one-stop portal to provide integrated wallet and multi-wallet support, access to multiple DeFi trading platforms, staking on multiple chains, and also a mobile wallet app.

Also in July, Cosmos announced it’s banding with cross-chain data oracle Band Protocol to integrate with Starport, a development tool for the Cosmos blockchain allowing third-party developers to gain access to numerous new data feeds, such as token information, real-world events, sports, weather, and random number generation. This partnership meant that newly created chains in the Cosmos ecosystem would be able to exchange data via the IBC protocol, making the network even more interoperable and accessible.

Cosmos’ cross-chain DEX Osmosis announced in January 2022 that it’s expanding its horizons with the launch of a new bridge, the Gravity Bridge, that would enable trading for Ethereum-based assets. The Gravity Bridge will act as an IBC to Ethereum translator, it will be built by internet services provider Althea.

Cosmos Ecosystem

As mentioned before, the first blockchain resident in the Cosmos ecosystem was the Cosmos Hub, launched by Cosmos itself and under which Zones run in sync. There’s an accelerating number of projects growing within the Cosmos network, including Terra (LUNA), ThorChain, Secret Network, Compound Gateway, Osmosis, Kava, and Akash.

The Future of Cosmos

There are quite some exciting milestones on the Cosmos roadmap for the year 2022. Obviously, one of the most important objectives is to onboard more blockchains that will plug into the Cosmos Network and ensure a seamless communication between them using IBC. However, there are also some powerful updates and features down the road, including Interchain Accounts, Interchain Security, Liquid Staking, and an expansion of its DeFi and NFT ecosystem.

The first upgrade that is expected in Q1 2022 is the Theta Upgrade. This will introduce Interchain Accounts, Liquid Staking and an NFT module, which will set the base for Cosmos’ NFT ecosystem. Interchain Accounts will leverage IBC and allow users to own, manage and transfer their tokens throughout the entire interoperable ecosystem and access blockchain-specific applications from one single account. One account to rule them all!

Currently almost 60% of all ATOM in circulation is being staked, rewarding contributors with a yield up to 13% per year. With the introduction of the first version of Liquid Staking, which is planned to be released as early as February 2022, this number is most likely to increase. Liquid Staking will allow users to stake their ATOM with no lock-up period, while also receiving a derivative of their bonded assets, which they ultimately can use for liquidity mining or other DeFi activities.

Interchain Security is another key feature that will be implemented with the Rho Upgrade, which is expected to take place in Q2 2022. It will enable Cosmos chains to effectively lease a set of security services to one another, allowing new chains to bootstrap their ecosystems, while enjoying solid security features right from the start. By staking ATOM on the Cosmos Hub, validators and delegators will be able to collect rewards on multiple chains in different tokens. ATOM stakers will therefore benefit from early access to new and innovative projects and greater token utility, while at the same time allowing new chains to get exposure of their tokens to Cosmos community members early on.

Cosmos’ ambition is to connect 200 blockchains in the year 2022. This would obviously unlock an unprecedented amount of liquidity and capital flows throughout all connected blockchains, which would be a massive tailwind for Cosmos’ DeFi. Moreover, UX and UI is still a massive challenge in DeFi and the crypto space in general, however, with the implementation of Emeris, the internet of blockchains will get a professional looking interface to track and manage assets. Emeris currently focuses on portfolio visualization, digital asset management and service discovery and will soon bring features like auto-compounding staking, airdrop tracker and cross-chain DEX aggregation.

On paper, the future Cosmos looks bright. If the internet of blockchains potentially solves one of the biggest obstacles in crypto, the lack of interoperability, and succeeds in connecting thousands of layer 1s and applications, this could mean a massive boost not only for the Cosmos network but for the entire crypto space.

Valuing Cosmos

A quantitative and qualitative evaluation of a crypto asset’s intrinsic value can be derived from a few key fundamentals. The first way we can think of when assessing the potential value of Cosmos’ native asset, ATOM, is carrying out a market sizing exercise to compare its value to that of its main competitors as its target market. By also looking at the total addressable market, we would be able to evaluate the factors that contribute to ATOM’s value. The final method would be using two metrics, number of transactions and their respective fees, to compare the revenue share.

