Nyheter

Avalanche (AVAX) Research Primer

Publicerad

1 år sedanden

Avalanche (AVAX) is a Proof-of-Stake blockchain using the “Avalanche consensus mechanism”. It is a blockchain network that promises high transaction throughput of 4,500 transactions per second (TPS) and the first smart contract platform that can confirm transactions in under one second. In contrast, Ethereum processes 15 to 30 transactions per second with over 1 minute finality. Avalanche is a high-performance, scalable, customizable and secure blockchain platform targeting building application- specific blockchains, scalable decentralized applications and complex digital smart assets.

Avalanche was launched by Ava Labs in 2020. Emim Gun Sirer, a Turkish- American computer scientist and associate professor at Cornell started Ava Labs in 2018. The company currently has offices in New York City and Miami and was initially funded by Andreessen Horowitz, Polychain Capital, Initialized Capital and angel investors such as Balaji Srinvasan and Naval Ravikant of AngelList.

In this report, 21Shares will offer an exhaustive overview of the Avalanche network, AVAX as a cryptoasset, and discuss the various investment risks associated with AVAX — in addition to how an investor can think about the future value of its underlying cryptoasset. This report offers an exhaustive coverage of Avalanche and AVAX available on the market.

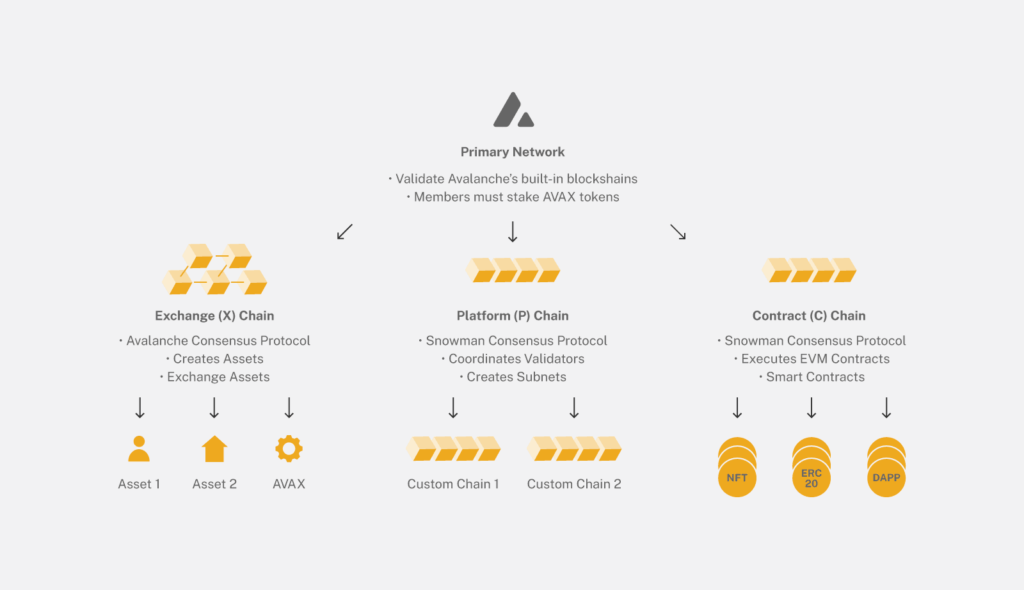

How Avalanche Works

The Avalanche network comprises multiple blockchains and employs a proof of stake consensus mechanism to achieve high throughput of over 4,500 transactions per second. Each chain in the Avalanche architecture represents its own virtual machine, with support for numerous custom virtual machines like EVM and WASM. This allows chains to include case-specific functionality. Each of these virtual machines is connected to a subnet with its own set of incentives to keep validators honest, it is a custom blockchain network made up of ”a dynamic set of validators working together to establish consensus.” As a result, Avalanche might be regarded as a ”platform of platforms,” made up of thousands of subnets that work together to build a single interoperable network.

The Avalanche Consensus Protocol is a family of four mechanisms — Slush, Snowflake, Snowball, and Avalanche, these build upon each other and become more secure in the process. In short, the Avalanche Consensus Protocol is a unique voting protocol that relies on “repeated random subsampling”. In this process, validator nodes randomly query other validators until the network reaches a consensus and decides whether to accept or reject an incoming transaction.

All validators are members of the Primary Network consisting of three blockchains: the Exchange Chain (X-Chain), Contract Chain (C-Chain), and Platform Chain (P-Chain).

In a given round, each validator randomly selects K nodes from the entire validator list (probability of selection is weighted by stake amount) to query for their preferred decision. Each queried validator responds with their preferred decisions, and if the majority of responses returned in a round differ to the node performing the query then it will update its own preferred decision to reflect that and respond to other nodes with that answer.

By having every validator randomly select other validators in order to ask them what their preferences are, participants in Avalanche build confidence in the correct decision shared by all nodes in the network. While one node does not query every other node like in classical consensus, each node performs their own sample of randomly selected nodes, thus is able to scale to hundreds of thousands or millions of nodes without adding lots of additional overhead on each node, as they are querying the same number of nodes. With enough confidence, a decision is finalized immediately. This process happens so quickly that Avalanche rivals major payment systems in its ability to process and clear transactions in the network.

