Nyheter

Algorand (ALGO) Research Primer

Publicerad

1 år sedanden

At 21shares, we are excited to have launched the world’s first Algorand ETP on the SIX Swiss Exchange on November 23, 2021 (ALGO | ISIN:CH1146882316). Algorand (ALGO) is a permissionless payments-focused Layer1 blockchain that is designed to help the creation of advanced decentralized applications along with complex financial primitives. The protocol employs a dual-tier network architecture, combined with a novel alteration of the Proof of stake consensus mechanism called pure-proof-of-stake (PPOS) to increase transaction throughput (processing up to 1,000 TPS), on top of achieving transaction finality under five seconds.

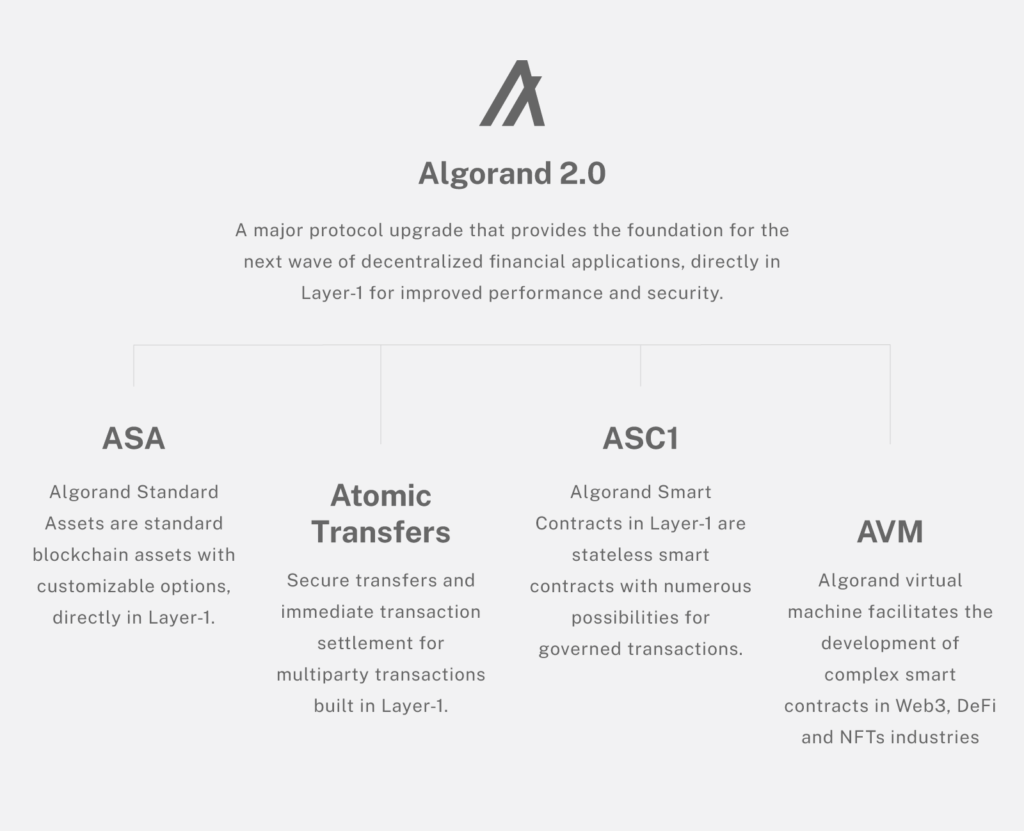

Algorand was founded in late 2017 as the brainchild of the renowned Italian MIT professor, Silvio Micali. The 2012 Turing-award winner, celebrated for his contributions to cryptography through instituting zero-knowledge proofs, contrived the idea behind the network in hopes of addressing the blockchain trilemma of security, decentralization, and scalability proposed by Ethereum’s founder, Vitalik Buterin. Although the network’s mainnet had launched in June 2019, the inventive protocol hadn’t picked-up steam until 2020 which featured the network’s major upgrade, Algorand 2.0. The network’s uphaul unlocked vital capabilities needed to underpin the creation of sophisticated use-cases such as decentralized financial services (DeFi), consistent with the thriving ecosystems on comparable smart-contract-based blockchains.

Resembling many other base-layer networks, Algorand is administered by a non-profit Singapore-based organization, the Algorand foundation, which concurrently commissions a for-profit Boston-based software company Algorand, Inc to nourish the development of the network.

In this report, 21Shares will offer an exhaustive overview of Algorand’s network, the ALGO cryptoasset and discuss the various investment risks associated with the project — in addition to how an investor can think about the future value of its underlying cryptoasset. Algorand has been lagging behind the rest of the large-cap crypto assets over the current extended bull market due to its disputable tokenomics, and what-was-once restrained base layer. Two aspects that have been addressed over the course of 2021, and so in this report, we’ll offer the most timely coverage of Algorand, and ALGO available on the market.

How Algorand Works

Algorand’s ability in offering high transaction throughput (1,000 TPS) combined with almost-instant transaction finality (~4.2 seconds) is bolstered by two network designs that help achieve this reality.

One is the blockchain’s unique dual-tier architecture that separates the computationally-demanding processes by locating it on the network’s off-chain layer (Layer 2), while designating the on-chain layer (Layer1) to host relatively simpler smart-contracts-based transactions. The network split serves to forestall any bottlenecks from materializing. Two, the scalable and randomness-predicated iteration on the proof of stake (POS) consensus mechanism known as pure proof of stake. In the following section, we’ll expand on these components and how they advance Algorand’s vision.