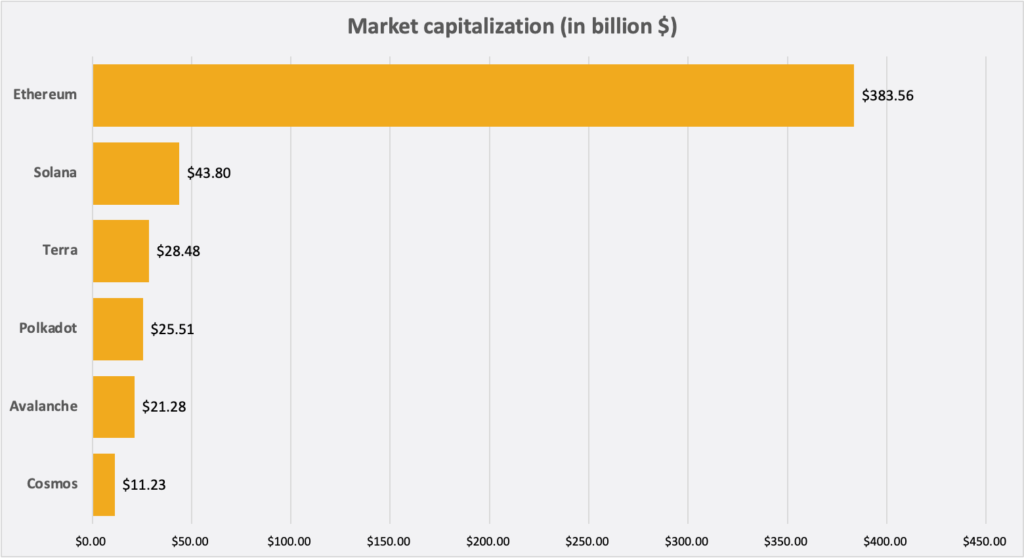

Market sizing

The chart below shows the current market capitalization of Cosmos compared to Ethereum, Solana, Terra, Avalanche and Polkadot. Ethereum represents what the market has judged as the current best use-case of blockchain technology while the smart contracts use case can be argued to be just as valuable in the long term. However, Avalanche with its Subnets or Polkadot with its Parachains are comparable projects with a more similar network architecture and serve as comparison for ecosystem development.