Avalanche supports an arbitrarily large and parameterizable set of adversaries. If the network is parameterized for a 33% attacker, and an attacker has 34% stake, unlike with classical consensus protocols, the attacker can launch a double spend attack which is guaranteed to succeed. However, with Avalanche, this only results just in a slightly higher chance to succeed rather than becoming a guarantee. Because there is no leader, the network is immune to a large class of attacks that other consensus protocol families face. The large number of validators ensures immutability and censorship resistance that proof-of-work protocols, backed by small numbers of mining pools, cannot achieve.

• Peer-to-peer transmission: Any participant can transmit AVAX to another participant with a digital wallet without bureaucracy, banks, excessive fees or delays. AVAX can be transferred among an unlimited number of people, instantly and simultaneously.

• Distributed database: Avalanche is designed to provide unprecedented decentralization with a commitment to multiple client implementations without centralized control of any kind. The ecosystem is designed to avoid divisions between classes of users with different interests. Crucially, there is no distinction and preferences between miners, developers and users.

• Transparency: Avalanche is open-source and the code can be seen and edited by anyone. The network is interoperable, which allows developers to build new permissionless or permissioned interoperable blockchains seamlessly. Network participants can easily create and trade digital smart assets.

• Record keeping: The Avalanche network technically consists of three blockchains that record different types of transactions. Firstly, the exchange chain or X-chain which hosts the native token of Avalanche, AVAX as well as other digital assets. The second is called the Platform Chain or P-chain, which is the metadata blockchain on Avalanche and coordinates validators, keeps track of active subnets, and enables the creation of new subnets. The P-Chain implements the Snowman consensus protocol. The third and final blockchain is the Contract Chain or C-Chain, which allows for the creation of smart contracts using the C-Chain’s API.

• Computational Logic: The Avalanche network relies on computational logic by way of a family of consensus protocols called Snow. The system operates by repeatedly sampling the network at random, and steering correct nodes towards a common outcome. Each node polls a small, constant-sized, randomly chosen set of neighbors, and switches its proposal if a supermajority supports a different value. Samples are repeated until convergence is reached, which happens rapidly in normal operations.

The AVAX Token

AVAX allows stakeholders of the network to:

- Make payments and provide a basic unit of account between the multiple subnetworks created on the Avalanche blockchain.

- Pay network fees.

- Secure the network and validate transactions through the Proof of Stake mechanism also dubbed staking.

AVAX is a capped-supply token.

• Capped at 720 million AVAX tokens, and 50% of those tokens (360 million) will be on the mainnet.

• AVAX serves as the base unit of account in the Avalanche network, provides the base security guarantees, pays for operations, and provides a wide suite of utility services.

• AVAX transaction fees are burned, increasing the scarcity of AVAX.

• About 10% of all tokens are allocated to the founding and non-founding team at AVA Labs.

• All tokens are subject to a vesting schedule.

Token Distribution

Purchaser Distribution

• Seed Sale: This sale was completed in February of 2019, where a total of 18M tokens were sold. Tokens were sold at a price of approximately $0.33 per token. The implied fully-diluted mainnet valuation of this sale was $120M. These tokens were sold to help initiate the development of the Avalanche codebase.

• Private Sale: This sale was completed in May of 2020, where a total of around 24.9M tokens were sold. Tokens were sold at a price of $0.50 per token. The implied fully-diluted mainnet valuation of this sale was $180M. These tokens were sold to distribute AVAX and build staking infrastructure.

• Public Sale: Option A1, Public Sale Option A2, and Public Sale Option B. These tokens are allocated for the current public sale, where at most 17M tokens will be sold. Since Public Sale Option A1 and Public Sale Option B take from the same pool of 12M tokens, public purchasers will decide the final percentages of each allocation. On other hand, in order to allow for a fair and equitable distribution of tokens, Public Sale Option A2 will have its own dedicated pool of 60M tokens. Public Sale Option A1 and Public Sale Option A2 tokens will be sold at a price of $0.50 per token, and Public Sale Option B will be sold at a price of $0.85 per token.

Ecosystem Distribution

• Foundation: These tokens are allocated to an independent, non-profit Singaporean foundation, called the Avalanche Foundation, which manages these tokens for various ecosystem-building initiatives, including marketing, bounties, incentive programs, and more. The current public sale will be conducted by Avalanche Foundation and its affiliates. Any unsold tokens from the sale were returned to the Foundation allocation.

• Strategic Partners: These tokens are allocated with the specific mandate of being distributed to groups, organizations, and enterprises that are building businesses using the Avalanche technology and network. For example, these may include entrepreneurs looking to build a business that does fast international remittance using Avalanche or financial institutions that are looking to tokenize assets on Avalanche through their own subnets.

• Community & Developer Endowment: These tokens are allocated with the specific mandate of being distributed to individuals and groups that are developing core tooling and infrastructure on Avalanche as well as supporting Avalanche through grassroots community building and marketing. For example, these may include Avalanche Hub (previously AVA Hub), Avalanche Ambassadors (previously AVA Ambassadors), Avalanche-X (previously AVA-X) grantees, and more.