Two-Layered Architecture

Algorand’s on-chain Layer 1 is where the core of activity takes place. Baked into the base layer is a set of features that equip the blockchain with the qualities necessary for fortifying their very own DeFi ecosystem and intricate real-world use-cases. Amongst some of these components are Algorand Standard Assets (ASAs), Algorand’s Virtual Machine (AVM) which powers the creation of Turing-complete smart-contracts written in both assembly-like language called TEAL combined with: Python, Clarity and Reach (simple variation of Javascript), Rekeying functionality, and finally Atomic transfers allowing for immediate and trustless settlement for multiparty transactions.

ASA is the network’s solution to bring about the creation of 4 different types of standardized tokens which benefit from the ease, compatibility, and shared security of the underlying network as they are embedded into the blockchain layer itself, rather than being presented through add-on smart contracts. The proposed system is seen as Ethereum’s ERC match designed to normalize the token creation process, to which it allows for conceiving: Fungible (in-game points, system credits, loyalty points), non-fungible (identity, in-game items), restricted fungible (securities, government issued fiat currency), restricted non-fungible tokens (real estate, regulatory certifications). To create one, developers are only expected to fill out a form supplying its basic details including asset and unit name and its total supply for it to be deployed, rather than compiling code. An approach that helps with fending off certain poor token designs which can jeopardize the asset’s security as witnessed by the billions lost in 2021 due to exploitative hacks in Ethereum’s DeFi ecosystem.

In addition to homogenizing the tokenization process, ASAs correspondingly capacitate transacting individuals with asset spam protections(ASP), while empowering token issuers with what’s known as Role Based Asset Control (RBAC). ASP protects users from receiving assets burdened with reputational or legal risk unless explicit consent to accepting the token is provided by users – an ensuing reality in places such as the United States where citizens are excluded from participating in airdrops due to the SEC’s interpretation that they might be violating securities laws. On the other hand, RBAC entrusts token managers with the ability to quarantine certain accounts under investigation, or introduce a whitelisting model where only a discrete group of users are warranted to transact, closely resembling schemes to that of the controlled financial environments ubiquitous in traditional finance.

Prior to the release of the AVM, algorand was initially limited to supporting the creation of stateless smart contracts (ASC1) through its non-Turing complete language TEAL ( Transaction Execution Approval Language), which restricted introducing complex logic into the applications as TEAL programs were primarily focused on running basic operations like returning true and false, while being used to approve and analyze transactions. Following its upgrade, Algo’s operating system is now capable of hosting dApps built with higher-level languages such as Python, Reach (simplified JavaScript-like), Clarity and GO, allowing for assembling more sophisticated use cases and simplifying the ecosystem’s maturity.

Pertaining to Atomic transfers, this property strongly positions Algorand’s main layer as a reliable financial ledger due to enabling the frictionless exchange of assets between untrusting parties, almost immediately. An unattainable phenomenon on the 1st generation of blockchains due to their limited capacity and long confirmation times. Due to Algo’s almost-instant finality, transactions are combined together and get either fully executed altogether or rejected with funds reverting to their original users. This functionality opens the door for facilitating expeditious interlacing multi-party and multi-asset transactions that can extend beyond the realm of the Algo’s ecosystem.

Rekeying functionality is Algorand’s final attempt at fortifying the blockchain as a user-oriented network tailored for seamless use. The feature allows for preserving a public address while interchanging the private key without imposing any structural changes to the account overseeing them both, which in return means that reassigning a contract’s ownership is now as seamless as sending a transaction. A reality that can be highly prized by companies or service providers with frequent alternating personnel, or for commissioning systematized spending key rotation.

Even though computation and settlement can be run on both layers, as evidenced by the feature-packed layer 1 smart contract capabilities, computationally-intensive dApps are discharged to Algorand’s off-chain layer (L2) to prevent bottlenecks from materializing. Contracts that handle private stock placement, for instance, and need to refer to external databases of certified investors are better kept off-chain as it is costly to hold sizable data on-chain. Other contracts employing privacy-oriented libraries, such as ZK-Snark, which requires considerable computing power are also redirected towards the off-chain layer. The mechanism by which Algorand ties the off-chain layer to the main network’s security is through randomly selecting a committee of nodes already partaking in block validation and calling on them to execute the more complex contracts when need be. That way, scalability would be subsumed into the blockchain’s core functionality.

Pure Proof of Stake and Block Production

Algorand’s democratized variation on POS, dubbed Pure-Proof-Of-Stake, is essentially the secret recipe by which the network claims it achieves its holy grail of scalability, decentralization and security. Three properties actualize this reality. One, it democratizes access to network participation by requiring only 1 Algo as the minimum stake to serve as either a relay or a participation node. Relay nodes are responsible for communicating across the network and making sure messages are propagated properly, while participation nodes run and engage in the consensus algorithm. Two, it distributes validator rewards to all token holders, as opposed to only validators present in the ETH model, amassing them ~4 to 6% APY. Three, the aspect of randomness that guarantees a fair opportunity of participation for all eligible nodes in respect to their stake.