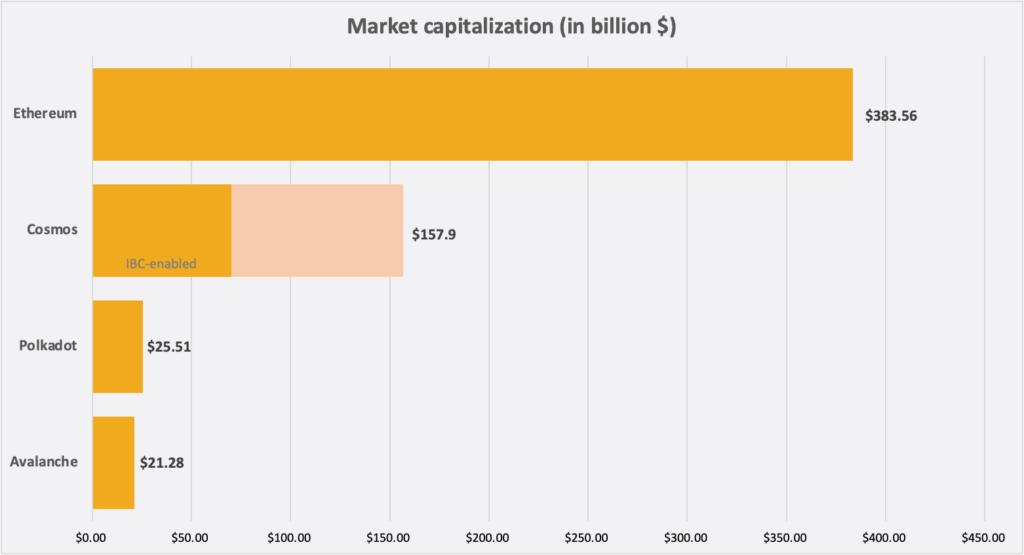

The bull case for Cosmos is that it fulfills its vision as the “Internet of Blockchains’’ connecting thousands of crypto asset networks such as Ethereum, Solana, Fantom or even Polkadot; in a similar way to the internet is a decentralized network that connects individual platforms such as Facebook, Amazon and Google. Even though applications can be deployed on the Cosmos Hub blockchain itself, the majority of value and the future potential is derived from the rate of adoption of Comos as the primary hub for interoperability between various Layer 1s. Looking at the current blockchains and projects that are plugged into the Cosmos network, which includes prominent players like Terra and Binance, we can see that the combined market cap, according to the Cosmos website, sits at $157B with a total of 49 apps and services. Although only 28 of those are currently active and IBC-enabled, this theoretically still makes it the second biggest ecosystem after Ethereum, which as of writing this report holds a market capitalization of $380B. Comparing the price and the state of the network to its closest competitor Polkadot, we could assume that Cosmos is currently undervalued.

Total Addressable Market

It’s important to note that Cosmos doesn’t necessarily compete with other projects, unlike the current rivalry between Layer 1s. It’s potential total addressable market is therefore the entire crypto market, leveraging the Cosmos Network as the underlying Layer 0, tying everything together. If we would assume Metcalfe’s law, which states that the value of a network is proportional to the square of the number of connected users, that means that Cosmos could see exponential growth when continuing to plug in new blockchains into its ecosystem. This ultimately wouldn’t only increase the value of ATOM, but every crypto network that’s being part of the network. This is a win-win situation for all parties involved.

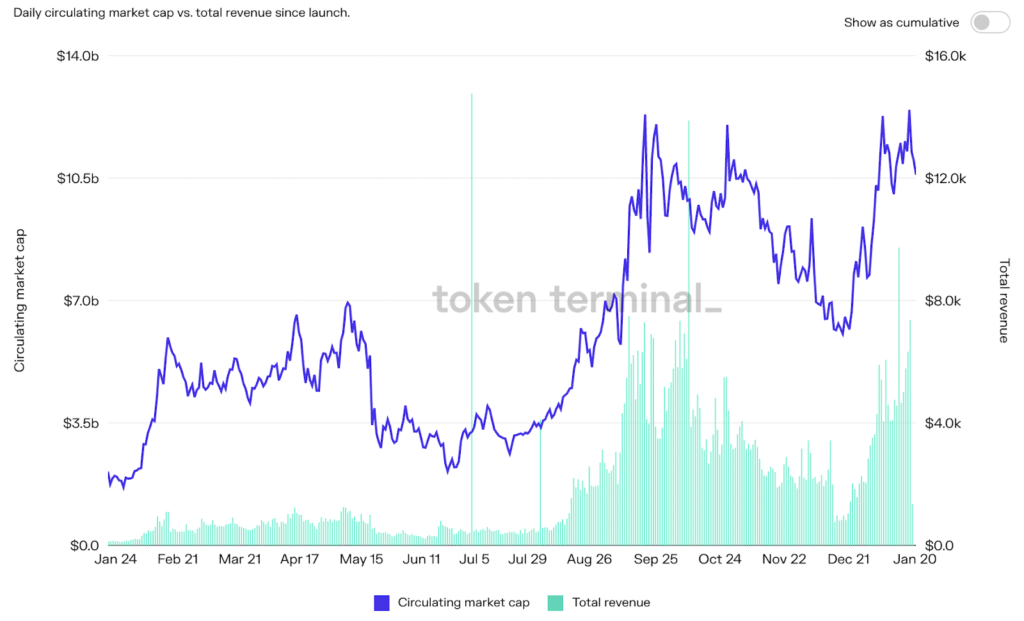

Revenue

Revenue generation is often a key metric when assessing network value. By assessing the total number of transactions and the average cost per transaction we are able to estimate the total revenue generated. Fees and revenue are a good signal for the overall demand for a given smart contract platform and arguably the strongest barometer of fundamental growth. Cosmos’ estimated total annualized revenue currently sits at around $1.38M, which is obviously minor compared to Ethereum’s $15B, yet an indication of the potential upside for the project. Taking into account the various upgrades and upcoming milestones on the roadmap, the probability of this trend to continue seems very likely in tandem with increased demand and therefore more economic activity on the Cosmos Hub.