• Airdrop: These tokens are allocated with the specific mandate of being distributed to various communities in order to onboard more people to the Avalanche community.

• Testnet Incentive Program: These tokens are allocated for participants that validated in the Avalanche incentivized testnet programs.

Team Distribution

• Team: These tokens are allocated to founding and non-founding members of AVA Labs. Team members, including founders, who have vested tokens prior to launch are voluntarily re-locking all tokens for four years, starting from three months after mainnet launch.

Token Unlocking Schedule

All tokens, except for Public Sale Option B, have some vesting schedule. Seed Sale (1 year vesting), Private Sale (1 year vesting), Public Sale Option A1 (1 year vesting), Public Sale Option A2 (1.5 years vesting), Foundation (10 years vesting), Incentivized Testnet Program (1 year vesting), and Team (4 years vesting) allocations start unlocking from mainnet launch, as outlined in more detail in Section 4.2.1 below. On the other hand, Community & Development Endowment (1 year vesting), Strategic Partners (4 years vesting), and Airdrop (4 years vesting) allocations do not start unlocking from mainnet launch, but instead start unlocking from grant date, as outlined in more detail in Section 4.2.2 below. The percentages in the following sections are shown as a function of the mainnet supply of tokens, namely 360M tokens.

The State of Avalanche

Q1 of 2021 saw several major improvements to the Avalanche platform including the Apricot upgrade that enabled a 50% reduction in transaction fees, improvement in C-Chain block indexing and API upgrades, strengthened default security options and various optimizations in the P-chain, C-chain and networking library. These upgrades greatly reduced the load on each validator and assisted in optimizing the network for scaling to meet future network growth and user demand.

The Avalanche ecosystem experienced exponential growth in Q2 of 2021 with assets under management in DeFi or total value locked (TVL) peaking at $10.55 billion at the end of October. Avalanche’s TVL growth trajectory was accelerated by the Avalanche Foundation’s announcement of Avalanche Rush, a $180 million liquidity-mining incentive program to attract applications and assets to the DeFi ecosystem. Phase 1 of this program was spearheaded by Aave and Curve over a 3-month period, with $20 million AVAX tokens for Aave users and $7M AVAX for Curve users. Other protocols contributing to Avalanche’s significant growth include BENQI, a lending and borrowing protocol native to Avalanche and StakeDAO, a yield optimizer leveraging Aave and Curve. Q2 also saw additional upgrades to the Avalanche platform to support several Ethereum-compatible software improvements.

The Avalanche Bridge (AB) is the key infrastructure piece used to transfer ERC20 tokens from Ethereum to Avalanche’s C-Chain and vice versa. The Avalanche bridge received several upgrades in Q3 for additional chain support and optimization for faster clearing and settlements.

Relatively user friendly, Ethereum transactions take 10 to 15 minutes and Avalanche transactions take only a few seconds, so far $5.62 billion has been transferred from Ethereum on the official AB. The speed of Avalanche’s bridge puts the network in a competitive advantage over networks like Polygon PoS which takes up to one hour and Optimism and Aributrum which take seven days for asset withdrawals. One caveat to AB is that, at the time of writing, it is unable to support transfer of native tokens created on Avalanche, Avalanche have announced however this functionality is on the long-term roadmap. To further incentivize the initial adoption of Avalanche, early users of the bridge were airdropped with a small amount of AVAX tokens. Aside from the official bridge, protocols such as Anyswap and Synapse currently provide bridging of assets for non-Ethereum networks such as Polygon, Arbitrum, Fantom and more. The continuous development of the cross-chain DeFi infrastructure on Avalanche in Q3 2021 was undoubtedly one of the key facilitators of the network usage and growth.

The Avalanche ecosystem currently has +100 dapps spanning DeFi, gaming, NFTs, exchanges and cross-chain solutions. The rise of Avalanche dapps is widely attributed to the EVM compatibility of the native programming language, reducing the barriers of existing Ethereum developers. As of November 2021, Trader Joe is the second leading exchange protocol on Avalanche, after Aave, with $2.04 billion in TVL and 32.85K daily users. The DEX boasts $347 million in daily trading volume and made a record of $1.9 million in single-day trading revenue on November 8th. In comparison, Ethereum’s Uniswap has 35.05k daily users and $10.3 billion in TVL.

This clearly demonstrates how Avalanche’s affordable transaction fees allows less friction and reduces the barriers to entry for DeFi and the long tail of Web 3 users. This chart presents a comparison of daily trading revenue between Pangolin, the second largest DEX on Avalanche and SpookySwap the leading DEX on Fantom.