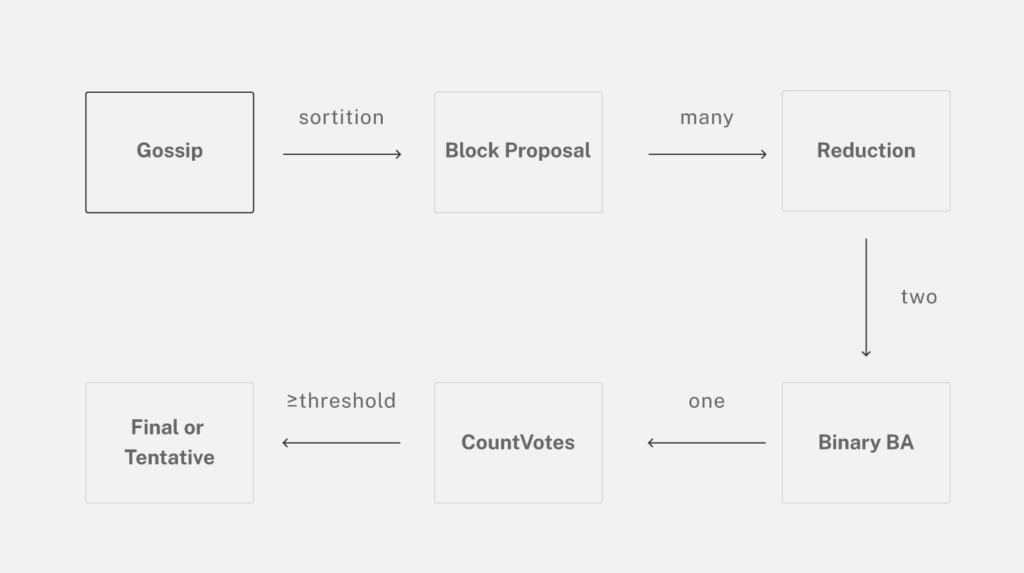

In that regard, Algorand’s process to block production, executable over 3 stages and reliant on on-chain randomness, includes a proposal, soft vote, and certify phases. Proposal begins with all eligible nodes looping through the sub accounts they oversee, while running a cryptographic primitive known as a Verifiable Random Function, to determine which ones are nominated to propose a block in the next stage of consensus based on their hashed proofs.

VRFsin short are pseudo-random cryptographic functions capable of providing proof that their outputs were correctly calculated by its submitter, as it is mapped to their public key. They perform similar to a weighted-lottery system in that the total number of staked ALGO increases the probability of being chosen as every token acts like it is its own lottery ticket for its owner’s address.

Selected accounts then transmit their next proposed block linked up with the associated VRF output that substantiates their validity as a proposer. Next stage proceeds with the aim of reducing all block proposals to one. VRF gets re-executed to form the soft vote committee where participants are randomly selected to vote for the proposal with the lowest hash value, repeatedly, until a quorum is reached. Finally, the certify-vote stage arrives with the formulation of a new committee to testify that the proposed block is absent of any double or over-spending issues. The committee then votes to certify the block if a quorum is present in an analogous manner to the previous stage.

As shown, Algorand’s key component in achieving scalability without compromising on either security or decentralization is the element of randomness abstracted in the pure of proof stake algorithm, and its reciprocal cryptographic sortition mechanism relating to VRF.

Randomness bolsters security as the proposing or committee accounts are chosen randomly and secretly without any P2P messaging overhead. Nodes only loop through their accounts and run a personal lottery to validate if they were chosen, meaning that block-producing nodes’ identities are concealed, further protecting them against any DDOS attacks. Even if they were identified, nodes and committees are replaced intermittently with a randomly-selected group in every round of consensus so targeting them that late would be fruitless.

Not only does this reduce the chances for a network attack, but it also inhibits the network with its unforkable state. To put in context, miners in POW-based systems are susceptible to solving the cryptographic puzzle at the same block height, which results in a soft fork of the chain; where the one belonging to the lower-activity chain will be eventually discarded. Within Algorand’s consensus, only 1 block can be confirmed as accounts are randomly chosen to propose the block and form the committee to fill this expectation at once, and then replaced by its next random-weighted round of selected accounts.

When talking decentralization, every participating node will be eligible to propose and approve a block, relatively proportional to their stake, as they are periodically and randomly chosen per round. There will never be a rigid set of validators controlling the block production process since nodes are randomly rotating, no matter how deep-pocketed they might be. Finally, randomness ensures scalability is maintained in that a 1,000 member committee along with a single-block proposer will always periodically and randomly rotate to lead new rounds of consensus, both at 100M, 1B, and 10B users network scale.

Tokenomics

The ALGO token is the network’s native currency and the bedrock for any activity on top of the Algorand blockchain. ALGO is capped at 10 billion tokens that were minted during the token generation event, with only 25 million sold during the first public ICO, on CoinList, at a price of $2.4 in June 2019. The wide discrepancy between what private investors bought at versus the public price created an initial huge selling pressure, prompting the foundation to offer two buy-back programs in August 2019 and June 2020 for all retail investors that were duly affected by the chaotic launch, where almost all of the retail investors opted in for redemption as it was significantly higher than the current ALGO’s market price.

When it comes to the token’s utility, ALGO is used as a medium of exchange to pay for storing data and processing transactions. The token is also used as an instrument to participate in the network’s consensus by allowing any individual with at least 1 staked ALGO to become a validating node, contribute to the block production process, and secure the network. Finally, ALGO will be also used to participate in the newly rolled-out community governance whereas locking the token for a predefined period enables holders to vote on the root governance matters, in addition to yielding further rewards of ~17% per current quarter, as a result of governance participation.

Algorand’s initial tokenomics projected that the entire supply of 10 billion should be reached by 2024 with 2.5 billion allocated for communal ALGO sales, 1.9 billion for ecosystem support, 3.1 billion for incentivizing early relay node runners program and 0.5 billion for the Algorand foundation. All distributed over time and not released at once, while 2 billion will be dedicated to the software company Algorand Inc. Listening to the community’s criticism nevertheless, the token distribution has been updated, with a focus on rewarding participants that can prove their commitment to the long-term growth of the projects through locking their stake for a lengthy period – to be extended until 2030 with the revised distributions below as well as the protracted token release schedule.

Algorand Ecosystem

The carbon-neutral blockchain did not really pick up steam just until last year. Early 2020 saw the Algorand 2.0 network upgrade introducing some of the layer-1 capabilities that make up the present foundation of the blockchain’s core functionality such as stateless smart contracts ,atomic transfers, and the ASA protocol. However, it was the debut of stateful smart-contracts in August 2020 that set the ball rolling for Algorand to garner attention as it became capable of servicing the exciting new wave of DeFi projects currently being developed on top of the network.