Risks

Technology Risks

Even though the Cosmos mainnet launched in March 2019, the network itself is still in an embryonic state. The network is still evolving by implementing new upgrades and changes to the protocol, which could introduce bugs, code vulnerabilities, or adversely affect the crypto network. These smart contract failures and other technical issues that will only be fathomable in hindsight not in foresight due to the fact that this is a novel technology. This is a risk that essentially all crypto projects are exposed to. However, at 21Shares, we’ve monitored the Cosmos ecosystem and saw how the Tendermint consensus mechanism was widely battle tested. With LUNA being the largest real-world application alongside Cosmos, our thesis is that only time, and the development that happens underway, will prove how efficient consensus becomes.

Financial Risks

The cryptocurrency market is known for its tremendous volatility, making it a risky investment. If the price of a token declines suddenly, an investor stands to lose a lot of money. Crypto projects are still considered to be risk-on assets, therefore macroeconomic dynamics can have a significant impact on price movements and volatility. Investing in crypto assets is nothing for the fainthearted, as many investors are unable to cope with the severe ups and downs. The crypto space is continuously changing, with both benefits and problems. As mentioned above, the Cosmos network is still in its infancy, therefore investors will see themselves exposed to an innovative and bleeding edge technology, which obviously bears certain financial risks, while offering an attractive potential upside.

Regulatory Risks

Like many other crypto projects, Cosmos was initially funded by a private token sale and ICO and is therefore potentially vulnerable to some level of regulatory scrutiny. However, due to Cosmos’ decentralized network infrastructure and used as a payment mechanism,, it is less likely to be on the radar of regulatory authorities. Therefore the likelihood of serious regulatory scrutiny from any governmental body for Cosmos itself is relatively low. Although this doesn’t include regulations that might impact the crypto space as a whole, Cosmos sits in a relatively safe spot compared to other crypto assets.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Du kanske gillar

-

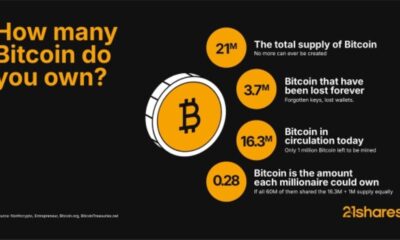

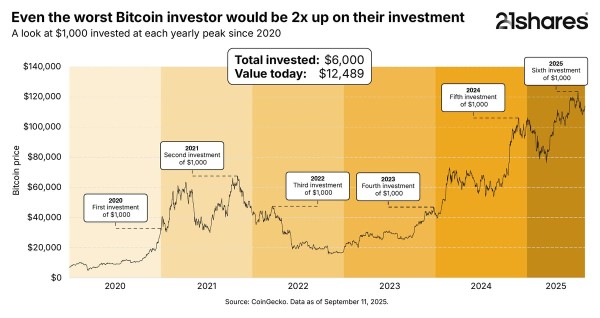

Time in Bitcoin beats timing Bitcoin

-

21Shares lanserar DYDX – Din port till decentraliserade perpetuals

-

Concerned about rising government debt? Bitcoin’s got you covered

-

Bitcoin is scarce. Will you get your share?

-

Bitcoin surpasses Alphabet and Amazon by market cap

-

The Bitcoin boom hiding in Americans’ retirement savings

Even buying Bitcoin at its yearly peak since 2020 would still have doubled your investment, proving the power of long-term growth versus trying to time the market.

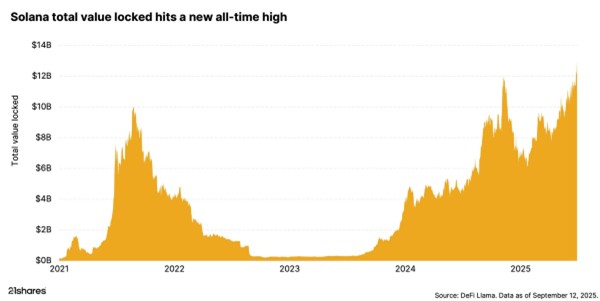

Why Solana matters: Exploring its use cases and growing adoption

Solana’s surge isn’t just market speculation; it’s driven by real-world adoption. From payments and DeFi to tokenization, the blockchain is seeing record engagement, reflected in its all-time high total value locked (TVL).