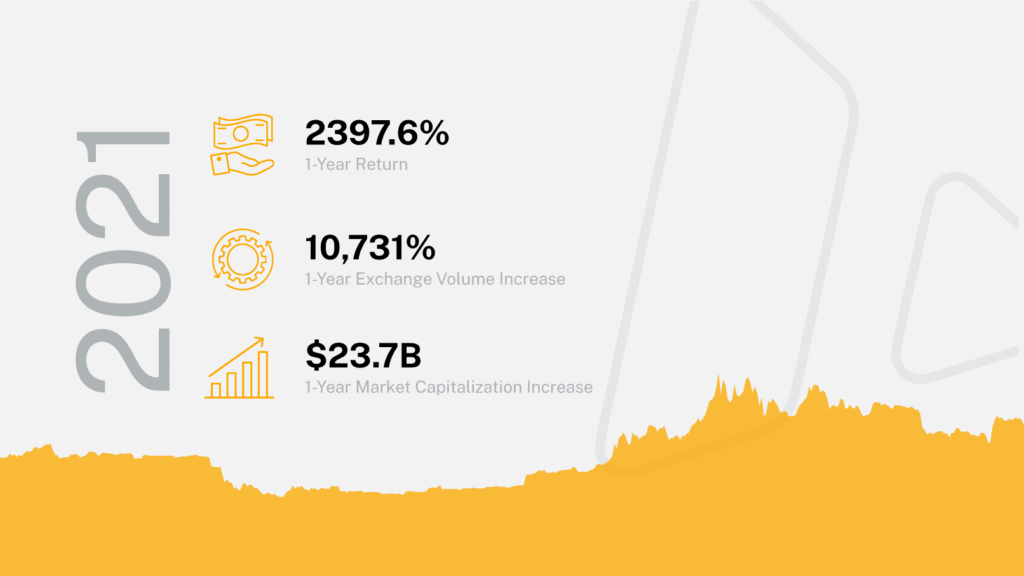

Reviewing the performance of AVAX in the last year, the YTD growth recorded 2,695%. Validator staking APR is at ~10% with 61.96% of AVAX staked and the network is currently supported by 1,158 distributed validators. A minimum of 2,000 AVAX is required to run a validator node and 25 AVAX to delegate. Assessing network performance, a reported average time to finality was 0.7299 seconds, well within the advertised sub 1 second in Avalanche’s documentation.

Outside of DeFi, Q3 of 2021 also saw Avalanche’s first Initial Litigation Offering (ILO) go live on Republic after its introduction in December 2020. The first of its kind token is a blockchain-enabled litigation financing product open to anyone. Legal financing or third-party litigation funding provides individuals who might otherwise lack the necessary funds to litigate or arbitrate a civil claim with the resources they require. An ILO not only raises the funding to pursue litigation, it tokenizes an economic right in such claims and can represent a legal claim to a portion of the financial recovery as a digital asset. The use of Avalanche’s blockchain technology to democratize financial products in the $10B asset class of litigation financing will allow individuals and small organizations to assert their legal rights against well-funded corporations.

The Future of Avalanche

Looking forward, we expect to see four key areas of growth across the ecosystem, DeFi, enterprise applications, NFTs and culture applications. This will be primarily driven by the Avalanche Foundation’s fund, Blizzard, consisting of $200M worth of contributions dedicated to development, growth and innovation on the network. The fund was announced in early November 2021 and was raised from Ava Labs, Polychain Capital, Three Arrows Capital and Dragonfly Capital to name a few.

Perhaps the most bullish case for any Layer 1 is its ability to integrate real-world use cases for social-economic benefit. Deloitte announced in November 2021 their strategic partnership with Ava Labs to leverage Avalanche’s blockchain technology in the Federal Emergency Management Agency’s new disaster recovery platform. The Close As You Go (CAYG) platform will help state and local governments to demonstrate their eligibility for federal funding and was designed by first responders, public works departments and grant-making agencies. Blockchain technology allows the platform to operate in a decentralized, transparent and cost-efficient manner for authorizing funds to recipients. In addition, it utilizes Avalanche’s security features to gather, process and authenticate documentation accurately to prevent fraud, waste and potential systemic abuse. The ability for Avalanche to streamline recovery efforts, simplify documentation and minimize administrative costs is a clear demonstration of how the integration of blockchain technology will fundamentally change and help build resilient modern financial systems.

The future of Avalanche will likely see a greater number of dapps verticals taking advantage of the network’s fast speed and low transaction fees. In Q4, 2021, we can expect Avalanche bridge upgrades as well as implementation of Apricot Phase 5 with X-Chain Dynamic Fees, X-Chain State Pruning and X-Chain Sync. It will also hail the start of the Blueberry upgrade which will enable the creation of independent blockchains with custom virtual machines and rulesets. These features will provide the essential infrastructure for enterprises and institutions who require greater control over their development and data. Retok is one such service utilizing Avalanche, they aim to enable fractional property ownership and increased liquidity in the real estate market through tokenization.

Focusing on the DeFi user experience, multi-chain wallet integration and the Avalanche wallet will undergo its V6 facelift and expand functionality to mobile devices. Similar to Ethereum Name Service for .eth names, Avvy Domains recently partnered with Avalanche so users will soon be able to register .avax names to their Avalanche wallet addresses. Plans are also in place for greater trading venues and exchange integration for AVAX, removing the need for cross-chain transfers ultimately leading to a more seamless on-ramp experience. These upcoming developments on the Avalanche network are likely to drive greater value creation across the entire ecosystem.