Few players understood Algorand’s potential early in the journey as initial rounds of adoption saw Algorand ink partnership with the Marshall Island to underpin the issuance of their central bank digital currency, while integrating conventional stablecoins like USDC, USDT onto the network to cater towards DeFi’s rudimentary substratum, at the same time of onboarding Australia’s gold tokenizing platform Meld Gold to democratize access to the $11T market. They also collaborated with SIAE, the largest Italian copywriting agency, to issue 4 million NFTs representing 95,000+ creators as ASAs. This was complimenting another coalition with planetwatch; an environmental monitoring service designed for capturing data to operate air-quality sensors in hopes of maintaining a global air quality ledger on Algorand’s blockchain.

To that end, Algorand launched their series of accelerator programs to capitalize on the network’s upgraded capabilities, 12 weeks initiatives focused on spurring the development of the blockchain’s ecosystem via providing funding resources (in partnership with Eterna and borderless capital) and mentorship (technological, economical, marketing) for aspiring projects hoping to build on top of the blockchain. The first iteration, Algorand’s Asia accelerator program, which ended in early Jan 2021, has ameliorating finance 3.0 as its focal point and saw a curated list of projects accepted into the program to build the foundational stage of financial services.

Some of the inductees included DEXTF (asset management protocol), StakerDAO (DAO for governing financial assets), yieldly (1st full-suite of DeFi services on Algorand), Veritx (digital commerce marketplace for exchanging physical assets like medical equipment). Algorand revived its attempts at spurring ecosystem growth with its follow-up initiative titled Europe Accelerator program, culminating in February 2021, which encountered the inauguration of payment startups such as ZTLment. All while infrastructure projects such as STORK (securitizing protocol) took the center stage alongside contemporary solutions like artsquare (fractionalizing art-shares protocol).

Be that as it may, the second half of 2021 has been the biggest growth catalyst thus far. First, Algorand’s technological stack was updated to include the AVM 1.0 upgrade, which was necessary to predicate the roll-out of more complex smart-contracts. It was an equally eventful biannual for the network’s funding as borderless capital set forth a $25M Miami-based fund for investing in projects harnessing Algo’s technology. This was followed by Arrington capital’s $100M advertised fund to back Algorand-focused protocols back in June. Then In September, Sky bridge capital allocated another $250M fund to fuel the growth of dApps building on top of the network.