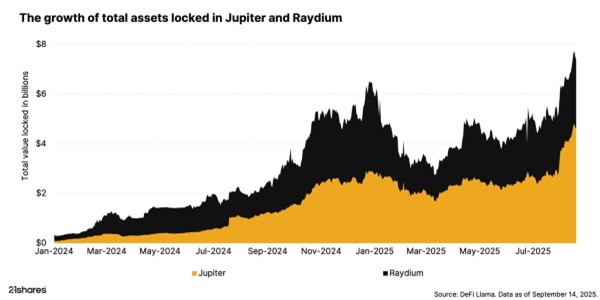

How Raydium and Jupiter are powering Solana DeFi

Raydium and Jupiter are the pillars of Solana’s DeFi ecosystem, delivering deep liquidity, seamless trading, and efficient execution that keep the network thriving. They make crypto markets faster, cheaper, and more accessible for everyone.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

WMMV ETF en lågvolatilitetsfond som handlas i euro och pund

Publicerad

13 timmar sedanden

17 september, 2025

Amundi MSCI World Minimum Volatility Screened Factor UCITS ETF UCITS ETF Acc (WMMV ETF) med ISIN IE0001DKJVC2, försöker spåra MSCI World Minimum Volatility Select ESG Low Carbon Target-index. MSCI World Minimum Volatility ESG Reduced Carbon Target-index spårar aktier från utvecklade länder över hela världen som är valda enligt låg volatilitet och ESG-kriterier (miljö, social och företagsstyrning). Indexet har som mål att minska utsläppen av växthusgaser och ett förbättrat ESG-poäng jämfört med jämförelseindex. Jämförelseindex är MSCI World-index.

Den börshandlade fondens TER (total cost ratio) uppgår till 0,25 % p.a. Amundi MSCI World Minimum Volatility Screened Factor UCITS ETF UCITS ETF Acc är den enda ETF som följer MSCI World Minimum Volatility Select ESG Low Carbon Target-index. ETFen replikerar det underliggande indexets prestanda genom fullständig replikering (köper alla indexbeståndsdelar). Utdelningarna i ETF:n ackumuleras och återinvesteras.

Denna ETF lanserades den 30 oktober 2024 och har sin hemvist i Irland.

Investeringsmål

Amundi MSCI World Minimum Volatility Screened Factor UCITS ETF Acc försöker replikera, så nära som möjligt, oavsett om trenden är stigande eller fallande, resultatet för MSCI World Minimum Volatility Select ESG Low Carbon Target Index (”Indexet”). Delfondens mål är att uppnå en tracking error-nivå för delfonden och dess index som normalt inte kommer att överstiga 1 %.

Handla WMMV ETF

Amundi MSCI World Minimum Volatility Screened Factor UCITS ETF UCITS ETF Acc (WMMV ETF) är en europeisk börshandlad fond. Denna fond handlas på Deutsche Boerse Xetra.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Största innehav

Denna fond använder fysisk replikering för att spåra indexets prestanda.

| Namn | Valuta | Vikt % | Sektor |

| T-MOBILE US INC | USD | 2.00 % | Communication Services |

| MOTOROLA SOLUTIONS INC | USD | 1.86 % | Information Technology |

| MCKESSON CORP | USD | 1.57 % | Health Care |

| ZURICH INSURANCE GROUP AG | CHF | 1.56 % | Financials |

| CISCO SYSTEMS INC | USD | 1.56 % | Information Technology |

| WASTE MANAGEMENT INC | USD | 1.47 % | Industrials |

| UNITEDHEALTH GROUP INC | USD | 1.42 % | Health Care |

| MICROSOFT CORP | USD | 1.35 % | Information Technology |

| KDDI CORP | JPY | 1.32 % | Communication Services |

| REPUBLIC SERVICES INC | USD | 1.32 % | Industrials |

Innehav kan komma att förändras

Nyheter

UBS AM lanserar UBS Treasury Yield Plus ETFer

Publicerad

14 timmar sedanden

17 september, 2025Av

Erik Forsell

· UBS Asset Management lanserar EUR och USD Treasury Yield Plus UCITS ETFer

· ETFerna syftar till att öka avkastningen samtidigt som riskegenskaperna hos deras referensindex bibehålls