Valuing Avalanche

There are two ways we can think of the potential value of Avalanche’s native asset, AVAX. The first is carrying out a market sizing exercise to compare its value to that of its main competitors as its target market. Secondly, we can compare Avalanche’s current adoption — through the proxy of fees paid on the network — to that of Ethereum in order to understand if the current value of Avalanche can be justified whether there’s product-market fit.

Market Sizing:

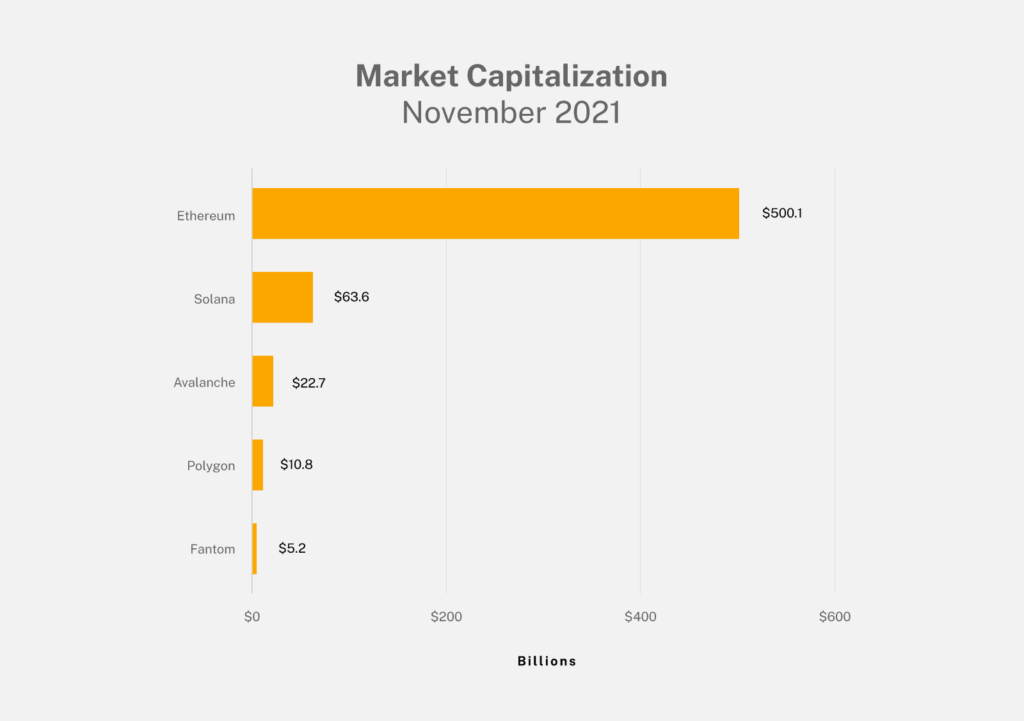

The chart below shows the current market capitalization of Solana, Avalanche, Ethereum, and Fantom. Ethereum represents what the market has judged as the current best use-case of blockchain technology while the smart contracts use case can be argued to be just as valuable in the long term. Fantom and Solana are networks that similarly experienced substantial growth in Q3 of 2021 and serve as comparison for ecosystem development.