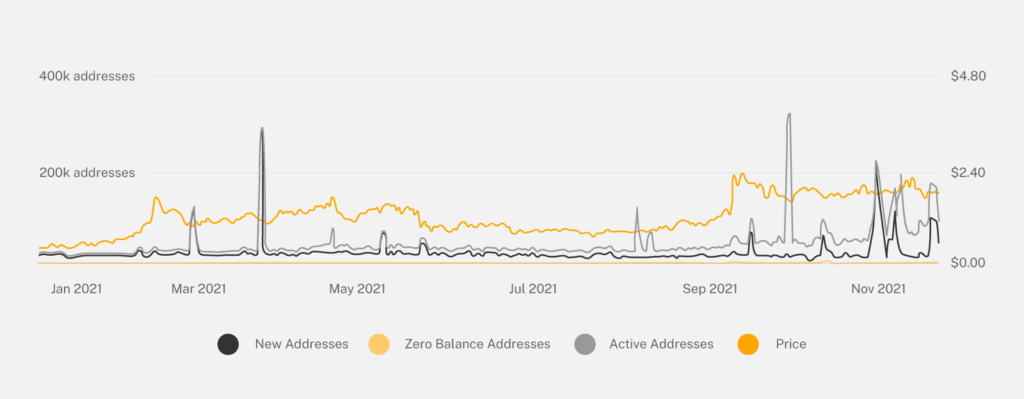

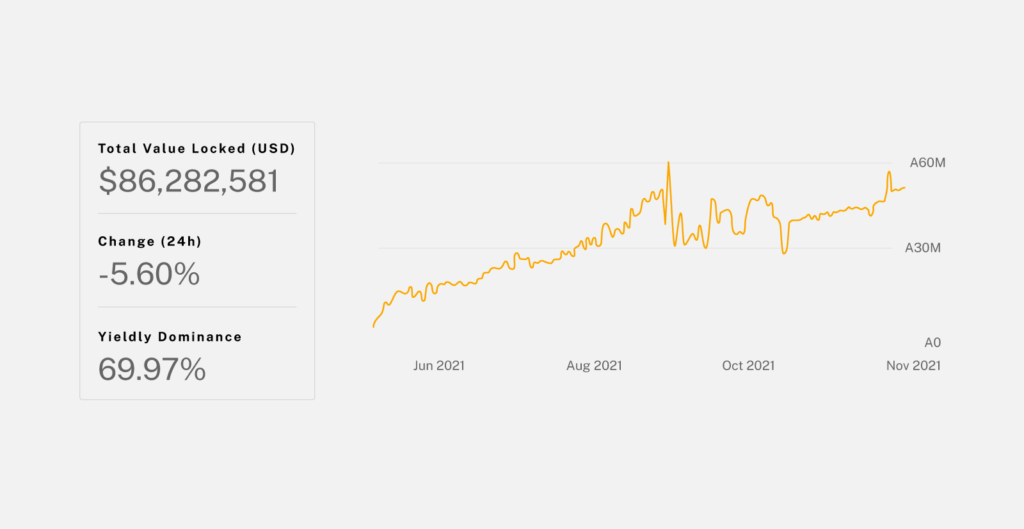

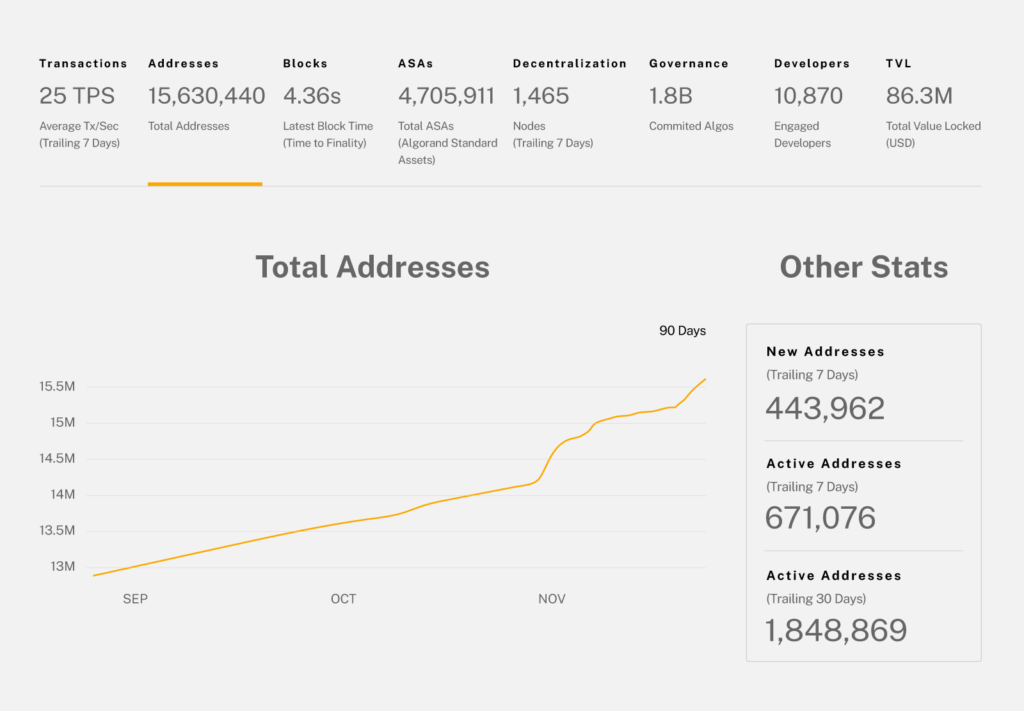

Activity truly began to forge ahead following Algorand foundation’s decision to launch the $300M Viridis fund in September that is focused on growing DeFi on the emerging network, as manifested by the increase of active addresses from last September shown above. Precisely, the capital was to be deployed for bankrolling applications relating to money markets, NFT platforms, and synthetics issuance, the ground-laying infrastructure for DeFi. Tinyman, an Algorand-based automated market maker, raised $2.5M following the fund’s announcement and in hopes to secure the required liquidity at launch. The DEX went live on mainnet on 31st of October, marking the first true passageway to DeFi on the growing blockchain. Yieldly and Tinyman are the only two DeFi applications live on Algorand’s mainnet where they attribute a sum of $85M in total value locked.

The upgrade capabilities combined with the inflow of capital unequivocally stirred the development of more complex primitives such as AlgoFi (lending, borrowing market), AlgoDex (order-book based DEX), Mese (Micro-equity exchange), Algomint (synthetics platform) and saw their deployment to testnet. Worth noting that there’s a growing list of applications building beyond the aforementioned scope, however due to Algorand’s embryonic state, only a select few are fully deployed, while a reasonable amount are still in their development phase following the forename protocols like Lofty (fractionalizing real estate protocol and the latest winner of the grant award), Smile coin (decentralized gaming management platform), Vesta Equity (providing home equity financing without selling/renting).

Looking into the future of Algorand, the infant blockchain is expected to undergo a performance boost that will witness the block finalization time reduced to 2.5 seconds from previously 4.5, while the capacity for processing transactions per second will grow to reach 25,000. The improved latency will surmise as a result of adopting an encoding mechanism that utilizes hex transactions (32 bits) over protracted names, with relation to how transactions are specified and called, while the enhanced transaction throughput will be enabled through the truthful block pipelining mechanism. A conceptually similar approach to sharding, but whereas a block is proposed without waiting on the finalization of its preceding block.

Considering the influx of VC funding and the blockchain’s elevated capabilities, Algorand should be in for a fruitful journey ahead assuming applications gather significant adoption in the coming year. Once the DeFi stack of protocols reach a relatively mature level and becomes more entrenched, the Algorand foundation’s next move will potentially be launching their own liquidity mining program. A decision intended to motivate the migration of market makers from alternative chains. And one that follows a wider pattern pervasive across the landscape of emerging layer 1 blockchains, as signified by Elrond’s $1.2B liquidity incentive program, which is another L1 going through a similar growth phase to Algorand’s. Worth noting that we believe at 21Shares that liquidity mining programs aren’t a sustainable solution to a sticky and long-term growth.