· En egenutvecklad regelbaserad modell används för att bredda investeringsuniversumet för att förbättra tillgången till en större uppsättning möjligheter

UBS Asset Management (UBS AM) tillkännager idag lanseringen av två nya ETF:er som syftar till att leverera förbättrad avkastning, samtidigt som riskprofilen för deras underliggande statsobligationsindex bevaras. UBS EUR Treasury Yield Plus UCITS ETF och UBS USD Treasury Yield Plus UCITS ETF syftar till att överträffa sina respektive Bloomberg Treasury-index genom att rikta in sig på högre optionsjusterad spread (OAS), samtidigt som de bibehåller en strikt anpassning till duration, kreditkvalitet och landsexponering1.

Portföljkonstruktion

· Universumsdefinition: Varje ETF börjar med sitt respektive Bloomberg Treasury Index (EUR eller USD) och utökar uppsättningen möjligheter till att inkludera högkvalitativa statsobligationer, överstatliga obligationer och agentobligationer (SSA), vilka kan erbjuda en högre avkastning än statsobligationer.

· Optimering: SSA-obligationerna väljs ut med hjälp av en egenutvecklad regelbaserad modell som maximerar OAS samtidigt som strikta begränsningar för rating, land, sektor, duration och kurvrisk följs.

· Dynamisk allokering: Portföljförvaltaren kan använda sitt eget omdöme för att ytterligare förbättra portföljens avkastning och/eller riskprofil.

André Mueller, chef för kundtäckning, UBS AM, sa: ”De snabbt ökande tillgångarna i förbättrade ränte-ETF:er signalerar en växande investerarefterfrågan på fonder som går utöver traditionella passiva riktmärken. UBS AM har långvarig expertis inom regelbaserade strategier, så jag är glad att vi för första gången kan erbjuda denna möjlighet till ett bredare spektrum av kunder genom det bekväma, transparenta och effektiva ETF-omslaget.”

Fonden är registrerad för försäljning i Österrike, Danmark, Finland, Frankrike, Tyskland, Irland, Italien, Liechtenstein, Luxemburg, Nederländerna, Norge, Spanien, Sverige, Schweiz och Storbritannien.

| ETF | Share class | TER | ISIN | Börs | Valuta | Bloomberg Ticker |

| UBS EUR Treasury Yield Plus UCITS ETF EUR | EUR acc | 0.15% | LU3079566835 | SIX Swiss | EUR | EUTYP SW |

| Borsa Italiana | EUR | ETY IM | ||||

| XETRA | EUR | CHSW GY | ||||

| EUR dis | 0.15% | LU3079566918 | XETRA | EUR | CHSZ GY | |

| UBS USD Treasury Yield Plus UCITS ETF USD | USD acc | 0.15% | LU3079567056 | SIX Swiss | USD | USTYP SW |

| Borsa Italiana | EUR | UTY IM | ||||

| XETRA | EUR | ’CHSY GY | ||||

| USD dis | 0.15% | LU3079567130 | XETRA | EUR | CHSX GY | |

| London Stock Exchange | GBP | UTYP LN |

Time in Bitcoin beats timing Bitcoin

WMMV ETF en lågvolatilitetsfond som handlas i euro och pund

UBS AM lanserar UBS Treasury Yield Plus ETFer

COINUNI ETP spårar kryptovalutan Uniswap

ETF- och ETP-noteringar den 16 september 2025: nytt på Xetra och Börse Frankfurt

Utdelningar och försvarsfonder lockade i augusti

Månadsutdelande ETFer uppdaterad med IncomeShares produkter

HANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

ADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

Septembers utdelning i XACT Norden Högutdelande

Populära

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanUtdelningar och försvarsfonder lockade i augusti

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanMånadsutdelande ETFer uppdaterad med IncomeShares produkter

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanHANetfs analyserar hur ett fredsavtal kan påverka det europeiska försvaret

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanADLT ETF investerar bara i riktigt långa amerikanska statsobligationer

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSeptembers utdelning i XACT Norden Högutdelande

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanFastställd utdelning i MONTDIV augusti 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanHANetf kommenterar mötet mellan Kina, Ryssland och Nordkorea vid militärparad

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanAICT ETF investerar i obligationer utgivna av företag från tillväxtmarknader