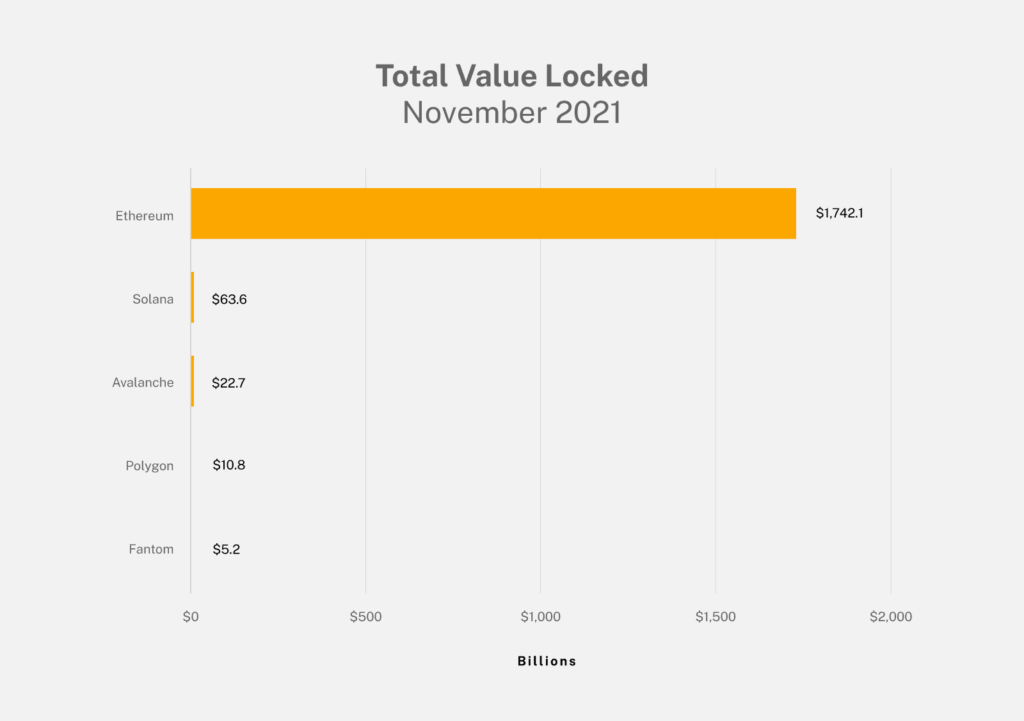

Total Value Locked

This section compares the current TVL of Avalanche relative to other major networks such as Ethereum, Fantom, Polygon, Solana and Bitcoin. TVL can be a useful tool to compare network utilization and a method to measure the flow of capital within DeFi. As the number of DeFi apps grow and the use cases like ILO and CAYG evolve on the Avalanche network, we can expect TVL to grow. The scalability of the network and relatively low transaction costs will likely capture more of Ethereum’s market share.

Fees

Revenue generation is often a key metric when assessing network value. By assessing the total number of transactions and the average cost per transaction we are able to estimate the total revenue generated. Fees are a good signal for the overall demand for a given smart contract platform and arguably the strongest barometer of fundamental growth. Avalanche’s estimated annualized revenue is $54.66 million compared to Ethereum’s annualized revenue of $21.28 billion. Along with greater network usage by DeFi applications, gaming, greater institutional adoption, and real world use cases mature, we can expect the number of transactions to exponentially increase, and with it, revenue derived from fees.

Price-to Sales (P/S) Ratio compares a protocol’s market cap to its revenues. Unlike the Price to Earnings ratio, where inflated token prices can be inaccurately depicted, P/S ratio derives the network’s value from tangible revenues. This metric is particularly useful for early-stage protocols where income is often reinvested into growth. A low ratio could imply that the protocol is undervalued and vice versa. An evaluation of historic P/S ratio against its market cap can also demonstrate the consistency of fees and revenue. This chart indicates the P/S ratio for other Layer 1s in comparison to Avalanche. AVAX is yet to launch on several major centralized exchanges, with retail and institutional investors on the precipitous end of recognizing its value, we can expect the P/S ratio to increase dramatically in the short term before stabilizing.

Risks

Technological risks

Avalanche has a limited operating history and has not been validated over a long run. The network launched the genesis block in late September 2020. Despite rigorous audits, the crypto network is still developing and making significant decisions that will affect the design, functionality, and governance. These factors may adversely affect public perception alongside AVAX’s price action.

For example, in February of 2021, the Avalanche network, under heavy load, experienced a trigger of a non-deterministic bug related to state verification. An increase of network traffic due to the launch of Pangolin (DEX) caused the number of processing blocks to increase concurrently. The event caused validators to accept invalid mint transactions, as the rest of the network refused to honor these transactions, it stalled the C-chain. Fortunately the other two Avalanche blockchains, X- and P-chains did not contain the minting bug and the network continued to process transactions.

The problem was quickly identified and although the easiest method to fixing the problem was to rewrite the blockchain and undo accepted transactions, the decentralized nature of the network meant that this was not feasible. Instead, an incrementally deployable patch disabled the cache and introduced the notion of special blocks which respected the invalid mints.

One major downfall of the patch was that it permitted the generation of 790.2 additional AVAX. In order to prevent the number of total AVAX not exceeding the hard cap of 720 mm AVAX, the Avalanche foundation decided to burn the additional AVAX created. Although the code was patched, and the technical bug never had the possibility of losing funds, it was a blatant reminder that blockchain technology is still in its infancy. The rapid rate of development and the relative experience of developers in the space means that no smart contract is immune to flaws despite extensive auditing by third-party firms. The health and integrity of the network will therefore continue to depend on a strong and supportive community.

Adoption risks

Adopting Avalanche is predicated on developers bidding and attempting to launch their applications and users (and developers) then choosing to build and use Avalanche-native applications. To date, there has been sizable investment and funding put towards projects that are building Avalanche applications amounting to $11 billion USD with Aave representing 29% of Avalanche’s assets under management or TVL. Still, actual adoption is limited and relatively small at the moment compared to Ethereum with +$170B in TVL. However, it’s important to note that Avalanche’s total AUM in DeFi grew by 3,164% since mid August while Ethereum’s assets grew by 46% in the same time frame. Part of this outsized growth rate is attributed to liquidity mining incentives and speculation, which at 21Shares, we believe is not a sustainable strategy to build a long term user base. On the other hand, these incentives foster greater innovation and adoption. The open question is to what extent applications on Avalanche will become constructive and meaningful for DeFi and Web 3 in the long run, especially when compared to applications currently existing on Ethereum.

Regulatory risks

Avalanche was funded initially by a token sale and, as such, is vulnerable to some level of potential regulatory scrutiny due to the suspicion of some jurisdictions, namely the United States. As Avalanche continues to further decentralise and build working applications, in a similar vein to what Ethereum has done, the likelihood of serious regulatory scrutiny from any governmental body would likely decrease. It can be argued that Ethereum’s “safety” in the eyes of US-based regulators, who stated that Ether is not a security, is one key moat that it has over the other smart contract networks such as Avalanche.