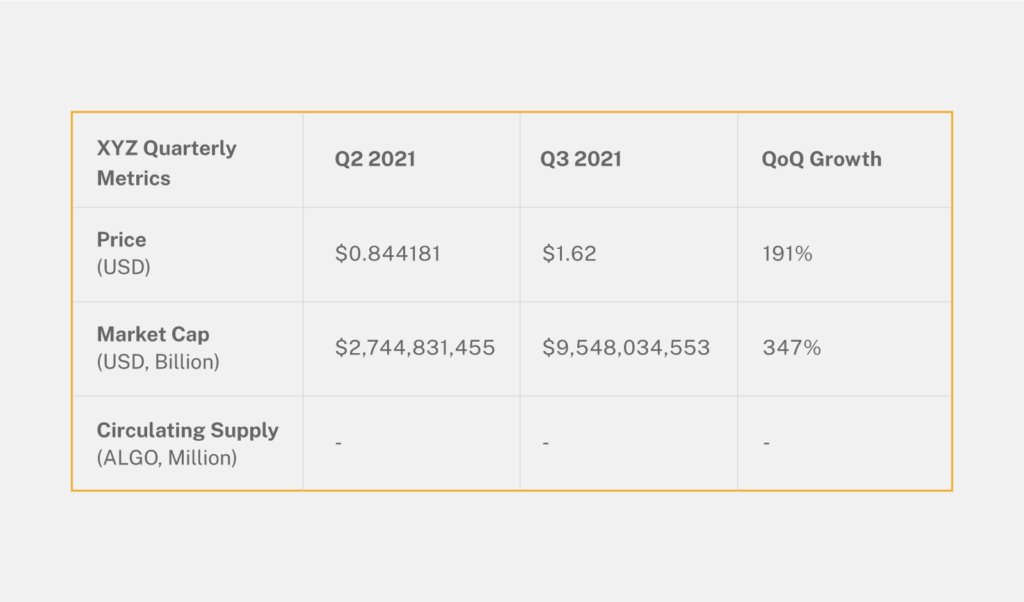

Figure 4: Quarterly Metrics

Valuing Algorand

Due to Algorand’s fledgling state of development – for the reasons touched upon throughout the report – the network’s ecosystem hasn’t come to fruition yet that would make it sensible to conduct an analysis into either its revenue for deducing a P/R Ratio or inferring the network’s value based upon its generated fees. Even though protocols are beginning to rise to the network’s mainnet, it will still be a while before Algorand’s ecosystem cultivates and enough data can be extracted out of it. That said, a market sizing exercise can be brought into play to make a simple sizing comparison between where Algo stands against the more established networks.

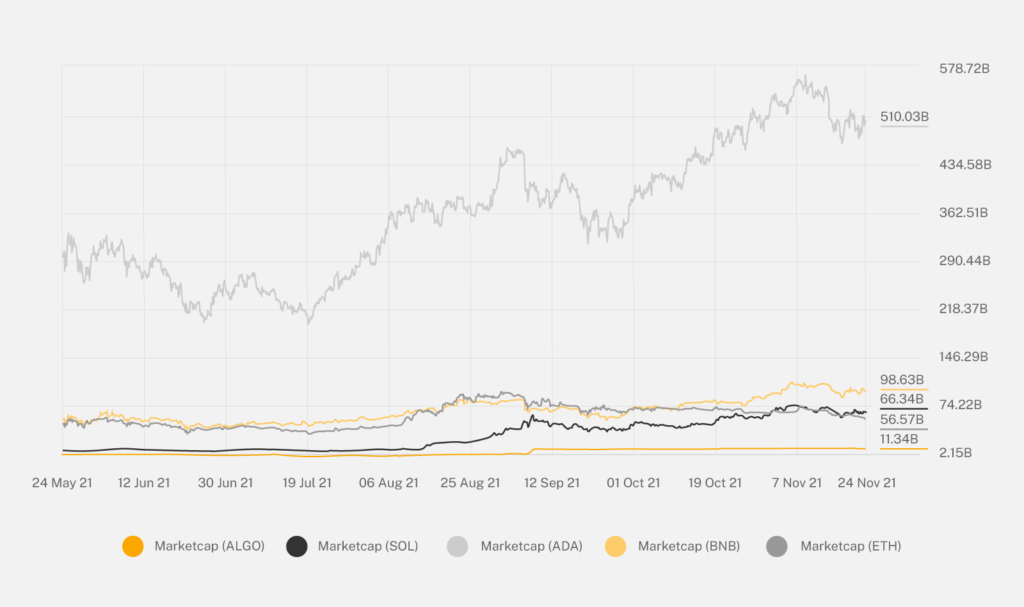

Market Sizing

As indicated by the below chart, Algorand is considered in its infancy when compared against other functioning smart-contracts based platforms and layer 1 blockchains. This juxtaposition corroborates that ALGO has a long way to go before catching up with a corresponding market sizing similar to its competitors — representing only 2% of Ethereum’s current market value. At 21Shares, we will closely monitor how this market-value metric, ALGO/ETH will evolve in the coming year. The best-case scenario will be for Algorand to reach at least 10 to 20% of Ethereum market capitalization in 2022 if the ecosystem is able to launch innovative and differentiated native products.

Risks Associated With Algorand

Technological risks

Comparative to most Layer 1 blockchains apart from Ethereum, Algorand’s mainnet went live just shy of two years ago. Of this period, activity had only recently begun ramping up due to the network’s new capabilities that are accommodative towards the plethora of complex smart contracts and long tail of web 3.0 applications. However, with only two dApps live on mainnet, it shows that Algorand’s technology is even less battle-tested than other relatively functioning blockchains such as Solana and Avalanche with hundred of deployed apps, who still have their fair share of issues that are in the process of being addressed. Seeing the big picture nevertheless depicts how early Algorand is to the Layer 1 blockchain wars.

Viewing how Algorand’s operating system AVM now supports creating dApps with 5 different programming languages, caution should be exercised as two out of the five (Clarity and Reach) are quite experimental languages that don’t have a provable record of stability yet, notwithstanding their prospects.

An issue that originally plagued the blockchain was the degree of centralization present in who ran the introductory round of relay nodes. Even though there are around 100 relay nodes distributed geographically around the world, they’re all vetted and appointed through the Algorand foundation for assuring that they satisfy the necessary performance requirements and avoid clogging down the blockchain. However, this is being addressed with Algorand’s community relay pilot program, launched on November 2nd, where they began accepting and onboarding more users to increase the diversity of relay nodes, eventually leading to more decentralization.

