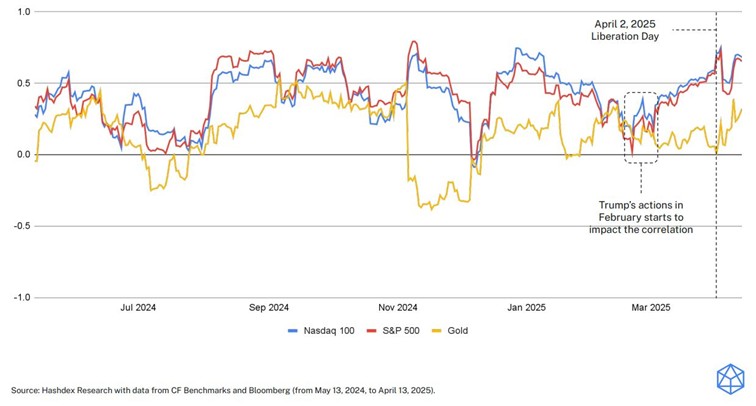

Platinum and the Rand: Can mining strikes offset currency headwinds? Platinum prices have rebounded by over 20% during 2016, as the South African Rand (ZAR) has strengthened 4%. A stronger ZAR should constrain supply by narrowing already stretched mining company margins. Opposing forces are likely to keep price volatility elevated in coming months as a potentially weaker ZAR balances the threat of output cuts from strike action.

Economic conditions are challenging to say the least. South African growth is expected to be just 0.6% in 2016 according to the IMF, from 1.3% in 2015, the lowest in over six years. Rising social tensions are a result of burgeoning unemployment. Unemployment is at the highest level since records began in 2008, at nearly 27% of the population, according to Stats SA.

Drought is impacting food prices, driving inflation higher, and at the same time the central bank is raising rates to try and keep prices in check. Raising rates to offset supply side inflation and reduce capital outflows is a sign of desperation and the local currency is unlikely to be a beneficiary of such action. Indeed, the South African Reserve Bank notes that the weaker currency could be fuelling inflationary pressures.

As a general rule of thumb, investors should be wary of those EM countries that are tightening monetary policy to stave off capital flight, especially when there is little inflationary pressure and weak growth – South Africa is a good example. With lacklustre outlook for the economy, the Rand is likely to remain weak.

Early June sees the potential for a credit rating downgrade for South Africa from S&P Global Ratings, with consensus economist expectations that the country’s rating will enter junk territory by end-2016. The IMF’s most recent mission to the country suggests that the government’s budget target ‘may be challenging’. A decrease to non-investment grade is likely to prompt further capital outflows and see the ZAR move lower against the USD.

The close correlation between the currency and platinum should see metal prices follow ZAR lower in the near term. However, later in June, and with another supply deficit forecast in 2016, the platinum price is likely to receive support from potential output reductions resulting from contract negotiation activity and possible strike action[i].

(click to enlarge)

[i] Recent strike action in South Africa in 2012 and 2014 lifted the platinum price by 17% and 0.5%, respectively.

Martin Arnold, Global FX & Commodity Strategist at ETF Securities

Martin Arnold joined ETF Securities as a research analyst in 2009 and was promoted to Global FX & Commodity Strategist in 2014. Martin has a wealth of experience in strategy and economics with his most recent role formulating an FX strategy at an independent research consultancy. Martin has a strong background in macroeconomics and financial analysis – gained both at the Reserve Bank of Australia and in the private commercial banking sector – and experience covering a range of asset classes including equities and bonds. Martin holds a Bachelor of Economics from the University of New South Wales (Australia), a Master of Commerce from the University of Wollongong (Australia) and attained a Graduate Diploma of Applied Finance and Investment from the Securities Institute of Australia.

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter4 veckor sedan

Nyheter4 veckor sedan

Nyheter2 veckor sedan

Nyheter2 veckor sedan

Nyheter3 veckor sedan

Nyheter3 veckor sedan