Disclaimer

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable. However, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential to not grow as expected.

There is currently relatively little use of crypto assets in the retail and commercial marketplace compared to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment. Nothing in this report does or should be considered as an offer by 21Shares AG and/or its affiliates to sell or solicitation by 21Shares AG or its parent of any offer to buy bitcoin or other crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction.

Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax, or other advice and users are cautioned against basing investment decisions or other decisions solely on the content hereof.

Du kanske gillar

Nyheter

Fem spanska fonder som har ökat med +12% under 2025

Publicerad

19 timmar sedanden

25 april, 2025

År 2025 visar sig bli ett tufft år för finansmarknaderna. Med det första kvartalet fortfarande att avslutat upplever de stora internationella aktieindexen kraftiga nedgångar, där indexfonder baserade på S&P 500 och Nasdaq-100 drabbas särskilt hårt. Det finns dock en kategori som står sig starkt: Ibex 35 indexfonder, som har blivit en av årets mest räddningsvärda tillgångar. Det finns fem spanska fonder som har ökat med +12% under 2025.

Mer specifikt har fonder som investerar i spanska aktier (både indexfonder och aktivt förvaltade) ackumulerat en genomsnittlig avkastning på 14,29 % hittills under 2025. Denna siffra gör kategorin till den mest lönsamma bland aktiefonder, och den näst mest lönsamma av alla investeringsfondkategorier, efter endast guld- och ädelmetallfonder, som har skjutit i höjden med en omvärdering på mer än 40 %.

Inom den spanska kategorin upplever Ibex 35 indexfonder en stark utveckling, med avkastning överstigande 12 % under 2025. Nedan granskar vi årets fem mest lönsamma Ibex indexfonder, rangordnade från lägst till högst avkastning:

BBVA Bolsa Índice FI

Denna Ibex 35 indexfond, som förvaltas av BBVA Asset Management, har stigit med 12,03 % hittills i år. Under de senaste 5 åren har den erbjudit en genomsnittlig avkastning på 16,12 %.

Den har tillgångar på 116,5 miljoner euro och följer Ibex 35 Net Return-indexet, vilket inkluderar utdelningar. Dess nuvarande kostnader är 1,21 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,57% |

| Banco Santander S.A. | 13,16% |

| Iberdrola S.A. | 12,39% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,32% |

| CaixaBank S.A. | 5,36% |

| Amadeus IT Group S.A. | 4,57% |

| Ferrovial SE | 4,42% |

| Futuro sobre IBEX 35 | 3,75% |

| Aena SME S.A. | 3,60% |

| Telefónica S.A. | 3,40% |

Santander Indice España FI Openbank

Santander Asset Managements indexfond Ibex 35 har en avkastning på 12,08 % år 2025. Under fem år har den ackumulerat en avkastning på 16,20 %.

Den förvaltar tillgångar till ett värde av 961,7 miljoner euro, vilket gör den till en av de största fonderna i detta urval. Förvaltningsavgiften är 0,70 % och de löpande kostnaderna är 1,11 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 14,18% |

| Iberdrola S.A. | 12,70% |

| Banco Santander S.A. | 10,82% |

| Futuro sobre Ibex 35 (venc. 02/2025) | 9,90% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 9,16% |

| Bono España 0,65% | 5,57% |

| CaixaBank S.A. | 4,84% |

| Amadeus IT Group S.A. | 4,60% |

| Ferrovial SE | 4,40% |

| Aena SME S.A. | 3,60% |

ING Direct Fondo Naranja Ibex 35 FI

Fondo Naranja Ibex 35 de ING, som förvaltas av Amundi Iberia, har hittills under 2025 haft en avkastning på 12,13 %. Under femårsperioden har den ackumulerat en avkastning på 16,31 %.

Denna fond har tillgångar på 268,4 miljoner euro och replikerar Ibex 35 Net Return. Förvaltningsavgiften är 0,99 % och de löpande kostnaderna är 1,1 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,90% |

| Banco Santander S.A. | 13,48% |

| Iberdrola S.A. | 12,69% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,57% |

| CaixaBank S.A. | 5,49% |

| Amadeus IT Group S.A. | 4,68% |

| Ferrovial SE | 4,53% |

| Aena SME S.A. | 3,68% |

| Telefónica S.A. | 3,49% |

| Cellnex Telecom S.A. | 3,48% |

Caixabank Bolsa Índice España Estándar FI

Caixabank AM-fonden har hittills under 2025 redovisat en ökning på 12,23 %. Dess genomsnittliga avkastning under de senaste fem åren har varit 16,72 %.