Finally, due to the network’s approach of increasing block size while reducing block time, the full ledger size of the Algorand blockchain was estimated at 647 GB back in May. For context, this figure is amassed over 2 years in contrast to Bitcoin’s 360 GB aggregated over 11 years. So, considering it has exceeded a trillion GB by this stage, average users would soon be quoted out of participating as relay nodes due to the unfeasible hardware requirements. Possible workarounds could include introducing zero knowledge proofs for compressing transaction history, or adopting decentralized data storage solutions such as Arweave. So it’ll be entrancing to see how this develops.

Regulatory risks

As Algorand had a public ICO sale that saw it raise $60M on coinlist, it could possibly come under purview of legal scrutiny bearing the resemblance of other projects currently in cahoots with the Securities and Exchange Commission. A notion that the Algorand foundation has also highlighted on its FAQs page. A positive mark was Algorand’s honorable mention by then-soon-to-be head of SEC Chairman Garry Gensler, that Algorand is one of the fit blockchains for onboarding Uber-like apps on top of its protocol (46:05), so hopefully, the network is on his good side. Another development worth treading carefully is the profusion of securitization and tokenization platforms emerging on Algorand due to its efficiently scalable blockchain that simulates TradFi efficacy. Will be interesting to see what the SEC eventually makes of this evolutionary adoption.

Adoption Risks

Blockchains diverting away from EVM compatibility risk sacrificing on the network effect accrued from Ethereum’s ecosystem of developers and users accustomed to the workings of the architecture. Algorand decided to take the longer path by rebuilding from scratch and bootstrapping their own operating system. Hence, adopting Algorand as the go-to platform for underpinning complex smart-contracts is predicated on developers appropriating the new developmental environment to create competing dApps to those found on the more familiar EVM compatible chains.

Another emerging issue, despite its irrelevance at the moment, comes down to instituting a reliable incentivizing mechanism to remunerate early-backers of relay nodes after 2024, as their advertised allocation (25% of ALGO’s total supply) will run out by then. There currently isn’t a rewarding mechanism for new entities hoping to join the relay node force.

Disclaimer

This report has been prepared and issued by 21Shares AG for publication globally. All information used in the publication of this report has been compiled from publicly available sources that are believed to be reliable. However, we do not guarantee the accuracy or completeness of this report. Crypto asset trading involves a high degree of risk. The crypto asset market is new to many and unproven and may have the potential to not grow as expected.

There is currently relatively little use of crypto assets in the retail and commercial marketplace compared to relatively large use by speculators, thus contributing to price volatility that could adversely affect an investment in crypto assets. In order to participate in the trading of crypto assets, you should be capable of evaluating the merits and risks of the investment and be able to bear the economic risk of losing your entire investment. Nothing in this report does or should be considered as an offer by 21Shares AG and/or its affiliates to sell or solicitation by 21Shares AG or its parent of any offer to buy bitcoin or other crypto assets or derivatives. This report is provided for information and research purposes only and should not be construed or presented as an offer or solicitation for any investment. The information provided does not constitute a prospectus or any offering and does not contain or constitute an offer to sell or solicit an offer to invest in any jurisdiction.

Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax, or other advice and users are cautioned against basing investment decisions or other decisions solely on the content hereof.

Du kanske gillar

- Trump’s crypto ally now leads the SEC, signaling the potential for a pro-crypto agenda

- Bitcoin isn’t just for HODLing anymore, thanks to Babylon

- The Dogecoin story: The emerging “intrinsic value”

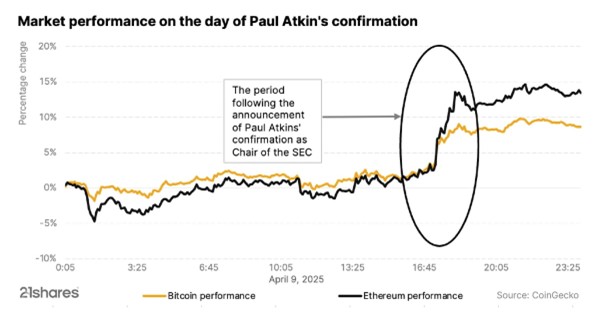

Trump’s crypto ally now leads the SEC, signaling the potential for a pro-crypto agenda

Paul Atkins’ appointment as SEC Chair marks a significant turning point for cryptocurrency regulation in the United States. The cryptocurrency market embraced him, with both Bitcoin and Ethereum rallying up to 9% and 14% respectively in the immediate aftermath. Given Atkins’ background in the crypto space, the industry has welcomed his confirmation and anticipates that he may expedite the approval of several pending projects.

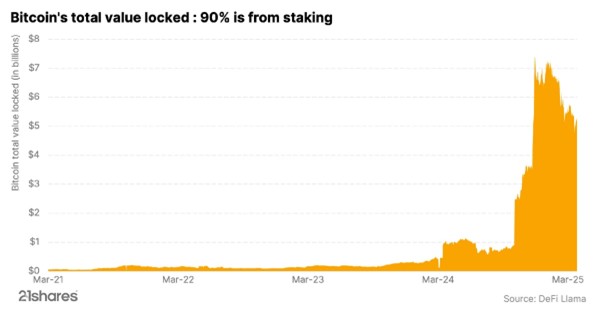

Bitcoin isn’t just for HODLing anymore, thanks to Babylon

Bitcoin is known for being one of the most secure blockchains out there. Now, a new project called Babylon is making waves by tapping into Bitcoin’s rock-solid security and bringing the staking feature to the Bitcoin world. Learn more about Bitcoin staking and its importance.

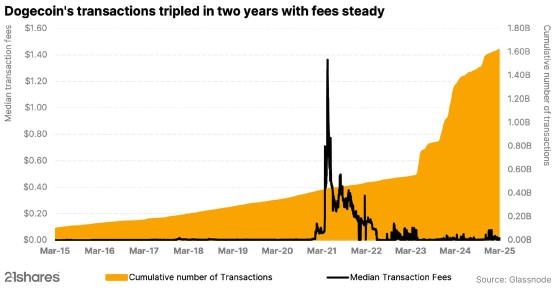

The Dogecoin story: The emerging “intrinsic value”

Dogecoin may have started as a meme, but it’s now a serious player in digital payments, offering fast, low-cost transactions to a passionate community driving real-world impact and innovation. The chart below underscores that real-world usage: it shows that cumulative transactions on the Dogecoin blockchain have surged over the past two years, effectively tripling in volume, all while transaction costs have remained remarkably low.

Research Newsletter

Each week the 21Shares Research team will publish our data-driven insights into the crypto asset world through this newsletter. Please direct any comments, questions, and words of feedback to research@21shares.com

Disclaimer

The information provided does not constitute a prospectus or other offering material and does not contain or constitute an offer to sell or a solicitation of any offer to buy securities in any jurisdiction. Some of the information published herein may contain forward-looking statements. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties and that actual results may differ materially from those in the forward-looking statements as a result of various factors. The information contained herein may not be considered as economic, legal, tax or other advice and users are cautioned to base investment decisions or other decisions solely on the content hereof.

Nyheter

SPFS ETF investerar i globala hälsovårdsföretag

Publicerad

5 timmar sedanden

22 april, 2025

SPDR MSCI World Health Care UCITS ETF (SPFS ETF) med ISIN IE00BYTRRB94, strävar efter att spåra MSCI World Health Care-index. MSCI World Health Care-index spårar hälsovårdssektorn på de utvecklade marknaderna över hela världen (GICS-sektorklassificering).

Den börshandlade fondens TER (total cost ratio) uppgår till 0,30 % p.a. ETFen replikerar resultatet av det underliggande indexet genom full replikering (köper alla indexbeståndsdelar). Utdelningarna i ETFen ackumuleras och återinvesteras.

SPDR MSCI World Health Care UCITS ETF är en stor ETF med tillgångar på 531 miljoner euro under förvaltning. Denna ETF lanserades den 29 april 2016 och har sin hemvist i Irland.

Fondens mål

Fondens investeringsmål är att följa resultatet för företag inom hälso- och sjukvårdssektorn, över utvecklade marknader globalt.

Indexbeskrivning

MSCI World Health Care 35/20 Capped Index mäter utvecklingen för globala aktier som klassificeras som fallande inom hälsovårdssektorn, enligt Global Industry Classification Standard (GICS).

Handla SPFS

SPDR MSCI World Health Care UCITS ETF (SPFS ETF) är en europeisk börshandlad fond. Denna fond handlas på flera olika börser, till exempel Deutsche Boerse Xetra och London Stock Exchange.

Det betyder att det går att handla andelar i denna ETF genom de flesta svenska banker och Internetmäklare, till exempel DEGIRO, Nordnet, Aktieinvest och Avanza.

Börsnoteringar

| Börs | Valuta | Kortnamn |

| gettex | EUR | SS49 |

| Borsa Italiana | EUR | WHEA |

| Euronext Amsterdam | EUR | WHEA |

| London Stock Exchange | USD | WHEA |

| London Stock Exchange | GBP | HEAW |

| SIX Swiss Exchange | USD | WHEA |

| XETRA | EUR | SPFS |

Största innehav

| Värdepapper | Vikt % |

| Eli Lilly and Company | 9,43% |

| Novo Nordisk A/S Class B | 5,97% |

| UnitedHealth Group Incorporated | 5,88% |

| Johnson & Johnson | 4,56% |

| Merck & Co. Inc. | 4,14% |

| AbbVie Inc. | 3,77% |

| AstraZeneca PLC | 3,11% |

| Novartis AG | 2,76% |

| Thermo Fisher Scientific Inc. | 2,65% |

| Roche Holding Ltd Dividend Right Cert. | 2,47% |

Innehav kan komma att förändras

De amerikanska aktier som kollektivt går under namnet Mag7, också kända som Magnificent 7 aktierna har förlorat 4,4 biljoner dollar i marknadsvärde sedan toppen i december.

Detta är nästan dubbelt så mycket som värdet på den tyska aktiemarknaden. Dessa aktier återspeglar ~29 % av S&P 500-börsvärdet, en minskning från rekordhöga 34 %.

Vi skrev nyligen en artikel om tyska utdelningsaktier som du finner här

För den som letar efter investeringar i Tyskland klicka här

Källa: Global Markets Investor @GlobalMktObserv

A pro-crypto agenda is underway

SPFS ETF investerar i globala hälsovårdsföretag

Slakten av Magnificent 7 aktierna

RMPH ETC Ansvarsfullt fysiskt guld med GBP-säkring

Gold’s rally may signal what’s ahead for BTC

Crypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

Montrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

Warren Buffetts råd om vad man ska göra när börsen kraschar

Svenskarna har en ny favorit-ETF

MONTLEV, Sveriges första globala ETF med hävstång

Populära

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanCrypto Market Risks & Opportunities: Insights on Bybit Hack, Bitcoin, and Institutional Adoption

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMontrose storsatsning på ETFer fortsätter – lanserar Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanWarren Buffetts råd om vad man ska göra när börsen kraschar

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanSvenskarna har en ny favorit-ETF

-

Nyheter3 veckor sedan

Nyheter3 veckor sedanMONTLEV, Sveriges första globala ETF med hävstång

-

Nyheter4 veckor sedan

Nyheter4 veckor sedanFastställd utdelning i MONTDIV mars 2025

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanSju börshandlade fonder som investerar i försvarssektorn

-

Nyheter2 veckor sedan

Nyheter2 veckor sedanVärldens första europeiska försvars-ETF från ett europeiskt ETF-företag lanseras på Xetra och Euronext Paris