Dess förvaltade tillgångar uppgår till 335,5 miljoner euro, och det motsvarar Ibex 35 Net Return. Din provision är i detta fall 1 % och dina nuvarande utgifter är 1,03 %.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Iberdrola S.A. | 13,61% |

| Banco Santander S.A. | 13,28% |

| Inditex (Industria de Diseño Textil S.A.) | 12,13% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,22% |

| CaixaBank S.A. | 5,82% |

| Amadeus IT Group S.A. | 4,49% |

| Ferrovial SE | 4,25% |

| Aena SME S.A. | 3,68% |

| Telefónica S.A. | 3,49% |

| Cellnex Telecom S.A. | 3,28% |

Bindex España Índice FI

Och den mest lönsamma fonden bland de som är indexerade mot Ibex 35 år 2025 (även om vi talar om tiondelar och hundradelar jämfört med resten) är Bindex Spain Index, från BBVA Asset Management. Denna fond har hittills i år haft en avkastning på 12,35 % och en 5-årsavkastning på 17,35 %.

Med tillgångar på 146,4 miljoner euro har denna fond etablerat sig som det billigaste alternativet av de fem (förvaltningsavgift på 0,11 % och löpande kostnader på 0,14 %). Den replikerar också Ibex 35 Total Return.

10 största portföljpositioner

| Värdepapper | Vikt% |

| Inditex (Industria de Diseño Textil S.A.) | 13,62% |

| Banco Santander S.A. | 13,20% |

| Iberdrola S.A. | 12,43% |

| BBVA (Banco Bilbao Vizcaya Argentaria S.A.) | 10,35% |

| CaixaBank S.A. | 5,38% |

| Amadeus IT Group S.A. | 4,59% |

| Ferrovial SE | 4,44% |

| Aena SME S.A. | 3,61% |

| Telefónica S.A. | 3,42% |

| Cellnex Telecom S.A. | 3,41% |

Nyheter

ASRP ETF ett spel på medtech företag världen över

Publicerad

20 timmar sedanden

25 april, 2025

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR (ASRP ETF) med ISIN LU2365457410, försöker följa ECPI Global ESG Medical Tech-index. ECPI Global ESG Medical Tech-index spårar företag från utvecklade marknader över hela världen som är aktiva inom medicinteknikbranschen. Aktierna som ingår filtreras enligt ESG-kriterier (miljö, social och bolagsstyrning). De utvalda värdepapperen viktas lika i indexet.

Den börshandlade fondens (total cost ratio) uppgår till 0,30 % p.a. BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR är den billigaste och största ETF som följer ECPI Global ESG Medical Tech-index. ETF:n replikerar det underliggande indexets prestanda genom full replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR är en mycket liten ETF med tillgångar på 12 miljoner euro under förvaltning. Denna ETF lanserades den 10 december 2021 och har sin hemvist i Luxemburg.

Handla ASRP ETF

BNP Paribas Easy ECPI Global ESG Med Tech UCITS ETF EUR (ASRP ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och Borsa Italiana.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

Nyheter

Europafokuserade ETPer ser större andel av flödena under första kvartalet

Publicerad

21 timmar sedanden

25 april, 2025

HANetf har släppt sin rapport om börshandlade europeiska ETPer för första kvartalet 2025, som avslöjar banbrytande insikter i den snabba utvecklingen av den europeiska ETF-marknaden.

Tillgångar i europeiska ETPer nådde 2,4 biljoner dollar under första kvartalet, varav ETFer stod för 2,28 biljoner dollar. Kärnaktions-ETFer ledde flödena (45,70 miljarder dollar) medan räntebärande ETFer ökade med 15,19 miljarder dollar.

Viktiga data

- Europeiska ETPer överstiger 2,4 biljoner dollar i förvaltat kapital under första kvartalet 2025

- Flöden omdirigerades till Europafokuserade ETPer jämfört med USA-fokuserade mitt i tullkrisen

- Kärnaktions-ETFer överstiger milstolpen på 1 biljon dollar i förvaltat kapital med 45,70 miljarder dollar i nettoflöden under första kvartalet

- Aktiva ETFer i förvaltat kapital ökade med 11,65 % under första kvartalet och optionsbaserade ETFer i förvaltat kapital med 54,55 %.

- Antalet europeiska ETP-varumärken fortsätter att öka och uppgår nu till totalt 131.

- Europa godkänner semitransparenta ETFer, vilket potentiellt uppmuntrar fler aktiva förvaltare i USA att gå in på den europeiska ETF-marknaden.

- Försvars-ETFer såg flöden på 4,16 miljarder dollar under första kvartalet, vilket motsvarar 4,5 % av de totala ETF-flödena i Europa och en 5-faldig ökning jämfört med föregående kvartal.

Läs hela rapporten för att upptäcka kvartalsdata, ETF-marknadens utveckling, tillväxten inom nya områden som optionsbaserade ETFer och mer.

Fem spanska fonder som har ökat med +12% under 2025

ASRP ETF ett spel på medtech företag världen över

Europafokuserade ETPer ser större andel av flödena under första kvartalet

JAAA ETF an aktiv satsning på säkerställda obligationer

Can crypto outperform amidst the current market turmoil?

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Sju börshandlade fonder som investerar i försvarssektorn

Populära

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanEuropeisk försvarsutgiftsboom: Viktiga investeringsmöjligheter mitt i globala förändringar

-

Nyheter2 veckor sedan

Nyheter2 veckor sedan21Shares bildar exklusivt partnerskap med House of Doge för att lansera Dogecoin ETP i Europa